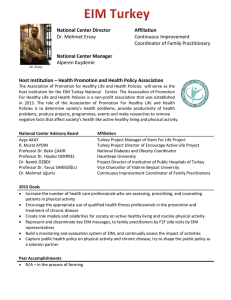

Phase 2 Final Report

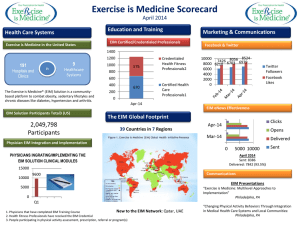

advertisement