Cowlitz EDC Tip Strategy - Cowlitz Economic Development Council

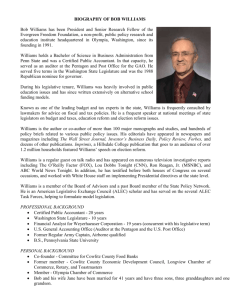

advertisement