a non-parametric test of consumer behavior using

advertisement

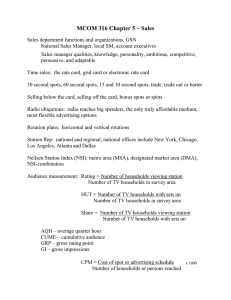

A NON-PARAMETRIC TEST OF CONSUMER BEHAVIOR USING PANEL DATA by Aurelio MATTEI* University of Lausanne ABSTRACT In this paper panel data are used to test if consumer behavior is consistent with utility maximization. The test is based on revealed preference theory and it does not assume a specic functional form (non parametric test). a The data come from surveys of Swiss household budgets for the period 1975-1987. We have been able to follow the monthly expenditure of 3167 households for at least 12 months (the average length of the period is 29.4 months) and for 31 households we have their monthly budgets for 13 years which is a remarkable feature for panel data. With a disaggregation into 188 homogeneous goods, these data come close to the theoretical requirements. Moreover, we have tested a subset of these commodities (non durable goods or food). Our results show that a static neoclassical model cannot be used to explain the monthly expenditure of about half of all households. However, almost all of these inconsistencies can be explained by purchase infrequency or a "nearly optimizing behavior". * Address: Prof. A. Mattei, Departement d'econometrie et d'economie politique, Universite de Lausanne, Ecole des HEC, CH-1015 Lausanne / Switzerland. The author gratefully acknowledge nancial support from the Swiss National Foundation for Scientic Research. 1 I. Introduction The neoclassical model of consumer behavior is one of the most fundamental economic models. Its use in microeconomics and even in macroeconomics has never been so general. As in the nineteen century, its main justication is its plausibility according to an introspective reasoning. Indeed, except in a few cases, all the empirical tests have used aggregate data which are the result of the behavior of million of consumers. The tests based on exible forms have rejected the model whereas those using a non-parametric approach have found that the data are consistent with a utility maximizing representative consumer. Since all these tests use aggregate data, it is not clear what conclusion could be drawn from these results. On the one hand, the negative results could be due to aggregation problems. On the other hand, the positive results could be due to a smoothing eect of the income changes. The data may not be sharp enough for the test. If we want to make real progress in the knowledge of consumer behavior, we must state precisely how the model should be tested and which data should be used. It is not clear where we shall look for the consumer of the theory. For instance, Hicks (1956, pp. 17-18 and 55) points out that the theory of demand "proceeds by postulating an ideal consumer, who by denition is only aected by current market conditions". The behavior of actual consumers need not "always satisfy the tests of consistency". Moreover, "to assume that the representative consumer acts like an ideal consumer is a hypothesis worth testing; to assume that an actual person, the Mr. Brown or Mr. Jones who lives round the corner, does in fact act in such a way does not deserve a moment's consideration". Nevertheless, the use of aggregate data has always been considered an unavoidable approximation. For example, Houthakker and Taylor (1970, p. 200) say that "we have 2 to look one diculty rmly in the face, and pass on, following the proverbial Scottish preacher's example. The theory of the dynamic preference ordering given here is strictly in terms of a single individual, yet we apply it to entire countries". Moreover, Deaton and Muellbauer (1980, p. 148) point out that "if..., as is frequently the case, the data are available only for aggregates of households, there are no obvious grounds why the a theory, formulated for individual households, should be directly applicable".1 Therefore, we will assume that panel data are the most appropriate ones for the test of the neoclassical model of consumer behavior. However, we will also make some aggregation in order to see if we have better results by using homogeneous groups of consumers. The theory of revealed preference is one of the few economic models that can be directly used to confront a theoretical hypothesis with real data. By examining the purchases of a consumer we can determine if he is consistent with the neoclassical model of consumer behavior. 1 It is very easy to show that the aggregate or the average expenditure of two or more preference-maximizing individuals cannot always be interpreted as the outcome of a rational consumer. Let us assume that the price ratio [p1 =p2 ] is 0.5 in the rst period and 1.5 in the second one. In the rst period the quantities bought are [1,5.5] for consumer I and [4,4] for consumer II. If, in the second period, the quantities bought are, respectively, [2 (2/3),5] and [5,1.5], the behavior of these two individuals is perfectly consistent with consumer theory. Nevertheless, the aggregate data, i.e [5,9.5] in the rst period and [7 (2/3),6.5] in the second one, do not satisfy the weak axiom of revealed preference (see section II). The demand function of a group of consumers (often called a market demand function) need not satisfy the classical restrictions of an individual demand function. The adding-up property and some mathematical conditions hold at the aggregate level but this is not the case, in general, for the symmetry restrictions (integrability condition) (see Shafer and Sonnenschein (1982)). Homogeneity of degree zero does not necessarily hold if the distribution of income changes (see Wold (1953), chapter 7). However, the hypothesis of a representative consumer is often an indispensable condition for 3 Varian (1982) has developed ecient algorithms for checking whether a set of data is consistent with utility maximization. However, the tests performed with these algorithms have used aggregate data which represent the behavior of several million of individual consumers.2 Surprisingly, only a few studies of the revealed preference theory have used panel data. This is probably due to the necessity of having data for the same household over several a months or years. Indeed, in many countries several large household surveys are carried out every year but they do not follow the same individuals through time. Moreover, the expenditures are recorded only for two or three weeks. Koo (1963) 's analysis is still one of the more comprehensive in this eld 3 . Household budget data exist for more than a century and they represent a unique source of detailed information on consumer behavior. Of course, panel data do not have the advantage of controlled experiments used in experimental economics but we can observe the real behavior of households instead of the articial behavior of some graduate students as is often done with the model of choice under uncertainty. Koo applies the revealed preference theory to food expenditures of 215 households from the Michigan State University consumer panel4 . However, as pointed out by most of the recent sophisticated macroeconomic models and the theorists are very reluctant to abandon such a powerful tool. 2 For example, Varian uses U.S. consumption data for 9 commodity groups; Manser and Mc Donald (1988) use U.S. per capita consumption data for 101 commodities. 3 Among a few other studies, on can mention Mossin (1972)'s investigation of the behavior of 49 Danish consumers using weakly data for 97 commodities. Some inconsistencies with the weak axiom were detected. Using a token economy as a laboratory for the experimental analysis of consumer behavior, Battalio et al. (1973) have considered the weekly purchases of 38 patients in a female ward for chronic psychotics at Central Islip State Hospital in New York. During 7 consecutive weeks, the relative prices of 16 goods were changed and some inconsistencies were observed. 4 The 52 weakly purchases are aggregated into 13 observations. 4 Dobell (1965), his computations amount to a search for the complete ordering of the goods bundles and they are not a test of the revealed preference theory. In this paper, we use monthly data for 3167 households to test the neoclassical model of consumer behavior. With a disaggregation into 188 homogeneous goods, these data come close to the theoretical requirements. Therefore, our results are more comprehensive than those obtained in previous studies. The paper is organized as follows. Section II provides the theoretical framework of the test which is used to check if the data are consistent with utility maximization. In Section III we examine the power of the test. Section IV describes the data used. In section V we present the results of the dierent tests. Section VI oers some concluding remarks. 5 II. The theoretical framework The revealed preference theory of Samuelson (1938), extended by Houthakker (1950), can be presented in several ways. We will restate Varian's version which is based on previous works of Koo (1963), Dobell (1965), Afriat (1967) and Warshall (1962), among others. i ) denote the vector of the quantities bought in period i and Let q i = (q1i ; q2i ; : : : ; qm pi = (pi1 ; pi2 ; : : : ; pim ) the vector of the corresponding prices. We have T observations of these prices and quantities (pi ; q i ) , i = 1; 2; : : : ; T . The revealed preference theory tells us that: (1) q i is directly revealed preferred to q j , written q i pi 1 q j Ro q j , if pi 1 q i pi 1 q j where is the inner product of the vectors pi and q j . (2) q i is revealed preferred to q j , written q i qb ; : : : ; qg such that pi 1 q i a pi 1 q a ; pa 1 q a R qj , if there is some sequence q i ; q a ; pa 1 q b ; : : : ; pg 1 q g pg 1 q j . The relation R is called the transitive closure of the relation Ro . A set of data satises the Generalized Axiom of Revealed Preference (GARP) if qi R qj implies pj 1 qj pj 1 q i . This axiom allows multivalued demand functions whereas the more common Strong Axiom of Revealed Preference [ qi R qj and qi = qj implies not qj R qi ] requires single 6 valued demand function (See Varian (1982), p. 947).5 Varian has shown that a set of data is consistent with the model of utility maximiza- tion if and only if it satises the Generalized Axiom of Revealed Preference. We can check if the data are consistent with GARP by constructing a T by T matrix A whose element aij is equal to 1 if pi 1 q i pi 1 q j (that is, if q i Ro q j ) and 0 otherwise. The transitive closure R can be computed using the Warshall algorithm, modied by 5 Since the vectors of quantities are often obtained by dividing the expenditures by the corresponding prices, it is very unlikely to nd two identical vectors. Therefore, the tests of the two axioms give almost always the same result. 6 Varian (See his algorithm 5). This algorithm creates a matrix equal to 1 if q i R qj B whose element bij is and 0 otherwise. A violation of GARP is obtained if bij = 1 and pj 1 q j > pj 1 q i . When we use real data, we have to be careful in applying this test of revealed preference. Indeed, a dierence of just one cent (of a franc or dollar) between the cost of two bundles is enough to reject the neoclassical model of consumer behavior. Since the price vector is always an approximation of the true values with which the consumer is confronted (see below) and a "nearly optimizing behavior" if perhaps more appropriate for an individual consumer, it is worthwhile using a weaker test. We can say that q i is directly revealed preferred to q j if the cost of q i is signicantly dierent from that of q j . Formally, q i Ro q j if a where e e pi 1 q i pi 1 q j 0e1 is called the Afriat eciency index6 . For example, if e = 0:8 then the cost of bundle q i must be 25% greater than that of bundle q j in order to say that q i is directly preferred to q j . A similar error must be allowed for the violation of GARP. We can check if the data are consistent with a "near optimizing behavior" by con- structing a matrix A whose element aij is equal to 1 if e pi 1 q i pi 1 q j and 0 otherwise. The transitive closure is computed as before, using the Warshall algorithm. A violation of a weakened GARP7 is obtained if bij = 1 and 6 e pj 1 q j > pj 1 q i . See Varian (1990), p. 130. It is possible to choose a dierent e for each observation or to search for the indices that are as close as possible to 1. However, given the number of computations required by these choices of the indices, we have considered only a single e, as suggested by Afriat (1967). 7 Or GARPe (see Varian (1990)). 7 III. The power of the test It is important to analyze the data before checking for consistency with preference maximization because if the are no budget set intersections, it is impossible to nd violations of GARP. Every bundle chosen which exhaust the budget is consistent with GARP. The power of the test is zero. Bronars (1987) calculates the approximate power of the test by using random consumption data which exhaust the budget set. He nds that per capita data give more information than aggregate ones. The variation in real per capita expenditure in the U.S. over the period 1947-1978 seems to provide a powerful test of preference maximization. Since a budget set intersection is a necessary condition to nd a violation of GARP, one can estimate the power of the test by calculating the number of budget set intersections. We have a budget set intersection between period t and period if for some y a>a ay ay p and for some other good j p < p (or vice versa) where yt is total good i pyitt i t jt j expenditure in period t. It is useful to express budget set intersections as a percentage 0 1 of the maximum number of these 2 x 2 comparisons which is T2 . 8 IV. The data The Swiss Federal Oce of Statistics organizes each year a survey of household budgets. The choice of families is based on the method of quota sampling among the households who respond to various announcements published in the press. This judgment sample has obvious disadvantages from the point of view of statistical inference but for our purpose it is more important to have accurate data than an estimation of the sampling error. Indeed, you need very cooperative, persevering and meticulous households to do all the bookkeeping8 . Every day, the household writes down in a special booklet all expenses and receipts. The Statistical Oce classies all these items, computes the monthly totals and then puts the data on tapes. These computerized data are available since 1975. We obtained a copy of the 26 tapes with the data for the period 1975-1987 9 . These tapes give a breakdown of expenditure into about 200 goods. This can be considered a good level of disaggregation. We do not have the quantity of "16 a oz. can of Delmonte peaches bought in a certain store" ( Houthakker (1987), p. 142) but the expenditure on canned fruits. Table A-1 in the appendix gives the description of the 188 goods considered for the test. The original list is somewhat longer since we have aggregated a few items because of problems with the price indices. Table I gives the yearly breakdown of the households budgets. The total number of yearly budgets is greater than the number of households because only about 49% of the households remain in the panel for more than 12 months. We have identied 3167 dierent households which have sent back the booklets for at least 12 months. Table II reports the longevity of the panel members. The average length of the period is 29.4 months. For 31 households we have data for 156 consecutive 8 9 The households receive a small amount of money for their participation in the survey. These data are the property of the Swiss Federal Oce of Statistics to whom requests for access should be directed. 9 months (1975-1987) which is a remarkably long period. During this period relative prices have changed and therefore it should be possible to detect inconsistencies. The lack of negative results using aggregate time series data is often attributed to large changes in income. Since each year is typically revealed preferred to the previous years, it may be dicult to nd inconsistencies. The region where inconsistencies can occur may imply an unlikely large change of quantities. For example, with aggregate U.S. consumption data by 66 types of expenditure over the period 1929-1989, each year is directly preferred to the previous years in 99.3% of all cases. Panel data show a greater variety of behaviors, in particular with monthly observations. Our data indicate that on average each month is directly revealed preferred to the previous months in only 90.9% of all cases. The most dicult problem with the test of revealed preference using household budgets is to get accurate data on prices. Indeed, we need all the prices which the consumer is confronted but it is obviously impossible to ask him to write down all these prices. a Hence, we need some estimations of the prices of all goods for the entire period. We use as prices the price subindexes computed each month for the consumer price index.10 The correspondence between the items of the household budgets and those of the subindexes can be obtained from the author (Because of changes in the number of computed subindexes, we had to consider three periods with broad aggregate at the beginning and a ner correspondence at the end). In general, the changes in relative prices and the coecients of variation are not as high as one would have liked but for some goods like fuel oil or TV sets the variations are important. The vectors of quantities are obtained by dividing the expenditures by the corre- sponding prices. 10 Koo (1963) computes a weighted average of the prices (paid by the consumers in the panel) where the weights are the expenditures of the households. He nds that they are similar to those collected by the Bureau of Labor Statistics. 10 V. The results First of all, we computed the percentages of budget set intersections. The mean value for the 3167 household budgets is 45.95% with a standard deviation of 16.19%. As expected, households with data for more than 12 months have proportionally more intersections (52% for households with data for more than 12 months and 62% for households with data for more than 60 months). All household have at least one intersection. Therefore, inconsistent behaviors can be observed with these data. We have reported in Table III the distribution of households whose behavior is inconsistent with the Generalized Axiom of Revealed Preference. These results show that for almost half of all households and for all the households with data for more than 60 months a static neoclassical model cannot be used to explain their behavior.11 Let us now allow for some errors in the data and / or nearly optimizing behavior. a With the Afriat eciency index set to 0.95, the number of households with inconsistent behavior is down to 188 and with an index equal to 0.9 we have only 51 households whose behavior is inconsistent with a weakened Generalized Axiom of Revealed Preference. One can give several reasons for these inconsistencies. A change in tastes could lead to an apparently inconsistent behavior. For example, tastes may change if there is a modication in the household composition. If we consider the change in the number of adults and / or children, we nd that 25% of the inconsistent households have a change in the household composition whereas this percentage is 17% for all the households. Therefore, there are other reasons for the inconsistencies. Seasonal purchases may be a special case of a change in tastes. Let us suppose that the household spends each month a certain amount for recreation. In January he buys 11 An intertemporal model may give similar results. Indeed, a strong rational expectations model with an intertemporally additive utility function, perfect foresight and perfect capital markets is rejected if the general axiom of revealed preference does not hold (see Browning (1989)). 11 a TV set and in July the same amount is spent for vacation. If the relative price of vacation increases between January and July than we have an inconsistent behavior that can be explained by a change in tastes.12 One can test this hypothesis by taking only the data of the same month.13 We nd that 25% of the households have at least one month14 with an inconsistent behavior. For these households, there must be some other reason for the inconsistencies. The purchase of a durable good may lead to a change in tastes. Therefore, we have excluded all durable goods15 and we have checked whether the remaining set of data is consistent with utility maximization. Using monthly data, we have obtained a slightly greater number of inconsistent households whereas with annual data only 2.4% of the 1506 households have an inconsistent behavior. Finally, by taking only food we have a 50.4% of inconsistent households using monthly data and 1.5% with annual data. All these results suggest that the inconsistent behaviors are unlikely to be due to a change in tastes. Purchase infrequency could be another reason for the inconsistencies. If good 1 is bought in January and good 2 in February, an unexpected decrease in the relative price of good 1 could lead to an inconsistent behavior. In order to check if purchase infrequency could be a reason for the inconsistencies, we have aggregated the monthly data. With quarterly data, only 475 households (15%) have an inconsistent behavior. Since this percentage decreases with the number of ag- 12 Browning (1989) suggests the use of annual data because "we do not generally assume that preferences are constant over the year". 13 As with annual data, we take the 1506 households with data for two or more years. 14 The inconsistent households are about 3% for each month. 15 When we take only a subset of the goods purchased by the household, we assume that the separability hypothesis for the preferences is satised. 12 gregated months,16 purchase infrequency seems to be a major reason for the inconsistent behaviors obtained with monthly data. In the case of annual data, we have just one observation for half of the sample and therefore we have to use only the households with data for two or more years. Table IV shows that only 2.9% of the households with data for two or more years have an inconsistent behavior but the percentage increases with the number of years (25% for the 51 households with data for more than 10 years). Moreover, with a value of 0.95 for the Afriat eciency index, all the 1506 households have a consistent behavior. One may say that the good results obtained with the annual data are due to the limited number of comparisons. Indeed, the 2 x 2 comparisons decrease from 2515675 to 13855. Moreover, for 164 households there are no budget set intersections. However, the mean value of the budget set intersections is 76.7% (the standard deviation is 23.1%) a which is higher than the value obtained with the monthly data. Therefore, one cannot say that the growth of real income has become a more prevalent factor. If we consider a nearly optimizing behavior with a value of 0.95 for the Afriat eciency index, 94% of the monthly data and all data on food expenditure are consistent with utility maximization. Table V summarizes all the results obtained with dierent values of the Afriat eciency index. This table shows that the neoclassical model of consumer behavior in its deterministic form should be considered only as an approximation of actual behaviors. In most cases, the breakdown of expenditure used by the statistical oces do not correspond to a specic item. Therefore, some of the inconsistent behaviors that we 16 We have obtained the same results using per capita consumption data from the U.S. national income accounts (Personal consumption expenditures by major type of product: 12 commodity groups for the period 1947-82). The annual data are consistent with utility maximization whereas the quarterly data (seasonally adjusted at annual rates) are inconsistent. However, these inconsistencies could be explained by rounding errors (the largest dierence being 1.9 $ between 1948.4 and 1949.3). 13 have discovered could be the result of commodity aggregation. Indeed, one can easily construct an example where an aggregation over goods leads to an inconsistent result. Suppose that 3 goods are aggregated to 2 groups with group 1 containing the rst good and group 2 the last 2 goods. The data are: q = [3 2 4] , p = [1 1 1] in period 1 and q = [4 3 1] , p = [6 1 5] in period 2. Using an implicit price aggregation17 which is the standard method used by the statistical oces, we obtain q = [3 6] , p = [1 1] in period 1 and q = [4 4] , p = [6 2] in period 2. These aggregate data are inconsistent with utility maximization whereas the original data satisfy the Generalized Axiom of Revealed Preference. For each household, we have aggregated the monthly data to 8 and 3 commodity groups. As prices, we have used the corresponding price subindexes of the consumer price index. a The inconsistent households were 39.1% in the former case and 25.0% in the latter. If we aggregate only the data of the households whose behavior is consistent with utility maximization, then 86% of the households in the case of 8 groups and 93.8% in the case of 3 groups remain consistent. These results indicate that commodity aggregation is unlikely to be the major reason for all the negative results. If consumer theory describes the behavior of a representative consumer, we have to check for consistency only with data from that consumer. According to Hicks (see above), the ideal consumer is only aected by current market conditions. If this means that all consumers whose tastes have changed have to be excluded, then the theory is 17 In this method, constant expenditures (i.e expenditures computed using the prices of the base period) are summed over all goods being aggregated to form a quantity aggregate. The implicit price is obtained by dividing the corresponding sum of current expenditures by this quantity aggregate. In our example, period 1 is the base period. 14 true by denition because we cannot discriminate between change in tastes and inconsistent behavior. If consumer theory describes the behavior of an average consumer, then we have to do some aggregation before checking for consistency. First of all, we have aggregated all the households.18 Second, we have aggregated the data per capita. Third, we have aggregated the data per equivalent capita19 . Fourth, we have formed dierent groups of households according to their income.20 All the resulting set of data are inconsistent with utility maximization. These results show how it is dicult to nd a representative consumer, at least with monthly data21 . a 18 The number of aggregated budgets for each year is given by Table I. 19 The equivalence scale used by the Swiss Statistical Oce is: 1 for an adult male (18 years and over), 0.8 for an adult female (18 years and over) and children are considered as a fraction, depending on their age, of a corresponding adult. 20 21 In all our empirical tests, income is in fact total expenditure. Annual data and, except for two periods, quarterly data are consistent with utility maximization. 15 VI. Concluding remarks Revealed preference theory can be used to test the behavior of individual households. With ecient algorithms as those proposed by Varian and a mainframe computer, it is possible to take a large data set of individual observations and make tests of consistency. In this paper, we have presented the results obtained with 3167 households and with monthly data ranging from 1 to 13 years. Contrary to the results obtained with aggregate data from the national income accounts, our panel data show a great variety of behaviors. Half of the households do not pass the test of consistency. However, if we use a weaker test which allows for relatively small errors, the percentage of inconsistent households decreases below 10%. Almost all of these inconsistencies can be explained by purchase infrequency or a "nearly optimizing behavior". Indeed, an aggregation of the monthly data shows that the annual purchases are consistent with revealed preference theory in 97% of the households. Therefore, the neoclassical model of consumer behavior can be used to explain the purchases of an individual household but, as with all models, some deviation should be allowed. 16 References Afriat, S.N. (1967), "The Construction of a Utility Function from Expenditure Data", International Economic Review, vol. 8, 1967, pp. 67-77 Battalio et al. (1973) "A Test of Consumer Demand using Observations of Individual Consumer Purchases", Western Economic Journal, vol. 11, 1973, pp. 411-428 Bronars, S.G. (1987), "The Power of Nonparametric Tests of Preference Maximization", Econometrica, vol. 55, 1987, pp. 693-698 Browning, M. (1989), "A Nonparametric Test of the Life-Cycle Rational Expectations Hypothesis", International Economic Review, vol. 30, 1989, pp. 979-992 Deaton, A. and J. Muellbauer (1980), Economics and Consumer Behavior, Cambridge University Press, Cambridge, 1980 Dobell, A.R. (1965), "A Comment on A.Y.C. Koo's "An Empirical Test of Revealed Preference Theory" ", Econometrica, vol. 33, 1965, pp. 451-455 Hicks, J.R. (1956), A Revision of Demand Theory, Clarendon Press, Oxford, 1956 Houthakker, H.S. (1950), "Revealed Preference and the Utility Function", Economica, vol. 17, 1950, pp. 159-174 Houthakker, H.S. (1987), "Engel Curve", in Eatwell J., M. Milgate, P. Newman, The New Palgrave, vol. 2, 1987, pp. 142-143 Houthakker, H.S. and L.D. Taylor (1970), Consumer Demand in the United States: Analyses and Projections, Second and Enlarged Edition, Harvard University Press, Cambridge, 1970 Koo, A.Y.C. (1963), "An Empirical Test of Revealed Preference Theory", Econometrica, vol. 31, 1963, pp. 646-664 Manser, M. and R. McDonald (1988), "An Analysis of Substitution Bias in Measuring Ination, 1959-1985", Econometrica, vol. 56, 1988, pp. 909-930 17 Mossin, A. (1972), "A Mean Demand Function and Individual Demand Functions Confronted with the Weak and the Strong Axioms of Revealed Preference: an Empirical Test", Econometrica, vol. 40, 1972, pp. 177-192 Oce federal de la statistique (1988), Budgets des menages 1987, Oce federal de la statistique, Berne, 1988 Samuelson, P.A. (1938), "A Note on the Pure Theory of Consumer Behavior", Economica, vol. 5, 1938, pp. 61-71 Shafer, W. and H. Sonnenschein (1982), "Market Demand and Excess Demand Functions", in Arrow K.J. and M.D. Intriligator (Eds.), Handbook of Mathematical Economics, vol. II, North-Holland, Amsterdam, 1982, pp. 671-693 Varian, H.R. (1982), "The Nonparametric Approach to Demand Analysis", Econometrica, vol. 50, 1982, pp. 945-972 Varian, H.R. (1985), "Non-parametric Analysis of Optimizing Behavior with Measurement Error", Journal of Econometrics, vol. 30, 1985, pp. 445-458 Varian, H.R. (1990), "Goodness-of-t in Optimizing Models", Journal of Econometrics, vol. 46, 1990, pp. 125-140 Warshall, S. (1962), "A Theorem on Boolean Matrices", Journal of the American Association of Computing Machinery, vol. 9, 1982, pp. 11-12 Wold, H. (1953) in association with L. Jureen, Demand Analysis, Wiley, New York, 1953 18 Year Table I Yearly budgets Number of budgets 1975 984 1976 515 1977 456 1978 434 1979 520 1980 580 1981 559 1982 616 1983 637 1984 618 1985 638 1986 623 1987 608 Total 7788 a (incomplete years included)22 22 These gures are slightly dierent from those published by the Swiss Federal Oce of Statistics (See Oce federal de la statistique (1988)) because we have excluded only two budgets due to unreliable data. 19 Table II Longevity of household panel members Number of months Number of households 156 31 144-152 13 120-132 28 108 32 96 33 84-91 69 72-79 116 60-68 132 48-57 180 36-46 356 24-35 516 13-22 38 12 1623 Total 3167 20 Table III Inconsistent households using monthly data Number of months Number of households Percentage 156 31 100 144-152 13 100 120-132 28 100 108 32 100 96 33 100 84-91 69 100 72-79 116 100 60-68 131 99 48-57 165 92 36-46 269 76 24-35 262 51 13-22 3 8 12 211 13 Total 1363 43 21 Table IV Results with annual data Number of years Total households Inconsistent households 2 516 2 3 356 2 4 180 3 5 132 5 6 116 4 7 69 6 8 33 6 9 32 2 10 21 1 11 7 3 12 13 1 13 31 9 1506 44 Total 22 Table V Percentage of inconsistent behaviors Afriat eciency index 1 0.99 0.98 0.95 All goods 43.0 19.6 12.4 5.9 Non durable goods 44.5 17.3 10.6 4.5 Food 50.4 13.6 4.1 0.5 All goods 15.0 6.2 3.4 0.8 Non durable goods 15.1 4.5 2.5 0.5 Food 14.7 1.1 0.3 0.0 All goods 2.9 0.4 0.1 0.0 Non durable goods 2.4 0.1 0.0 0.0 Food 1.5 0.0 0.0 0.0 Monthly data Quarterly data Annual data