Grain Supply Chain Study

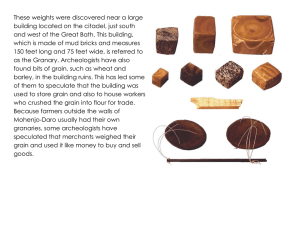

advertisement