sample forms for filing a lien - the Pennsylvania Association of

advertisement

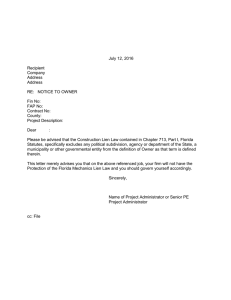

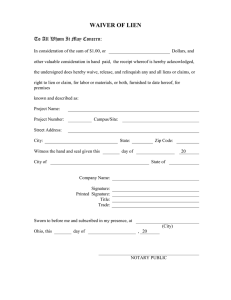

COMMERCIAL REAL ESTATE BROKER LIEN ACT An Overview On Friday, March 20, 1998, Governor Tom Ridge signed Act 34 of 1998, the Commercial Real Estate Broker Lien Act. The Act took effect on May 19, 1998. This overview is general, and is not intended to be a substitute for thorough review of the Act by any commercial broker intending to avail himself/herself of its benefits. The Pennsylvania Association of REALTORS strongly recommends that any broker intending to file a lien engage the services of legal counsel. The Act is applicable only to commercial real estate. Commercial real estate is defined as any real estate other than: 1. Real estate containing 1 to 4 residential units; or, 2. Real estate that is zoned for agricultural purpose and that is not subject to an agreement of sale contingent upon the rezoning of all or any portion of the real estate to provide for non agricultural uses. The lien may be recorded only by the broker and not by associate brokers or salespersons. The Act is applicable to sales and leases and liens may be filed against owner clients (where there is a listing agreement) and buyer clients (where there is a buyer agency contract). The procedures, while not all together complex, must be specifically followed if one is to avoid loss of the lien or avoid paying the other side’s attorney’s fees and expenses. The procedures for filing a lien are set forth in the Act which also incorporates the Pennsylvania Rules of Civil Procedure with the respect to the form of notices and other legal documents. A lien may only be placed upon an owner’s property when the broker has a written listing agreement, has provided real estate services, and when the property is subject to an agreement of sale. A notice of lien must be filed in the Office of the Prothonotary of the county where the property is located prior to settlement. This notice of lien may not be filed, however, unless the broker has given the owner and prospective buyer at least 3 days prior written notice of his/her intent to file the notice of lien on the commercial property. A buyer’s broker may file a lien against the property no later than 90 days after the buyer takes title. The notice of lien filed with the Prothonotary must be preceded by a prior notice served on the buyer client. Likewise, a lien may be filed against property of a landlord within 90 days following the event (procurement of a written lease agreement) which entitles the broker to payment. Prior notice of the intent to file the lien is also required. When a lien is filed, its priority is determined by the date of filing. Liens filed or recorded before the broker’s lien will be paid first out of the proceeds of any sale. The exception to this rule is that mortgages and mechanics liens will always take priority ahead of a broker’s lien, regardless of the date of recording. A broker who placed a lien against commercial property must initiate formal proceedings to enforce the lien within 2 years of its recording. To enforce the lien, the broker must file a complaint against the client who owes the fee. The compliant must conform to the Rules of Civil Procedures and must contain a brief statement of the agreement upon which the lien is founded, the date when the agreement was made, a description of the services performed, the amount due and unpaid, and a description of the property that is subject to the lien. Failure to take this action within 2 years of the filing of a notice of lien shall extinguish the lien. An owner who is subject to a lien may file a formal notice (Praecipe) upon the broker requiring the broker to file a complaint within 20 days. If the broker fails to file a formal complaint within 20 days after service of the Praecipe upon him/her, the lien may be extinguished. In this way, owners who feel that the lien has been placed upon the property unjustly, can bring the matter to issue in a court of law and have the lien properly extinguished. Should an owner prevail against a broker, the broker will be required to pay the owner’s legal fees and expenses. Of course, a broker who prevails is entitled to reimbursement of legal fees and expenses in addition to the amount of the lien. The Act provides that a lien will be discarded when an owner deposits an amount equal to the lien with the court. The Act also provides that a lien will not preclude settlement if at settlement an escrow is established in an amount sufficient to satisfy the lien. In such a case, a seller may not refuse to close, even though proceeds sufficient to pay the broker will be escrowed. A hard fought provision of this Act involves the provision limiting the effect of a broker’s waiver of the right to file a lien. In the absence of such a provision, no owner would list substantial commercial property with a broker unless the broker, in the listing agreement, waived the right to file such a lien. Act 34, however, expressly denies affect to any waiver that is made contemporaneous with the listing agreement. As noted above, PAR strongly encourgages brokers to consult with legal counsel before attempting to file a lien under the Act. Sample copies of lien documents are attached below. Sample Document: This should not be used as a substitute for consulting legal counsel. NOTICE OF INTENT TO RECORD A CLAIM FOR LIEN DATE: TO: and (All Owners) Owners (All Buyers) Buyers Be advised that , Broker, is entitled to compensation under the terms set forth in the written dated (listing contract or buyer agency contract) and intends to claim a lien on the commercial real property described as follows: (Description of Property) The notice of lien will be filed with the Prothonotary in the county of ______ ___, Commonwealth of Pennsylvania, no sooner than 3 days following service of this notice pursuant to the Real Estate Broker Lien Act, Act 34 of 1998. Pursuant to Section 10 of the Act, whenever a claim for lien has been filed with the Prothonotary that would prevent the closing of a transaction or conveyance, an escrow account shall be established from the proceeds from the transaction or conveyance in an amount that is sufficient to release the claim for lien. The requirement to establish an escrow account shall not be cause for any party to refuse to close the transaction. These monies shall be held in escrow until the parties’ rights to the escrowed monies have been determined by written agreement of the parties, a court of law or other process as may be agreed to by the parties. Upon deposit of funds in escrow in the amount of the lien, the broker who is claiming the lien shall release the claim for lien. The parties are not required to follow this escrow procedure if alternative procedures which would allow the transaction to close are available and are acceptable to the broker in the transaction. Broker Address, City, State, Zip Code Sample Document: This should not be used as a substitute for consulting legal counsel PRAECIPE County of : Docket No.: :S Commonwealth of Pennsylvania : Civil Action - TO THE PROTHONOTARY: Pursuant to the Real Estate Broker Lien Act, Act 34 of 1998, please enter a lien in favor of (Broker)_______, against the property more specifically described as follows: _ Owned by (Name of Owner) . The broker’s real estate license number is #____________. (Broker’s signature)_________ Broker ________________________ Address ________________________ City, State and Zip Code VERIFICATION I, , verify that the averments in this Praecipe are true and correct. I understand that false statements herein are made subject to the penalties of 18 Pa. C. S. 4904, relating to unsworn falsification to authorities. By: Dated: 99994-1