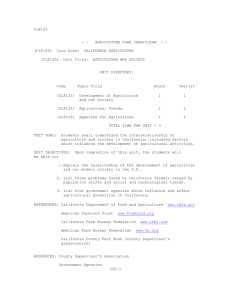

Credit Information Bill 2015

advertisement