Downloadmela

advertisement

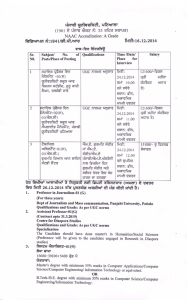

Term-End Examination

Bachelor'sPreparatory Programme (B.P.P.)

(For Non 10+2)

PCO-01 : Preparatory

Course in Commerce

December,2006

Maximum Marks : 50

Tirne : L20 Minutes

v{id qfrenr

ffi

(fr.fi.fi.)

ffi

(k{r 10+zl

ff.S.4il-01:ErftFTfinrqfu W

'i'.

2006

k,

tu

{r{m: lso ftffi

P'CO.01

( 1 )

w s : 50

la

P.T.O.

.

.

l

(

i

l

General. Instructions

.:

1.

'

All questions are compulsory, each of which carries one mark.

'

,Preparatory Course in Commerce (PCO-01)

Questions.l-50

S.sh question has four alternatives one of which is correct. Write the Sl. No. of your correct

2.

'

alternatives/answers below the corresponding question number in the answer sheet and then

r .rhark the rectangle for the same number in that column. If you frnd that none of the given

alternativesiscorrectthenqrite0andmarkincolumn.0.

3. i.1,'Donot waste ti-" i" reading the whole question paper. Go on solving questions one by one.

, ' You'may come back to the left out qugstions, if you have tirire at the end. ,

rtrr,qfrdp;

.

qril TsI 3ffiqg

.:

F

f\

1,

O

r

\

.

E I Rtr YFTt fgq qd Bis Frril t I

Etlturwtt HrtFrqqr{Tmqtqt'qr.3i[.-01)

t\

TsT 1-50

xffi lnra * qlq qR fd6.€ t' fu1q t qd wT t I strr gksT q fti$1gR wr

wtr/Fseit sr ili6F':nrq€qr * fi+ ffit s*{ ftF{sS iri-{ * sn{rdqr sS 6frq t

z.

Fr6Et'rqr qrn errvw{ f* *i S'trirq q-fitrfi t n} o ffi silt +isqrt fd

m'n( r

;

.

'

e

\

B. ,qRysT-wrfri qg+if qrrqqqiqrd dRq r gq * ErE'qswq d re a',rtqrger

, :'.,fr,qn fr qqq'w, fr q+ gqs{i * gcnrtgr qr v+nrt r

PCiO-01

( 3 )

P.T.O.

l.

'

Commerce is mainly corr"eroed with the distribution of goods.

Statemcnp B :

Commeree is a business activity in the form of,trade ind aidg to trade.

Read the above statements and dnswer which of the following is correct i

'

I (f) Shtement A is correctr'and.

statement B is wrgng; ,

:

'2.

Q)

Stalernent'B'is correct arid' statement A is #ons

(3)

Both statements are wrong

(4)

Both statements are right

.

l

'

Finadcial position of the business means

. (1) Net effect of the business operations

(2) Systematic records of the business transactions

'

tgl

(4)

3.

What the business owes to others and whatit;ciwns at a given point of time

All of the above

. ,,

Which of the following branches of accounting is concerned witJl the measurement and

control of costs ?

r

4.

Statement A:

(1)

Financial Accounting

(2)

Cost Accounting

(3)

Management Accounting

(4)

Accountgncy

A bookseller buys 1O copies of a book froq a publisher prioed at Rs. Sd. fn" publisher

allows a discount of LOVo

and chargesRs. 450 net. (List price RS. 500 minus discountof

pays only the net price. The recordingof this traneactionwill be"made

for

(1)

the net amount only

the list price and discount both

:

(3)', the nbt amount and s4e'vwr!

dispount both

wu

(4) the u*""ut,

""rif's

Read the question no. 4 given abovq. In this question th. piUUrfr* is offeriag the bookseller

at a discount of Rs. 50, Which of the followihg discounts is the publisher atlowing to ttre

buyer ?

' ' ,

(1) Cash'discount

(Z) Trade discount

'

(3) Rebate

(4) B i l l d i s c o u n t

.:

(2)

J

fD.

I

6-

Mr. vinod started business with Rs. b0,000 cash. He purchased go€d$ on credit frsm Mohan

for Rb. 5,000, His Total As$ets will be

(1) Rs. 50,000'

(3) Rs. 55,000

i'

(Z) Rs. 45,000

(4)

Rs. 5,000

i

PCO-o1

(4)

1.

fisnefij qrFrrqsr x5q 6d Eqeit t5,rr{fiul t't

s qdsfliq t mrs,r q!{q qTqRdqr qqrt it wrm

6wGr; elFrrsqq-sG 6

qFi*,f,rfr,

t i r

-sqrfqq'rqE6sit* qf-dq

FqIqdr{qffi frqffi

fr n d$r s& t I

(r.) 6fi q crfi t nqr 6T{ s n-oa{

(2) 6fi q v€r t dsTrsffi m rrea i

(s) qr;frffrT trcc t

(4) rtil om vfr t

z.

qirqFTfr ffiq Rqfr 61 3T{t

(1) *fiTr{T qRqrffi q,r $q qRun-q

i

(z) eqq$fuse{-Hi or trFr+afisT-d

qrtr qR{qRdiHqr

i;; frfi firfi Hrrqqr sr{rq sl aa1dqrsq* qrqfrtnr *r+t,

t{dpll fr Rqfr

(4) sq{fr qS

s.

ffifu'f,

q't

qt FrqtPI

irsrqrur 61 6\rei yffqt 6r qtrrq drlrd qE{ s{iT dqT ss

tgqrt ?

(1) trf'q tgtqtq

(2) EIFkTercllt5{uT

(s) sr*[ terfr{q

(4) ffifu

50T't '

t w gwn"61roqfrrdgtf*.t]ry.{s+

4. qs gw{ trhfrr}r-srqrfr

IrfI{FFgffs {s qr nvoS t" t dsnqd gffi 450u. ago-ryr t r lq.fr gfr

b00€. qerbol. *, r t* i,q€ fffd Xs tar t r gs +{-tq * ftTqnsid ffiqr

qrqlr

.

d.

(1) *+q fr+e {rRrei

(2) qS qrt dqrqr rtif *}

(s) fffn rrRrcErqe *ii si

; i'*q.*

sqt fq rI( xqq{. a d qGq r qe :rsTit rqrvm5.ffi fqtdr d sot' * W tat

t l F w f n t u d q r f r t m r v r * * n T d r y q c i azr t

(r) ;rm<qa

6.

'

e) qrqrRqW

(4) f+e ga

{. 6,rtns sqn sfiqr r

€. +FEt q*nq Es fo+rrEqi ieq t b,000

fr*q t b0,000

€Ffr

@ gs qRiqR€tr

45,000s.

(1) 50,000d.

Q)

(3) 55,ooo

{'.

(4) 5,ooo

€'

Pcopl

(5)

'P.T.O

7.

8'

Aman promised to purchase a building from his friend for Rs. 1,00,000. Its market value is

Rs. 1,50,000. With what amount will he record this transaction in his books ?

'l

(1) Rs. 1,00,000

(2)

Rs. 1,50,000

(3)

Rs. 50,000

g)

He will not record this transaction

As per which concept are the business enterprise and its owner treated a,s two separate

entities ?

(1)

9.

(2)

Business entity concept

Dual aspect concept

(3)

Flistorical record concept

Which of the following is a Personal Account ?

(1) Kamal's Account

(2)

10,

(3)

Loan from Aman Account

Indian Bank Account

(4)

All of the above

Salary Outstanding Account is a

( lt Real Account

(2)

11.

:

Personal Account

(3)

Real and Nominal Account

(4)

Nominal Account

Real Accounts are the accounts which relate to

(1) Assets only

(2)

Expensesonly

(3) Assets and Losses

(4)

12,

Incomes

Narration must be written

(1)

for every transaction entered in the Journal

(2)

at the time of preparing Trial Balance

(3)

while classifying the transaction

(4)

Both (2) and (B)

PCO-01

(6)

F. i5r qflq qffi

7. , sTrR+ 3[qi fr? t 1,00,000

EFfHr(t rd,ql I {q rFsH Sr qgR qrq

t. t r errt errs gwd if 6 i-{-h d frT {rftr+ nstr 6t-{r?

1,50,000

(1) 1,00,000{'.

(2) 1,5o,ooo

{.

(3) 5o,ooo

t'.

(4) T6 Eq Aq-ta s1 RsTdT& EfoIT

8.' nrs riqffi{r * ergsn-trqflfrs ssrq* eq+ Tqrfrt erirr qnr qrf,It ?

(1) aqr+qrFffiqfrI {q.tril

(z) fdqqfrq{trffir

(B) tfdtrfusnetd+1*qmt

(4) qrra qi {+€{r

e.

fr t 61qqTurcr qffiin erm t ?

FTtrTldfud

(1) 6,rltT 6,t €RII

(z) offi{ t ETTttrdt

(s) qrtrq tq rsmr

(4)

qs

"r$ffi

10. qsrqraf,q €rfrr t

(1) Ercf,rS€rtrr

(2) dTfuqf, €lf,T

sTrq-qq EIrdT

(3) ERdr.fi, HedT

(4) 3{rq-Eqqqrdr

11. ERf,ffi 1g|a{rsqtr{frt

(1) tild qfr$nTfr4t

t

(z) hnm 6ry4ft

(B) ffi

Trqn

ETFriit

.

(4) 3Tr{T

t

L2. anG4rsrdrq ftfid qrfr qGq

(1) qdq tr-tq t m ffi Grdntf Ed frqr qrff t

(2) ffirre flqR qrt srq

(s) Ar-h irt Effflq q,'r} rrrq

(4) (zi)e*{ (s)+ii fr

PCO-O1

( 7)

P.T.O.

13.

Journalising is the process of recording the business transactions, in'the ,

(1) Book of prime entry

:

(2) Balance Sheet

(3)

Petty Cash Book

U)

All of the above

I

14.

15.

16.

17.

Amount realised for the goods sold or services rendered is called

(1)

Revenue

(D

Profit

(3)

Gain

(4\

(4)

Eorritv

Equity

Posting will be done in the

(1) Ledger

(2)

Trial Balance

(3)

Journal

(4)

AII of the above

which of the following accounts normally show a debit balance ?

(1) Assets accounts

Q)

(3)

Debtors'accounts

(4)

All of the above

Trial Balance is prepared

(1)

18.

19.

!

Expenses accounts

(2)

before preparation of final accounts

after preparation of final accounts

(3)

before posting in the ledger

(4)

AII of the above

\

A system of ad.vancing a fixed amount to the petty cashier periodically is called

(1)

Single entry system

(2)

Double entry system

(3)

Imprest system

(4)

All of the above

A copy of the customet's account as maintained by the bank is called

(1)

Pass Book

(D

Cheque Book

(3)

Cash Book

(4)

Sales tsook

PCO-O1

(8)

qnfigi-sqli qi'qFrqr

rs. nq{rrqrt anqsrfs i{-ei

(1) p xFtrq1{fr fr

. (z) (er{-q*(tdfsYta)t

I

, (B) g-flr t*,g qd q

1aywfrr eS

a

\\

l,4. ti 'rq qrf, qr { T$ frqpif + tdq qrq {rf{r qrmrfi t

'

(1) sP[ r

(3) qF{rdh

a

@) ikd

rtr...Et-rttfr

si qfi'fr

'

'

(1) frd{q

(z) rsqa C

'

(s) qdfi t

(4) .r{tn qq1

.

t

\

:

,16. 'FTEafdfur

fr + dS urt wr;rm gfdc*q qvrttt I

,

(1) qnrtg{frETt

,

(z) ffii + rgri

(s) qq ert

(4) sqtd qlr1

f

.

--i

I

'

\

17. (€Te fi{m qror €

ru eifrHsri fuR +.ri t q-dd

(z) 3iFirq€rd +qn sii * qK

: (a) s€tr qS

,

\ ' a

a

sffid +A +Rrqrfr sryq-q{q.rt qd f{fdd {rRrM

i

18. tS FF, ffi

qrfr i, q,edr,ir

t

^

\

A

\

(1) {+-d{Iaqr f+r

\

'

(B) {ds

fqFT

a

(4) sq$ffi qS

rQ. i* aru tg qq qr6fr s qrd qi, 6T.fr.s-ffifr, i

(1) qrq Ss

Q) i6 g{

'

(B) trg m

.

PCO-01

:

(4) Erq TS

* sq it qT

20.

For nominal accounts the rule of debit and credit iB

'' -

12) Debit all cxpenses and losses, Credit all gains and incomes

(3) Debit a! gafns and,incornes, Credit all expenses,and losses '

',. ' (4)

21.

22.

Debit all incornes and gains, Credit what goes out

,

: ,

Bank overdr aft means

;

i

(1)

amount withdrawn from the bank in excessof amourlt of balance"in the Banh Account

(2)

credit balance in the Bank Account

(3)

when there is no balance in the account in the bank

(4)

All of the above

When'a cheque is returned dishonoured,it is recorded on the

(1)

debit side of Cash Book in the cash column

(2)creditside'of.CashBookinthebankcolum

(31 debit side of Cash Book in the bank column

(4)

credit side of Cash Book in the cash column

1F'

23.

A cheque is received.on 1s1;February and is not deposited into the'bank 0n the same day.

ItwiI1beenteredinthethreecolumnCashBook

(1)

in the bank column on the debit side

(2)

in the bank column on the credit side

(3)inthecashco|umnonthedebitside

'

(4) in the cash column on the credit side

I

24.

A cheque payable at the counter of the bank without identification is called

(1)

Bearer cheque

,(3).: Order cheque

:

5rtr

-.raa'

(2)

Crpsqed cheque

(4)

Specific cheque

.

.

'

'

..

' (

. t

i

l

,

.

30,.2005,, the Cash Book of Rakesh shswed a.bank balance-of Rs. 28'000..4

O'n,Novemper 'Cash

deposited

Book with Pass Book revealed lhat a cheque of Rs. ZO;OOO

of

comparison

bank

as perr

fie

but:not collec,tedby November 30, and interest on iiiveetment cslleatedlbXn

standing iu-structions appearing in the Pass Book only of Rs. 400O' Fek9$,h;prepar6d Bank

Reconciliation Statement on November 30, and ascertained Pass Book balance is :

(1) Rs. 6,000

PCo-01

:

(2)

Rs. 8,000

(4)

Rs. 42,A0A

(10)

20. srm-q.Tsrd t Cfdc-if,sc+ firq Fffiqt

(1) q$ qq *t afpf efdcq,t aqrqlt qra * iFe q* :

q,t

(2) qs qq .ft EFd gm. u* dqrgilq 3ft €Ttild *trc

i;; *fi .* s+r€Fii* irdc qt nqrqs qq "L SS |Rz q;'t

1t

6t efu-s+ dqrs qrdt'qffft ss *rsc

(4) e$ qrq sk ETFil

zr,' *s sil{qr€ m q{ t

(1) +s €Tet qqr tq {rRrg 31ftr+op1fa*rc+r

(z) ts qre qr if,sE tq

'

i;; wtofr€refrgetqat)

(4) s€ffi qIfr

: ', :

zz. qq qd aq srffi * qr1rrdtz1ffir qrff t, Tqq6nsTdffiqrWr t

' (1) tdg rfr * itdc qqTt t6g @ lt

* de qfoqt

(z) nw {fr * *Fa qqT

(B) tw frr + nr{c qer* ** qrsqq

* af,scwr * i.r.g 6Tnqt

i;; +*

"A

qqr {fi ffi4 :116| T€ fra eil€q

zs. q.s** r s{Efi 6} rn6 gq1€nhs+ sS ffi +d d

q|d tc'g {S t nsfd ffiqr qrq'n

(z) *fse qq + +s qfdq t

(3) sTdc l{tt i5 {f€

qiqiq q

(4) if,se qeT* tw

eilqq it

snfl 6, qWrcr e

24. rc t+ fr ds * ors;n qt frqr RriTw * 5a1q1

(1) tTR-dis

qS

(3) 31TE{T

(z) tnin +d

(4) fqf{Rs+{

d. 6l +s iq i ' 1W d

L6, soqEtER,zoosd {r*{r m *'+g cA * eiyn 28,000

rm'

ifi'r qffi gs t FrdH ott qt qRTwrff t fr zo,o00{. in't lrd +d EttlTiF{qt

.1s! 'rfi g$ q *urfr FRTfqqR

ts fftr 1Ft frqTT

.T!E 30iFrEKds 3-qfr

'tf

t, t r {I*vr } 3sq1qt d

A$il qt ailq + *{m o* gs tFos:g.n t, z,ooo

+6 qrilqn rffirur sTrqTfffT qrq gs *

lr+,qr -ir t

(1) 6,000€.

Q) 8,ooo€.

(g) lo,oooT.

€.

(4) 42,000

PCO-o1

( 1 1)

P.T.O.

26.

'

27

28.

sales Return Journal is also called

(1)

Returns Outwards Journal

(2)

Returns Inwards Journal

(3)

Day Book

(4)

Invoice Book

Entries passed in the Journal Proper to record certain

- unrecorded items like closing stock,

land depreciation on

:

fixed assets uh. *u called .

(1)

Closing entries

e)

Opening entries

(3)

Rectification entries

(4)

Adjustment entries

which of the following entries will be recorded in Journal proper ?

(1) Credit purchases of frxed assets

(2)

(3)

(4)

29.

3l'

.

which of the following errors would affect the Trial Balance ?

(1) sales of Rs. 750 to Radha was completely omitted

from the books

(2) Wages paid for installation of machinery were

debited to Wages Account

(3)CreditpurchaseoffixedassetsrecordedinPurchaseJournal

(4)

30'

Withdrawal of goods from the business by the owner for personal use

Writing off bad debts

. i

:

All of the above

salary paid to Mohit recorded in cash Book as payment to him

An expenditure incurred on repairs of machinery debited to Machinery

Aecount would affect

(1) Cash Account only

(D

Machinery Account only

(3)

Machinery Account and Machinery Repair Account

(4)

Machinery Repair Account and Cash Account

Whieh of the fgll.olinc concepts implies that while measuring ineome

of a business

----:'

for an

"

accounting period the non-material facts can be ignored ?

(f) Matching concept

e) Consistency concept

(3) Conservatis*.o.r""pt

(4)

PCO-o1

Materialityconcept

(12) -

zB, f{fiq qrrs qfe w fr wernl t

(1) Ffrrd qlq-qTwitT

(z) gfl{6 qrq$ qff,

(s) tr{s ftr

(4) fus {fr

aq qqET

27. gi6 qt t$ *fi t ffi $E asr Ffsii fr ;rfr3 Ilfr st $q.d* qrfr

dqffif qr dt€re qirRr fr{ rfqEqlEnrrt qdf61rArug-s qt€ fr 61 t r€

q,6et

(B) T€-grilRqEfuf

,

I

(4) qqdqr ffiq

;.

d 5w cdq fr ftf'd f*,,qrYrEn ?

zE, trefrfira t t f*,{

(1) enqmqFtsqf#if * =* #

(2) qrw + Fnqi ERrqrqR + qfu'rd sqqt'r+ rdq fuq 'rqr qre

(s) sr{nq Etif * €fi q gtffrT

(4) sr$-d qS

2s. trcrFoFrtfr t 6t+S .r{E ftilre +1 xqrf{d 6t'fr ?

(1) rnm* ?80{'. qr fwq wr FimqSRlit q f{r$.d rfr qfltqFrqr

(2) qqr{ qi} q.'n} + lirq { rrrt q-qfr 61 qwq$qre t €ra s{ RqFHr

(a) rqrfi' {qfrdt d' sqn qfi'q en 5q vf,o t nsfd f*,qrrr'n

(4) Ii]rfi qit rflr rrqriaq {sg qEi fr ritrd en 5'nra * sq q fiftTdfqqr rrqr

it etrc frqr rrql I qE Tqltrd 6trn

qqffi u.Ie

rmr qt

ur t+e

frn rrq

mr arq

arr d

* qsffi

urt fr

go. qtm d rrqd

(1) *+q tw ertt

(z) *+o qqffi srdr

(s) q{fiFrtl EIrff defl q{ffi qtcffi €kIT

(4) q{ffi q{trrf, EIKTilefi tW qrcr

'

sr. Fmrnnrd t + frq {6tr{r sl sTet€ 1-6qqR fi El-€ilsfqftl 6T Ei_r'{'{-iGffi'ffi

E,u{ffiqA A ?

(1) Fffirqfr {s,,w{r

12y (frstliTTd, t+,wqr

tgt"sqEKqtRfrIfrtqwqT

(4) wtq fr

Pco-01

( 13 )

F.T.O.

32.

33.

The accountingsystem wrluchconsidersincorneon cegh

fasis anfl expensoson,actrual basis

is called

(1) Hybrid system

(2) Cash basis of accounting

(3)

Mereantile system of accounting

(4)

Single entry system

Which of the following concppts isralso called .prpflgnce concepf ?,

(1) Conservatism concept:i., , , t

(D Consistencyconcept , ,

!

(3)Matchingconcept'..i...(4).Full.disclosureconcept

g4.

If any capital expendituie id *rorrgfy classifibd:as idvenue'expenditure, it would result in

(3)

No change in profits

,,

(4)

Understatement of losses

85.WhichofthefollowingisacapitaIexpenditure?l'l:;l-'..i

(1)

(2)

Rs. 4,000 paid as brokerage in connection,yith pqchape of |and

Rs. 1,00,000 spent on construction of railway siding

(3)

A second-harid machine was bought for,R$i :ZO,bOO

ana ns. 5,000 were spent on its

o v e r h a u l i n g , ) " i

(4)

-

36.

. .

All of the above

a

i

Stock in hand January 1, 2005

8,s.

Raw materials

L0,000

Work in progress

S,OOO

l

Stock on December 31, 2005

Raw materials

5,000

Work in.progress

15,000

Purchase of raw materials

50,000

Carriage in

Direct wages

8,000

Motiye piwer

6,000

Depreciation on machinery

6,000

From the above particulars find out'the cost ofgoods produced during the year ended

December 31, 2005.

The cost of goods produced will be

(1)

Rs. 80,000

(Z) Rs. 8b,000

(3)

Rs. ?0,000

(4)

PCoe01

Rs. 95,000

(14)

(1) lie't frfBT

(z) €giq.r EFI{I-*:9 sITtrR

(B)'frsffi +1qrqrRsftfrr

(4) {dtt, qm fqF{

gs : frqffid fr + tr-srimeqrd''qfE{rfit

s4.

qRpTrq

fr,rn

q'f-it

if 6q1

(1)

( B )f f i q q t $ q n g d q €

q q 6tilSf ar

gE.

--l-l

: Q) qnfrfrqffi

(4)

ti^lfirrn qzT i

&vll-l\l

s.fr

?!

{. imffi .' tT{

sffi + fdq 4,ooo

Ttr

'*-a

.

e

l

qrqfgrrffiur frTi q 1,00,000

d. s't q{T gsTr

qs 5{rqTqqfiT 20,000

Q. fr g{rEr Heilb,000{. sqqfi q{sqil I|-t qq Tfi.q r{q

f.

a\

gq€q qql

r qffiS, zoob

s6.

.F!E[T qlTT

. , .

i

w

10,000

5,000

qff,

FTqiurnfrq

31R{rR, 2005

s-Eqf qff,

qff,

FI${IUITTIFT

qTf, TTTSI

5,000

15,000

W

50,000

5,000

8,000

6,000

6,000

ryN,

i Frrem {|fr (q}riiq

TIYffi ' T {qq6rq

s.q{ Rq {9 tr{{q i ,el Rgqt, zoos* q'IIqTdi qra q{ t silrRfi fle s'?fitTfr

Frm rq I

+ srqrftnw sT ErF EIrfr

(2)

85,000€.

(4)

95,000{.

( 1 5)

P.T:O.

S?.' Readthe questiorrno. 36. From:its'particulars find out the .ost of raw materials consumed.

It will be

(1) Rs, 55,000

(2) Rs.,60,000

$

(3) Rs. 65,000

38.

89;

,

'

lO.

(4) Rs. 50,000

Manufacturing Account is prepared to find out

(1)

Cost of $ales ,

(.2) Direct Expenses

(3)

Gross Profrt

(4)

Cost'of Production

Salanes and wages are shown on the

(1)

debit side of Trading Account

(2)

credit side of Trading Account

(g)

debit side pf Profit .lia mr,

(4)

credit side of Profit and Loss Account

:

' '

,,

.t .qorrt

'

,

,,

l

,

WUich of thg following items are'chargcd to Profit and Loss Account ?

(1) Carriage out ,

(?)

Samples

(3)

Packing

';'

:i;;*"1'*-i';,

41. Wages paid to workers*engug"d i1r the construction of buildings should be

''

,,t.

, (1) debited to l}ading Acgount

,:

'

(2) debited to Profit and Loss eccount

'

(3) added tq the costiof asset co;lcerned

- (4) added to the cost of good" p-ao".a

{2.

All the indirect expensep are shown in

(1) Trading Account

(2)

Profrt and Loss Account

(3)

Manufacturing Account

:

'

48.

f

'

: -.

Any amount realised from sale of scrap is treated as income and hence shoutrdbe

(1) added in the capital

(2)

shown in Profrt and Loss Account

(3)

adjusted in the cost af goods produced

(4)

adjusted in the cost of sales

PCO,01

({s)

$il{ s{s+Flqtur+ cq+rr,frq trq qS' q-s,+1drrraf{d6dq I Td&ft

w.;. {W {. 36qF-dq

'

.

,

(.1) 55,000F,

(3) 65,000d'-

'

'

(2), 60,0008.

(4) 50,000F.

" '

:' '

l '

,

. ,

' ':

' r ' '

I

s8. fqfrqiurEndrFil flRTsFT + idq strqT ETktri Z

(1) trtr4ary

(2) TFRI 6qg

(3) TF5',eT

ETq

\

' 3e. irq

.

' c)

(z)

(B)

.'.

Evtfqrqrdl t

gfdc qq{fr

*tre qq it

t iffe w fr

aqr

rq{tt: d

.

E{rqR€fr *

anqn sre t

gtd

HlrT-trFT

.

' :

" ral apr-arhrgril+ *tra qq fr

)

{ t fr-{ rrfr +} enr-erF{qft fi fqqrqrqrdri i

a0. ffifu6

(1) f{rtd EIrFI qq

\

(?) rT4

'

(3) rlliFrr

(+) vq{ffi qrt

\a..

'

41. ?rq{F trt fr Ht qq(fr q} q1q{ -r-{{frfi}

(1) qHR rrm fr gfdcfr'qrqt;tTqrfu

(2) qI.ETtrsr* fr gFe FFqrW qrfdq

T ssr 6{ t{r

{|q Fsi HrIkTq qrTTtFq EFTqTlEq

(4) rflrffi

Er{TRilq

4?'. qqr 3{5rFTqT

tilri t

qw sre iT

Q) eIq-EIh'srAt

(B) EFffiftry

srft fr

(4) *rfm qql ,

A

F

_t.

.\

\.

:

43.

€ qrfr t ffitrq t Tqil !*.q } s{Lqqrqr qrnTt, qqp.*1q

(1) ffi q qqrffiqTqnr gT_.frq

(z) Hrq-ortrsrd if Rsrqr qrqrqTFq

ir\

\

(s) 3ffirffi qrfr qfTetrrrTq g{FFTqqr?iq{ fqrqr qF{Tqrfdq

Ffir fr

Hqrztmqfuqr qi4T qTFq

PCO.0'1

( 1 7)

P.T.O.

jll4."''A statebeiit:showing. asbets'and;liatilitids

of "thb:buCiness::asiattlie,end of an accounting

year is called

, . r :

1

: .

. . ,

,

,

:

.

. ( 1 ) T r i a l B a l a n c e i . ( 9 B a l a n c e S h e e t '

(3) Ledger

'

(4).Jo;alProper

rr'

.t

,

'

' i

.

'

l

45.'r':Oapital bn January.,l.ri2005wab Rs.'SO,000On Oclbber1, 20OEproBrietorintroduced.a

fur.thercapital of Rs.'6,000.The interest at 1Vqis to be allowed on capiital.The interest on

, capitatrtill December31, 2005 will be

46,

'

(.1) Rs. 2,500

(2) Rs. 2,800

(3) Rs. 2,750

(4) Rs. 2,625

Interest o"ndrawings is shown on the

(1) credit side of Profit and TrossAccount

(2)

debit side of Profit and Loss Account

(3)

credit side of Trading Account

(+)

debit side of Trading Account

:

4f.

Itthe debit and'credit sides,'of tlie frial Bhlanice do not,,tafu,:the

difference is put against

',

'

the

.

;

(1) Suspense Account

' ( 2 ) P r o f l t a n d L o s s A e c o u n t . . . : . ' ' , . : ] , . . , . , . . . , "

(3)

:

48.

, ,

Trading Account

@t) Adjustment Account

'

,

l

.

Which of the'follbwing is an'exalriple of current asset ? :

(1)

Stock

(2)

Sundrydebtors

tgl

(4)

Shod-f,erm investments

:

' ' ,

AII of the above

'

49. Cooa#n is a

(1)

)

,

(4)

- ' '

Intangible asset,

' ' .

.

Tangible asset

(3), Fixed asset

PCO-01

:

:

.

: .:

qlqr ffi{q qrancr't'

44, ,itr[ q{ + sifdqf{q qen{rq* qn$qfrdidq{Ardrsii''* m

, (1) ft1re

(2) gtr{-qdftfu lfre)

@) 5@ q.-im

(3) dcR

'

;

S I rwqn, 200bfrsrrn i e,ooor.d srfrRffi

46. rqffifr, zoord {S so,ooot'.

am

tfr c'n$ r {fr vt6zaffiq,,qqS'41-qfr*t vRr$' t slfrsqt, zgo5ils'{fivt

t'n

(1) 2,500d'.

(2) 2,800{.

.:

(3) 2,750F'

.

(4) 2,626I''

qt qrsT f€Hr qnr t

46. eTr6qor

(1) qmafr sre * itre qHfr

' (z) arFT-afr

rgril* 3t+sqq{fr

(s) qIqRsre + *Fa qq if

(4) qrqn€ril+tfrawfr

$.

" i

r

gfdenqr'if,ee'qql'frFrdlqTfr A slFF,{,6q $RR,+1

qR nrcTrc,+

ffi ffi vrer

t

gre fr

(1) FFitrd (suspense)

(z) €rq-tlfrsr} fr

(B) qrsnqre t

(4) qqrqNFT EIRTq

urq vRsefr ql cEroqur

48.,Frqfuba { * *tq$ qR-{$gft

t r

(1) o-d Hd q,r d*

(z) Rfqq tff{

'

A

:

A \

(3) €reFffiil?Tfq+{r

(4)

Hql

"r$i6

4e. lg|rdt

(1) Tf qnKF{R

(3) rql{ qffi

bo. ts Biq{gT€ t

(1) q,rqqn$sqfr

(3) trteTqRgqfr

:

l

e) ErfrqRsqR

(4) .ffi qnrrsTfr

(2) qrq, qTtTT

(4) {Wq

*rdr

I

PCO-o1

( 1 e)

TtD'6rd

b frg ry

SPACE FOR ROUGH WORK

PCO-O1

(20)

11,000