code of federal regulations

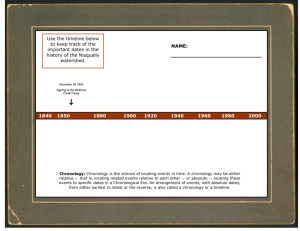

advertisement