Second Quarter Management Report Bapºst Foundaºon of Illinois

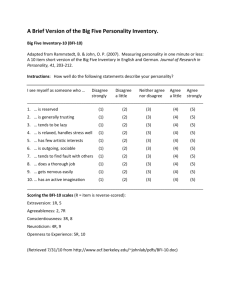

advertisement

Second Quarter Management Report Bap$st Founda$on of Illinois June 30, 2015 3085 Stevenson Drive Springfield, IL 62703 BaptistFoundationIL.org 217.391.3102 Execu$ve Summary While the second quarter of 2015 saw addiAons and growth in all areas, a contracAon in the market resulted in Total Funds Under Management increase being less than the increase in cost basis. The following represents highlights in each of BFI five areas of operaAon. TFUM grew to $24.99M in 516 accounts managed. BFI Bond/Loan Program: BFI completed loans financed by BFI bonds for the Redeemer Church in Champaign Urbana ($550,000) and the Iglesia BauAsta Betel church in Berwyn ($42,000). All BFI loans are performing as agreed and this program has grown to just under $5 Million with 150 unique investors. As a result, interest paid to bond holders has grown dramaAcally. It was also in the second quarter that BFI began offering defined maturity bonds (one to five years in length). As a result of this move, BFI will be replacing 1/5 of each bond issue each year, increasing availability, and eliminaAng the complexity of communicaAng regarding variable bond maturiAes. Life Stewardship Program: Charitable GiZ Expectancy topped $46 Million as a result of the compleAon of addiAonal ChrisAan Estate Plans. Custodial Inves$ng: BFI conAnued to diversify its offering of custodial management services. For the first Ame, both individuals and organizaAons can parAcipate in ALL asset classes. The current custodial funds abstract showing performance informaAon can be downloaded a BapAstFoundaAonIL.org. Capital Stewardship Campaigns: First BapAst Eldorado completed their stewardship campaign for their building, exceeding their goal. Campaigns conAnue underway for FBC Waterloo and Agape ChrisAan High School. BFI Educa$onal Scholarships: BFI trustees have awarded 37 scholarships totaling $76,750, including the new scholarships to part Ame and non-­‐tradiAonal seminary students. This fall, BFI trustees will consider a partnership between IBSA Church PlanAng in which consideraAon may be given to granAng a renewable mulA-­‐year full seminary scholarship in an effort to encourage excellence in Illinois Church PlanAng support. Year to date, expenses have exceeded revenue by $66,333, with our net subsidy (aZer transferring endowment support to IBSA) at $28,348. Once again, thank you for the opportunity of service. Respecfully submiged, Doug Morrow, CFRE 2009 2013 2010 2014 2011 2Q15 2012 $26 2Q15 (YTD) BFI Endowment Support, $85,078.24 $22 $19 $15 IBSA & Church Planting 35% $11 BCHFS 2% CAC 1% NAMB IMB 1% 1% Churches and Associations 4% $7 $4 Educational Scholarships 43% $0 CP (via IBSA) 9% Other 2% Total Funds Under Management 2Q15 (market) $24.99 M BFI Accounts by Type 8 516 accounts DAF 26 Org Custodial LTFI 36 34 Custodial Term (CBL Pool) Custodial Market 79 10 11 2Q15 Custodial Cash Charitable Trust CGA Endowment BFI Bond Holders 1 1 2 0 158 150 Custodial Trust Custodial Ind LTFI Retained Life Estate 80 160 BFI Earnings by Custodial Partner & Account Type 2Q15 (annualized) 2014 2013 2012 SBF INCOME (TR) 2.1% 1.60% -­‐0.55% 5.67% 2.87% 4.12% 4.2% SBF BALANCED (TR) 1.62%% 9.27% 15.7% 9.29% 1.12% 10.32% 17.38% SBF GROWTH (TR) 3.80% 11.78% 33.3% 11.33% -­‐3.1% 14.89%29.69% SBF FLEXIBLE INCOME (TR) -­‐.56% 6.76% -­‐1.91% 7.26% 5.82% 6.16% 7.47% BFO 1 MONTH (EFFECTIVE AUG 15) 0.73% 0.73% 0.96% 1.02% 1.73% BFO 6 MONTH (EFFECTIVE AUG 15) 1.11% 1.11% 1.32% 1.38% 2.13% 2.44% NA BFO 9 MONTH (EFFECTIVE AUG 15) 1.45% BFO 1 YEAR (EFFECTIVE AUG 15) 1.79% 1.71% 1.87% 1.92% 2.89% NA BFO 2 YEAR (EFFECTIVE AUG 15) 2.41% 2.33% 2.45% 2.31% 3.67% 3.73% BOS CASH MANAGEMENT 0.75% 0.75% 0.75% 0.6% 1.2% NA NA BOS/LPL TRUST ACCOUNT 4.24% 18.63% -­‐4.58% 10.5% NA NA NA BOS/LPL INTERMEDIATE TRUST ACCOUNT (TR -­‐ GROSS) -­‐2.43% 7.43% BOS/LPL NET INCOME TRUST ACCOUNT (YIELD -­‐ GROSS) 5.25% 5.59% BOS/LPL CUSTODIAL LONG TERM FIXED INCOME (YIELD -­‐GROSS) 6.25% 6.15% 6.21% 8.1% NA NA NA BOS/LPL ENDOWMENT 6.03% 6.01% 5.94% 4.96% NA NA NA BFI BOND YIELD —-­‐ 3.25% 3.00% ONE YEAR BFI BOND 1.25% TWO YEAR BFI BOND 2.25% THREE YEAR BFI BOND 3.0% FOUR YEAR BFI BOND 3.6% FIVE YEAR BFI BOND 4.25% (TR -­‐ GROSS) (YIELD -­‐ GROSS) 2011 2010 1.9% 3% 2009 NA NA