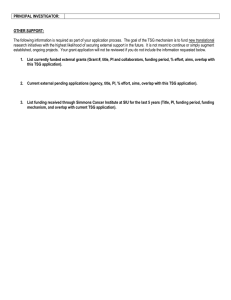

TSG Status Report # 3

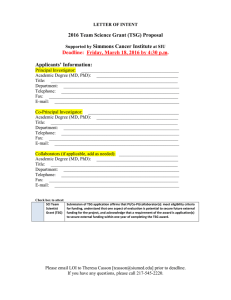

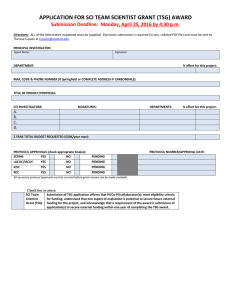

advertisement