Login / My Account

Home

About Us

Our Analysts

Recommended Portfolio

MTSL

Subscribe

Contact Us Current Issue

Search

MTSL Issue 827

May 12, 2016

UPDATES: ACAD, ANTH, FPRX, INCY, XON, IONS, MDCO, NKTR, NVAX, PCRX, ZIOP

IN THIS ISSUE: Anthera (ANTH) — As Data Nears, The Case For Reduction In Proteinuria

Since Last Issue: BTK: -8.7%; NBI: -8.5%; Model Portfolio: -14.3%; Trader’s Portfolio: -24.1%

Biotech Sector Analysis

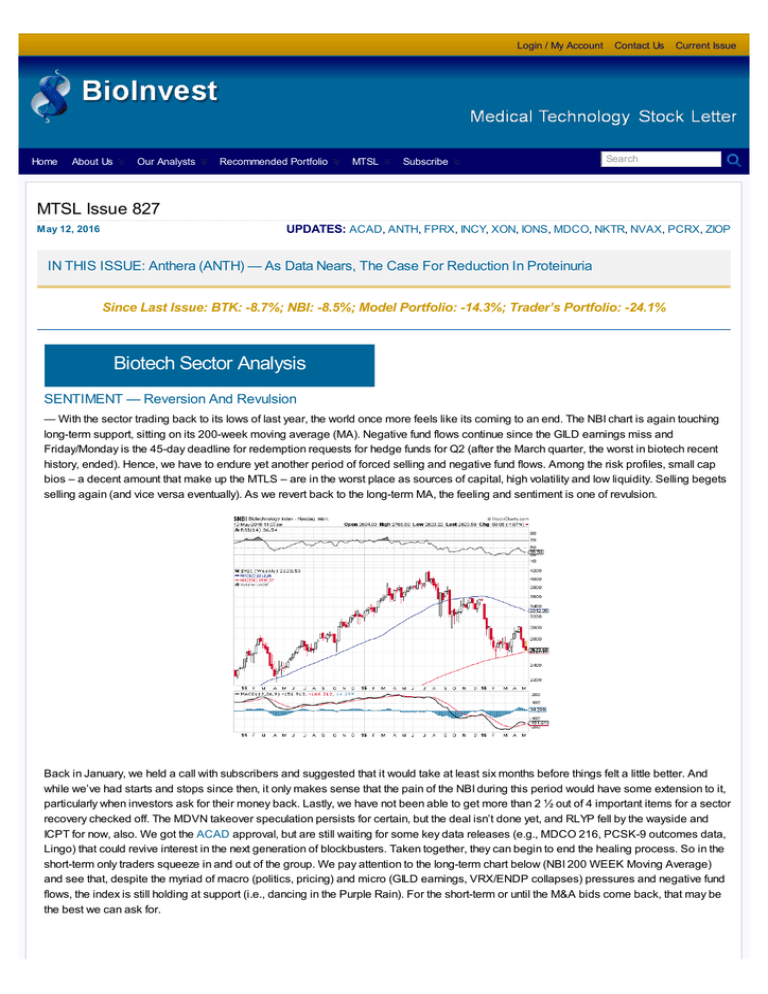

SENTIMENT — Reversion And Revulsion

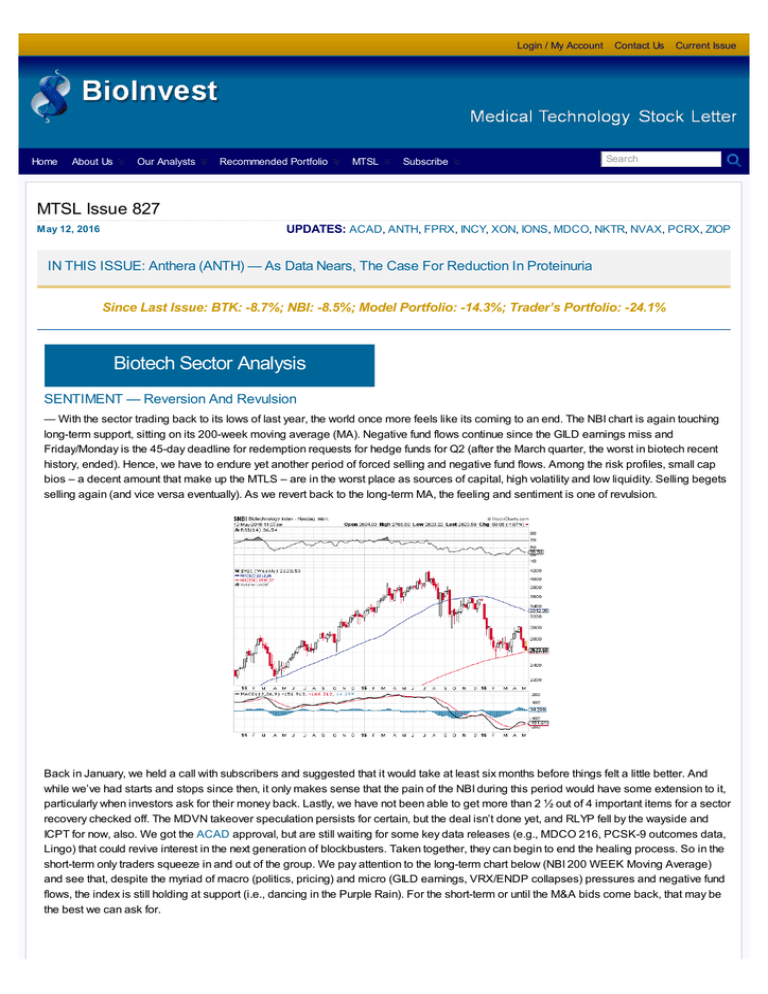

— With the sector trading back to its lows of last year, the world once more feels like its coming to an end. The NBI chart is again touching

long-term support, sitting on its 200-week moving average (MA). Negative fund flows continue since the GILD earnings miss and

Friday/Monday is the 45-day deadline for redemption requests for hedge funds for Q2 (after the March quarter, the worst in biotech recent

history, ended). Hence, we have to endure yet another period of forced selling and negative fund flows. Among the risk profiles, small cap

bios – a decent amount that make up the MTLS – are in the worst place as sources of capital, high volatility and low liquidity. Selling begets

selling again (and vice versa eventually). As we revert back to the long-term MA, the feeling and sentiment is one of revulsion.

Back in January, we held a call with subscribers and suggested that it would take at least six months before things felt a little better. And

while we’ve had starts and stops since then, it only makes sense that the pain of the NBI during this period would have some extension to it,

particularly when investors ask for their money back. Lastly, we have not been able to get more than 2 ½ out of 4 important items for a sector

recovery checked off. The MDVN takeover speculation persists for certain, but the deal isn’t done yet, and RLYP fell by the wayside and

ICPT for now, also. We got the ACAD approval, but are still waiting for some key data releases (e.g., MDCO 216, PCSK-9 outcomes data,

Lingo) that could revive interest in the next generation of blockbusters. Taken together, they can begin to end the healing process. So in the

short-term only traders squeeze in and out of the group. We pay attention to the long-term chart below (NBI 200 WEEK Moving Average)

and see that, despite the myriad of macro (politics, pricing) and micro (GILD earnings, VRX/ENDP collapses) pressures and negative fund

flows, the index is still holding at support (i.e., dancing in the Purple Rain). For the short-term or until the M&A bids come back, that may be

the best we can ask for.

Are Hedge Funds Buying While Mutual Funds Are Selling?

Most would argue that, for biotech investors, smart money lies in hedge funds versus mutual funds. Hence, as we went to press, someone

sent us the following two charts that may offer some optimism as we head into the rest of 2016 and beyond. While the overall health care

funds flow is still negative, it appears that since the beginning of 2016, and certainly into the second quarter, hedge funds have been buying

biotech stocks while mutual funds have been steady sellers. While it is still rather short-term in nature, to us the charts suggest the generalist

(long only or LO) fund is looking more short-term macro (i.e., the election) while the specialist (hedge fund of HF) is adding to positions now.

It may be just one sign, but eventually those generalists come back to biotech. When? Usually after the stocks have gone up a bit. A little

food for thought.

Gilead, Gilead, Gilead

At last Issue’s printing, sector leader GILD once more led the rotation out of biotech – this time with disappointing earnings. What is truly

frustrating is that, with incredible speed, Harvoni/Solvaldi sold more than $19 billion last year.

Due to competition and a shrinking patient pool – because the drugs actually cure Hepatitis C – it will take some time for the

Company to make up the upside down v-shape move in HCV sales. As an important backstop to this story, GILD is still printing money

at an astronomical pace and now has more than ~$22 billion in cash sitting on its balance sheet.

That cash hoard, however, does little to attract the growth investors that hugged and kissed GILD from 2012-2015. For now trading at a

P/E of less than 8x, GILD will be a value player’s core holding until management figures this one out. While it is not exactly fair to

compare GILD with Pfizer and the loss of the Lipitor patent, GILD for now feels like PFE did. GILD has been very acquisitive and

successful in some key acquisitions, and in our view, they can reverse the negative sentiment with some good use of its cash. Since the

plateau and drop in HCV sales happened quicker than most expected, the Company is not in a major hurry to make another big

purchase. While its cash hoard swells and its stock price languishes, however, that may force a deal sooner than later. Also, with the

AGN deal behind it, PFE too may go pipeline shopping again (despite the CEO’s recent comments suggesting otherwise). At least, we

hope so.

MDCO Is Moving Quicker Than GILD

Another company that lost its major cash cow last year (well GILD didn’t actually lose theirs), MTSL’s The Medicine’s Company has

made a handful of moves to recoup Angiomax’s $600 million in annual sales. It’s on a much smaller scale than GILD, of course, but that

too is relatively easier to make up, and the Company has now embarked on a strategic plan to focus on not one but four potential

blockbusters (see MDCO below). And the recent sale of more or its non-core assets that allows the company to both fund and focus on

the high-value pipeline, in our view, MDCO may recover and then some of the value lost from Angiomax’s patent expiration. In our view,

the leverage and even diversification of the MDCO’s R&D pipeline – with several later-stage clinical catalysts on all four starting midyear – will lead to another incredible resurrection by CEO Clive Meanwell et.al.

MDCO vs. GILD One Year Stock Chart

Recently, MDCO shares declined a bit after the second sale of its non-core assets, despite an excellent price paid by Italy’s Chiesi.

Part of that may be due to the fast money in the sector, selling on the news and those thinking maybe the Company was going to be

bought. (We believe it is too early for that.) Another reason may be a deal that insurer Cigna cut last week with the two current makers of

the new PCSK-9 cholesterol drugs, and the association with MDCO’s PCSK-9-si compound. However, for several reasons we would

argue that this deal is even more positive for MDCO’s next-generation version. First, as an anti-sense or synthesis inhibitor, the MDCO

PCS-si compound has a unique mechanism of action compared to antibodies. It is more potent and needs much lower drug volume for

efficacy, and as such has a longer duration of action and likely will have a once quarterly and probably once-every-six months dosing.

Due to the significantly lower drug volume given, it is likely even safer than the Mabs, too. Finally, the COGS of an antisense compound

are logs lower than that of an antibody. So, MDCO should be in the driver’s seat with regards to cost-benefit data on top of a wider

therapeutic window. The upcoming outcomes trials on AMGN’s Repatha are key, but we remain confident in MDCO’s leadership

position in PCSK-9 therapeutics.

Q1 Updates For The MTSL; Near-Term Focus On ZIOP And ANTH

Many of our universe companies released Q1 results and held quarterly conference calls. We summarize them in our Company

Updates below. In the very near-term, ASCO abstracts (http://abstracts.asco.org) will be released on May 18th after the close. While

many of our names have some exposure to the conference – the biggest cancer meeting of the year – we are focused on the brain

cancer data for ZioPharm’s (ZIOP) IL-12 compound and believe it may be one of the highlights of the meeting. INCY, too, should have

a solid presence. FPRX will also present data and deliver on Oral presentation for FPA144. Other immunotherapy data will be, mostly

from Big Pharma.

This week’s white paper focuses on a long-discarded and forgotten about microcap, Anthera (ANTH), over the next six weeks (plus

the remainder of 2016) the Company will begin a long-list of late-stage clinical catalysts, its first in years.

ANTHERA

ANTH — As IgAN Data Nears, The Case For A Reduction In Proteinuria

With Anthera shortly delivering its first new clinical trial results in a long time, the implications of the IgAN data, in our opinion the implications

of the IgAN data, while not yet valued by investors, are many.

IgAN Background

IgA nephropathy (also known as Berger’s disease) is a kidney disease that occurs when an antibody called immunoglobulin A (IgA) lodges

in your kidneys. This results in local inflammation that, over time, may hamper your kidneys’ ability to filter wastes from your blood. IgA

nephropathy usually progresses slowly over many years, but the course of the disease in each person is uncertain. Some people leak blood

in their urine without developing problems, some eventually achieve complete remission, and others develop end-stage kidney failure

(ESRD).

Proteinuria is the presence of abnormal quantities of protein in the urine, which may indicate damage to the kidneys. There is no direct

treatment but a number of medications can slow the progress of the disease and help you manage symptoms such as high blood pressure,

protein in the urine (proteinuria), and swelling (edema) in your hands and feet. Medications used to treat symptoms of IgA nephropathy

include high blood pressure medications, omega-3 fatty acids, immunosuppressants, statins, and mycophenolate mofetil (CellCept). All of

the above treat symptoms of IgAN but there is no disease modifying therapy. Anthera’s blisibimod, with reduces levels of elevated BAFF

levels in IgAN (and SLE), may be the first disease-modifying therapy for IgAN.

Several published clinical trials – including one printed February in the Journal of Nephropathology – regard proteinuria as an important

risk factor of IgA nephropathy and the best surrogate marker for the progression of end-stage renal disease ESRD

(http://www.ncbi.nlm.nih.gov/pmc/articles/PMC4844912/). Over the past year, Anthera has met with global regulatory agencies that have

agreed with the Company that proteinuria is an acceptable single biomarker that would qualify for conditional and accelerated approval of

b-mod in IgAN.

Phase 2 BRIGHT-SC Data Is Due In Q2:16

Anthera will conduct a proof-of-concept efficacy analysis of the BRIGHT-SC study when all patients have received a minimum of six months

of therapy. This analysis will examine the effects of blisibimod versus placebo in the proportion of qualifying patients who achieve a

complete response or a partial response in proteinuria (urinary protein excretion rate or UPE) at six months. As well, the effects of

blisibimod on various other disease markers will be assessed (https://clinicaltrials.gov/ct2/show/NCT02062684?

term=BRIGHT+SC&rank=1). While the full trial will continue patients for 52 week, six months (~24 weeks or even sooner) is roughly the time

that proteinuria levels were significantly reduced by b-mod in the PEARL studies – “The Subcutaneous BAFF Inhibitor, Blisibimod,

Significantly Reduces Proteinuria in Subjects with Moderate-to-Severe Systemic Lupus Erythematosis” was presented at the 2012 Asia

Lupus Summit, and published last summer (Furie RA, et al. Ann Rheum Dis 2015;74:1667–1675. doi:10.1136/annrheumdis-2013-205144).

In addition, in the Glaxo (GSK) BLISS trials that led to Benlysta’s FDA approval, patients with baseline proteinuria >0.2 grams/24 hours had

numerically or significantly greater median percent reductions in proteinuria during weeks 12–52 than those treated with

placebo (http://www.ncbi.nlm.nih.gov/pmc/articles/PMC4419251/). Benlysta, the last approved drug for lupus with sales annualizing ~$400

million per year, has a similar mechanism of action as Anthera’s blisibimod.

Implications For B-Mod & ANTH

While the BRIGHT study is just a proof-of-concept study, the information that results from the interim look will have important implications for

blisibimod not only in IgAN but in lupus as well. First, while the Company has taken successful interim looks with b-mod in CHABLIS (1/15)

and BRIGHT (3/15), and has added Sollpura to its pipeline (10/14), the BRIGHT actual initial data will be the first new clinical trial results

released by the Company in almost four years (e.g., there have been several deeper reviews but no major trials since PEARL Q2:12).

Design of the CHABLIS 7.5 Trial in SLE

Based upon our research above, we expect to see a favorable reduction in proteinuria in patients given b-mod and that will lead to the

next step in IgAN clinical development. Additional biomarker data (e.g., C3/C4 levels) will be released in Q3, the same patients will be

followed for the full 52-weeks and that data will be released in the fourth quarter (e.g., eGFR).

With 2-3 ongoing Phase III trials in both lupus (b-mod) and EPI (Sollpura) due this year alone, and the fact that there is no Asian partner,

no approved drugs available or clear-cut measurable market, the IgAN opportunity for b-mod is not really valued by ANTH investors.

The prevalence in Japan alone (300,000) is large and in U.S. (100,000) the drug would qualify as an Orphan Drug. Positive data,

although an interim look, could drive the possibility of a new Japanese partner for IgAN, as the prevalence is quite high there. On the

other hand, with the CHABLIS 1 top line data release coming in Q3, the Company will likely evaluate the options of a global or non-US

partnership for all blisibimod markets versus IgAN in Asia alone.

The Company ended Q1 with $38 million in cash and is spending approximately $10 million per quarter, which is enough to last until

almost all of the catalysts occur in the table above. They have just renewed a $25 million ATM financing vehicle, that has yet to be

tapped by the Company. Moreover, with the addition of Craig Thompson as President/COO, in our view, the Company is already in

preliminary talks with potential partners that may lead to a higher value-added deal(s) once the data is out.

The IgAN interim look, we believe, will continue to de-risk the lupus trials. As the CHABLIS 7.5 is also due to be initiated this quarter (by

the end of June), the proteinuria marker is an important endpoint in this condition as well (see the CHABLIS 7.5 design above). The

new data will therefore begin the steady flow of ANTH news, remind us of the activity and mechanism of b-mod, and the value

opportunity driven by its ability to inhibit B-cell activation in autoimmune disorders (e.g., lupus, nephritis, IgAN, even multiple myeloma).

(Remember, this compound was licensed from AMGN.) So we are just about to embark on a transformative year for Anthera – with

data from at least three clinical trials in three different indications from two separate compounds. In our view, there is no small biotech

company with this much near-term, late-stage clinical activity than Anthera. As we all know, this is an awful market for small cap biotech

stocks and ANTH has been no exception. But the reasons the stock hit $11 last summer have not changed and with Sollpura’s

emergence since then, in our view, they are even better.

ANTH is a BUY under 10 with a TARGET PRICE of 25

Clinical Trials Watch

Relevant New Studies or Changes Posted on ClinicalTrials.gov for our MTSL Portfolio and/or Related Companies Since Last Issue:

ACAD: Expanded Access of Pimavanserin for Patients With PD Psychosis

CELG/Roche: Study of Tocilizumab in Pancreatic Cancer Patients (PACTO)

INCY/Pharmacyclics: A Study of INCB039110 in Combination With Ibrutinib in Subjects With Relapsed or Refractory Diffuse Large BCell Lymphomaa

PCRX: Liposomal Bupivacaine for Pain Control After Total Shoulder Arthroplasty

Company Updates

UPDATES: ACAD, ANTH, FPRX, INCY, XON, IONS, MDCO, NKTR, NVAX, PCRX, ZIOP

ACAD – Receives FDA Approval, Pricing Higher & The Launch Next

The FDA approval of Nuplazid for Parkinson’s disease psychosis (PDP) last week was a major milestone for the Company. While the

stock traded well after the AdCom meeting in March, the stock sell off after the full approval is a good example of the sentiment of the

sector. The combination of a horrible biotech tape and sell the news mentality has dominated the current short-term action of most

stocks – even ones with the ultimate exceptional news – FDA approval.

The large short position should set a floor as we believe the drug will be a big seller. In our view, the most important news post-approval

is that Nuplazid was priced at $1,950/30-day supply, which is more than 50% above the level most on the Street were assuming.

Commercial launch is set for June. This should provide for some sales estimate increases from Wall Street analysts, as the higher

price will make it easier for ACAD to exceed initial consensus forecasts. Also it is important to remember that ACAD is now a derisked asset with an FDA approved drug in hand and could be acquired for a large premium.

ACAD is a BUY under 40 with a TARGET PRICE of 55

FPRX – Advances FPA008 into Phase II for PVNS

FPRX announced the advancement of FPA008 into the Phase II dose expansion portion of the ongoing Phase I/II trial in Pigmented

Villonodular Synovitis (PVNS). The Company started patient dosing in this Phase I/II clinical trial of ‘008 in July 2015. During the Phase

I dose escalation portion of the trial, FPRX assessed the safety and pharmacodynamics of multiple ascending doses of ‘008 to

determine the dose for expansion. During the Phase II expansion, the Company will evaluate response rate and duration, as well as

measures of pain and range of motion, in approximately 30 patients.

PVNS is a rare, locally aggressive tumor of the synovium. It is characterized by local over-expression of CSF-1 which recruits

macrophages into the joints, forming the non-malignant tumor mass.

It is associated with high morbidity, and there are no approved therapies for the condition. ‘008 blocks the binding of CSF-1 and

inhibits the activity and survival of the macrophages that form the bulk of the tumor. Five Prime is currently in a Phase 2 clinical trial

studying FPA008 as a treatment for PVNS. In January 2016, the FDA granted Orphan Drug Designation for ‘008 for the treatment of

PVNS, which is estimated to have a prevalence of 25,000 patients in the U.S.

FPRX will have data and an “oral” presentation at ASCO for FPA144 as the drug candidate has shown intriguing activity in combination

with PD-1 therapy. Oral presentations at ASCO are often reserved for high-profile studies. The company continues to both advance

their pipeline and present intriguing data at scientific conferences.

FPRX is a BUY under 42 with a TARGET PRICE of 55

INCY – Acquires ARIA’s European Operation & Delivers Solid Jakafi Quarter

The unexpected news on the Q1 conference call was the acquisition of ARIA’s EU operations and in-licensing Iclusig (ponatinib) rights

in Europe for $140 million in cash plus future royalties. In our view, this is a positive as it accelerates expansion of INCY‘s European

infrastructure while being cash-flow accretive in 2018. Remember INCY has little-to-zero experience in the EU as partner Novartis sells

Jakafi in Europe. Importantly, INCY reported another solid quarter on strong Jakafi growth and also raised 2016 Jakafi guidance. The

company’s massive wholly-owned oncology pipeline (14+ compounds and counting) remains on track, with the next major clinical

catalyst being the IDO/PD1 combination data in H2:16.

Jakafi Guidance Raised

INCY reported U.S. Jakafi revenue of $183 million (+0.7% QoQ, +58.9% YoY) in-line with consensus $184 million. Ex-U.S. Jakafi royalty

revenue of $22 million was expected given prior reported NVS sales of $124 million. Total revenue was $264 million was also in line.

FY16 U.S. Jakafi sales guidance was increased to $815 million-$830 million from $800 million-$815 million.

ARIA Deal Details

Under the proposed transaction, INCY will acquire all shares from ARIA’s European subsidiary responsible for EU Iclusig

commercialization in exchange for a $140 million upfront.

In addition, ARIA is entitled to up to $135 million in potential development and regulatory milestones for Iclusig in new indications, some

of which relate to second line CML (H2:16 pivotal study vs. nilotinib ongoing); details will be disclosed by indication. INCY will also fund

part of ARIA’s ongoing Iclusig OPTIC and OPTIC-2L trials via cost-sharing payments of up to $7 million each in 2016 and 2017. Lastly,

ARIA will receive tiered royalties (32-50%) on Iclusig net sales in the EU and 22 other countries (includes Switzerland, Norway, Turkey,

Israel, and Russia). INCY will also gain ARIA’s European commercial team of 125 employees.

In our view, the deal makes strategic sense for INCY as it continues to build its ex-US commercial footprint and given the company’s

lack of experience in Europe due to Novartis selling Jakafi in the EU. INCY has retained global rights to IDO and its entire massive

oncology pipeline (14+ drugs and counting) and will eventually require an EU commercial team. The decision to buy versus build a fully

integrated hem/onc commercial operation makes sense when adding in Iclusig revenue which will partially offsetting the cost of building

out infrastructure. In our view, the deal gives INCY ample time to both gain valuable sales experience while simultaneously building its

EU commercial team ahead of a potential IDO launch in 2019. The deal may have taken some near-term takeover spec out of INCY, but

if anything may increase a future buyout value.

INCY is a BUY under 100 with a TARGET PRICE of 120

XON – Q1 Results – ZIOP IL-12 Brain Cancer Data at ASCO Is Next

Intrexon reported Q1:16 earnings slightly below consensus estimates, including revenues of $43 million, and a net loss of $64 million

driven by greater than expected expenses. The cash position is $336 million, roughly the same as the end of 2015, demonstrating

continued fiscal efficiency. Solid progress was made with existing ECCs, JVs, and subsidiaries, including positive regulatory

developments with Oxitec and regulatory progress with Fibrocell. The 500-liter pilot plant for the methanotroph-driven production of

isobutanol is now operational, with site selection for a demonstration plant expected to begin by year-end. In our view, the next catalyst

for XON will be the presentation of clinical results for ZIOP’s Ad-RTS-IL-12 at ASCO in June and the abstracts will be released this

week (5/18 after the close).

At ASCO, ZIOP is expected to provide an update on the ongoing Phase I trial testing Ad-RTS-IL-12 in patients with glioma (severe

brain cancer). The poster (Abstract #2052) will be presented June 4th and is entitled “Effect of controlled intratumoral viral delivery of

Ad-RTS-hIL-12 + oral veledimex in subjects with recurrent or progressive glioma.” ZIOP has previously disclosed encouraging early

data from this trial and has already begun enrolling patients in the dose escalation portion. We will be on the lookout for initial survival

data at ASCO from the first several patients enrolled.

Fibrocell ECC – Fibrocell is advancing toward the start of a Phase I/II trial in recessive dystrophic epidermolysis bullosa (RDEB)

patients. The company has received an FDA allowance to start a Phase I/II trial for FCX-007 in adults with RDEB. Fibrocell has also

received Orphan Drug designation for FCX-013, its second gene-therapy product candidate being developed under the ECC with

XON. FCX-013 is being developed for the treatment of localized scleroderma and is expected to advance into the clinic in 2017. Also

in the quarter, an additional ECC was formed with Fibrocell, focusing on genetically-modified fibroblasts for the treatment of chronic

inflammatory and degenerative joint diseases, including arthritis. The current ECCs focus on orphan diseases and XON must like what

they are seeing, as these new indications could be sizable with arthritis representing a major health problem worldwide for an aging

population.

The 500-liter pilot plant for the methanotroph-driven production of isobutanol is operational, and demonstration plant site selection and

ground breaking is expected to begin by year-end with their partner Dominion. In addition, the Company is exploring other products that

can be generated from natural gas and expects to integrate the ability to test the production of these alternate products into the existing

pilot plant. The key hurdle is diverting sufficient carbon from natural gas into higher order carbon forms for both isobutanol and other

alternate products. In our view, the company remains on track for potential commercialization in 2018.

Zika Q1 Summary

Oxitec continues to advance in regulatory development of OX513A (genetically-engineered Aedes aegypti) against the Zika virus in

various countries including the following positive developments in Q12016:

The National Health Surveillance Agency of Brazil announced that Oxitec would receive temporary registration to deploy OX513A

throughout the country.

The FDA Center for Veterinary Medicine published a preliminary finding from the OX513A investigational trial in the Florida Keys

of no significant impact.

The WHO Vector Control Advisory Group issued a positive recommendation for pilot deployment of OX513A. Furthermore, the

Pan American Health Organization offered to provide support for pilot studies of OX513A.

The Cayman Islands Mosquito Research and Control Unit plans to utilize OX513A in the Cayman Islands. This follows a

successful pilot study of OX513A that reduced Aedes aegypti by 96%.

XON made good progress in multiple programs during the first quarter as the company’s management team continues to lay the

groundwork for future success. The Zika virus opportunity with OX513A emerged suddenly during Q1 and has the potential to create

real near-tem revenue. This is an excellent example of XON’s management being ahead of the curve, as Oxitec was purchased before

Zika recently re-emerged based on other market opportunities with Zika now representing a free wildcard for XON investors. In our

view, it would take a Zika contract in the neighborhood of $100 million to be a significant catalyst for XON. We would not be surprised to

see the first Zika contract this quarter. The upcoming ZIOP IL-12 Glioma data at ASCO has the potential to move the needle for both

XON and their partner. Positive data from this program throughout 2016 would position ZIOP to start a pivotal trial next year.

XON is a BUY under 42 with a TARGET PRICE of 60

IONS – Q1 Results – TTR-Rx Update & Partners Kynamro

The most important information for investors from the Q1 conference call, in our view, was the update on the TTR-Rx Phase III program.

Specifically, IONS said that low platelet counts have been seen in the ongoing familial amyloid polyneuropathy (FAP) study. The

company also said that platelet reductions are the focus of FDA concerns regarding the planned familial amyloid cardiomyopathy

(FAC) study, which is on clinical hold. Importantly, the FAP study remains on track for pivotal data in H1:17. On the Q1 conference call,

IONS discussed the low platelet counts observed in the TTR-Rx FAP study and believes this adverse event is not caused by the

antisense platform and is specific to TTR-Rx drug candidate. We should receive some additional clarity on this potential safety risk at

the international Society of Amyloidosis Meeting that will be held over the Fourth of July weekend. This investigator-sponsored

presentation of the TTR-Rx Phase II FAC data by IONS and their partner GSK address should the FDA’s concerns.

Kynamro Partnered With Kastle

IONS has partnered Kynamro with Kastle. They will earn a $15 million upfront payment and an additional $10 million payment on the

third anniversary of the deal, plus up to $70 million in sales-related milestones, for a total package of $95 million. IONS will also receive

a 10% equity stake in Kastle and starting in 2017 IONS will receive royalties in the mid-to-low teens on global net sales of Kynamro.

Under the previous arrangement with former partner Sanofi, Genzyme will receive a 3% royalty on sales of Kynamro and 3% of the cash

from Kastle plus a modest one-time payment for transition services.

While IONS does not have many near term catalysts, the first half of 2017 is approaching for two other significant Phase III readouts with

nusinersen in spinal muscular atrophy (SMA) Type I and II/III (now both fully enrolled) and volanesorsen in familial chylomicronemia

syndrome (FCS). Outside of the three pivotal programs, we look to FXI-Rx preliminary Phase I safety and dosing data later this year

(40-50 patients) that will set the stage for large Phase II trials in 2017 with their partner Bayer.

IONS is a BUY under 75 with a TARGET PRICE of 100

MDCO – Sale of Non-Core CV Business Adds Important Cash As Key Clinical Catalysts Near

In another solid move that further executes on the new strategic plan, The Medicines Company has divested its non-core cardiovascular

assets to Chiesi Farmaceutici S.p.A. Chiesi will acquire Cleviprex, Kengreal and rights to Argatroban for Injection for a total

consideration of up to $792 million. The deal will also reduce annual SG&A and related R&D expenses between $65-$80 million.

Taken together with the sale of the hemostasis business to Mallinckrodt last December, MDCO has generated ~$1.2 billion in total

cash obligations from both deals, with over $400 million paid in already. The transaction sharpens the Company’s strategic focus on the

four potential blockbuster R&D products, and significantly strengthens the Company’s financial position with non-dilutive capital.

With a healthy cash position of $700 million, MDCO can fully develop its R&D pipeline that has very important clinical data releases all

during 2016. Updates in the quarterly call include:

a) MDCO PCSK-9si (synthesis inhibitor) – The Phase II ORION 1 is on track with enrollment and the trial is expected to be complete

by Y/E. The next study, ORION 2, in patients with HFH (homozymous familial hypercholesterolemia) is on target to start by year–end;

MDCO will release the 90-day interim data, which will give the Company data supporting the quarterly dosing option and looks at

different doses. Of course, the Holy Grail for this novel cholesterol drug is every six-months or twice a year dosing.

To date, the start of the PCSK9-market has been challenging. Demand by payors for outcomes data will be required for the mega sales

markets. While we (and MDCO) are optimistic that the AMGN and REGN/SNY trials coming this summer and year end respectively, will

be positive, MDCO is happy to “let their colleagues educate everyone for now.” Insurers/PBMs are gun shy from their recent HCV

experience, so lots of pushback – refusal to reimburse by insurers when doctors prescribe. The tipping point will be the outcomes data.

b) MDCO-216 – Advanced enrollment of patients in the MILANO-PILOT study evaluating the drug’s effects on atherosclerotic plaque

burden; the trial is set to enroll 120 evaluable patients, with the first 40 patients expected to be analyzed around mid-year 2016;

Keeping an eye out for the CLS’ A1A Milano compound outcomes data that is due this year and will also impact MDCO’s (we believe)

better version.

c) ABP-700 – Transitioned to Phase II clinical development with the expectation of enrolling patients for the first study of a global

procedural sedation colonoscopy program by end of Q2; with continued success, expect to launch Phase III clinical testing in 2017;

d) Carbavance – Announced the granting of Fast Track status by the FDA and the anticipated completion of Phase 3 clinical trials

during H2:16; anticipate filing NDA and MAA by end of year;

e) Angiomax Update – There was an “excellent” en banc hearing last week. The preservation of the Company’s intellectual property

through 2029 remains a possibility and may add value. There is about a 3-month period before the next step in this process. Angiomax,

though generic, is still the leading novel cath lab product around. Expectations for a return to market as a branded drug are minimal, so

any positive conclusion/settlement for MDCO would be considered upside, and add to the Company’s improving financial condition.

f) Newly Launched Revenues – Kengreal, Cleviprex, Orbactiv, Minocin IV and Ionsys increased 161% to $10.9 million in the Q1:16

vs last year. Of those, the hospital based infectious disease (Orbactiv, Minocin IV) and anethestic (IonSys) drugs remain after the

Chiesi deal. While they are not synergistic with the blockbuster R&D pipeline, as data is delivered, they too could be food for another

sale via the strategic plan.

The second half of 2016 will see a major list of clinical catalysts for MDCO that we believe will vastly enhance value as a public

company and/or as a private one.

MDCO is a BUY under 50 with a TARGET PRICE of 75

NKTR – Provides Solid Q1 Update, ‘181 & ‘214 Next Major Catalysts

Nektar reported Q1:16 loss of ($0.14) owing to revenue that was higher than Q4:15, driven by a $28 million Movantik milestone for

approval in the EU. Movantik, which is marketed by AstraZeneca and Daiichi-Sankyo, is growing further thanks to DTC ads with total

retail scripts now at 7,700 per week. ADYNOVATE, launched in the U.S. in December 2015 by Baxalta, recently received approval in

Japan and has now been filed for approval in Europe.

NKTR-181

Enrollment in the ongoing pivotal Phase III trial SUMMIT-07 is ahead of schedule and NKTR still is on track to report top line data in the

Q1:17. As a reminder, the trial utilizes an enriched enrollment randomized withdrawal design, and is evaluating ‘181 in approximately

600 opioid naive patients with chronic lower back pain. Patients from the ongoing SUMMIT-07 are also rolling over into the 52-week

long term safety study of ‘181, that was initiated last year as well. The company will also be starting a human abuse labiality trial, which

they will design with the FDA’s guidance under their Fast Track status to support abuse deterrent labeling and less restrictive

scheduling. This trial will start in the second half of the year and, therefore it will conclude around the same time as SUMMIT-07 is

completed. ‘181 has significant potential as a possible DEA Schedule 3 rating, and that would make this abuse deterrent pain reliever

a true blockbuster in billion-dollar pain markets.

NKTR-214

NKTR is becoming even more optimistic in the ‘214/checkpoint inhibitor combo. The theory is that if you don’t have sufficient

lymphocytes in the tumor microenvironment, the checkpoint inhibitor is not going to do anything; hence this is potentially very important

in that tumor setting. The key is to put sufficient lymphocytes in a tumor, make that cold tumor hot and then the checkpoint inhibitors can

effectively release the brake.

In our view, this could be a very important combination in immuno-oncology. Only about 30% of tumors currently respond to checkpoint

inhibitors leaving a substantial market opportunity for a drug which could help address this huge unmet market. ‘214 is currently in a

Phase I/II trial as a single agent in patients with advanced solid tumors (including melanoma, kidney, NSCLC), with initial data in 20

patients expected in H2:16. We also expect a combination trial with checkpoint inhibitors to start this year.

NKTR-255

This compound is the next IO agent that will enter human clinical trials as the company looks to position itself as a new but unique player

in the red hot IO space. NKTR’s scientists designed ‘255 to stimulate IL-15 which has strong synergies with the IL-2 stimulated by ‘214,

making ‘255 a complementary compound. There are certain immunological features of the IL-15 mechanism of action that are distinct

and non-over lapping with IL-2’s mechanism of action. The scientific literature shows that IL-15 has a very defined place in maintaining

longevity of T-cell responses in the tumor microenvironment, which could be important in IO combo therapy.

NKTR is a well-balanced platform company with a impressive mix of partnered drugs that generate signficant revenue and an promising

wholly-owned pipeline with blockbuster potential. In our view, the next major catalysts for the company are the Phase I/II solid tumor data

for ‘214 in H2:16 and the Phase III pain data for ‘181 in Q1:17. Immune oncology and pain management are two of the largest drug

market opportunities and both ‘214 and ‘181 may represent new best in class molecules.

NKTR is a BUY under 16 with a TARGET PRICE of 25

NVAX – Q1 Call – Preparing For The Launch Of The RSV Vaccine With Partners In The Wings; We Are In

The Zone

The first quarter call highlighted the significant pre-approval progress the Company is making with regulators/policymakers and an

update on ongoing discussions with potential global partners. As we head towards the unblinding of the Phase III RESOLVE study in

Q3 (likely September), in our opinion Novavax is once more executing at an extremely high level – maybe even more focused that Big

Pharma – with a $70 million quarterly burn rate. There is little doubt that NVAX management is up to the task. In fact, the awareness

factor that Novavax is “the leader in RSV vaccines” is now known to the FDA, the CDC/ACIP and international Big Pharm companies, if

not Wall Street.

We now know that a worldwide marketing partner and/or possible acquirer of NVAX will likely wait until after the release of the pivotal

trial results. However, if anything that tells us that management is confident that they have increased the odds of success and are willing

to make the bet and have the partner pay up after the fact. This makes a lot of sense to us.

Raising Awareness of RSV and The NVAX Vaccine

The Company has also begun an RSV Disease State Awareness Campaign designed to raise awareness with policy groups, payors,

KOLs and advocacy groups ahead of a potential U.S. launch. They are conducting pharmacoeconomic studies to verify and document

the economic burden of RSV in older adults that will guide pricing and payor strategy. NVAX is also working with the CDC on RSV

disease burden evidence generation. Management is optimistic that will lead to the creation of a specific ACIP RSV working group this

summer. The Company also launched an informational website, www.discoverrsv.com on the day of the earnings call (5/4). Lastly,

NVAX will set up informational booths at major conferences.

The company understands the payer system for vaccines, and how fast vaccines are reimbursed. Once they get FDA approval, a

presentation to ACIP (http://www.cdc.gov/vaccines/acip/) takes place and then in about 3-6 months to be properly covered. In that first

season, this can happen very quickly. NVAX is already meeting with members of ACIP/CDC and we believe the likelihood of a specific

“RSV ACIP” panel is starting to be formed – solely on expectation of the launch of the NVAX vaccine.

This RSV Season Is Fine For RESOLVE

As we have mentioned before, www.rsvalert.com data suggests that 2015/216 is a normal RSV season. Management also noted the

latest updates from the RSV surveillance service, RSV Alert, and it indicates that the 2015-2016 RSV incidence is tracking in line with

trends seen over the previous five years, despite a relatively mild influenza season. In our view, the Phase III RESOLVE study should be

adequately powered to provide a clear result in Q3:16. We expect the data release to be generated later in the quarter due to the size

of the trial (~11,850 subjects) compared with previous NVAX trials (~1,600 being the largest.

Partnership Discussions With Global Vaccine Leaders At a High Level

Management revealed on the call that global players acknowledge NVAX’s leadership in RSV vaccines. The Company also believes

that they are meeting with the crème-de-la-crème of vaccine makers in the world. While the current market is not paying anywhere near

what we (or the Company) believes is the NPV of the RSV vaccine, it allows the potential suitor to a) either offer a low bid now; or b)

wait for the data for a more definitive outcome and pay up. While CEO Erck said on the call that the latter is more likely, he also said

that anyone could come up with acceptable terms or a more hostile approach before then. Most likely, something will happen after the

data is out. Until then, we believe it is full steam ahead for this revolutionary blockbuster vaccine.

Vaccines Are The Single Most Cost Effective Product Around

There is an abundance of data supporting the fact that an effective vaccine can not only save lives but – in today’s hypersensitive

healthcare system – save a lot of money. RSV is the largest cause of hospitalization in adults over 65. People are just now beginning to

hear and learn more about RSV versus the flu – which everyone knows about. As new vaccines and also new therapeutics come to

market, in our view, the price of an effective RSV vaccine like Novavax’s will be tiny compared to its economic benefit. And even

smaller when compared with a new cancer compound, for example the NVAX RSV vaccine may cost a few hundred dollars or less per

vaccine versus >$100,000 per year for a new cancer drug. This is one reason we believe NVAX stock should be more immune – and

maybe more rewarded – when the government/payers attack the drug industry for the high price of new drugs.

We Are In The Zone

NVAX has the money they need, they have the people they need and most important, they have product they need – the best and firstto-market RSV vaccine in a multi-billion market. Traders may not want to wait until then, hence the small pullback in the stock since the

quarterly call, for we are in a bear biotech market. Management has come a long way since 2013’s initial positive RSV trial and the

clinical finish line is approaching fast. While the stock market is not yet paying for what we believe is one of the sector’s next big

products, in our view, a much larger deal may be struck shortly after positive results. Historically, the most money in biotech stocks is

made between the four year period – 2 years before and 2 years after the approval of a blockbuster. For Novavax, we are certainly in

that zone now.

NVAX is a BUY under 15 with a TARGET PRICE of 20

PCRX – Q1 Results – EXPAREL Still In “Re-Launch” Mode, But Many Tailwinds Behind

Q1:16 revenue of $63.8 million were just a drop below the ~$65 million consensus forecast and up 14% from last year’s Q1. Non-GAAP

net income was $5.7 million, or $0.14 per diluted share slight above consensus forecasts. Adjusted EBITDA for the quarter was $9.5

million. Margins remain in the 71-72% range as the Company wears off earlier inventory build at the end of last year (in anticipation of

the timing of the FDA settlement). The Company re-affirmed expense guidance for the year.

Exparel remains in “re-launch” mode and without the overhang of the FDA Warning Letter, Pacira has begun an aggressive investment

growth plan surrounding EXPAREL. The company’s ability to reclaim the drug’s benefit up to 72-hours of post-operative pain control in

its label should lead to improvement to multiple surgical procedures that were growing steadily before the legal/regulatory disruption,

such as orthopedics, general and cosmetic procedures. Product discussions/follow-ups are occurring steadily at major meetings such

as the American Academy of Orthopedic Surgeons, major orthopedic care providers at the American Society of Regional Anesthesia

meeting around TAP blocks with EXPAREL, and at the American Society of Enhanced Recovery.

Hospitals are continuing to employ a local opioid-sparing approach in pain management with EXPAREL having shown that it can

substantially reduce hospital resource consumption and promote faster patient mobilization, decrease risk of fall, shorten hospital stays,

and increase patient satisfaction and discharge to home, which ultimately makes a significant difference in hospitals’ reimbursement

and bottom lines. For example, at the ERAS World Congress in Lisbon last week, a Memorial Sloan-Kettering Cancer Center study

recognized EXPAREL as one of several important elements for its breast reconstructive surgery enhanced recovery protocol that can

lead to significantly reduced opioid use and one-day reductions in the hospital length of stay. Other soft tissue procedures like breast

reconstruction, [QAN] oncology surgery, abdominal, thoracic, bariatric and bladder surgery should further expand the use of EXPAREL.

Another major potential growth driver, the public outcry against the abuse of opioid prescription drugs is fueling EXPAREL use. The

FDA and regulators everywhere are aggressively asserting plans to try to curtail the use of the addictive pain pills and the burgeoning

global epidemic that keeps rising. The Company is working with many state and local governments to use EXPAREL as a safer

alternative to opiods.

As a result of these investments and the lag since the drug’s marketing efforts have been revamped and re-introduced, we have been

targeting the time for meaningful improvement in Exparel growth curve by H2:16. While the Company is still not issuing 2016 sales

guidance, we believe sequential Exparel sales will grow steadily once more, reaching ~$300 million this year. At the end of Q1, a total

of 4,041 accounts have ordered EXPAREL since launch, an add-on of 124 new accounts this quarter versus last year. A large portion

of PCRX business is for elective procedures.

Healthcare insurance dynamics around deductibles and co-pays lead to strong activity in Q4, but a bit more seasonal in Q1. The

second quarter should see a solid growth from Q1, then a slight higher Q3, and a strong Q4. Nonetheless, the trends for utilization and

sales are positive and we still believe that $300 million is a realistic forecast for this year’s Exparel sales.

As a reminder, a Q3:16 launch in oral surgery is on track. PCRX expects to complete enrollment in two nerve block studies by the end

of the year, and file an sNDA for nerve block in early 2017. More clinical trials continue regularly with Exparel than almost any drug we

follow (see our Clinical Trials Updates every Issue.

In this particular stock market, it takes time to recover the credibility lost from any negatives, particular big regulatory ones. And although

the agency rescinded their original position, even some PCRX customers are their taking time to re-insert EXPAREL into their hospital

formularies. Despite that, in our view Q1 results were ok. The move away from opiods is gaining momentum, and has only just begun.

Importantly, PCRX with EXPAREL are just beginning to fill this important and very large void.

PCRX is a BUY under 75 with a TARGET PRICE of 90

ZIOP – Shows Rather Impressive Preclinical Data at ASGCT, Up Next Human Data at ASCO

ZIOP was front and center at the 2016 Meeting of the American Society of Gene and Cell Therapy (ASGCT) in Washington D.C. last

week. The company presented exciting preclinical data for IL-12 in combo with a PD-1 that showed 100% survival. The non-viral

Sleeping Beauty (SB) system was also on display. In our view, this technology should be particularly important in leveraging T-cell

receptors (TCRs) to target neoantigens in solid tumors which requires individualizing this immunotherapy, an approach that is possible

with a customizable, easy-to-manufacture non-viral gene transfer system. ZIOP is poised for a clinical explosion as they expect to

initiate or continue prosecuting up to six clinical trials across multiple platforms in 2016, and potentially a registration trial for IL-12 in

malignant glioma patients in 2017.

Preclinical studies combining Ad-RTS-IL-12 + veledimex and checkpoint inhibitors in brain tumor models

presented at ASGCT

In an oral presentation, ZIOP presented data from preclinical studies of Ad-RTS-IL-12 + veledimex combined with immune checkpoint

inhibitors (iCPI) in GBM mouse models at ASGCT. Results demonstrated that survival of mice treated with Ad-RTS-IL-12 + veledimex

and anti-PD-1 therapy was superior to either treatment alone, with a combination showing 100% survival. Because Ad-RTS-IL-12 and

anti-PD-1 are clinically available, these data provide impetus for evaluating this combination immunotherapy in humans. ZIOPHARM

plans to initiate a combination study in 2016 and is currently in discussions with partners to provide anti-PD-1 therapy. Given the hyper

competitiveness of the PD-1 space, we expect a deal to be announced sooner than later. It is important to remember that PD-1s as a

monotherapy only work in about one third of the potential patients leaving a huge opportunity for drugs that can address the other two

thirds with combination therapy.

Preclinical study showing evolution of the Sleeping Beauty (SB) non-viral transposon-transposase system in a

mouse model of leukemia presented at ASGCT.

In an oral presentation, MD Anderson researchers in collaboration with ZIOPHARM presented data from preclinical studies

demonstrating the ability to address the challenges of streamlining the manufacture of cell based therapy by leveraging the non-viral SB

system to reduce cell culture time. These data also demonstrated an improvement in the anti-tumor activity of the CD19-specific CAR

by modifying the “stalk” of the CAR.

Encouraging data from Phase I brain tumor study to be presented at ASCO.

ZIOPHARM expects to present data from a multicenter, Phase I gene therapy study of Ad-RTS-IL-12 in patients with recurrent or

progressive GBM or Grade III malignant glioma at the 2016 ASCO Annual Meeting in June (http://am.asco.org, June 2-7, Chicago).

Following reporting of encouraging data from the first cohort of the study at the initial dosing of Ad-RTS-IL-12 + veledimex, the

Company announced last March that the first patient had been enrolled in the study’s second dose cohort – implying acceptable safety

at the very least, if not responses as well. ZIOP has publicly said recently that they are encouraged by the survival results observed to

date. In our view, this data has the potential to be a significant catalyst for the stock as these patients are very sick with no treatment

choices and a life expectancy of as little as 10 weeks. Survival data in particular is the gold standard in cancer drug development and

any positive survival signal will catch the attention of biotech investors, as this drug candidate could be in registration trials as soon as

next year.

ZIOP is a BUY under 12 with a TARGET PRICE of 18

The Back Page

Price (52-week)

Symbol

Company

ACAD

# of

Mkt. Value

Orig.Rec.

Lo

Hi

Current

Target

Shares(m)

($mil)

Recommendation

Acadia

33.79

16.44

51.99

27.81

55

100.91

2,806

BUY under $40

ALKS

Alkermes

10.13

27.78

80.71

37.00

75

150.1

5,552

BUY under $55

ANTH

Anthera

3.04

2.06

11.65

3.14

25

39.9

125.2

BUY under $10

BMRN

BioMarin

12.68

62.12

151.75

79.79

145

161.3

12,866

BUY under $110

CBMG

Cellular Bio

35.26

10.44

49.00

14.62

55

11.7

170.8

BUY under $40

CELG

Celgene

24.97

92.98

140.72

100.30

115

785.6

78,795

BUY under $90

FPRX

Five Prime

16.29

14.70

45.72

39.65

55

27.5

1,090

BUY under $42

INCY

Incyte

5.88

55.00

133.62

70.54

120

186

13,120

BUY under $100

XON

Intrexon

34.42

18.52

69.45

24.50

60

116.4

2,851

BUY under $42

IONS

Ionis

7.63

30.93

77.80

30.49

100

118.9

3,625

BUY under $75

MDCO

Medicines Company

31.98

25.27

43.79

33.87

75

69.4

2,351

BUY under $50

NKTR

Nektar

4.66

9.16

17.53

13.09

25

133.5

1,746

BUY under $16

NVAX

Novavax

2.44

4.08

15.01

4.33

20

269.9

1,168

BUY under $15

OGXI

OncoGenex

36.82

.46

4.10

.83

8

29.8

24.7

BUY under $4

PCRX

Pacira

15.78

35.78

121.95

43.76

90

36.8

1,608

BUY under $65

SGMO

Sangamo

4.77

4.63

19.25

6.00

20

70.1

420

BUY under $12

ZIOP

Ziopharm

8.00

4.56

14.93

7.59

18

130.9

993

BUY under $12

*new recommendation

THE MODEL PORTFOLIO*

COMPANY

SHARES OWNED

TOTAL COST

TODAY’S VALUE

Long Positions

Acadia

3,000

102,417

84,430

Alkermes

2,500

32,695

92,500

Anthera

16,015

123,540

50,287

Cellular Biomed

2,700

101,417

39,474

Five Prime

4,820

91,136

191,113

Incyte

2,250

34,817

158,715

Intrexon

2,200

76,510

53,900

Ionis

4,000

49,123

121,960

Medicines Co

2,600

76,405

88,062

Nektar

6,500

63,277

85,085

Novavax

27,000

60,984

116,910

OncoGenex

20,600

125,222

17,098

Pacira

1,500

23,907

65,640

Sangamo

7,190

53,597

43,140

Ziopharm

12,500

101,000

94,875

Equities:

$1,302,189

Cash:

$65.00

(5/12/16)

PORTFOLIO VALUE:

$1,302,254

*The Model Portfolio is designed to reflect specific recommendations. We began the Model Portfolio on 12/23/83 with $100,000. On 4/13/84, we became

fully invested. All profits are reinvested. Stocks recommended since then may be equally attractive, but may not be in the Model Portfolio. Transactions

and positions are valued at closing prices. No dividends are created, and a 1% commission is charged. We don’t use margin. Interest income is credited

only on large cash balances.

THE TRADER’S PORTFOLIO**

COMPANY

SHARES OWNED

TOTAL COST

TODAY’S VALUE

Long Positions

Acadia

3,000

102,417

83,430

Alkermes

2,000

27,189

74,000

Anthera

9,765

70,985

30,662

Cellular Biomed

2,700

101,417

39,474

Five Prime

4,020

70,679

159,393

Incyte

3,139

51,176

221,425

Intrexon

2,170

75,472

53,165

Ionis

3,300

53,501

100,617

Medicines Co

1,250

40,375

42,338

Nektar

6,000

36,411

78,540

25,000

58,025

108,250

Novavax

OncoGenex

30,700

162,503

25,481

Pacira

1,000

15,938

43,760

Sangamo

7,190

53,597

43,140

Ziopharm

12,500

101,000

94,875

Position Total:

$1,198,550

Margin:

–$605,027

(5/12/16)

PORTFOLIO VALUE:

$593,523

**The Trader’s Portfolio joined the Model Portfolio on 1/6/05 with $500,000 and is designed to take advantage of short-term opportunities throughout the

biotech sector. The Trader’s Portfolio will hold both long and short positions in stocks, trade-in options, and use margin. These strategies increase risk.

Although there is no limit on the time any purchase can be held, the time frame for most investments will be weeks to months.

BENCHMARKS

NASDAQ

Last 2 Weeks

S&P 500

MODEL

TRADER‘S

-1.4%

-0.6%

-14.3%

-24.1%

0.1%

0.3%

-32.2%

-49.2%

Calendar Year 2015

-0.1%

-0.1%

25.1%

27.9%

Calendar Year 2014

13.4%

11.4%

29.2%

45.0%

Calendar Year 2013

38.3%

29.6%

103.4%

214.7%

Calendar Year 2012

13.4%

15.9%

25.7%

68.7%

2016 YTD

NEW MONEY BUYS

(Based on Market Cap when under our limit)

1st Tier: ALKS, BMRN, CELG, INCY, IONS

2nd Tier: ACAD, MDCO, NKTR, NVAX, PCRX, XON, ZIOP

3rd Tier: ANTH, FPRX, CBMG, OGXI, SGMO

Contact Info

Medical Technology Stock Letter

John McCamant, Editor

Jay Silverman, Editor

Jim McCamant, Editor-at-Large

Mahalet Solomon, Associate

Joan Wallner, Associate

BioInvest.com

PO Box 40460

Berkeley, CA 94704

510-843-1857

Send us an email

Download a PDF of MTSL Issue #827

©Piedmont Venture Group (2015). Address: P.O. Box 40460, Berkeley, CA 94706. Telephone: (510) 843-1857. Fax: (510) 843-0901. BioInvest.com.

Email: mtsl@bioinvest.com. Published 24 times a year. Email subscription rates: 1 year – $399; 2 years – $678; 3 years – $898. You may cancel at any

time for a prorated refund. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no

representations or warranty, express or implied, is made as to the accuracy or completeness. In no way shall this newsletter be construed as an offer to

sell or solicitation of an offer to buy any securities. The publisher and its associates, directors or employees may have positions in, and may from time to

time make purchases or sales of, securities mentioned herein. We cannot guarantee and you should not assume that future recommendations will equal

the performance of past recommendations or be profitable.

MTSL Issue 826

ABOUT

NEWSROOM

CONNECT

About BioInvest

Medical Technology Stock Letter

Subscribe to MTSL

Free MTSL Issue

Disclaimer

Privacy Policy

Publicity

Media Inquiries

Testimonials

Contact Us

Refer A Friend

Facebook

Twitter

Google +

© 2016 Bioinvest. All Rights Reserved.

Website by Hammond Media Group

Suffusion theme by Sayontan Sinha