ANALYST INSIGHT

Next-Generation Data Centers

How Capgemini and its peers are conjuring up space for

medium-density clouds

Reference Code: OI00144-023

Publication Date: April 2011

Author: Ian Brown

SUMMARY

Catalyst

Data centers are at the heart of IT. If enterprises large and small are going to move to greater use

of cloud computing, those clouds are going to have to be hosted somewhere and that means more

data centers. That is to say nothing of hosting the clouds that support the consumer market. In

short, there's increasing demand for data center space suitable for hosting both private and public

cloud computing. But next-generation data centers aren't just for clouds: enterprises are running

out of suitable space and power capacity to locate their newly virtualized server farms; inefficient

cooling in overcrowded data centers is doubling energy costs; enterprises need to consolidate data

centers and reduce costs. Not surprisingly, these factors have led to a rush of activity in the data

center market with new builds, refurbishments, and expansion of existing data centers. Just about

every IT services vendor is upgrading its key customer-facing data center facilities or adding new

capacity. These next-generation data centers are usually described as suitable for cloud

computing environments, while vendors also promote their sustainability credentials.

Ovum view

Location is key – power capacity, connectivity, and low risk from environmental

hazards head the list of requirements for a good data center location. That's leading to

a good number of "out-of-town" facilities to avoid expensive city locations with limited

capacity and access.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 1

Modular construction cuts the length of data center projects in half and saves money,

but the interpretation of "modular" is varied and not all versions are equally flexible for

customers' IT.

Power efficiency and "fresh-air" cooling have become almost de facto standards for

northern Europe and geographies at similar latitudes.

Industrial locations and out-of-town "business parks" are popular for new data center builds in the

main European ICT locations (France, Germany, the Netherlands, and the UK) and North America,

because of the ready availability of power capacity and good road or rail access. Access is

significant because in many countries, fiber networks tend to follow main arterial infrastructure

routes (gas, road, and rail in the UK, for example). Proximity to existing backbone fiber networks is

essential to avoid the expense of laying fiber to a new facility. Industrial and former manufacturing

sites also offer plenty of power capacity and are becoming sought-after locations for data center

facilities in Europe.

Modular construction is driving innovation in the data center market. It delivers speedier

construction and enables existing structures such as distribution warehouses to be re-purposed as

data centers. Many of the new generation of highly efficient, out-of-town data centers coming on

stream in the UK, for example, have been constructed inside existing warehouse or distribution

facilities. The ex-warehouses provide vast, ready-made shells into which the data center halls,

modules, and infrastructure can be deployed with a relatively low level of additional site

preparation, thus reducing construction time and cost.

The interpretation of "modular" with regard to data center design is becoming increasingly varied,

however. In Ovum's view, there are three main kinds of "modular" primarily differentiated by the

amount of usable technical floorspace and capacity they provide:

containers

pre-fabricated modules

modular on-site assembly.

Power efficiency for all modular formats and many next-generation data centers primarily comes

from the use of "free" or "fresh-air cooling" and hot/cold aisle layouts. By minimizing the use of

chillers and air-conditioning systems to reduce temperatures in the data centers, operators can

reduce power usage, improve the power efficiency of their data centers, and reduce costs.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 2

Key messages

The new generation of data centers relies on fresh air and modular designs to keep

costs low.

Enterprise IT services clients won’t compromise on resilience for data center

efficiency.

Enterprises must be prepared to compromise on flexibility in terms of data center

capacity and flloorspace as the trade-off for speed of delivery and potential cost

savings from improved power efficiency.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 3

THE NEW GENERATION OF DATA CENTERS RELIES ON FRESH

AIR AND MODULAR DESIGNS TO KEEP COSTS LOW

Data center design is evolving

Ovum has recently visited a number of data centers in the UK, which illustrate current thinking on

data center design and innovation. These include data centers owned and operated by Capgemini,

Colt, Fujitsu, and HP. Although many of the examples in this report refer to these UK-based data

centers, the design criteria, vendor strategies, and issues around data center site location and

availability are almost universal. The practices adopted by Capgemini, Colt, Fujitsu, and HP in their

UK data centers are repeatable and represent an evolution from previous designs implemented in

North America, Europe, and the Asia-Pacific region. Similarly, the learnings and experiences from

the UK centers are being incorporated and developed further in new data centers in other regions

around the world. Data center design is evolving and IT services vendors, enterprise and public

sector organizations, and data center suppliers need to take account of it and the common issues

they face in whichever region they're based.

All the data centers that Ovum has recently visited have been designed with two key criteria in

mind: power efficiency and modular expansion. All are also designed to offer at least tier-3 or

above resilience and security.

IT services vendors have designed data centers to host their enterprise and public sector clients'

IT. These are managed services and outsourcing clients; IT services vendors such as Capgemini,

Fujtsu, and HP don't offer co-location services, so they're not building data center space to offer

directly to clients. (Colt does provide co-location services, primarily to financial services customers

that use its UK and European networks.) Consequently, the design criteria for the IT services

vendors' data centers are based on the wants and needs of enterprise and public sector clients,

rather than the kilowatt/hour (kW/h) price points of the data center co-location market. Data center

operating costs are "hidden" within the overall managed services terms and conditions and

contracts that are typically five years or longer.

Nevertheless, Capgemini, Fujitsu, and HP have all highlighted power efficiency, sustainability, and

modularity as key features of their next-generation customer-facing data centers. Two of these

features – power efficiency and modularity – are often pitched as cost-reduction measures,

particularly for enterprises and organizations that continue to build and manage their own data

centers. Electricity costs have become the biggest operational cost in most data centers as

electricity costs rise and more power is expended on cooling racks of densely-packed industryNext-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 4

standard servers than is actually used to power IT equipment. Modular construction techniques

and the use of data center modules enable enterprises and data center providers to add capacity

incrementally and delay capital expenditure.

Ovum thinks it unlikely that Capgemini, Fujitsu, and HP have decided to build their sustainable,

modular data centers solely with a view to passing on reduced costs to their managed services or

outsourcing customers. As data center operators, vendors also face rising power and construction

costs that threaten margins, so not surprisingly they have incentives to look at ways to reduce

such costs.

Fresh air is the new coolant

The consistent theme for all of the next-generation data centers that Ovum has recently

investigated is that the operating vendors operating them aim to keep power usage efficiency

(PUE) ratings below a best-practice PUE level of 1.5.

PUE is a measurement of a data center's power efficiency. It is determined by measuring the total

power coming into the facility from the power utility, divided by the electricity used directly to power

the IT equipment (servers, storage, and network equipment). If a facility uses 100,000kW/hr of

total power per annum and 60,000kW/hr are used to power the IT equipment, then the data center

has a PUE of 1.7.

The electricity which isn't used directly to power the IT goes to power things like the lights, the

office heating and ventilation, and the computer room air-conditioning (CRAC) and humidifier

systems which keep the IT equipment within its optimal operating environment parameters. The

CRAC is usually the other big consumer of electricity in the data center besides IT. If the amount of

power required to cool the IT equipment rises above the amount required by the IT systems

themselves, this is clearly inefficient – and expensive in electricity costs. But many legacy and

customer-owned data centers are inefficient and anecdotal evidence suggests that PUE ratings of

between 2.5 and 3.0 are the norm for older data centers and many customer-owned and operated

facilities. Cut the amount of air cooling needed to keep IT within its environmental operating

parameters and you can cut your data center operating costs.

In the UK, average summer temperatures are between 12.2 degrees and 17.7 degrees Celsius (C)

or 54.0 degrees and 63.9 degrees Fahrenheit (F) and seldom rise above 30 degrees C (86

degrees F). Consequently, even in summer, outside temperatures are typically well within the

operating environment requirements for data center IT equipment and many new data centers now

use "fresh-air cooling" as the primary method for cooling IT equipment. But it's not as simple as

opening the windows. IT equipment heats up the air inside the data center, so the hot exhaust air

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 5

being blown out of the equipment racks has to be kept separate from the cooler incoming air. Most

legacy data centers don't separate hot and cold airflows efficiently or constantly monitor

temperatures and adjust cooling in response to changes in ambient temperatures.

The arrangement of fans, ventilation, the separation of hot and cold aisles, venting of hot air,

monitoring of environmental conditions (temperature and humidity), and the air-flow through the

data center is complex. Separating hot and cold air into aisles running between the racks of IT

equipment is essential -- cold air is blown down the front of the racks; hot air is exhausted from the

rear. By enclosing the aisles, hot and cold air can be kept separate.

All fresh-air systems also require some form of additional air-conditioning, usually chillers or (more

likely in a "sustainable" build) an evaporative water system, to cool the incoming air on those days

when outside temperatures rise above acceptable operating levels for IT equipment, typically

22–24 degrees C (72–75 degrees F). The ability to cool and recycle hot air is also required in case

the outside air becomes polluted (by smoke, for example). Data centers can't be entirely CRACfree, even in the coldest locations. As IT equipment is designed to operate reliably within a wider

temperature envelope than previously, however, next-generation data centers can consistently

achieve 95% or more fresh-air cooling over the course of a year in northern European locations.

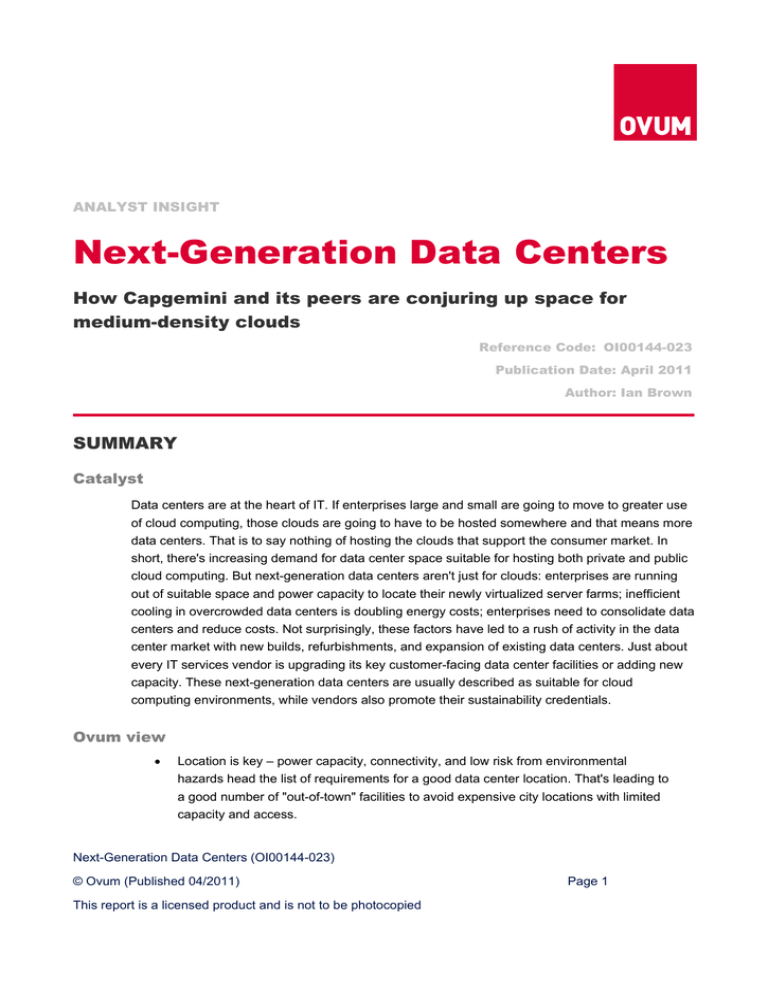

Modularity

The other key design principle of the next-generation data center is modularity. Ovum identifies

three modular formats currently in use in new builds or data centers under construction (see Figure

1):

Containers -- the small, 20- or 40-foot steel shipping containers used to house up to

around 20 equipment racks, typically filled with the vendor's industry-standard servers

(vendors include IBM, HP, Dell, and other server manufacturers). Container-based

"data centers" are typically used for additional temporary capacity, though some cloud

services providers are using containers to fit out their mega data centers, because of

the speed with which they can be deployed and the density of IT equipment that can

be achieved.

Pre-fabricated ship-to-site modular data halls – manufactured off-site, these selfcontained modular data halls are bigger and more flexible than containers, but still

small enough to fit on the back of a (very large) truck. They have self-contained

cooling, power distribution, and individual hot/cold aisles; Capgemini's modules used

in its new UK Merlin data center have up to 250 sq m (2,690 sq ft) of usable

"technical" floor space enough for 104 standard IT equipment racks, for example.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 6

Modular "on-site assembly" data halls – data center components are manufactured

off-site for assembly on site; standardized components reduce the cost and length of

time to build the data center. This modular format supports larger areas of technical

space than pre-fabricated ship-to-site halls; up to 1,115 sq m (12,000 sq ft) in the case

of Digital Reality Trust's PODs or 500 sq m (5,340 sq ft) for Colt's bolt-together

modules, for example. Some modular on-site assembly formats are more flexible than

others, supporting raised or non-raised floor data centers, water-based or fresh air

cooling, and greater resilience (typically 2N versus N+1, for example). Like other

forms, it allows for incremental builds.

The three formats represent a range of different deployment levels, from easiest and quickest for

the containers to hardest and longest for the on-site assembly modules. In fact, prefabricated and

on-site assembly are not that dissimilar in terms of time to construct the parts and assemble (from

four to six months), but deployment of the prefabricated modules on site is of course quicker than

on-site assembly.

Not every next-generation data center uses pre-fabricated modules or components, however. Of

the European data centers that Ovum has visited in the past year, HP's Wynyard data center in the

UK is "modular" insofar as it's being built out in phases. HP has constructed and fitted out four

1,000 sq m (11,000 sq ft) halls and has room to build another four 1,000 sq m data halls in a

second phase.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 7

Figure 1: Modular data-center formats

AST Modular’s Thor containerbased data center

Deploying a Capgemini Merlin

module

HP “Butterfly” data center: four

modules linked to a central

support area

Source: AST Modular/Capgemini/HewlettPackard

OVUM

Capgemini's Merlin data center exemplifies the trend to modular,

sustainable facilities

Capgemini's Merlin data center, which opened in the south west of England in October 2010, is

typical of the new breed of "sustainable" data center. It is built on an industrial site on the outskirts

of Swindon, a town about 110km (68m) from London. It has good access and road links -- it's not

by chance that the industrial park, where it's located, is situated near Honda's UK auto

manufacturing facility.

Merlin is housed in a former distribution warehouse. All four of the data centers that Ovum has

visited most recently are housed in ex-warehouses. It's a growing trend in Europe. The warehouse

forms the shell for the facility, which in Merlin's case provides enough space for 12 modular data

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 8

center rooms or 3,000 sq m (around 32,000 sq ft) of technical data center capacity. In European

terms, this is a medium capacity data center. In North American terms, where "mid-sized" is

around two times the size of Merlin, it's on the small side for an out-of-town data center.

Why are warehouses so appropriate for the next-generation data centers? Because they require

relatively little in the way of new construction:

the warehouse "shell" can be adapted

modular units can simply be assembled or deposited inside

there's less site preparation required

the process is quicker than a traditional build.

Modular data centers can be up-and-running in four to six months, compared with 12 to 18 months

for a traditional data center build. More locations that are appropriate for modular data centers

(disused warehouses and former manufacturing sites) have also become available in recent years

in European countries and in North America as a result of the recession.

Finding the right location is the critical first step for a data center provider. Capgemini, for example,

considered 260 locations before selecting Swindon, which was eventually chosen in part for its

proximity to Capgemini's state-of-the-art data center in Bristol, 64km (40m) away. The Swindon

site also offered adequate electrical capacity without the need to upgrade the existing on-site

power capacity and reasonable proximity to fiber backbone networks, though Capgemini had to lay

some fiber to reach the data center. At more than €150,000/m ($19,600/ft) providing additional

connectivity can be an expensive undertaking and is a key consideration that may influence

location along with power and risk factors. The Swindon location also offered a low risk from

flooding and other hazards, and its environment (air temperatures and humidity) was ideal for a

data center cooled by fresh air.

All-round sustainability

Merlin is a customer-facing data center rather than one intended for Capgemini's internal use.

Many of its potential and existing customers are running out of data center capacity or need to

renew ageing capacity that is becoming less than fit for purpose, especially as they deploy more

industry-standard, higher-density IT (industry-standard server farms, blade servers, and storage

arrays). With capex budgets especially tight in the present economic climate, however, there are

increasing incentives for enterprises and public sector organizations to outsource IT and avoid

significant capital expenditure. Few IT projects are as capital intensive as building a new data

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 9

center, hence the increasing number of enterprises and public sector organizations looking to

outsource or share facilities.

Sustainability was very high on Capgemini's agenda for Merlin, but not only from the point of view

of power usage, though the vendor set its sights on class-leading power efficiency. Capgemini had

two other key requirements with regard to sustainability:

to reduce water usage and contamination

to reduce the overall carbon footprint associated with the construction of the data

center.

Water is used in CRAC systems and the addition of glycol in traditional refrigerant cooling systems

is a major contaminant. In Capgemini's system, three-stage "air optimizers" are fitted to each of

the data center modules (see Figure 1). These either distribute the ambient cool air coming into

the data center with no additional cooling or provide additional cooling if the outside temperature is

above the internal operating thresholds.

For the majority of the time, the air optimizer uses external fresh-air cooling for ambient

temperatures up to 24 degrees C (75 degrees F). The second stage of Merlin's air-optimizers use

an evaporative cooling method, which doesn't contaminate the water. This stage comes into play

for temperatures between 24 degrees C (75 degrees F) and 34 degrees C (93 degrees F). The

third stage employs direct expansion (DX) refrigerant cooling, but is only needed in extreme

circumstances: when outside temperatures exceed 34 degrees C (93 degrees F) or when the air

optimizer runs in full re-circulation mode, because the outside air is contaminated (usually by

smoke from a fire within or in the vicinity of the data center or from a chemical spill).

Capgemini estimates that its evaporative and refrigerant cooling systems, when they are required,

use 30% less water than a traditional data center cooling system. A number of data center

infrastructure vendors are developing air optimizer systems for inclusion in modular data rooms

similar to those used by Merlin, and Ovum expects to see the technology widely adopted.

Outside Merlin's data halls, there's a "gray" water system for the bathrooms.

Modularity at the core of Merlin

Capgemini's use of a brownfield site and re-purposing of an existing building also fitted its

sustainability criteria. It was able to avoid unnecessary onsite construction, restricting such

activities to modification of the existing warehouse "shell", site preparation and installation of the

four diesel backup generators, addition of security and access facilities, and office construction

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 10

and modification. The data center modules themselves are manufactured off-site (about

160km/100 miles away) and transported to the site by truck. They are made from 95% recyclable

material, which has low embedded carbon.

As Figure 2 illustrates, the Merlin modules are larger than containers - they provide 250 sq m

(approximately 2,690 sq ft) of usable floorspace, although they currently support lower densities of

IT equipment than container-based modules - and are based on units originally designed for use

as mobile hospitals and laboratories. They are pre-fabricated "ship-to-site" modular data halls.

Capgemini has taken the middle line on modularity for Merlin. Its "modules" are larger and more

flexible than containers, but not as large in terms of technical floorspace as the pre-fabricated, onsite assembly modules produced by Digital Realty Trust (DRT), for example. The Merlin modules

which are really small pre-fabricated buildings have a structural life of 60 years. They're selfcontained and don't even require a separate building (the warehouse "shell") to contain them.

Customers could purchase a data center module from Capgemini at the end of the outsourcing

contract and move it to a new location, assuming the necessary power and services are available

at the new location. As such, the modules are fully reusable.

Among the other sustainability features included in Capgemini's design are a flywheel

uninterruptible power supply (UPS) and quick-start generators rather than lead-acid batteries for

short-term power. Again, this is becoming increasingly common practice in mid-sized data centers.

There is motion-sensitive passive infrared (PIR) lighting throughout the building.

The Merlin data center was voted Best Green Data center in Europe in the Data centerDynamics

Leaders Awards 2010. HP's Wynyard won the Uptime Institute's Green Enterprise IT Award 2010.

These two data centers are vying with each to be the greenest in Europe. In Ovum's opinion,

Merlin is currently the greener by a whisker, but the two data centers are targeted at different

customers, so comparisons of their "greenness" don’t tell the whole story.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 11

Figure 2: Capgemini's Merlin modules

Data Centre Module Components

A data centre module consists of 6 sections (7 for a power dens

ity of 2000 w/m2)

View in to cold aisle

Power distribution

120 racks forming hot

and cold aisles

Source: Capgemini

OVUM

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 12

ENTERPRISE IT SERVICES CLIENTS WON'T COMPROMISE ON

RESILIENCE FOR DATA CENTER EFFICIENCY

Sustainability is desirable; resilience is mandatory

Although sustainability was high on Capgemini's requirements for the Merlin data center, it wasn't

allowed to compromise data center resilience. Merlin is a certified tier 3 data center designed to

fulfill the security and availability requirements of "most" public sector and commercial clients. It

achieved tier 3 design certification from the Uptime Institute in March 2011. HP's Wynyard data

center offers higher levels of resilience with tier 4 certification: i.e. it’s fault-tolerant and designed

for 100% availability. Both tier 3 and tier 4 resilience require redundant infrastructure (N+2 in the

case of tier 4 rather than N+1 for tier 3), the duplication of power paths and, in the case of tier 4,

continuous cooling and multiple independent dual-powered systems. Such duplication of

infrastructure and redundancy in the data center impacts power usage and efficiency, owing to the

increased number of paths and switches.

Security at Merlin is also designed to a high level. Capgemini has taken into account compliance

with the UK Ministry of Defence and Police Authorities List X audit requirements. (These are the

UK's primary security requirements: List X status means that a contractor or subcontractor can

undertake work marked "confidential" or higher on the audited premises. List X status is typically a

requirement for UK government and Ministry of Defence contracts.) One of the advantages of the

modular computer halls is that dedicated modules can be customized to the client's requirements.

If a module needs to be blast-proof, it can be made that way. Instead of the standard Intrusion

Level 3 (IL3) security, customers can opt for IL4-rated security if required. (IL3 and IL4 are also UK

ratings.)

Achieving data center efficiency

Adherence to tier-3 data center resilience and security is generally considered a minimum

requirement for the type of enterprise and public sector clients that Capgemini, HP, and other IT

services vendors are trying to attract. For most of these customers, resilience is currently higher on

their list of priorities than either sustainability or power efficiency. Nevertheless, sustainability is

rising up the agenda for public sector clients that need to be seen to be green and for sectors such

as retail, where sustainability in the supply chain is increasingly important -- and IT is now part of

that supply chain. For the majority of enterprises, however, "green IT" is not yet a major focus for

investment. In Ovum's 2010 CIO Technology Trends survey, for example, less than 1% of the

4,914 respondents had green IT as the area of investment for their single biggest IT project in their

current budget year.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 13

Figure 3: Ovum CIO Technology Trends Survey

Source: Ovum

OVUM

Power efficiency and the rising costs associated with inefficiency and wasted power (wasted on

inefficient cooling, that is) are, however, top of the agenda for many enterprises that maintain their

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 14

own data centers and for the IT services suppliers, such as Capgemini, HP, and IBM, that host and

operate clients' IT in their data centers. Rising electricity costs coupled with the high cost of

building new data centers are driving more customers to consider outsourcing at least some of

their IT operations. The data center may not be the primary incentive to use managed services, but

increasingly it's the tipping point – few enterprises or public sector organizations consider building

data centers a core competency.

As we've already indicated, Capgemini like many of its peers has gone down the fresh-air cooling

route to achieve greater power efficiency in its new data center. The vendor claims better than

industry-leading PUE levels of less than 1.1. Fresh-air cooling isn't just for small to mid-sized data

centers. HP's Wynyard data center in the north-east of England is considerably larger than Merlin

(four data halls of just over 1,000m²/11,000ft², with capacity for four more similar halls to be built

out at a later date), but also uses fresh-air cooling. Rather than the integral air-optimizers and

building management control systems of Merlin's small self-contained modules, however, HP has

implemented its fresh-air cooling systems on a grand scale. The Wynyard data center has a wall of

massive 2.1m (7ft) fans and a 3.5m (12ft) high cold-air plenum under the large data center halls -40,300m³ (130,800ft³) of unused space (the cold air plenum) under the four mezzanine-level data

halls.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 15

ENTERPRISES MUST BE PREPARED TO COMPROMISE ON

FLEXIBILITY

Sizing up modular

While both Capgemini and HP claim industry-leading PUE levels for their recently opened UK data

centers, these are very different beasts, designed with different criteria in mind. HP inherited the

Wynyard project, when it acquired EDS and the project was already well under way, primarily

intended for a large UK government client. The result is that HP's approach to fitting out its nextgeneration data center was along more traditional data center lines than Capgemini's. HP

Wynyard's data center is constructed inside a warehouse shell, but not with pre-fabricated

modules.

Merlin, on the other hand, is completely modular: its modules are pre-fabricated, self-contained,

and shipped to site ready to be "plumbed in" and the IT equipment installed. There is a third way,

which sits between Merlin and Wynyard. Colt, Digital Realty Trust (DRT), and HP itself have all

developed pre-fabricated data center modules for on-site assembly. Again, the modules fit

together to form self-contained data halls, but as they're assembled on-site rather than transported

in finished form to the site on the back of a truck, they can be larger:

Colt's Modular Data Center modules have 500 sq m (5,500 sq ft) of floorspace

HP's "Butterfly" modules have approximately 560 sq m (6,000 sq ft)

DRT's POD 2.0 modules, have 740–1,115 sq m (8,000–12,000 sq ft) of technical

floorspace.

All three vendors' modules can be linked together to form larger data centers. Colt's Modular Data

Centers (essentially aisle-based modules) can be stacked and linked for up to 3,000 sq m (32,000

sq ft) of technical floor capacity, up to four HP Butterfly modules can be linked to provide up to

2,230 sq m (24,000sq ft) of capacity, and up to eight DRT PODs can be linked for up to 7,430 sq m

(80,000 sq ft) of technical floorspace.

The chief drawback with the pre-fabricated format employed by Capgemini for its Merlin data

center is that it is arguably less flexible than the competing pre-fabricated/on-site-assembly

designs of Colt, DRT, and HP. Merlin's data center modules can be customized, but they're limited

to 250 sq m in size and a maximum of 104 equipment racks. If a client needs 300 sq m of technical

floorspace, then they either have to take 50 sq m of floorspace in a shared module, or security

reasons might dictate that they have to specify a complete second module. Merlin's modules don't

link together in any way. Capgemini says, however, that few of its customers require more than

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 16

250 sq m and of those that do, none mind sharing a module. The self-contained aisles are never

shared. It can also provide smaller half-sized modules.

Capgemini's UK customers don’t have to locate their IT in its Merlin data center of course. It has

other UK and European data centers, including the nearby Bristol data center. The vendor has

clearly designed and built Merlin the way it has, because it meets the needs of its target customers

and prospects, which include major UK public sector clients. These are customers with a relatively

modest IT footprint that are willing to share or own modules. Customers with a need for more than

250 sq m contiguous space would need to look elsewhere. In Ovum’s opinion, while Merlin's 12module format would be an inefficient use of space for a single enterprise, it's very appropriate for

a data center provider, especially one that caters for mid-sized data center customers.

Ovum has questioned Merlin’s suitability for legacy systems and storage. Merlin's modules do not

have raised floors or underfloor cooling so it was felt they might not be suitable for some

mainframes and other standalone IT equipment. The aisles are designed for uniform 19-inch

industry-standard racks and Ovum suggests that customers looking to install large storage arrays

in non-standard over-sized cabinets such as those used by EMC consult with Capgemini over their

suitability for the modular design. Ovum believes that non-standard cabinets and system designs

could alter the airflow dynamics of the hot and cold aisles and impact the efficiency of the center.

However, Capgemini says it has resolved the problem and related issues with regard to HP, IBM,

and Sun equipment.

While Merlin has achieved tier-3 certification from the Uptime Institute and is one of only a handful

of data centers in Europe to have been certified so far, it is modular and so compromises have

been made compared with the state-of-the-art for more traditional designs. It can only run to N+1

redundancy rather than 2N for power and cooling in the modules, though the main backup

generators and flywheel UPS are 2N. Again, some of the on-site-assembly modules, such as

Colt's Modular Data Center and DRT's POD 2.0 support 2N power, backup and in DRT's case,

cooling.

As yet, Merlin only offers single-story support it hasn't added a second storey. That's an option that

would be open to Capgemini given the size of the original warehouse building in which the data

center is housed.

Does Merlin meet customer needs?

Why are the benefits, drawbacks, and compromises indicated above relevant to Capgemini's and

other vendors' managed services customers? To put it simply, Capgemini intends to deploy similar

data centers elsewhere in Europe, as do other vendors, and these modular data centers will

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 17

clearly be needed to fulfill the increasing shortfall of up-to-date, power efficient data center

capacity. While Capgemini will only deliver managed services from Merlin (it's not offering Merlin

as pure co-location space), Ovum believes that customers should nevertheless be clear about

what Merlin and its ilk are best suited for and the implications that hosting IT in power-efficient data

centers may have on customer costs. Low PUE ratings may be valuable bragging rights, but

customers will expect tangible benefits.

If Merlin's chief drawback is that it doesn't offer large enough amounts of contiguous technical floor

area for customers that want to install large server farms or consolidate existing data centers, it

nevertheless succeeds as a hosted location for its target managed services customers on a

number of levels, not least of which are the benefits and advantages to Capgemini itself:

Merlin is built to the tier-3 standards for resilience and availability that most enterprise

and public sector customers require.

It offers proven sustainability and has been acknowledged as such by bodies such as

LEED.

It has an industry-leading power usage efficiency (PUE) rating of <1.1, which means

that its not overly wasting electricity on ancillary systems, and operating costs should

consequently be very competitive.

It's modular -- Capgemini can expand the data center's capacity incrementally as it

adds new customers.

It has been quicker and less expensive to build than a traditional data center.

Capgemini is an IT services vendor. It earns its money from deploying and managing its

customers' IT efficiently. It doesn't offer pure co-location services – it's not an Equinix, Global

Switch, or Digital Realty Trust, which are in the business of providing data center facilities to lease

or rent. In that respect, Capgemini needs to build efficient data centers, to which it can add

capacity on an 'as-needed' basis as well as keep its data center operational costs low in order to

earn decent margins.

So is Merlin more about answering Capgemini's requirements than about answering customer

needs? From the point of view of Capgemini's customers, Merlin meets their requirements for tier3 resilience and security. Capacity can be delivered relatively quickly – it takes 22 weeks to build a

new module – although more traditional data center builds like HP's Wynyard have a certain

amount of spare capacity that's available almost from the signing of contracts. Even so, fitting out

a more traditional data center space, preparing for migration, and undertaking the migration will

typically take 2–3 months.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 18

Do customers want power usage efficiency or is that more a requirement for Capgemini?

Customers certainly want low costs and need to be protected from rising energy costs. IBM has

analyzed data center operating costs and calculated that energy costs can be anything from three

to five times the cost of the original construction costs, depending on the data center's efficiency,

during the typical 20-year lifecycle of a data center (Capgemini will depreciate Merlin over 15

years). Intel reckons that during a much shorter three-year lifecycle (Intel's preferred lifecycle for a

server), power will account for 23% of the total cost of ownership of a typical Internet data center.

However, most of Capgemini's outsourcing and managed services customers are on long, fixedterm, fixed price contracts. The outsourcing price has usually been fixed upfront: this is not like a

co-location contract where customers pay for data center space on a kilowatt per hour (kW/h)

basis or an in-house data center operation, where power costs are a very obvious operational cost.

So, apart from any corporate and social responsibility (CSR) commitments that the customer has

with regard to using sustainable suppliers and reducing the carbon footprint of its supply chain the

chief benefits of building efficient, next-generation data centers for traditional infrastructure

outsourcing and managed services, accrue to the service provider rather than the customer. There

is an environment and delivery model which could change this, however, and which could lead to a

more direct relationship between data center operating costs and customer charges: cloud

computing.

Cloud computing and the data center

It's not surprising that just about every provider of outsourced data center facilities mentions their

readiness for cloud computing. Much of consumer computing has moved or is moving to the cloud

– apps, social networking, media, storage, photos, music, shopping, and more – and enterprises

and public sector organizations increasingly are looking to outsource parts of their operations or

processes to the cloud or build private clouds for their internal customers and users. As a result,

demand for data centers that can support the type of high-density computing infrastructure that

cloud computing demands is inevitably increasing.

There is a huge and growing market among those providing the emerging cloud ecosystem: the

Internet content providers; Internet music, video, and entertainment providers; information content

collection and delivery networks; Internet search and navigation providers. But this is not typically

the market in which IT services vendors such as Capgemini, CSC, HP, or IBM have had much

success to date. Most of the "content cloud" ecosystem providers go to data center/Internet

exchange providers such as Equinix, Terremark, and Interxion, or managed hosting providers such

as Rackspace, AT&T, Verizon Business, or one of the many other global telecom and network

operators that are trying to get into the hosting space.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 19

So who among Capgemini's, CSC's, HP's, and IBM's target customer base are potential

candidates to have their private and customer-facing clouds hosted in the IT services vendors'

data centers? The most obvious candidates are their traditional enterprise and public sector

customers: government, healthcare, insurance, financial services, retail, and manufacturing.

The big long-term opportunity for the traditional SIs and outsourcers such as Capgemini, HP, and

IBM, however, is to transform enterprise and public sector legacy IT to a hybrid cloud-like

infrastructure. This is a full "cloud lifecycle" play, of which the data center forms just one element.

It's also a long-term play, in which IT services vendors lead with data center transformation

consulting engagements, from which they aim to pick up follow-on implementation or, ideally,

managed services and data center outsourcing engagements.

Insofar as customers want vendors to build, host, and manage off-premise private clouds for them,

then modular next-generation data centers like Merlin are a suitable option. Merlin can't support

the very high density of a "Googleplex" or a public cloud data center. It only supports up to 1000

watts/sq m in standard form with the option of 2000 watts/sq m. But that's good enough for 10kW

per rack and about the level of most current customer requirements, cloud or no cloud.

Most power capacity requirements seen by Ovum in Europe are in the 5–10kW per rack range,

with occasional requests for up to 16kW. A rack full of fully virtualized blade servers, operating at

full stretch, however, could require more than 30kW of power. At present, only the largest

enterprises, public cloud providers, and data center exchanges have a need to support such high

densities. But as more customers consolidate data centers and IT, virtualize more of their servers

and storage, and perhaps even deploy more blade servers, the requirement for higher densities

will increase.

Merlin will undoubtedly be used to host its customers' private clouds. It's suitable for racks of low to

medium density servers; one, rather than many blade server chassis in a rack. But this is not a

high-density "cloud data center" in the sense in which many customers tend to imagine it. In

Ovum's opinion, Merlin is ideally suited to the requirements of an enterprise or organization looking

to locate around 50 to 60 racks of equipment, the bulk of it industry-standard servers and storage,

with perhaps some larger Unix servers mixed in for core legacy applications. Larger organizations,

for whom Capgemini already outsources their IT infrastructure, might consider consolidating their

non-core industry-standard servers in Merlin. Its proximity to Bristol and the high-bandwidth linking

of the two sites mean that Merlin has the full disaster recovery capabilities required of a high-end

enterprise data center.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 20

Class-leading PUE, but does Merlin change the game?

So is Merlin a game-changer? There's no doubt that its PUE rating is industry-leading for the time

being and for the type of data center. The modular construction and self-contained modules have

enabled Capgemini to get the data center up and running in considerably less time and at less cost

than a traditional data center build. It can also add capacity incrementally and spread its costs. For

customers and vendors who still build their own data centers, it offers a useful example of how to

keep costs low – both capital costs and, perhaps more significantly for the long term, operating

costs. It's not appropriate for enterprises that need large amounts of contiguous floorspace or that

need hundreds of racks in one large hall. But it is appropriate for enterprises with more modest

requirements, that are happy to add halls incrementally or that may even want to keep computer

rooms separate for security and resilience reasons – public sector organizations that want a

shared services data center, for example.

Merlin's significance to Capgemini's traditional managed services customers, however, has less to

do with reducing costs – they don't directly pay for their electricity use – or the benefits of modular

construction, and more about their ability to obtain managed services hosted in a tier-3 data

center. Merlin also has benefits and value for organizations that place importance on sustainability

for CSR reasons or because they are committed to sustainability in their supply chain. As

Capgemini's customers move to on-demand and private cloud models and start to consume the

vendor's managed services on an on-demand basis, then Merlin's power efficiency could

conceivably contribute to keeping the vendor's pay-per-use pricing competitive.

In Ovum's opinion, however, Merlin's greater relevance for cloud and customers' moves to cloud

are that it will enable customers to locate their hosted IT alongside the vendor's own hosted cloud

infrastructure and to have this managed as one under the same roof. While few, if any, IT services

vendors intend to become suppliers of large-scale public clouds, most will offer virtual private

clouds and infrastructure-as-a-service from their data centers. The ability to be able to transition

customers over to infrastructure-as-a-service, to provide on-demand virtual private clouds for

temporary capacity requirements, and to manage these and the customer's private clouds in the

same location with the same SLAs is something that Merlin is well placed to support.

RECOMMENDATIONS

Recommendations for enterprises

Enterprises that are running out of space, faced with the capital expense of building a new data

center, or finding operational costs difficult to bear because of rising power costs, may consider the

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 21

availability of next-generation data center capacity the tipping point that convinces them to move to

a managed services engagement.

Building a new data center, predicting future capacity requirements, and calculating the return on

investment are becoming increasingly difficult as enterprises choose to outsource more and move

workloads and processes to the cloud. Building data centers is not a core competence for most

enterprises, but it is for most IT services vendors and outsourcers. That expertise is one more

reason to outsource.

Carbon taxes and legislation offer a further incentive to outsource IT to service providers' more

efficient data centers. In the UK, organizations using more than 6,000mW hours of electricity per

year must sign up to the Carbon Reduction Commitment (CRC) Energy Efficiency scheme, which

requires organizations to report their emissions and commit to reducing them. As data centers are

often responsible for an increasing proportion of an organization's electricity consumption, the

incentive to "outsource the carbon" is another factor encouraging organizations to consider hosted

managed services, especially for subsidiary, backup, or disaster recovery sites.

Capgemini is understandably proud of its achievements with Merlin. It ticks all of the boxes in

terms of power efficiency, time to build, cost, and resilience. However, customers need to weigh up

the importance of their need to demonstrate sustainability credentials against tangible cost

savings. Capgemini is committed to sustainability, but as a managed services supplier, it also

needs to keep operating costs low to maximize its margins. Customers should only concentrate on

PUE levels and the outsourcer's data center costs insofar as they have a direct impact on their

outsourcing costs.

Capgemini is typical of IT services vendors in that it does not usually offer co-location-only

facilities, though Ovum believes that, like other similar vendors, if the customer is significant

enough and offers significant potential to upsell services, then it may make exceptions.

Ovum believes that Merlin's modular design is best suited to organizations that have modest

density and capacity requirements (fewer than 100 racks), perhaps for a secondary, backup, or

disaster recovery site. While Merlin is not currently optimized to support very high-density racks,

the ability to house customer equipment alongside or in the same location as the host's servers

and storage and managed consistently "as one" can lead to a smoother transition to a hybrid or

hosted private cloud environment.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 22

Recommendations for vendors

Capgemini's Merlin data center throws down the gauntlet for other data centers on power

efficiency and sustainability, while achieving respectable levels of resilience and security. The

latter have not been forfeited in the pursuit of efficiency. Where there are compromises to be made

with the type of modularity employed by Merlin, they relate to the limited contiguous floorspace and

flexibility of the modules. Vendors that need to support larger data halls (>250 sq m) should

consider pre-fabricated units that can be assembled on-site into larger linked data halls.

Pre-fabricated modular designs offer commendable savings in cost and time, two crucial factors for

customers who are fast running out of data center capacity. More importantly for vendors, the use

of standard components, off-site construction or on-site assembly, and reduced time-to-market

provide useful cost savings and a quicker return on investment. Modular designs, pre-fabricated

components, and modular construction methods mean that vendors have a number of options for

avoiding high upfront capital expenditure and adding capacity on an incremental basis in response

to demand.

Ovum believes Merlin is best suited to the kind of virtualized x86 server and storage farms that

typically form the infrastructure and underpinnings for cloud computing. Most customers probably

don't call their virtualized x86 server farms "private clouds", but many vendors like to use the term

"cloud" fairly loosely. Whatever the case, Merlin's modules have enough capacity to support

medium density server racks. Merlin won't support high-density racks and Ovum believes its

modules are not ideally suited to legacy IT systems. Some other modular designs have similar

drawbacks and highlight the fact that IT services vendors must have a range of different types of

data center capacity suitable for different locations and for differing customer requirements. In

some of their larger data center sites, this may include a variety of different types of construction

on the same site to maximize speed to market, while enabling incremental builds to avoid upfront

investment in over-capacity.

Location is a key consideration for all data center projects, especially as locations in traditional city

locations, such as the City of London, Paris, Frankfurt, Amsterdam and other popular data center

locations become more expensive, run out of capacity, and are unable to support higher power

capacity levels. Both Capgemini and HP have located their latest next-generation European data

centers at brownfield sites and Ovum believes this is a trend that will increase in popularity.

Merlin's location is less than 70km from Capgemini's state-of-the-art traditional data center in

Bristol. By locating Merlin in an existing industrial park, Capgemini was able to capitalize on the

following:

good access for transportation

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 23

the availability of adequate power capacity, without need to upgrade the local supply

reasonable proximity to backbone fiber networks and connectivity

adequate proximity to a sister site to allow synchronous replication of data

a suitable climate for fresh-air cooling

a relatively low degree of on-site construction and site preparation

well away from flood-risk areas.

It was for similar reasons that HP located its new start-of-the-art UK data center at Wynyard and

Colt chose a similar type of location for its latest UK data center.

Capgemini says it looked at 260 locations in the UK. Few of them were existing data center

locations, but we'd expect many more of them to become data center locations in the future. Ovum

expects demand for out-of-town brownfield sites at former factories, industrial parks, university

campuses, and science parks to more than double in the next three to five years, in countries such

as the UK, France, Germany, the Netherlands, the northeastern seaboard of America, and

Australia.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 24

APPENDIX

Further reading

Data Center Efficiency: the role of management in environmental sustainability and the cloud,

OI00127-017

2011 Trends to Watch: Data Center Technologies, OI00001-001

Methodology

Primary research/data center visits: ongoing briefings with IT services and data center co-location

providers.

Secondary research: industry publications, companies’ annual reports and press releases, and

data from public databases.

Ovum CIO Technology Trends surveys: structured telephone-based interviews with IT decision

makers at end-user organizations across North America, Western Europe, and Asia-Pacific

Author

Ian Brown, Senior Analyst, IT Services

ian.brown@ovum.com

Ovum Consulting

We hope that the analysis in this brief will help you make informed and imaginative business

decisions. If you have further requirements, Ovum’s consulting team may be able to help you. For

more information about Ovum’s consulting capabilities, please contact us directly at

consulting@ovum.com.

Disclaimer

All Rights Reserved.

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any

form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior

permission of the publisher, Ovum (a subsidiary company of Datamonitor plc).

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 25

The facts of this report are believed to be correct at the time of publication but cannot be

guaranteed. Please note that the findings, conclusions and recommendations that Ovum delivers

will be based on information gathered in good faith from both primary and secondary sources,

whose accuracy we are not always in a position to guarantee. As such Ovum can accept no

liability whatever for actions taken based on any information that may subsequently prove to be

incorrect.

Next-Generation Data Centers (OI00144-023)

© Ovum (Published 04/2011)

This report is a licensed product and is not to be photocopied

Page 26