Data Validation Center (DVC) Loan Review Reports

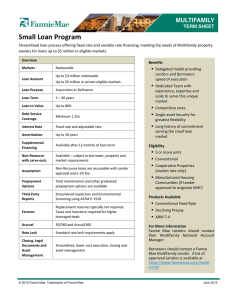

advertisement

Data Validation Center Loan Review Reports Process Steps July 2014 This document is designed to assist staff responsible for receiving post-acquisition data change review requests and working with Fannie Mae’s Data Validation Center (DVC) on resolution. This process is part of Fannie Mae’s updated discretionary post-purchase review (DPPR) framework. Included in this job aid are details about the timing of data change review requests, how to retrieve each month’s Data Validation Center Loan Review Report that includes new requests, and how to respond to data change review requests and submit supporting documentation when appropriate. NOTE: * All references in this document to “seller” or “lender” refer to the “responsible party” as defined in the Servicing Guide Glossary: “ ‘responsible party’ means a seller, servicer or other entity that is responsible for the selling representations and warranties and/or for the servicing responsibilities or liabilities on a mortgage loan.” DPPR Data Change Process Steps Steps correlate to process flow steps as depicted in the diagram on page 5. Step Details and Notes # Loan Delivery and Fannie Mae Data Analysis Process 1 The *seller may use loan underwriting and delivery tools, such as EarlyCheck™, UCDP Appraisal Messaging, DU® Red Flag Messages, and management reports to increase confidence in its loan delivery data. More information on these tools is available on the Loan Quality page. 2 The seller delivers loan to Fannie Mae via Loan Delivery. 3 Initial loan eligibility assessment (approximately 150 days after delivery) – Fannie Mae uses loan-level assessment tools, including technology and proprietary analytical models, to identify loans that may merit further review. 4 Once a loan is selected for further review, Fannie Mae may request the underwriting file for a full review or may choose to evaluate the loan for possible data inconsistencies or inaccurate information. 4a If Fannie Mae’s review appears to confirm that the loan data is not accurate but Fannie Mae may be willing to retain the loan on its books with data corrections and possible pricing adjustments, the loan is evaluated with the seller for a potential data change. 4b If Fannie Mae’s review reveals that additional information is required to confirm the accuracy of the data or eligibility of the loan, the loan file is requested from the seller for review and follows the Discretionary Post-purchase Review path. For details on this discretionary file review and repurchase process, please refer to the Discretionary Post-purchase Review (DPPR) Process Steps job aid. Managing and responding to data change review requests This summary is intended for reference only. All criteria are subject to the formal terms and conditions of the Fannie Mae Selling Guide, Fannie Mae Servicing Guide, and any applicable seller contracts with Fannie Mae. In the event of any conflict with this document, the Guides and/or lender contracts will govern. Fannie Mae reserves the right to change its data validation and change process at any time. © 2014 Fannie Mae. Trademarks of Fannie Mae. July 2014 Page 1 of 5 Step Details and Notes # 5 Fannie Mae’s Data Validation Center (DVC) manages the data change review process. The DVC reviews loans selected in the loan eligibility assessment (#3) for a possible data change request and confirms the need for the request to be reviewed by the seller. Loans for which Fannie Mae requests a data change review are provided to the seller in a Data Validation Center Loan Review Report in Message Manager. The report is an Excel spreadsheet that lists loans Fannie Mae has identified that appear to have missing or incorrect data submitted at delivery, with comments regarding the potential issue. 5a Loans initially selected for a file review (Step #4b) may be moved to the data change review process if, upon review of the loan file, Fannie Mae determines the loan may remain on Fannie Mae’s books with a data change and possibly a pricing adjustment. 6 Sellers will receive their data change review requests via Message Manager on approximately the 15th calendar day of the month. Sellers that deliver to Fannie Mae under multiple seller/servicer numbers will receive one Data Validation Center Loan Review Report in Message Manager for each seller/servicer number that has data change review requests for that month. Receiving data change review notifications. The seller’s designated data validation contact(s) will receive an email notification when the Data Validation Center Loan Review Report is posted to Message Manager. Although they will not receive an email notification, any Message Manager user with Seller-Only or MM-Reports-Only roles may access their organization’s report after it is posted to Message Manager. Accessing Message Manager. A user ID and password with an assigned Seller-Only or MM-Reports-Only role in Message Manager is required to access the report. To obtain access to Message Manager, contact your company’s Technology Manager Corporate Administrator, who has the ability to provision user IDs for your company. Finding the Data Validation Center Loan Review Report in Message Manager. Once logged into Message Manager, enter your 9-digit seller/servicer number, select the Message Type of Data Validation Center Loan Review Report, and click the submit button. A search results screen will display the data change reports for the seller/servicer number. Sellers that deliver under multiple seller/servicer numbers should query each seller/servicer number to view reports applicable to that seller/servicer number. Modifying contact information. If your company has not designated a data validation contact, the email notification will default to the “UP/Credit Loss/Repurchase” contact your company provided through Form 582/Lender Record Information as part of the annual certification or via a periodic update. To provide a designated data change contact immediately, contact your customer account team or email Data_Validation@fanniemae.com. You may provide a primary and secondary contact for the Data Validation Center communications. (A group email address may be provided as one of your contacts if you want notifications to go to a group distribution.) 7 The seller reviews each data change noted in the Data Validation Center Loan Review Report and updates the “Lender Comments” column (far right) with either an acceptance of the proposed data change or a response to the proposed data change. The seller gathers any documentation required to support the response. The completed Data Validation Center Loan Review Report with comments must be sent to Data_Validation@fanniemae.com within 30 calendar days of the report publication date. The seller’s seller/servicer number must be included at the beginning of the subject line of the email and in the Data Validation Center Loan Review Report spreadsheet report name. Do not change the formatting of the Data Validation Center Loan Review Report – such changes could result in Fannie Mae being unable to process the response and your submission being rejected. This summary is intended for reference only. All criteria are subject to the formal terms and conditions of the Fannie Mae Selling Guide, Fannie Mae Servicing Guide, and any applicable seller contracts with Fannie Mae. In the event of any conflict with this document, the Guides and/or lender contracts will govern. Fannie Mae reserves the right to change its data validation and change process at any time. © 2014 Fannie Mae. Trademarks of Fannie Mae. July 2014 Page 2 of 5 Step Details and Notes # If supporting loan documentation is attached to the email response, the messages should be encrypted or submitted through a secure web service. It is preferred that lenders provide supporting loan documents by upload to the Quality Assurance System (QAS) (see step 7a). Note: All comments made by the seller in response to the data change request and all supporting documentation provided by the seller become part of the loan documentation and thus part of the mortgage loan file. For processing efficiency, we strongly encourage sellers to email their completed Data Validation Center Loan Review Report with responses in a single monthly submission for all loans listed on the report. In the isolated cases in which you need to break up your submission, please avoid submitting responses for the same individual loans multiple times because this may lead to errors in our system update and tracking process. Please provide a point of contact, email address, and phone number in the email response. Failing to deliver data change acceptances or responses within the required 30-day timeframe. Failure to provide a requested file within 30 calendar days may lead Fannie Mae to conclude the data is not true, correct, and complete, and to consider other remedies, including possible repurchase requests. Timely response. Sellers must contact the Data Validation Center at Data_Validation@fanniemae.com for consideration of any exceptions to the 30-day timeline for responses. Status updates. The Data Validation Center Loan Review Report includes a “Lender Reconciliation” tab showing loans that had a status change to "Closed -- Lender Reconciliation Complete" or "Submitted for Data Correction" during the previous month's reporting cycle. Status updates appear on this tab only once and other, interim statuses do not appear while reconciliations are in progress. For example, the November 2013 reports show status updates from the past reporting cycle (from Oct. 17 through Nov. 18, 2013). 7a Lenders may upload supporting loan documentation through the Quality Assurance System (QAS) instead of sending it via encrypted email or through a secure web platform. This submission method streamlines the data validation process. It is important to note that you must continue to submit the Data Validation Center Loan Review Report, with your comments added for each loan, to the DVC mailbox (Data_Validation@fanniemae.com). That spreadsheet should not be uploaded to QAS. 8 The DVC credit analysts will review seller acceptances, responses, and supporting documentation for all loans listed on the Data Validation Center Loan Review Report. DVC credit analysts may contact the seller’s designated point of contact by phone or email if information provided by the seller does not satisfactorily clear the identified issue(s) or requires further action or discussion. 8a If the seller and the DVC Credit Analyst cannot agree on a proposed data change or pricing adjustment within a time frame prescribed by Fannie Mae, Fannie Mae will consider other remedies, including a possible repurchase request. The fact that Fannie Mae may have offered a pricing adjustment that was rejected shall in no way impact Fannie Mae’s ability to enforce an alternative remedy for an identified breach. 9 The DVC credit analyst works with the seller’s designated point of contact to execute data change resolutions agreed to with the seller, and to correct loan data in Fannie Mae systems. Most updates to loan data that do not require a pricing adjustment are completed by the DVC credit analyst with no This summary is intended for reference only. All criteria are subject to the formal terms and conditions of the Fannie Mae Selling Guide, Fannie Mae Servicing Guide, and any applicable seller contracts with Fannie Mae. In the event of any conflict with this document, the Guides and/or lender contracts will govern. Fannie Mae reserves the right to change its data validation and change process at any time. © 2014 Fannie Mae. Trademarks of Fannie Mae. July 2014 Page 3 of 5 Step Details and Notes # further action required by the seller (after the seller’s acceptance of the data change resolution). Required lender action to make data changes. The DVC Credit Analyst will instruct the seller if further action is required by the seller to execute the data change. 9a In some circumstances, the seller may be instructed by the DVC Credit Analyst to make data changes through the Loan Delivery ADE (Additional Data Elements) tool. Additional Fannie Mae applications the lender DVC contact will need access to. In addition to Message Manager, the seller’s point of contact will need to contact their organization’s Technology Manager account administrator for access to Loan Delivery (which will also allow the user access to ADE to change key loan data as instructed by the Fannie Mae DVC credit analyst). 10 Data change resolutions are sent by the DVC team to the Fannie Mae Loan Operations department to complete the data adjustment, which may result in a pricing adjustment for certain data changes. Pricing adjustments may occur in the form of a debit or credit to the seller’s account based on the result of the data change resolution. MBS Delivery Refunds or drafts that are approved by Loan Operations by the 15th business day of the month will occur in the monthly cycle on the 5th business day of the following month. Any MBS loan-level price adjustments resulting from a post-purchase adjustment will be communicated to the seller through the standard Post-Purchase Adjustment letters (Message Manager) and/or via the Risk Based Pricing Report (Message Manager) Cash Delivery Drafts or refunds will be initiated two business days after successful processing. Upon final approval by Loan Operations, a communication will be posted for the seller through the standard Post-Purchase Adjustment letters (Message Manager). 11 Feedback on data exception trends are communicated through monthly reports that are distributed from the DVC to your primary contact. NOTE: It is important to note that the data change process described in this document is specific to Fannie Mae’s discretionary post-purchase review process. It does not replace Fannie Mae’s process for data changes self-identified by the lender or required for some other reason unrelated to Fannie Mae’s discretionary post-purchase review. This summary is intended for reference only. All criteria are subject to the formal terms and conditions of the Fannie Mae Selling Guide, Fannie Mae Servicing Guide, and any applicable seller contracts with Fannie Mae. In the event of any conflict with this document, the Guides and/or lender contracts will govern. Fannie Mae reserves the right to change its data validation and change process at any time. © 2014 Fannie Mae. Trademarks of Fannie Mae. July 2014 Page 4 of 5 Discretionary Post Purchase Loan Review Process – Data Change Process Flow This summary is intended for reference only. All criteria are subject to the formal terms and conditions of the Fannie Mae Selling Guide, Fannie Mae Servicing Guide, and any applicable seller contracts with Fannie Mae. In the event of any conflict with this document, the Guides and/or lender contracts will govern. Fannie Mae reserves the right to change its data validation and change process at any time. © 2014 Fannie Mae. Trademarks of Fannie Mae. July 2014 Page 5 of 5