electronic sales suppression: a threat to tax revenues

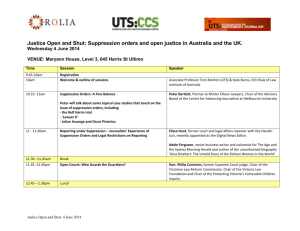

advertisement