“Cadillac” Tax on High Cost Employer

advertisement

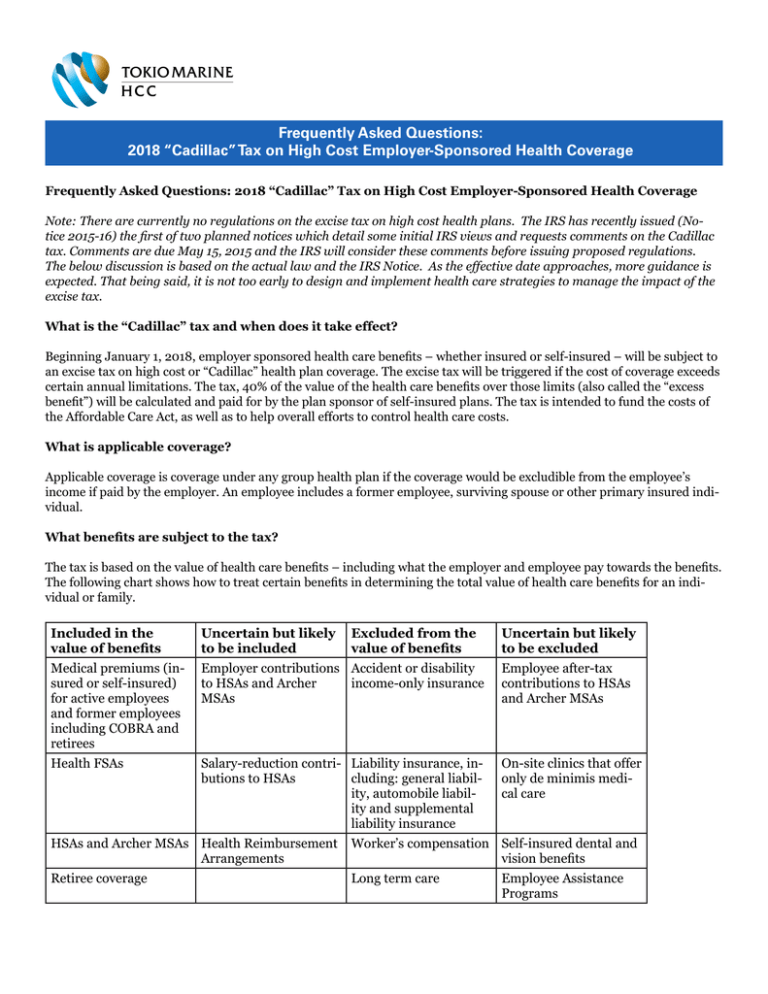

Frequently Asked Questions: 2018 “Cadillac” Tax on High Cost Employer-Sponsored Health Coverage Frequently Asked Questions: 2018 “Cadillac” Tax on High Cost Employer-Sponsored Health Coverage Note: There are currently no regulations on the excise tax on high cost health plans. The IRS has recently issued (Notice 2015-16) the first of two planned notices which detail some initial IRS views and requests comments on the Cadillac tax. Comments are due May 15, 2015 and the IRS will consider these comments before issuing proposed regulations. The below discussion is based on the actual law and the IRS Notice. As the effective date approaches, more guidance is expected. That being said, it is not too early to design and implement health care strategies to manage the impact of the excise tax. What is the “Cadillac” tax and when does it take effect? Beginning January 1, 2018, employer sponsored health care benefits – whether insured or self-insured – will be subject to an excise tax on high cost or “Cadillac” health plan coverage. The excise tax will be triggered if the cost of coverage exceeds certain annual limitations. The tax, 40% of the value of the health care benefits over those limits (also called the “excess benefit”) will be calculated and paid for by the plan sponsor of self-insured plans. The tax is intended to fund the costs of the Affordable Care Act, as well as to help overall efforts to control health care costs. What is applicable coverage? Applicable coverage is coverage under any group health plan if the coverage would be excludible from the employee’s income if paid by the employer. An employee includes a former employee, surviving spouse or other primary insured individual. What benefits are subject to the tax? The tax is based on the value of health care benefits – including what the employer and employee pay towards the benefits. The following chart shows how to treat certain benefits in determining the total value of health care benefits for an individual or family. Included in the value of benefits Uncertain but likely to be included Excluded from the value of benefits Uncertain but likely to be excluded Medical premiums (insured or self-insured) for active employees and former employees including COBRA and retirees Employer contributions Accident or disability to HSAs and Archer income-only insurance MSAs Employee after-tax contributions to HSAs and Archer MSAs Health FSAs Salary-reduction contri- Liability insurance, inbutions to HSAs cluding: general liability, automobile liability and supplemental liability insurance On-site clinics that offer only de minimis medical care HSAs and Archer MSAs Health Reimbursement Arrangements Worker’s compensation Self-insured dental and vision benefits Retiree coverage Long term care Employee Assistance Programs Multiemployer plans Specified disease or fixed indemnity insurance coverage that is not excludible from income Specified disease or fixed indemnity insurance coverage that is excludible from income Dental or vision coverage provided under a separate policy, certificate or contract of insurance Governmental plans Credit-only insurance On-site clinics that offer more than de minimis medical care How will the value of coverage be determined? The value of health coverage will be calculated similar to the way COBRA is calculated – taking into account what both employer and employee pay. Under the proposed approach, each group of similarly situated individuals would be determined for each benefit package then subdivided based on certain mandatory and permissive rules. The IRS is still considering different approaches for dividing the groups and is requesting comments on this topic. For example, if an employer offers a PPO plan and a high deductible plan, those would be considered two separate benefit packages. Insured plans would use the full premium, while self-insured plans would use the COBRA rates set for the plan. For example, if the annual COBRA costs for an employee enrolled in family coverage in an employer-sponsored medical plan are $33,000, this amount will be compared to the annual limitation in effect to determine if that individual has an “excess benefit” that will be subject to the tax. Employees enrolled in multiple coverages subject to the tax would have the value of all benefits aggregated to see if their coverage exceeds the limitation and is an excess benefit. There are two methods for determining the cost of a self-insured plan: the actuarial basis and the past cost method. Generally the actuarial method is based on the COBRA premium for the plan and the appropriate coverage tier (e.g., single, family). The COBRA premium is the cost for providing coverage to similarly situated non-COBRA beneficiaries and taking into account certain additional factors set by the IRS. Among the additional factors IRS has proposed are: -- Any excise tax imposed is not taken into account in determining the cost of coverage -- Separate costs must be determined for self and other-than-self only coverage (other than under a multiemployer plan) -- Health FSA costs include salary reduction contributions plus any employer flex contributions -- Costs are determined based on the plan or option in which the employee is actually enrolled The past cost method is only allowed if the plan administrator elects to use this method and the plan is eligible to use this method and looks at the plan’s cost for similarly situated beneficiaries during a prior period. The IRS is still determining what costs need to be taken into account such as claims, premiums for stop-loss or reinsurance, administrative expenses, and overhead expenses. What are the annual limits? The annual limits set in the law are $10,200 for self-only coverage and $27,500 for non-self-only coverage (any coverage tier other than self-only). Higher limits apply with respect to retiree coverage and coverage for employees engaged in a high-risk profession. In the example above, the employee with family coverage with a COBRA value of $33,000 would have an excess benefit of $5,500 ($33,000 - $27,500) that would be subject to the excise tax. In the simplest form, it is calculated as the “excess benefit” for all applicable employer sponsored coverage, in the most basic form 40% of the difference between the annual limit and the total amount of the value of the health care benefits. However, there are certain adjustments to the annual limits applicable under the law. Are there any adjustments to the annual limits? Health inflation: For 2018 the annual limits will be adjusted to reflect adjustment percentage is 100% of the excess cost in 2018 compared to the cost of the BCBS standard benefit in 2010 – 55%. For 2019, the adjustment will be the base limita- tion indexed using the Consumer Price Index (CPI) plus one percentage point and rounded to the nearest $50 In 2020 and beyond, the annual limitation will be the based indexed using CPI and rounded to the nearest $50. Because the annual limit will be indexed by CPI (and not the health care rate of inflation, which is expected to be higher than CPI), the value of most health coverage is expected to exceed the annual limit in the future. Qualified retirees: This adjustment applies when an individual (rather than a group) meets the standards, and is applicable for anyone who is receiving coverage as a retiree and has attained the age of 55 but is not eligible for benefits under Medicare (age 55-64). This adjustment cannot be combined with the high-risk professional adjustment. If this adjustment applies, the annual limitation would increase by $1,650 for self-only coverage and $3,450 for non-self only. In addition, the non-self-only annual limit for coverage will apply to any level of coverage (including self-only) under a multiemployer plan (also called a Taft-Hartley plan). Other adjustments: Special increases in the annual limits will apply to plans covering employees considered high-risk professionals, like law enforcement, fire protection, construction, mining and others, or those who install electrical and telecommunications equipment. Other will be permitted for age and gender of participants. How is the cost for self-insured plans calculated? The IRS is still considering whether to propose a standard that the cost of self-insured plans is equal to a reasonable estimate of the cost of providing coverage under the plan for individuals in the group using reasonable actuarial principles and practices. The IRS intends to issue guidance on what costs need to be taken into accountable in determining the cost of applicable coverage under a self-insured plan, including claims, premiums for stop-loss or reinsurance policies, administrative expenses, and reasonable overhead expenses. Who calculates and pays the tax? A plan sponsor is responsible for calculating and allocating payments for the tax. The insurer is responsible for paying the tax for a fully insured plan, while the person administering the plan (likely the employer/plan sponsor) is responsible for paying the tax for self-insured plans. There is nothing in the law to prevent plan sponsors from passing on the costs of the excise tax to others, for example, covered employees. Coverage offered by taxable and tax-exempt employers, governmental employers, and church employers is subject to the tax. Coverage for self-employed individuals will be subject to the tax if that coverage is tax deductible. Is the tax deductible? The excise tax is not deductible. What are some employer strategies to avoid the tax? Although there is limited guidance on the excise tax, there are many strategies to control costs and be prepared to avoid the tax in 2018. Currently, employers are doing things like insuring ancillary dental or vision coverage to reduce the total cost of coverage. Another popular strategy that employers are currently using is to implement more high deductible health plans and try to steer employees into those plans. Other potential strategies include raising employee cost sharing to decrease utilization or adding/improving wellness to improve overall population health. Moving forward employers may consider other opportunities such as changing the plan funding options (moving from fully to self-insured), utilizing alternative care delivery methods such as reference-based-pricing, narrow networks or moving to a defined contribution method. Though 2018 may be far away, beginning to focus on controlling costs is an important strategy not just to avoid the excise tax. Tokio Marine HCC - Stop Loss Group is providing this information for educational purposes only. It does not contain legal advice. While we strive to make the information as timely and accurate as possible, we make no warranties or guarantees on its accuracy, completeness or adequacy. All information is subject to change. Tokio Marine HCC - Stop Loss Group 225 TownPark Drive, Suite 350, Kennesaw, GA 30144 main (800) 447 0460 facsimile (770) 973 9854 A member of the Tokio Marine HCC group of companies MSL2213- 5/2015 tmhcc.com