Limitation of Liability Worksheet

advertisement

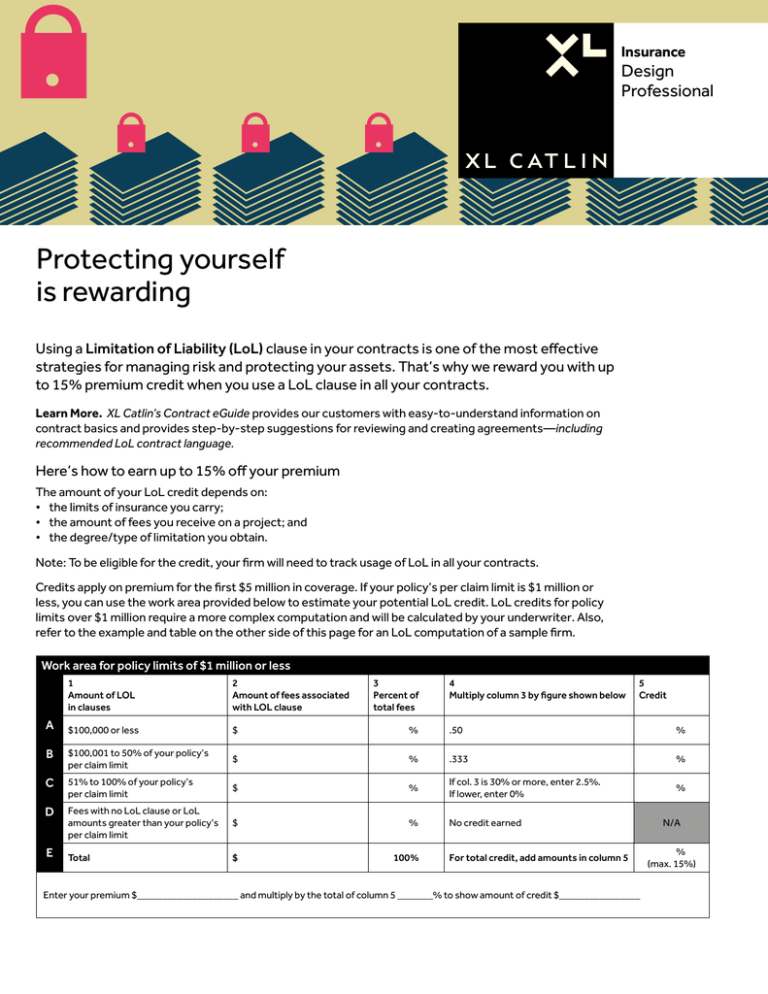

Insurance Design Professional Protecting yourself is rewarding Using a Limitation of Liability (LoL) clause in your contracts is one of the most effective strategies for managing risk and protecting your assets. That’s why we reward you with up to 15% premium credit when you use a LoL clause in all your contracts. Learn More. XL Catlin’s Contract eGuide provides our customers with easy-to-understand information on contract basics and provides step-by-step suggestions for reviewing and creating agreements—including recommended LoL contract language. Here’s how to earn up to 15% off your premium The amount of your LoL credit depends on: • the limits of insurance you carry; • the amount of fees you receive on a project; and • the degree/type of limitation you obtain. Note: To be eligible for the credit, your firm will need to track usage of LoL in all your contracts. Credits apply on premium for the first $5 million in coverage. If your policy’s per claim limit is $1 million or less, you can use the work area provided below to estimate your potential LoL credit. LoL credits for policy limits over $1 million require a more complex computation and will be calculated by your underwriter. Also, refer to the example and table on the other side of this page for an LoL computation of a sample firm. Work area for policy limits of $1 million or less 1 Amount of LOL in clauses 2 Amount of fees associated with LOL clause $100,000 or less $ % .50 % B $100,001 to 50% of your policy’s per claim limit $ % .333 % C 51% to 100% of your policy’s per claim limit $ % If col. 3 is 30% or more, enter 2.5%. If lower, enter 0% % D Fees with no LoL clause or LoL amounts greater than your policy’s per claim limit $ % No credit earned Total $ 100% A E 3 Percent of total fees 4 Multiply column 3 by figure shown below 5 Credit For total credit, add amounts in column 5 Enter your premium $____________________ and multiply by the total of column 5 _______% to show amount of credit $________________ N/A % (max. 15%) Protecting yourself is rewarding A look at the limitation of liability credit for a sample firm Able Architects earns $2 million in fees and carries a $1 million limit of insurance for which it pays a $50,000 premium. On $200,000 of its fees (10% of total fees), Able persuades its clients to limit its liability to $100,000 or less — typically, clients agree to accept related fees as the limit. This gives Able a credit of 5%. On one $400,000-fee project (20% of total fees), the client agrees to limit Able’s liability to the fee, and Able earns a credit of 7%. On four other jobs with fees totaling $600,000 (30% of total fees), the clients hold out for the insurance limit ($1 million) as the limitation of liability for which Able receives a credit of 2.5%. On the final $800,000 in fees, clients refuse to agree to any limitation of liability and no credit is earned. Policy Limit: $1 million 1 Amount of LOL in clauses 2 Amount of fees associated with LOL clause 3 Percent of total fees 4 Applicable ratio of credit to fees 5 Credit A B C $100,000 or less $200,000 10% 1:2 (column 3 x .50) 5.0% $100,001 to $500,000 (50% of limit) $400,000 20% 1:3 (column 3 x .333) 7.0% $500,001 to $1 million (the limit) $600,000 30% If col. 3 is 30% or more, enter 2.5%. If lower, enter 0% 2.5% D Fees with no LoL clause or LoL amounts greater than $1 million $800,000 40% No credit earned N/A Total $2,000,000 100% For total credit, add amounts in column 5 14.5% E Premium for first $1 million: $50,000 x 14.5% (column 5) = $7,250 premium credit Maximum total credit: 15% For more information on our Limitation of Liability credit program, tracking LoL usage in your contracts, or other professional liability insurance and loss prevention services, talk with your agent or visit us at xlgroup.com/dp to find the name of the agent nearest you. Contact XL Catlin Design Professional 800 227 8533 x2102508 30 Ragsdale Drive, Suite 201, Monterey, CA 93940-7811 xlgroup.com/dp ................................ MAKE YOUR WORLD GO xlcatlin.com The information contained herein is intended for informational purposes only. Insurance coverage in any particular case will depend upon the type of policy in effect, the terms, conditions and exclusions in any such policy, and the facts of each unique situation. No representation is made that any specific insurance coverage would apply in the circumstances outlined herein. Please refer to the individual policy forms for specific coverage details. XL Catlin is the global brand used by XL Group plc’s insurance subsidiaries. In the US, the insurance companies of XL Group plc are: Catlin Indemnity Company, Catlin Insurance Company, Inc., Catlin Specialty Insurance Company, Greenwich Insurance Company, Indian Harbor Insurance Company, XL Insurance America, Inc., XL Insurance Company of New York, Inc., and XL Specialty Insurance Company. Not all of the insurers do business in all juridiscictions, nor is coverage available in all jurisdictions. Information accurate as of September, 2015. 5508_09/2015 The result: Able Architects ends up with better protection on 60% of its work, and the firm gets a premium credit of 14.5% or $7,250 off its $50,000 premium.