Implementing the Fourth Directive

advertisement

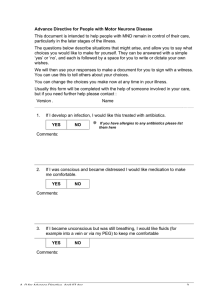

REPARIS – A REGIONAL PROGRAM Implementing the Fourth Council Directive Overview and options THE ROAD TO EUROPE: PROGRAM OF ACCOUNTING REFORM AND INSTITUTIONAL STRENGTHENING (REPARIS) The Fourth Directive adoption and amendments ! The Fourth Council Directive was adopted on 25 July 1978 and amended 13 times by other Council Directives (see M amendments)…… ! and 4 times for accession amendements 2 The Fourth Directive amendments ! The Fourth Company Law Directive was amended 5 times for accession purposes (see A amendments) ! A consolidated version is available on the EU website ! http://europa.eu/legislation_summaries/internal_market/businesses/company_law/l26009_en.htm 3 Cross references to other Directives and EC Regulations ! Several cross references to directives • First Company Law Directive 68/151/EEC • Second Company Law Directive 77/91/EEC • Seventh Company Law Directive 83/349/EEC on consolidated accounts of companies with limited liabilities • Eighth Company Law Directive 4/253/EEC, the Statutory Directive ! And to EC regulations • The IAS Regulation (EC) No 1606/2002 adopting IAS/IFRS for consolidated accounts of publicly traded companies • Commission Regulation (EC) No 1725/2003 endorsing certain IAS/ IFRS 4 Preamble: objective and scope of application ! In the context of companies activities frequently extending beyond the frontiers of national territories…. ! ……and competition within the EU: necessary…to establish in the Community minimum equivalent legal requirements as regards the extent of the financial information that should be made available to the public by companies that are in competition with one another ! Targeted to limited liability companies ……..in respect of certain companies with limited liability… because they offer no safeguards to third parties beyond the amounts or their assets ! and protection of third parties and owners ….. and is of special importance for the protection of members and third parties ! Dealing with……the presentation and content of the annual accounts (i.e. financial statements) , valuation methods, related annual and audit reports, and their publication 5 Preamble: objectives and scope of application ! TRUE AND FAIR VIEW CONCEPT…..annual accounts must give a true and fair view of a company's assets and liabilities financial position and profit or loss ! LAYOUTS : must be prescribed for the balance sheet and the profit and loss account and whereas the minimum content of the notes on the accounts and the annual report must be laid down [therefore a mandatory layout] … ! VALUATION METHODS: the different methods for the valuation of assets and liabilities must be coordinated to the extent necessary to ensure that annual accounts disclose comparable and equivalent information ! PUBLICATION: Whereas the annual accounts of all companies to which this Directive applies must be published in accordance with Directive 68/151/EEC; certain derogations may likewise be granted in this area for small and mediumsized companies ! AUDIT: Whereas annual accounts must be audited …only small companies may be relieved of this audit obligation 6 Options of the Fourth Directive ! The Fourth Directive was prepare to harmonize existing financial reporting frameworks for nine different countries ! The Fourth Directive negotiation was a long process under which some of the differences were reconciled through options ! The evolution of the Directive, including to making it compatible with IFRS has even led to more options ! Some options are key when defining the financial reporting framework: definition of small and medium-sized entities 7 Implementation of the Fourth Directive: challenges ! At EU or regional level: How do you ensure consistency of application, when requirements for different sizes of enterprises are not the same in all countries? ! At Country level: - Are the requirements of the Fourth Directive sufficiently detailed and complete, (they are not accounting standards) - Many options to choose from 8 Options of the Fourth Directive ! ! Numerous options of various scope: Member States (MS) options: - each time that the directive mentions MS may permit or require: 13 options (art. 2, 4.6, 8, 10a, 22, 31.1a, 33.1, 33.3, 42.a, 5.a, 42c.2, 42e, 42 f, 59) - each time that the directive mentions MS may authorize or require: 2 options (art 2, 6) - each time that the directive mentions MS may authorize: 1 option (art. 20) - each time that the directive mentions may permit: 11 options (art. 11, 27, 30, 37, 39, 40, 43, 44, 45, 46a, 47) - In other instances depends on national legislation (other type of member state option)…. ! Company options: on companies special circumstances 9 Options of the Fourth Directive ! Member States option to extend the scope of application of the directive to other type of entities - However, risk of overburden some due attention is needed for defining the small and medium entities…. and nonprofit - At EU level and international level the motto is “Better Regulation” and avoid golden plating 10 Options of the Fourth Directive ! ! Determining option small enterprises (art 11-12): The Member States may permit companies which on their balance sheet dates do not exceed the limits of two of the three following criteria: - balance sheet total: EUR 4 400 000 ◄, - net turnover: EUR 8 800 000 ◄, - average number of employees during the financial year: 50 to draw up abridged balance sheets ! Other options based on the same criteria - Obligation to draw an annual report - Obligation to have an annual audit 11 Options of the Fourth Directive ! ! Determining option medium-sized enterprise (art 27-12): The Member States may permit companies which on their balance sheet dates do not exceed the limits of two of the three following criteria: - balance sheet total: EUR 17 500 000 ◄, - net turnover: EUR 35 000 000 ◄, - average number of employees during the financial year: 250 to draw up abridged profit and loss statements 12 Scope of the Fourth Directive (78/660/EEC) ! Scope of application (art. 1 ) ! Section 1 – General provisions (art. 2) ! Section 2 – General provisions concerning the balance sheet an the profit and loss accounts (art. 3 – 7) ! Section 3 – Layout of the balance sheet (art. 8) ! Section 4 – Special provisions relating to certain balance sheet items ! Section 5 – Layout of the profit and loss account (art. 15 – 27) 13 Scope of the Fourth Directive (78/660/EEC) ! Section 6 – Special provisions relating to certain profit and loss account items (art. 28 – 30) ! Section 7 and 7a – Valuation rules (art. 31 – 42f) ! Section 8 – Contents of the notes on the accounts (art. 43 – 46) ! Section 9 – Content of the annual report (art. 46) ! Section 10 and 10A – Publication (art. 47 – 50c) ! Section 11 – Auditing (art. 51) ! Section 12 – Final provisions (art. 52 – 62) 14 Section I General provisions ! Annual accounts comprise: - Balance sheet - Profit and loss accounts - Notes on the accounts Prepared in accordance with the provision of the directive ! Option: member states may permit or require the inclusion of other statements (e.g. statements of changes in equity, cash-flow statements) Option: members states may authorize or require the disclosure of other information….[in addition to the directive requirements] ! ! True and fair view concept - Applying to the annual accounts - Mandating supplementary information when needed - True and fair view override (exceptional and given in the notes) 15 Section II General Provisions Layout ! Previous year comparison If not comparable the previous year figure …non comparability and adjustments to be disclosed in the notes (MS option) ! Presentation of amounts to have regards to substance (MS option) ! Set off prohibited for both balance sheet and profit and loss ! Special layouts for annual accounts for financial holdings and investment companies but has to provide a true and fair view - Investment companies: sole object to invest their funds in various securities, real estate… and to spread their benefits - Companies associated with investment companies with fixed capital - Financial Holdings Companies ! 16 Section II General Provisions Layout ! Layout is mandatory ! Any departure from the layouts should be permitted on exceptional basis and… …..should be disclosed in the notes ! Option for small companies to draw abridge balance sheets (if over two of the three thresholds for two consecutive year … the derogation ceased to exist) ! Option to integrate appropriation of profit or treatment of the loss in the layouts ! General provisions - Consistency in the presentation from one year to the next - Items to be presented separately according to the layouts prescribed - Subdivision shall be authorized for assets and liabilities but the layout must be complied with (MS option) - Possible new items if not provided in the layouts (MS option) - If the nature of an undertaking requires then some of the layout, nomenclature, and terminology must change (MS requirement) - If amounts are immaterial or combination makes more clarity they may be combined (MS option can require the combination); 17 Section II Layout of the balance sheet ! Difference between full ………..and abridged layouts Assets XX XX-­‐1 A. Subscribed capital unpaid of which there has been called Liabilities XX XX-­‐1 A. Capital and reserves I. Subscribed capital In that case, the amounts of subscribed capital and paid-­‐up capital must be shown separately). B. Formation e xpenses as defined by national l aw, and i n so far as national l aw permits their being shown as an asset. National l aw may also provide for formation e xpenses to be shown as the first i tem under II. Share premium account C. Fixed assets III. Revaluation reserve I. Intangible assets IV. Reserves 1. Costs of research and development, i n so far as national l aw permits their 1. Legal reserve, i n so far as national l aw requires such a reserve. 2. Concessions, patents, l icences, trade marks and similar rights and assets, 2. Reserve for own shares, i n so far as national l aw requires i f they were: such a reserve, without (b) created by the undertaking i tself, i n so far as national l aw permits their pbrejudice eing shown to Aarticle s assets. 22 (1) (b) of Directive 77/91/EEC. 3. Goodwill, to the e xtent that i t was acquired for valuable consideration. 3. Reserves provided for by the articles of association. 4. Payments on account. 4. Other reserves. II. Tangible assets V. Profit or l oss brought forward 1. Land and buildings. VI. Profit or l oss for the financial year 2. Plant and machinery. (unless national l aw requires that this i tem be shown under F 3. Other fixtures and fittings, tools and e quipment. or under E under "Liabilities"). 4. Payments on account and tangible assets i n course of construction. B. Provisions for l iabilities and charges III. Financial assets 1. Provisions for pensions and similar obligations. 1. Shares i n affiliated undertakings. 2. Provisions for taxation. 2. Loans to affiliated undertakings. 3. Other provisions. 3. Participating i nterests. C. Creditors (Amounts becoming due and payable within one year and 4. Loans to undertakings with which the company i s l inked by virtue of participating amounts bi nterests. ecoming due and payable after more than one year must be shown separately for e ach 5. Investments held as fixed assets. item and for the aggregate of these i tems.) 1. Debenture 6. Other l oans. 1. Debenture l oans, showing convertible l oans separately. 7. Own shares (with an i ndication of their nominal value or, in the absence of a nominal value, their accounting par value) to the e xtent that national l aw permits their being shown i n the 2. Amounts owed to credit i nstitutions. D. Current assets 3. Payments received on account of orders i n so far as they I. Stocks as deductions from stocks. 1. Raw materials and consumables. 4. Trade creditors. 2. Work i n progress. 5. Bills of e xchange payable. 3. Finished goods and goods for resale. 6. Amounts owed to affiliated undertakings. 7. Amounts owed to undertakings with which the 4. Payments on account. company i s l inked by virtue of participating i nterests. II. Debtors (Amounts becoming due and payable after more than one year must be shown separately for e ach i tem.) 8. Other creditors i ncluding tax and social security. 9. Accruals and deferred i ncome (unless national l aw 1. Trade debtors. provides for such i tems to be shown 2. Amounts owed by affiliated undertakings. under D under "Liabilities"). 3. Amounts owed by undertakings with which the company i s linked by virtue of participating i nterests. D. Accruals and deferred i ncome 4. Other debtors. 5. Subscribed capital called but not paid (unless national l aw provides that called-­‐up E. Profit for the financial year 6. Prepayments and accrued i ncome (unless national l aw provides for such i tems to be III. Investments 1. Shares i n affiliated undertakings. E. Prepayments and accrued i ncome (unless national l aw provides for such i tems to be shown as an asset under D (II) (6)). F. Loss for the financial year Total Assets A+B+C+D+E+F Total Liabilities A+B+C+D+E Layouts distributed to the participants Assets XX XX-­‐1 A. Subscribed capital unpaid A. Capital and reserves B. Formation e xpenses I. Subscribed capital C. Fixed assets II. Share premium account I. Intangible assets III. Revaluation reserve II. Tangible assets IV. Reserves III. Financial assets V. Profit or l oss brought forward D. Current assets VI. Profit or l oss for the financial year II. Debtors (Amounts becoming due and payable after more than one year must be shown separately for e ach i tem.) B. Provisions for l iabilities and charges III. Investments C. Creditors IV. Cash at bank and i n hand D. Accruals and deferred i ncome E. Prepayments and accrued i ncome E. Profit for the financial year (unless national l aw provides for such i tems to be shown as an asset under D (II) (6)). F. Loss for the financial year (unless national l aw provides for i t to be shown under A (VI) under "Liabilities"). Total Assets A+B+C+D+E+F Total Liabilities A+B+C+D+E ! ! ! ! Liabilities XX XX-­‐1 As a MS option they are different for small entities (abridged) One level of detail less P/L is also simplified but the difference is smaller Less related disclosure 18 Section IV Special Provision relating to certain balance sheet items ! If assets are to be shown as fixed or current assets depends on the purpose for which they are intended ! Movement in the various fixed assets items shall be shown in the balance sheet or in the notes on the accounts • Purchased price or production cost • Additions, disposals and transfer during the financial year 19 Section 5 – Profit and Loss layouts ! ! ! Choice between four different layouts Are spelled out under articles 23 to 26 Fewer benefit for the abridged version as compared to the Balance sheet and valid for both small and medium-sized company Article 25 1. Net turnover. 2. Cost of sales (including value adjustments). 3. Gross profit or loss. 4. Distribution costs (including value adjustments). 5. Administrative expenses (including value adjustments). 6. Other operating income. 7. Income from participating interests, with a separate indication of that derived from affiliated undertakings. 8. Income from other investments and loans forming part of the fixed assets, with a separate indication of that derived from affiliated undertakings. 9. Other interest receivable and similar income, with a separate indication of that derived from affiliated undertakings. 10. Value adjustments in respect of financial assets and of investments held as current assets. 11. Interest payable and similar charges, with a separate indication of those concerning affiliated undertakings. 12. Tax on profit or loss on ordinary activities. Profit or loss on ordinary activities after taxation. 13. Profit or loss on ordinary activities after taxation. 14. Extraordinary income. 15. Extraordinary charges. 16. Extraordinary profit or loss. 17. Tax on extraordinary profit or loss. 18. Other taxes not shown under the above items. 19. Profit or loss for the financial year. To be combined under one i tem called gross profit or l oss 20 Section 6 – Special provisions related to certain item ! Definition: - the net turnover shall comprise the amounts derived from the sale of products and the provision of services falling within the company's ordinary activities, after deduction of sales rebates and of value added tax and other taxes directly linked to the turnover. - Income or charges that arise otherwise than in the course of the company’s ordinary activity must be shown under “Extraordinary income and extraordinary charges” 21 Section 7 – Valuation rules ! Common valuation rules: art. 31-42: historical cost is the default, production cost or purchasing price ! Overarching principles - Carrying business as a going concern - Consistency in application from one financial year to another - Valuation must be made on a prudent basis • Only profit made at balance sheet date may be included • All liability must be accounted for even for previous financial years even if they appear after balance sheet date • Accounts must take care of all depreciation - Account must be taken of income and charges relating to the financial year irrespective of the date of payment - Components of assets and liability must be valued separately - The opening balance sheet of each financial year shall be consistent with the closing balance sheet of the previous year 22 Section 7a – Valuation at Fair Value ! Valuation rules at fair value: art. 42a-42f - Is a MS option that can be restricted to consolidated accounts - Deals mainly with the valuation of financial instruments and related disclosures (art 42d) - Are registered generally through P/L (exception for cashflow hedge and some exchange differences linked to investment in a foreign subsidiary) - A MS option allows other categories of assets than financial instruments to apply fair value… then changes in fair value is included in profit and loss 23 Section 8 – Notes ! The directives sets minimum requirements ! Examples of requirements with few options • the valuation methods applied …. and the methods employed in calculating the value adjustments.. • List of subsidiaries, and related information • List of subsidiaries for which the company has unlimited liability • Number and value of shares • Liabilities per maturity… • Financial commitments • Related parties transactions • Management and supervisory bodies remunerations and credit extended to them • Audit and advisory fees • Average number of employees ! Notes can be abridged under the provisions of articles 11 and 44 (MS option) 24 Section 9 – Contents of the Annual Report ! Requirements under art 46 ! Annual report shall include a fair review - of the developments of the company’s business and position - The description of the risks and uncertainty it faces - Contain financial and non-financial key performance indicators - Information on environmental and employee matter - Information to and additional explanation of amounts reported in the financial statements - … - Additional requirements for publicly traded companies ! MS Option: no annual report for small entities MS Option: exemption from certain requirements of the report ! 25 Section 10 – Publication ! The publication shall include - Annual accounts approved - Annual report - Opinion of the statutory auditors - Proposed appropriation of the profit and treatment of the loss - Actual appropriation or treatment 26 Section 10 – Publication Publica(on exemp(ons Small Medium Sized Publish Abridged Balance Sheet MS Op7on MS Op7on but semi-­‐abridged Publish Abridged Profit and Loss MS Op7on MS Op7on Publish Abridged Notes MS Op7ons MS Op7on but semi-­‐abridged Publish Annual Report MS Op7on No 27 Section 10 – Publication ! If the annual accounts and the annual report are published in full: - They must be reproduced in the form and text on the basis of which the person responsible for the financial statements has drawn his opinion - The must be accompanied with the full text of the statutory audit report - the proposed and the actual appropriation of profit and treatment of loss needs to be published ! If the annual accounts are not published in full: - Need for indicating that the version is abridged - Reference to be made to the register in which the accounts have been filed - If the financial statements have not been filed it needs to be stated 28 Section 11 – Auditing ! Annual accounts to be audited by persons approved by the member states ! On the basis of the Eighth Directive ! The statutory auditors shall express an opinion concerning the consistency of the annual reporting with the annual accounts ! Small Companies (defined in art 11) may be relieved from the audit obligations (MS option) ! If there is no audit Member State shall introduce appropriate sanctions in their laws for cases in which the annual accounts or annual reports are not drawn up in accordance with the directive ! Note: the directive is silent on the monitoring of the obligation. How to sanction, without monitoring? 29 Section 11 – Auditing ! The content of the auditors’ report is described in the directive and leads to: - Identifying the annual accounts that are subject to the statutory audit, together with the financial reporting framework applied in their preparation - Describe the scope of the audit and at least indentify the auditing standards applied - Issuing an audit opinion • Opinion on the true and fair view • Disclaimer of opinion - Reference to any matters to which the statutory auditors draw attention by way of emphasis - An opinion concerning the consistency of the annual report with the annual accounts for the same financial year (specific of the directive and not an ISA requirement) - Report to be signed and dated by the statutory auditors 30