The

Insurance

Coverage Law Bulletin®

Volume 10, Number 4 • May 2011

Up Against a

Chinese Drywall

Coverage Issues Stemming from Dry Cleaner

Contamination Suits

Developments in the

Ongoing Investigation

And Coverage Litigation

By Chet A. Kronenberg

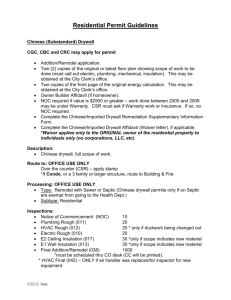

Homeowners from 42 states,

the District of Columbia, American Samoa, and Puerto Rico have

reported concerns about drywall imported from China and

installed in their homes. These

homeowners believe that health

symptoms and the corrosion of

metal components in their homes

are related to Chinese drywall.

The reports began to arrive in

force in 2009 and have triggered

the largest consumer product investigation in the history of the

federal Consumer Product Safety

Commission (“CPSC”).

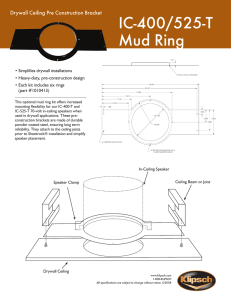

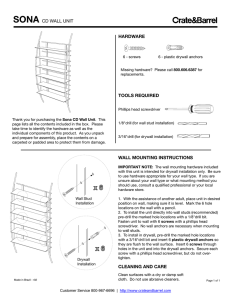

Drywall, also known as wallboard or plasterboard, is an essential element in residential

construction. Home builders

in the United States historically

used domestically produced drywall, composed primarily from

gypsum, a mineral. However,

the housing boom of 2004-2006,

and the scramble for materials

that followed the 2004-2005 hurricanes, led suppliers to import

vast amounts of drywall from

China to keep up with demand.

According to the CPSC, more

than 550 million pounds of drywall and associated building materials were imported from China to the United States between

2006-2007. According to the

investigations, use of Chinese

drywall was widespread, but

the vast majority of the product

continued on page 5

I

In This Issue

Dry Cleaner

Contamination.......... 1

Chinese Drywall....... 1

PERIODICALS

By John David Dickenson

n recent years, there has been a growing number of dry cleaners claiming to

be “organic,” “green,” or “eco-friendly.” While that may be true with respect

to some, many dry cleaners continue to use a cleaning method involving the

use of a solvent called perchloroethylene, commonly known as perc. And, there

seems to be an increasing number of lawsuits stemming from environmental

problems associated with historic dry cleaning operations utilizing this chemical.

As a result of past disposal practices and spills of perc, many current and former

dry cleaning sites are contaminated. By some estimates, 75% of dry cleaner facilities operated in past decades have caused environmental contamination. Cleanup

costs range from tens of thousands of dollars to several million dollars.

Forest Park National Bank & Trust v. Ditchfield, 10 CV 3166 (N.D. Ill. May 21,

2010), presents a typical “dry cleaner contamination” fact pattern. In that case, a

bank foreclosed on an Illinois residence, and then filed a lawsuit in federal court

against the owners and operators of an adjacent strip mall and its dry cleaning tenant. The bank contends that after acquiring the residence, it learned that

perc from the dry cleaner had leached into the soil and groundwater under the

residence. Even though the residence is located on a block targeted by the city

for a big redevelopment project, the bank claims that it has not been able to sell

the property because of the perc contamination. The bank sought compensatory

damages in excess of $100,000. Certain defendants filed a third-party complaint

against their insurer alleging that it failed to provide defense and indemnity

against the underlying suit.

Similarly, in Neal v. Cure, 937 N.E.2d 1227 (Ind. Ct. App. 2010), neighboring

property owners brought a lawsuit against a landlord that leased commercial

property to a dry cleaning tenant. The plaintiffs, who owned commercial property near the landlord’s building, alleged that they were having health problems,

and that the value of their property had decreased because of perc in the soil and

the air inside their building. The plaintiffs settled with the dry cleaning tenant,

continued on page 2

Dry Cleaner

continued from page 1

and then continued to pursue statutory and common law claims against

the landlord. The appellate court affirmed the trial court’s grant of summary judgment in favor of the landlord because of the landlord’s lack

of involvement in or knowledge of

the dry cleaner’s actions.

In a recent high-profile suit, the

Suffolk County Water Authority,

which bears responsibility for providing potable drinking water to

more than one million residents

in Suffolk County, New York, sued

various companies involved in the

creation of perc and the dry cleaning equipment that used the chemical. The Water Authority claims to

have detected perc contamination in

more than 150 of its wells, requiring

expensive remediation and prevention measures. The Water Authority

alleges that the defendants were

aware that dry cleaners customarily

dumped perc wastewater into public sewer systems or dry wells, and

that equipment companies even directed dry cleaners to do it. See Suffolk Co. Water Auth. v. Dow Chem.

Co., 30 Misc. 3d 1202(A) (Sup. Ct.

Suffolk Co. Dec. 17, 2010).

To date, there are surprisingly

few reported coverage decisions

concerning whether and to what

extent dry cleaner contamination

may be covered under a comprehensive general liability policy. But

the handful of decisions that do exist provide a good framework for

discussing key issues that often

arise when coverage is sought for

dry cleaner contamination.

Lost Policies

Because the release of perc often

took place decades ago, many policyholders no longer have their policies from that time frame. For example, in the Forest Park and Neal

cases, the contamination purportedly began in the 1970s and 1980s,

respectively. If the dry cleaner defendants in those lawsuits had kept

their insurance policies, they might

Chet A. Kronenberg is a litigation

partner in the Los Angeles office of

Simpson Thacher & Bartlett LLP.

2

now be entitled to defense and indemnity. However, if the dry cleaners did not maintain copies of their

old policies, the dry cleaners could

find themselves uninsured.

Kleenit, Inc. v. Sentry Insurance

Company, 486 F. Supp. 2d 121 (D.

Mass. 2007), is illustrative. Kleenit

was the owner and operator of a dry

cleaning chain. Kleenit sought insurance coverage from Travelers for the

environmental remediation of two

sites in Massachusetts. Kleenit believed that Travelers provided comprehensive general liability insurance to Kleenit during the period of

1964-1970. However, both the original owner and accountant of the insured business were deceased, the

insurance agency that handled most

of the insured’s policies during the

relevant time frame was defunct, and

neither Kleenit nor Travelers could

locate copies of the policies at issue. Against this backdrop, Travelers

moved for summary judgment.

The court held that, under Massachusetts law, Kleenit was required to

show by a preponderance of evidence

both the existence and contents of the

policies. With respect to the policy

period of 1964-1967, Kleenit submitted ledger entries reflecting payments

to its insurance agent. In addition,

an employee who began working at

Kleenit in 1967 testified that when

he began working at Kleenit, “everything was Travelers.” The court stated

that, at best, the ledger entries merely

established that Kleenit made payments to its insurance agent for some

sort of insurance. The court further

noted that even assuming that “the

payments were indeed payments of

premium to Travelers, the entries say

nothing about the type of insurance

involved, nor do they establish in any

way the terms of the missing policy.”

Accordingly, the court granted summary judgment in Travelers’ favor for

the years 1964-1967.

With respect to the years

1967-1970, Travelers admitted that

continued on page 3

The publisher of this newsletter is not engaged in rendering

legal, accounting, financial, investment advisory or other

professional services, and this publication is not meant to

constitute legal, accounting, financial, investment advisory

or other professional advice. If legal, financial, investment

advisory or other professional assistance is required, the services of a competent professional person should be sought.

The

Insurance

®

Coverage Law Bulletin

EDITOR-IN-CHIEF . . . . . . . . . . . . . . Thomas O. Mulvihill

Pringle, Quinn, Anzano, P.C.

Morristown, NJ

EDITORIAL DIRECTOR . . . . . . . . . . Wendy Kaplan Stavinoha

SENIOR MANAGING EDITOR . . . . . Julie Gromer

Marketing DIRECTOR . . . . . . . . . Jeannine Kennedy

graphic designer . . . . . . . . . . . Louis F. Bartella

BOARD OF EDITORS

ROBERTA ANDERSON . . . . . . K&L Gates LLP

Pittsburgh, PA

Dennis brown . . . . . . . . . . . . Edwards Angell Palmer & Dodge

Hartford, CT

TIMOTHY W. BURNS . . . . . . . Perkins Coie LLP

Madison, WI

JOHN N. ELLISON . . . . . . . . . Reed Smith LLP

Philadelphia

LAURA A. FOGGAN . . . . . . . . Wiley Rein LLP

Washington, DC

MARIALUISA GALLOZZI . . . . Covington & Burling LLP

Washington, DC

STEVEN R. GILFORD . . . . . . . Proskauer Rose LLP

Chicago

ROBERT D. GOODMAN . . . . . Debevoise & Plimpton LLP

New York

LEWIS E. HASSETT . . . . . . . . . Morris, Manning & Martin, LLP

Atlanta

RALPH S. HUBBARD, III . . . . Lugenbuhl, Wheaton,

Peck, Rankin & Hubbard

New Orleans

PAUL KALISH . . . . . . . . . . . . . Crowell & Moring, LLP

Washington, DC

LINDA KORNFELD . . . . . . . . . Dickstein Shapiro LLP

Los Angeles

FRANK L. LATTAL . . . . . . . . . . ACE Limited

Bermuda

HARRY LEE . . . . . . . . . . . . . . . Steptoe & Johnson, LLP

Washington, DC

KIM V. MARRKAND . . . . . . . . Mintz, Levin, Cohn,

Ferris, Glovsky & Popeo, P.C.

Boston

DONALD R. mcminn . . . . . . Hollingsworth LLP

Washington, DC

DAREN S. McNALLY . . . . . . . . Clyde & Co US LLP

Florham Park, NJ

CATHERINE A. MONDELL

Ropes & Gray

Boston

JOHN M. NONNA . . . . . . . . . . Dewey & LeBoeuf LLP

New York

SHERILYN PASTOR . . . . . . . . . McCarter & English, LLP

Newark, NJ

ANDREW M. REIDY . . . . . . . . Dickstein Shapiro LLP

Washington, DC

KENNETH A. REMSON . . . . . . Dickstein Shapiro LLP

Los Angeles

PAUL A. ROSE . . . . . . . . . . . . . Brouse McDowell

Akron, OH

MICHAEL T. SHARKEY . . . . . . Dickstein Shapiro LLP

Washington, DC

WILLIAM P. SHELLEY . . . . . . . Cozen O’Connor

Philadelphia

SETH A. TUCKER . . . . . . . . . . Covington & Burling LLP

Washington, DC

The Insurance Coverage Law Bulletin® (ISSN 1541-0773) is

published by Law Journal Newsletters, a division of ALM.

© 2011 ALM Media, LLC. All rights reserved. No reproduction of any

portion of this issue is allowed without written permission

from the publisher. Telephone: (877) 256-2472,

Editorial e-mail: jgromer@alm.com,

Circulation e-mail: customercare@alm.com

Reprints: www.almreprints.com

The Insurance Coverage Law Bulletin 023148

Periodicals Postage Paid at Philadelphia, PA

POSTMASTER: Send address changes to:

ALM

120 Broadway, New York, NY 10271

Published Monthly by:

Law Journal Newsletters

1617 JFK Boulevard, Suite 1750, Philadelphia, PA 19103

www.ljnonline.com

The Insurance Coverage Law Bulletin ❖ www.ljnonline.com/alm?ins

May 2011

Dry Cleaner

continued from page 2

it found a reference to a comprehensive general liability policy issued to Kleenit during the time

period in question. In addition,

Kleenit produced ledger sheets reflecting payments to Travelers, and

Kleenit’s annual reports for 1967

and 1968 contained a summary of

Kleenit’s insurance coverage, including the limits of coverage. Finally, Kleenit asserted that the terms

of the 1967-1970 policy could be

inferred from the 1970-1973 policy.

The court held that: 1) it could not

consider the annual reports because

they had not been properly authenticated; 2) while the ledgers reflected payments to Travelers and referenced the same policy number that

Travelers had conceded it identified

in its own records, the ledger sheets

said nothing about the specific material terms of the policies; and 3)

there was no evidence in the record

to suggest that the 1970-1973 policy

was a renewal of the previous policy. In light of the above, the court

concluded that Travelers also was

entitled to summary judgment with

respect to policy years 1967-1970.

As Kleenit demonstrates, if old

policies have been discarded, it can

be very difficult for a dry cleaner

or other insured to prove the terms

and conditions of coverage.

Known Loss

As a general rule, liability insurance coverage does not exist for

property damage that the insured

knows about when the policy is

issued. This issue was litigated in

Crawfordsville Square, LLC v. Monroe Guaranty Insurance Company,

906 N.E.2d 934 (Ind. Ct. App. 2009).

In Crawfordsville, a shopping mall

operator purchased a parcel of land

adjacent to the mall that contained

several businesses, including a dry

cleaner. During the due diligence

process, the shopping mall operator

learned that the soil and water under the parcel were contaminated.

The shopping mall operator agreed

to proceed to buy the parcel so long

as the seller established an escrow

account of $44,000 on account of

such contamination.

May 2011 Upon the closing of the transaction, the shopping mall operator

added the parcel to its existing general commercial liability insurance

policy. Subsequently, the Indiana

Department of Environmental Management demanded that the shopping mall operator remediate the

site. The shopping mall operator

sought coverage from its insurer,

which the insurer denied. The court

held that under the known loss

doctrine, losses which exist at the

time of the insuring agreement, or

which are so probable or imminent

that there is insufficient risk being

transferred between the insured and

insurer, are not properly subjects of

insurance. The court stated that the

record in that case clearly indicated

that the shopping mall operator had

knowledge of actionable contamination. As such, summary judgment

was properly granted in favor of the

insurer.

Pollution Exclusion

Prior to the early 1970s, commercial general liability policies did

not exclude coverage for pollution

claims. Between the early 1970s

and 1985, however, insurers started

adding qualified pollution exclusion clauses in their policies. The

qualified pollution exclusion barred

pollution claims except where the

polluting discharge or release was

sudden and accidental. In 1985,

most commercial general liability

policies began including absolute

pollution exclusions barring coverage for even sudden and accidental

discharges and releases of contaminants. The effect of pollution exclusion clauses has been litigated in

the context of dry cleaner environmental contamination.

In Morrow Corporation v. Harleysville Mutual Insurance Co.,

101 F. Supp. 2d 422 (E.D. Va. 2000)

(“Morrow I”), a dry cleaner sought

defense and indemnity with respect

to a lawsuit brought against it by

a shopping center operator stemming from the presence of perc.

Certain policies contained absolute

pollution exclusions, and others

contained qualified pollution exclusions excepting sudden and accidental discharges of pollutants. The

court easily found that the policies

with an absolute pollution exclusion barred coverage. The more difficult question was whether the dry

cleaner’s discharge of perc was sudden and accidental.

The court in Morrow I held that

the phrase “sudden and accidental”

means “both unexpected and unintended and quick or abrupt.” The

court found that the shopping mall

operator’s allegations against the dry

cleaner were of sufficient breadth to

encompass releases that were both

sudden and accidental for purposes

of assessing whether a duty to defend is owed:

[T]he underlying complaint alleged that “during the operation

of the Facility, [the dry cleaner

and its employees] spilled or

released [perc] and discharged

[perc] … into the environment.” … [A]llegations employing these terms were sufficient

to trigger [the insurer’s] duty to

defend [the dry cleaner] against

the [shopping mall operator’s]

lawsuit, because “the obligation

to defend … arises whenever

the complaint alleges facts and

circumstances, some of which, if

proved, fall within the risk covered by the policy.”

The court stated that the insurer

may ultimately succeed in proving

that the contamination arose from

“a continuous pattern” of pollution during the coverage period, in

which event the insurer would have

no duty to indemnify the dry cleaner.

However, with respect to the duty to

defend, the inquiry is not whether

the releases were in fact sudden and

accidental, but simply whether the

underlying complaint’s allegations

reasonably encompassed sudden

and accidental releases of perc.

Employers Insurance of Wausau v.

California Water Service Company,

2008 WL 3916096 (N.D. Cal. 2008),

also interpreted a qualified pollution

exclusion. The complaints in the

underlying suits, which were filed by

the California Department of Toxic

Substance Control (“DTSC”), alleged

that several dry cleaning businesses

and property owners released perc

into the soil and groundwater beneath the central business district

continued on page 4

The Insurance Coverage Law Bulletin ❖ www.ljnonline.com/alm?ins

3

Dry Cleaner

continued from page 3

of Chico, CA. The California Water

Service Company (“Cal Water”) was

named as a defendant in each of

the underlying actions. The DTSC

alleged that Cal Water’s activities of

pumping water and operating, monitoring and shutting down of certain

wells affecting the Chico city water

supply all purportedly contributed

to the dispersal of the contamination in the groundwater.

Cal Water sought defense and indemnity from its insurer, which had

issued general liability insurance

policies to Cal Water. The policies

issued between 1972 and 1986 contained a qualified pollution exclusion, which barred coverage arising

from the discharge of pollutants except when such discharge is sudden

and accidental. The court held that

the relevant discharge for coverage

purposes was that of third-party dry

cleaners and not the subsequent activities of Cal Water which spread

the environmental contamination.

Cal Water contended that there were

sudden and accidental discharges

by the dry cleaners, and as such, the

exception to the pollution exclusion

applied. The court denied the insurer’s motion for summary judgment

on the duty to defend, holding as

follows:

Cal Water appears to acknowledge that many of the discharges by the dry cleaner facilities

were made as part of their

routine operations. Nevertheless, it points to a number of

discharges by two of the dry

cleaners … that may qualify as

sudden and accidental. These

alleged sudden and accidental releases include five or six

spills of [perc] of 3 to 4 gallons

each from April 1986 through

September 1976 by [one dry

cleaner] and 1 to 5 gallon spills

once every 5 or so years by [another dry cleaner]. … Although

Cal Water makes no attempt to

demonstrate how much, if any,

of the environmental damage

would have been caused by

these spills over and above the

routine disposal of [perc] into

the water by the dry cleaners,

4

the evidence is enough to defeat summary judgment on the

duty to defend.

Finally, in State Farm Fire and Casualty Company v. Walnut Avenue

Partners, LLC, 675 S.E.2d 534 (Ga.

Ct. App. 2009), a shopping center

operator sued a former dry cleaning

tenant seeking damages connected

with remediating the property. The

dry cleaner’s insurer sought a declaratory judgment that it was not

obligated to provide a defense due

to the pollution exclusion in the dry

cleaner’s umbrella policy. The body

of the policy excluded certain specified instances of property damage

arising out of the discharge or release of pollutants. One endorsement to the policy narrowed the

scope of the pollution exclusion in

the body of the policy by exempting

from it discharges that are “quick,

abrupt and accidental.” Another endorsement broadened the scope of

the pollution exclusion in the body

of the policy by eliminating any pollution coverage which would have

otherwise existed under the policy.

The court held that the conflicting

endorsements created an ambiguity

in the policy, and that, as a result,

the trial court did not err in construing the policy to provide coverage

for quick, abrupt and accidental discharges of pollutants.

Timing

of

Accident

With respect to dry cleaner contamination alleged to have taken

place decades earlier, the insurance

policies that potentially might provide coverage typically are older,

occurrence-based policies. Under

occurrence policies, so long as the

insured can plead and prove that

an “accident” occurred during the

policy period, coverage may be

available. In assessing whether an

accident occurred during the policy

period, issues often arise, as they

did in the cases discussed below, as

to whether the contamination at issue was the result of an accident,

and if so, whether the accident took

place during the policy period.

In Hinkle v. Crum & Forster Holding, Inc., __ F. Supp. 2d __, 2010 WL

3023174 (D. Ala. 2010), the current

property owners brought a contribution action against the former

property owners due to groundwater contamination on and emanating from the property. The current

and former owners operated a dry

cleaning business on the property.

The current property owners settled

with the former property owners for

more than $2 million, an assignment

of rights against the former property owners’ insurers, and a covenant not to collect on the judgment

against the former owners. The current property owners then sued the

former owners’ insurers. The court

dismissed the suit on summary

judgment, holding that the current

property owners “failed to prove or

establish sufficient evidence of an

‘occurrence,’ i.e., an accident during the policy period impacting the

ground water.” For example, the

court held that “the deliberate dispersal of contaminants from a barrel

in order to find a wedding ring” was

not an accident and, in any event,

such incident occurred three years

before any of the insurance policies

at issue were purchased.

In Pilgrim Enterprises, Inc. v.

Maryland Casualty Company, 24

S.W.3d 488 (Tex. App. 2000), a dry

cleaner alleged that its insurer had

a duty to provide it with a defense

with respect to certain environmental lawsuits filed against the dry

cleaner by the dry cleaner’s landlord and adjacent property owners

for personal injuries and property

damage. Each applicable policy defined the term “occurrence” as “an

accident, including continuous or

repeated exposure to conditions,

which results in bodily injury or

property damage neither expected

nor intended from the standpoint of

the insured.” The insurer argued that

it was required to defend the dry

cleaner only if the alleged property

damage or bodily injury manifests

or becomes identifiable during the

policy period. By contrast, the dry

cleaner argued that the court should

find an “occurrence” under the policies if the injured parties were exposed to contaminants during the

policy period. The trial court ruled

in favor of the insurer, but the appellate court reversed, holding that,

under Texas law, “for CGL policies

continued on page 5

The Insurance Coverage Law Bulletin ❖ www.ljnonline.com/alm?ins

May 2011

Dry Cleaner

continued from page 4

covering continuous or repeated

exposure to conditions, injury can

occur as the exposure takes place.”

The appellate court concluded: “Because the pleadings potentially allege exposure during the policy

periods and damages for this exposure, we conclude that [the insurer]

owes [the dry cleaner] a duty of defense, even if it should later become

apparent that the contamination of

which the plaintiffs complain occurred at a later point.”

In Morrow Corporation v. Harleysville Mutual Insurance Co.,

110 F. Supp. 2d 441 (E.D. Va. 2000)

(“Morrow II ”), the policies at issue

defined the term “occurrence” as

“the date on which bodily injury

or property damage first manifests

itself.” The court held that, under

Virginia law, the term “manifests”

means “discoverable or subject to

being discovered by reasonable

means, not actually discovered or

perceived.” Although the perc contamination at issue was not actually

known or discovered by the shopping center that had sued its dry

cleaner tenant until after the expiration of the policies at issue, the

court held that such contamination

“may have manifested itself years

earlier, at the point at which the

[perc] contamination from each iter-

Chinese Drywall

continued from page 1

was used in Florida, Louisiana and

Virginia.

Now, it is estimated that more than

60,000 residential units in the southeastern United States alone contain

Chinese drywall. Complaints about

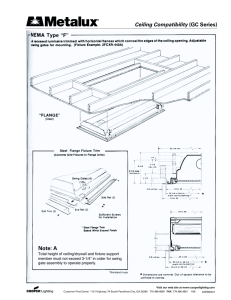

it have been numerous. Chinese drywall allegedly corrodes copper coils

and electric wires, emits fumes that

John David “J.D.” Dickenson is a senior associate in the West Palm Beach,

FL, offices of Edward Angell Palmer

& Dodge LLP. He represents insurers

and reinsurers in complex coverage,

claims handling and bad faith litigation, and also provides coverage and

excess exposure opinions.

May 2011 ative discharge was detectable and

discoverable in the soil and groundwater by virtue of reasonable testing.” As a result, the insurer was required to provide a defense to the

dry cleaner.

Damages

Comprehensive general liability

policies typically limit coverage to

claims against the insured for damages. A question that has arisen in

dry cleaner environmental coverage

actions is whether a lawsuit seeking

reimbursement for the cost of environmental remediation constitutes a

suit seeking “damages.”

This precise issue came up in

Morrow I. The insurer argued that

the lawsuit by the shopping center

operator against the dry cleaner for

reimbursement for the cost of environmental remediation was not

a damages action. The court disagreed, holding that, under Virginia

law, “environmental remediation

costs constitute damages within the

meaning of a comprehensive general liability insurance policy,” particularly when “the suit is brought by

a private party seeking to recover

the clean-up costs it incurred, as opposed to one brought by a governmental agency seeking to compel a

polluter to pay to remediate pollution damage.”

Similarly, in Spic and Span, Inc. v.

Continental Casualty Company, 552

N.W.2d 435 (Wis. Ct. App. 1996), the

smell like rotten eggs, and allegedly

causes respiratory health problems.

As a result, state and federal lawmakers have taken action, and thousands of lawsuits have been filed.

This article provides an update on

the Chinese drywall investigation as

well as a summary of significant insurance coverage decisions to date.

Federal

Date

and

State Action

to

With the majority of the affected

homes, Florida is at the center of the

Chinese drywall controversy. Threehundred million pounds — more

than half of the total amount of imported Chinese drywall — was imported to Florida, enough to build

approximately 36,000 homes. With

the concurrence of the U.S. Centers

for Disease Control and Prevention

(“CDC”), the Florida Department of

court held that a lawsuit brought by

the developer of a shopping center

against a dry cleaner that formerly

operated at the site was a suit for

“damages.” The insurers argued

that the developer was not seeking

“damages” because it merely sought

indemnification from the dry cleaner for government-mandated response costs. The court disagreed,

holding that, under Wisconsin law, a

suit seeking to recover remediation

costs and other damages with respect to contamination that extended beyond the premises formerly

occupied by the dry cleaner fell

within the meaning of “damages.”

Finally, in Employers Insurance,

Cal Water sought to recover from its

insurer the estimated costs to comply with certain consent decrees it

had entered into with the DTSC. The

court held that, under California law,

costs incurred pursuant to a consent

decree in a water contamination case

constitute “damages” under a comprehensive general liability policy.

Conclusion

To date, there have been only a

handful of reported decisions addressing coverage issues arising

from dry cleaner contamination.

Whether coverage exists has depended on the policy language, the

governing law, and the nature and

cause of the contamination at issue.

—❖—

Health (“FDOH”) conducted the first

testing of Chinese drywall in 2009;

two Chinese manufactured drywall

samples from Florida houses were

selected for analysis. Additionally,

four samples of U.S. manufactured

drywall were tested. The FDOH

found a corrosive sulfide-based

compound in the Chinese drywall

samples.

Ultimately, an Interagency Drywall Task Force, spearheaded by

the CPSC, was established to study

homes with Chinese drywall and to

investigate claims of property damage and bodily injury associated with

the product. The Interagency Drywall Task Force includes the CPSC as

the lead agency, along with the CDC,

the U.S. Environmental Protection

Agency (“EPA”), the U.S. Department

continued on page 6

The Insurance Coverage Law Bulletin ❖ www.ljnonline.com/alm?ins

5

Chinese Drywall

continued from page 5

of Housing and Urban Development

(“HUD”), as well departments of

health from Florida, Louisiana and

Virginia, among others.

On Friday April 2, 2010, the CPSC

and HUD issued “interim remediation guidance” to homeowners

impacted by Chinese manufactured

drywall. The two federal agencies

advised homeowners that “problem

drywall” should be removed and

replaced along with other components that the drywall may have

corroded. The guidance relates that

completed studies show a clear connection between certain Chinese

manufactured drywall and corrosion in homes.

The CPSC also released a staff report on data from a study by Lawrence Berkeley National Laboratory

that measured chemical emissions

from samples of drywall obtained

for the CPSC as part of the federal

investigation. The study confirmed

the presence of hydrogen sulfide

in some Chinese drywall. Hydrogen

sulfide is a potentially corrosive gas

that was suspected of causing the

corrosion associated with Chinese

drywall. The hydrogen sulfide emission rates of certain Chinese drywall

samples were 100 times greater than

the rates of drywall samples not produced in China. According to the interim guidance, the patterns of reactive sulfur compounds emitted from

drywall samples show a clear distinction between the Chinese drywall

samples manufactured in 2005/2006

and non-Chinese drywall samples.

“Our investigations now show a

clear path forward,” said CPSC Chairman Inez Tenenbaum. “We have

shared with affected families that hydrogen sulfide is causing the corrosion. Based on the scientific work to

date, removing the problem drywall

is the best solution currently available to homeowners. Our scientific

investigation now provides a strong

foundation for Congress as they consider their policy options and explore

relief for affected homeowners.”

Who Is Going

to

Pay?

Once it became clear that remediation of Chinese drywall was nec6

essary, the focus turned to how to

pay for it. It has been estimated that

Chinese drywall remediation efforts could average approximately

$100,000 per home. The Internal

Revenue Service approved a rule in

late 2010 that would permit taxpayers with defective drywall in their

houses to deduct the cost of repairs

and replacement of damaged appliances. Under the new rule, taxpayers can deduct drywall related “casualty losses” in the year in which

the loss occurs, as long as those

losses are not compensated by insurance or other sources. This rule,

of course, primarily benefits homeowners who can afford to fund the

necessary remediation themselves.

Obviously, most homeowners are

not in a position to conduct such remediation. Thus, the core question

remains: Who is going to pay?

While there has been some discussion of potential federal relief,

the primary targets to date have

been: 1) the manufacturers, and 2)

insurers. These targets have been

pursued via thousands of state and

federal lawsuits. The federal products liability suits, along with some

insurance coverage suits, have

been rolled into the Chinese Manufactured Drywall Products Liability Multi District Litigation (“MDL”)

pending in the Eastern District of

Louisiana. Still other suits are pending in state courts across the United

States. So far, the results have been

mixed with respect to the manufacturers, with some progress being

made with a significant manufacturer. On the insurance coverage side,

some clarity has developed with respect to first-party claims. However,

questions abound, particularly with

respect to third-party coverages.

Knauf Remediation

Pilot Program

Although the numbers are not

yet precisely known, it is thought

that two primary manufacturers,

Knauf Tianjin and Taishan Gypsum,

produced the bulk of the problem

Chinese drywall used in the United

States between 2004-2007. Knauf is

a German company that manufactured drywall in China through a

Chinese subsidiary (Knauf Tianjin)

and then imported it to the United

States. Taishan Gypsum is reportedly a Chinese “state sponsored”

drywall manufacturer with operations in China. Until recently, no

manufacturer had formally stepped

forward to discuss problems with

its product or to negotiate potential

remediation efforts.

In a significant development, it

was announced in October 2010

that Knauf has agreed to pay to repair 300 homes in four states in a

remediation pilot program. Owners

of homes in Florida, Louisiana, Alabama and Mississippi with drywall

manufactured by Knauf are eligible

to participate in the program. Reportedly, a Louisiana-based supplier

and several home builders and insurers are contributing to the cost

of the repairs.

According to reports, more than

3,000 claims are pending against

Knauf. The pilot remediation program might provide the framework for a larger settlement of

these claims. It remains to be seen

whether Knauf will expand its remediation program to include more

homes, and perhaps condominium

developments.

CPSC Chairman Tenenbaum described Knauf’s decision to participate in the remediation pilot program as a “major breakthrough.”

Tenenbaum also said that she believes one particular governmentsponsored Chinese company is resistant to cooperating and currently

represents an impediment to international collaboration on the issue.

She did not name the company, but

is likely referencing Taishan Gypsum. Tenenbaum said in January

2011 that the United States has not

been able to persuade Chinese officials to agree to compensate U.S.

homeowners for losses associated

with Chinese drywall. At a media briefing during a trip to China,

Tenenbaum said:

We have not been able to get

any of the Chinese manufacturers to come to the table to discuss our scientific findings and

what, if any, they think their responsibility is to the American

homeowner … We are still very

hopeful that the Chinese companies can come to the table

continued on page 7

The Insurance Coverage Law Bulletin ❖ www.ljnonline.com/alm?ins

May 2011

Chinese Drywall

continued from page 5

and let us explain what our findings are and see if they can participate in helping us make our

homeowners get a remedy in

getting the Chinese drywall out.

Thus, while there continues to be

progress with respect to the resolution of claims involving Knaufmanufactured drywall, considerable

roadblocks still exist regarding Chinese participation in the necessary

remediation. The situation continues to evolve.

Insurance Coverage Decisions

The landscape of Chinese drywall

related insurance coverage decisions is also continually evolving.

There have been a few important

decisions to date in both the firstparty (primarily homeowners) and

third-party (primarily CGL) claims

contexts. The focus of the coverage

decisions has been in a few key areas. Specifically, decisions to date

have principally discussed: trigger

of coverage issues, definition of “occurrence,” number of “occurrences,”

pollution exclusions, and “business

risk” exclusions. This section discusses a few key Chinese drywall

coverage decisions issued to date.

First-Party Claims

In one of the first drywall coverage

decisions, the U.S. District Court for

the Eastern District of Virginia found

on June 3, 2010 that a homeowner’s

policy did not cover damages associated with Chinese manufactured

drywall. In Travco Insurance Company v. Larry Ward, 715 F. Supp. 2d

699 (E.D. Vir. June 3, 2010), Larry

Ward alleged that the drywall in his

Virginia Beach home released sulfuric gases into his home, damaging

his air conditioning, garage door

and flat-screen televisions. When

Ward made a claim under his homeowner’s insurance policy, his insurer sought declaratory relief as to

whether there was coverage.

On the insurer’s motion for summary judgment, the court found that

the damages alleged did constitute

a “direct physical loss” within the

meaning of the policy. However, the

court found that the policy’s latent

defects, faulty materials, corrosion

and pollution exclusion clauses exMay 2011 cluded coverage for Ward’s damages. The court also found that none

of the losses qualified for coverage

under the policy’s ensuing loss provisions. Thus, the court ruled that

the policy did not cover the costs

associated with removing or replacing the drywall, or any damages

stemming from the drywall. However, the court would not “categorically rule out” that other, as-yet unclaimed, losses might be covered.

Critically, and in reliance in part

upon Travco, the presiding judge

in the Chinese drywall MDL granted 10 homeowners’ insurers’ motions to dismiss. In In re Chinese

Manufactured Drywall Prods. Liab.

Litigation, 2010 U.S. Dist. LEXIS

133497 (E.D. La. Dec. 16, 2010),

the court applied Louisiana substantive law, as the policies were

all issued to Louisiana homeowners on Louisiana properties. Presiding MDL Judge Eldon Fallon found

that, based upon Travco, the damages alleged did constitute a “direct

physical loss,” but that the loss was

excluded under the policies’ faulty

materials and corrosion exclusions.

The judge concurrently found that

latent defect, pollution, contamination, dampness and temperature exclusions in some or all of the policies did not preclude coverage for

the Chinese drywall claims. Importantly, the court’s refusal to apply

the pollution exclusion was based

upon the prevailing Louisiana interpretation of the pollution exclusion,

which limits its application to the

industrial environmental pollution

context.

Most of the existing first-party decisions have been decided in favor

of the insurers, and the landscape

regarding such claims has begun to

be charted. These decisions, particularly the MDL decision regarding

the application of the pollution exclusion, may provide clues regarding how third-party coverage claims

may be decided going forward.

Third-Party Claims

In the first significant Florida coverage decision, Amerisure Mutual

Insurance Co. v. Albanese Popkin

The Oaks Development Group L.P.,

2010 U.S. Dist. LEXIS 125918 (Nov.

30, 2010), the U.S. District Court for

the Southern District of Florida held

that the developer’s insurer had no

duty to provide coverage or a defense for claims related to Chinese

drywall made against a developer.

The court ruled that the commercial general liability policies issued

to the developer did not cover the

claimed losses because the damages

at issue “manifested” before the developer’s policies were issued.

The coverage dispute arose from

the lawsuit that Alan and Annette

Goddard filed against the developer, Albanese Popkin. According

to court documents, Albanese Popkin completed construction on the

Goddards’ Florida home in October 2006. The Goddards discovered

damage to the air conditioning coils

in one of their seven air handling

units and a periodic sulfur odor in

December 2006. Based upon the

allegations made in the Goddards’

complaint, the court found that the

damages related to Chinese drywall

“manifested” before the applicable

policies’ January 2008 effective date.

Reaffirming Florida’s adherence to

the “manifestation” trigger doctrine,

the court wrote:

Manifestation of the damage is

relevant in this context because

it establishes that the Goddards

sustained actual damage before

the policy in question became

effective. Therefore, there was

no “bodily injury” or “property

damage” during the policy period.

In an unreported decision involving third-party coverage, Scottsdale

Ins. Co. v. American Safety Indemnity Co., Case No. 10-0445-WS-N

(S.D. Ala. Nov. 10, 2010), the U.S.

District Court for the Southern District of Alabama considered whether an insurer had an obligation to

defend a complaint based upon Chinese drywall damages. The insured

builder was issued commercial general liability policies by it insurers,

Scottsdale and American Safety.

The builder sought coverage from

its insurers for allegations brought

against it in two underlying lawsuits

pending in Alabama state court that

allegedly arose from property damage caused by defective Chinese

drywall. Scottsdale agreed to defend

the builder against the allegations

continued on page 8

The Insurance Coverage Law Bulletin ❖ www.ljnonline.com/alm?ins

7

Chinese Drywall

continued from page 7

in the underlying lawsuits, however,

American Safety declined to participate in the defense on the basis that

the pollution exclusion applied to

preclude coverage. Scottsdale filed

suit, and American Safety filed a

12(b)(6) motion to dismiss on the

basis that it had no duty to defend

or indemnify the builder in the underlying lawsuits.

Specifically, American Safety asserted that the absolute pollution

exclusion in its policy precluded

coverage for the drywall-related

claims, and thus American Safety

had no duty to participate in the defense with Scottsdale. The court, applying Georgia law, but focusing on

the language of the pollution exclusion in the American Safety policy,

first opined that the fumes and off

gassing from the allegedly defective

drywall constituted a “pollutant” as

defined by the policy.

The court then, pointing to the

language in the exclusion that

stated that it only applies to losses

arising from the discharge of pollutants from a site where builder or its

agents “are performing operations,”

opined that the pollution exclusion

did not unambiguously preclude

coverage. The court ultimately concluded that the allegations against

the builder in the underlying litigation appeared to relate, in part,

to a discharge of a pollutant from

the allegedly defective drywall that

occurred and continued to occur

long after the builder had ceased

operations at the construction site.

As such, the court was not satisfied

that American Safety had shown

that all claims in the underlying action were clearly excludable, and

thus, American Safety had a duty to

defend and the court denied its motion to dismiss.

In a more recent decision, U.S. District Court Judge K. Michael Moore

of the Southern District of Florida

has ruled that a pollution exclusion

bars coverage for personal injuries

and property damages associated

8

with Chinese drywall. In General

Fidelity Insurance Co. v. Katherine

L. Foster et al., Case No. 09-80743,

(S.D. Fla. Mar. 24, 2011), the court

found that the compounds released

by the Chinese drywall were “pollutants” within the meaning of the

policy. The court further found that,

under prevailing Florida law, the application of the pollution exclusion

is not limited to injury or damage

caused by environmental or industrial pollution. The court granted

summary judgment to the insurer,

ruling that it has no duty to defend

or indemnify.

The construction of the pollution

exclusion will continue to be a critical

issue in ongoing third-party Chinese

drywall coverage cases. Different jurisdictions have vastly different approaches to such exclusions. As the

In re Chinese Manufactured Drywall

Prods. Liab. Litigation first-party decision demonstrates, insurers subject

to Louisiana law will have to contend

with a more restrictive view of the

pollution exclusion. In contrast, so

far it appears that Florida will continue to take a broader view of the

pollution exclusion, applying it outside of the industrial environmental

pollution context, and specifically to

indoor air claims. Accordingly, the

law applicable to a particular Chinese drywall coverage case, along

with the forum of that dispute, can

have a potentially dispositive impact

on the interpretation of the pollution

exclusion.

The Bodily Injury Question

Based upon the investigations to

date, it is clear that at least some Chinese manufactured drywall causes

property damage. Corrosion to metal

components, particularly copper, has

been confirmed, and the emission of

corrosive hydrogen sulfide fumes

has been established.

There is less certainty with respect

to allegations of bodily injuries associated with Chinese drywall. The

CPSC has stated that hydrogen sulfide gases are acidic and, in instances of significant exposure, have been

known to irritate the eyes and respiratory tract. Further, the CPSC has

For even FASTER service, call:

877-256-2472

stated that it is “possible that the additive or synergistic effects of these

and other compounds in the subject

homes could cause irritant effects.”

The CDC, in its role as a member of

the Interagency Drywall Task Force,

recently released a study targeting

11 deaths that took place in Florida,

Louisiana and Virginia about which

family members had expressed a

concern regarding a potential connection with Chinese drywall. The

CPSC studies, released in February

2011, found that exposure to Chinese drywall was not believed to be

a factor in the 11 deaths. Rather, in

all 11 cases, the decedents had significant pre-existing chronic health

conditions before their deaths, including cancer, diabetes, and chronic heart disease. While the CPSC

concluded that none of the deaths

were associated with exposure to

Chinese drywall, the CDC recommended that the CPSC continue to

monitor health reports and involve

the CDC when appropriate.

Thus, the bodily injury investigations are ongoing and no conclusive

determinations have yet been made

regarding the alleged human health

impacts of defective Chinese drywall. Now that the property damage

aspect of Chinese drywall has been

largely confirmed, and as the recent

CPSC reports have demonstrated,

increased attention will be paid to

this component of Chinese drywall

claims going forward.

One reality is clear: The Chinese

drywall issue continues to develop

at a rapid pace on numerous fronts.

Future announcements from the Interagency Drywall Task Force will

continue to shed light on the viability and potential scope of alleged

bodily injury claims. Interested parties can also expect that pressure on

the manufacturers will continue and

that the pace of coverage decisions

will accelerate. Developments in

these areas will further clarify how

Chinese drywall remediation efforts

will be funded going forward.

—❖—

On the Web at:

www.ljnonline.com

The Insurance Coverage Law Bulletin ❖ www.ljnonline.com/alm?ins

May 2011