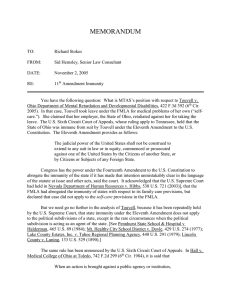

Should Political Subdivisions Be Accorded

advertisement