Semiparametric Bayesian inference for dynamic Tobit panel data

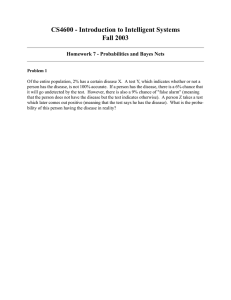

advertisement