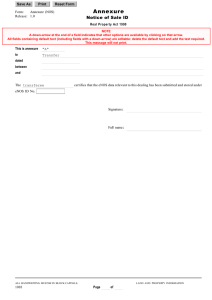

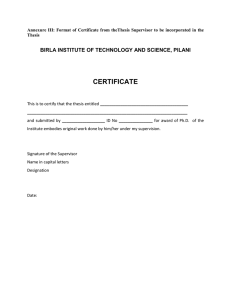

Detailed information on production rebate credit certificates

advertisement