Annual Reports 2014-15 Pdf

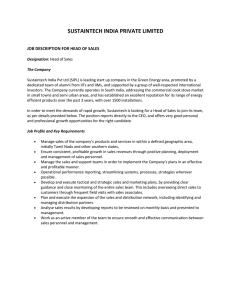

advertisement