The European single insurance market: Overview and impact of the

advertisement

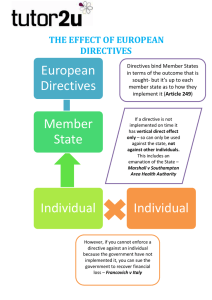

The European Single Insurance Market: Overview and impact of the liberalization and deregulation processes Maciej Sterzynski, LL.M.1 Abstract. Liberalization has progressed significantly within the European financial market in the past 10 years. The implementation of the Third Generation of Insurance Directives has enabled all European Union-based insurers to establish own representatives throughout the Single Insurance Market [SIM] and to offer their services in cross-border trade under the freedom of services. The aim of this study is to point out the efforts made by the European Community to create the SIM. The paper gives an overview of impacts of the liberalization and deregulation processes within the SIM and provides some reflections concerning the efficiency of the introduced (legal) solutions. More specifically, this paper will examine the meaning and goals of liberalization and deregulation in the insurance sector. It identifies the new legal structure of the SIM. Furthermore, the paper investigates the obstacles encountered by the European insurers and shows the barriers on the path to a fully integrated insurance market. These limitations threaten the ambitious project of the European Commission to establish the most competitive market in the world by the year 2010. Keywords: European Insurance Law, Financial Institutions and Services, Insurance, Insurance Companies, subsidiaries.1 I The path to the Single Insurance Market (by liberalization of capital flows) The establishment of the SIM as we know it nowadays took almost 30 years. This ultimate goal resulted from different legal, economic and political actions. Local markets were particularly strictly regulated and “hermetically closed” to foreign companies. The major dissimilarities between national (legal) systems resulted mainly from a structure of the financial services defined in different juridical ways. The intensity of the consumer’s protection varied from country to country. Furthermore, according to Article 51 of the Treaty of Rome2, the creation of the SIM had to parallel the liberalization of the capital flow which is central to the running of the European integrated financial services market consisting of insurances, banks and securities trading.3 1 Chair of Insurance, The Poznan University of Economics, 10 Al. Niepodleglosci, 60-967, Poznan, Poland, sterzynski@novci1.ae.poznan.pl 2 Article 51 of the Treaty of Rome states: "The liberalization of banking and insurance services connected with movements of capital shall be effected in step with the liberalization of movement of capital." This made it impossible to create a single financial services market comprised of banking, insurances and stock exchange sectors without mobilizing capital throughout Europe. 3 It should increase the profitability of investments and allow particular regions to become more attractive. Therefore, the freedom of movement of capital is not only an indispensable factor for establishing the single © BELGIAN ACTUARIAL BULLETIN, Vol. 3, No. 1, 2003 Until 1990, some poorly developed countries were in opposition to the full mobility of capital, believing it might threaten the stability of their financial systems by creating uncontrolled capital outflow. Others like Germany and UK decided on their own to liberalize capital markets, encouraging investors to locate assets in those countries. The uncompromised position of less developed countries against the liberalization within the European financial services market seriously delayed the entire process of the creation of the SIM. Because of these factors, especially the strong legal diversification, a harmonization of local regulations seemed rather impossible. This procedure had to be replaced by an approximation of the member’s systems in the way of mutual recognition of existing differences. Hence, the integration effects in the European insurance sector could be achieved only through liberalization and the deregulation within the member’s markets (e.g., Skipper, 2000 or Sterzynski, 2003). The new structure of the European insurance market, however, required a uniform legal framework, at least at the basic level. It allows all insurers coming from different member states to establish and provide services freely throughout the European Community without needing any additional authorization by any host country authority. This means the same rules should apply to all market participants about establishing and providing insurance business. The legal framework for the SIM is established on the basis of three major principles arising from the founding Treaties, namely: the freedom of movement of capital, the freedom of establishment and the freedom of movement of services4 which were gradually realized by the three Generations of Insurance Directives5 (e.g., Gieger, 1997). The first initiatives towards the integration of the European insurance market were made at the beginning of the 1970’s and completed in July 1994 by the implementation of the Third Generation of Insurance Directives, see Figure 1. financial market, it also plays an important role with regard to the global position of the European economy. 4 The freedom of capital movement is based on the principle that the capital flows within the European Community without any obstacles. Regarding the Single Insurance Market the freedom of establishment means that all insurance companies based in the European Community countries have the right to establish subsidiaries, branch offices or agencies in every member state using the same rights and being subjected to the same duties as “local” companies. The freedom of services let the insurers to provide their business throughout the European Community with or without own representations in the member states in terms of the cross-border transactions. 5 Note that, directives are binding proposed by the European Commission and issued by the EU Council of Ministers. They oblige all member states to realize their binding goals regardless of the way of this realization. Figure 1: The three Generations of Insurance Directives First Generation of Insurance Directives: the freedom of establishment limited by the Host Country Control o Non-life directive (1973) o Life directive (1979) Second generation of Insurance Directives: the freedom of movement of services limited by directive’s diversifications o Non-life directive (1988) o Life directive (1990) Third Generations of Insurance Directives: the Single European License and the Home Country Control o Non-life directive (1992) o Life directive (1992) • 1 The First Generation of Insurance Directives: a first step in the liberalization process • According to the First Generation of Insurance Directives issued in the 1970’s, European insurance companies were allowed to establish their own branches, offices or agencies within the Community on the basis of the Host Country Control principle.6 This meant that European-based firms had the option to launch their own representation in every member country, but only with the permission of the local authority. Foreign companies were subjected to more restrictive conditions. Therefore the Host Country Control principle did not really enhance the process of creating an integrated European market and the deregulation and liberalization processes were not significantly advanced. Crossborder financial activity was more the exception than the rule. For example, as late as 1988, cross-border life insurance in Europe7 was less than 1% of total life insurance business. 2 Between “company business” and “private business” - in the first case the home country authority supervised the insurer while in the second case the insurer was subjected to the Host Country Control. Between “large risks” and “small risks” - here a distinction between supervision competencies was made according to the type of covered risks. These diversifications followed from the idea that a private consumer still requires special (more) protection. Many European governments (excl. UK and the Netherlands) believed that this special protection might be achieved only at the local level where the insurance is sold. As a result it remained hard for foreign companies to perform cross-border transactions regarding individual policies. Until 1992, the liberalization and deregulation process took place only in these sectors of the insurance market where the need to protect customers was insignificant. National supervisors kept their right to control foreign companies trying to provide business in the way of free movement of services. Therefore the integration effects of the Second Generation of Insurance Directives seemed to be unsatisfactory towards establishing free movement of services (e.g., Skipper, 2000 or Sterzynski, 2003). The Second Generation of Insurance Directives: a limited freedom of movement of services The main goal of the Second Generation of Insurance Directives was to realize freedom of services and to enable European companies to operate abroad without having to establish a branch/agency in a particular member state.8 The Second Generation of directives came into force in 1988 and 1990, allowing insurers to provide their business in terms of freedom of services. Nevertheless, many restrictions still remained. The directives introduced two kinds of separations: 3 The Third Generation of Insurance Directives: the establishment of the SIM The breakthrough in the process of liberalization and deregulation was achieved by the Third Generation of Insurance Directives.9 The new law came into force on July 1, 1994 and established the SIM for the European insurance industry.10 The philosophy of 9 Third Council Directive 92/49/EEC of 18 June 1992 on the coordination of laws, regulations and administrative provisions relating to direct insurance other than life assurance and amending Directives 73/239/EEC and 88/357/EEC. Third Council Directive 92/96/EEC of 10 November 1992 on the coordination of laws, regulations and administrative provisions relating to direct life assurance and amending Directives 79/267/EEC and 90/619/EEC. 10 Note that, the legal framework of the SIM concerns the insurance industry and not subsidiaries, which still have to apply for a license issued by the host country authorities to provide their business in other member’s states. So far, the legal framework for the European intermediaries bases on the Directive 77/92/EEC on the activities of insurance agents and brokers issued in 1977. The new approval on the Directive 2002/92/EC on insurance mediation has been made by the EU Council of Ministers in September 2002. The Directive requires that all intermediaries be registered in their home Member State. To obtain that registration, they will need to meet strict requirements protecting the consumers. Once they have done so, they will be free to sell their services anywhere in the EU. This legal construction is based on the European License by the insurance industry. 6 First Council Directive 73/239/EEC of July 24, 1973 on the coordination of laws, regulations and administrative provisions relating to the taking up and pursuit of the business of direct insurance other than life insurance. First Council Directive 79/267/EEC of March 5, 1979 on the coordination of laws, regulations and administrative provisions relating to the taking up and pursuit of the business of direct life insurance. 7 Note, that EUROPE is meant in this paper as the collection of member states belonging to the European Union. 8 Second Council Directive 88/357/EEC of 22 June 1988 on the coordination of laws, regulations and administrative provisions relating to direct insurance other than life insurance and laying down provisions to facilitate the effective exercise of freedom to provide services and amending Directive 73/239/EEC. Second Council Directive 90/619/EEC of 8 November 1990 on the coordination of laws, regulations and administrative provisions relating to direct life assurance, laying down provisions to facilitate the effective exercise of freedom to provide. 43 these directives was to eliminate state intervention on the insurance market as much as possible by introducing the following three essential principles (e.g., Frutos, 1994): • • • withdrawal of the authority. Therefore it is necessary to establish a legal structure where state interventionism coexists with a free development on the market (e.g., Webb, 2000). Deregulation and liberalization remain in a strict relation with decisions taken by the government and parliament. In the European Union [EU] such undertakings will be realized by the European Commission and the Parliament in coordination with the European Council. According to Article 2 of The Treaty on the European Union and the Treaty establishing the European Community the Communities take aim at creation of the internal market which is based upon a prototype of the liberal market.11 This process follows the approximation principle described in the section above. The Single European License – which allows all Europeanbased insurers registered in their homelands to operate within the European Community. It comprises both the establishment of branches and cross-border transactions in terms of freedom of movement of services. Once a company is issued the license, no additional permission of the host country authority is required. The Home Country Control - the insurers are only subjected to the supervision of their home authorities whenever they provide operations within the European Union. The solvency supervision - the prior control of insurance premium and policy conditions for all insurance risks and all policyholders has been abolished. The previous substantive supervision has been replaced by the solvency supervision only. It means that any insurance company based in the European Union is subjected to the financial control including e.g. the level of the technical provisions and the strategy of the assets location among others, (e.g., Skipper, 2000 or Webb, 2000). III Establishing the Single Insurance Market by deregulation and liberalization This chapter gives an overview of the impact of liberalization and deregulation (on the companies) on the Single Insurance Market. The section focuses on the Single Market Effects arising from the easier market entry and the Deregulation Effects resulting from changes within the insurance supervision. These modifications caused important alterations on the market and created the present structure of the SIM. The chapter points out an increase of competition as main and direct effect of liberalization and deregulation. Furthermore, it approaches the restructuring on the SIM with emphasis on the concentration tendency and changes of the volume of premiums in the time period 1995 to 2000. II Regulation versus deregulation Discussion on deregulation and liberalization cannot be continued without explanation of the notion of regulation. In fact it is the reason of the existing of the previous two ones. Regulation means infringement of free competition on the market (ideal competitive market). It occurs through legal limitations on the competition or by agreements among market’s participants (e.g., Farny, 1987 or Mogowitz, 1958). State’s restrictions comprise among the others: the access to the market and an easy exit, price regulations, conditions of contracts (e.g. insurance contract), quality of offered services, supervision etc. Then deregulation is an occurrence opposite to regulation. It means a reduction of existing limits or import of regulating assumptions of the state on a lower level (e.g., Farny, 1987). Hence, deregulation efforts lead to reduce the above-explained interference of the state on the market. Liberalization results from the deregulation process. That means directions of liberalization are determined by actions of deregulation character. The more profound deregulation on the market the wider spread might be liberalization within certain economic sectors. From definitions above one deduces that liberalization is a process that leads to establish the liberal market, on which interventionism of the state is limited to the indispensable minimum (e.g. consumer protection rules). The entire withdrawal of the state from the market would be possible only if a market was perfectly competitive. It would mean that: • • • 1 Single Market Effects and Deregulation Effects According to Skipper/Star/Robinson (2000) a perfectly deregulated and liberalized insurance market means that regulations are limited to the indispensable minimum and concerns the questions such as: • • • Who is authorized to operate an insurance business? What products might be considered as insurance products? What are distributions channels? Although the Single Insurance Market differs from the abovementioned model, its structure has been created exactly through partial liberalization and deregulation of the local markets. Both processes have not been finished yet. Furthermore, the SIM is based upon integration of local insurance markets of Member States requiring characteristic (additional) elements i.e. the Home Country Control principle and the Single European License. These conditions have been met already by implementation of the Third Generation of Insurance Directives (e.g., Sterzynski, 2003). The deregulation of the insurance supervision and the liberalization of the market access are central for running of the Single Insurance Market. Figure 2 presents certain important effects of liberalization and deregulation both for the companies and for consumers. They have been categorized as the Single Market Effects and the Deregulation Effects. Liberalization made an easier market entry for foreign companies possible which in turn influences a dynamic growth in competitiveness. Today one can observe certain consequences on the SIM resulting from this phenomenon. They concern the growing presence of foreign companies, the alteration in a legal form of functioning (acting) on the market, the larger spectrum of products and the reduction of business costs: Sellers and buyers are ideally informed that exactly the same products are offered at the same price, Rules of access to the market and rules of withdrawal from market are easy (e.g., Skipper/Starr/Robinson, 2000), No mutual agreements among market participants. However, it is an ideal construction, not possible to be workable in practice. To achieve such a model of the market is not even a purpose of liberalization. Liberalization means removal of barriers limiting the free competitiveness and does not mean a complete 11 44 OJ 2002/C 325/01 Figure 2: The Single Market Effects and the Deregulation Effects Impacts of liberalization Growing presence of foreign companies Wider spectrum of new or innovated products Fuller meeting client’s needs Higher quality of services Know-how transfer by foreign insurance enterprises Investments transfer Restructuring on the European insurance market Easier market access Increase of competition • • • • • • • Impacts of deregulation • • • • 2 insurance industry means the value of gross premiums accumulated by the European insurers. The figures and remarks in this section concern the period from 1995 to 2000. Restricting to this time period enables to evaluate tendencies without the disturbing effects of changes due to problems in financial markets after 2000 and consequences of terrorist attacks on September 11, 2001 in the USA. Stronger penetration of local markets by foreign firms This means that, e.g. German insurers are more present in Portugal than they were 15 years ago. The most often used activity forms are foundation of branches/agencies/ representatives of insurers or taking over the shares of existing local companies. Demutualization of previous legal form - Increase of competition forces the mutual insurers to use demutualization procedures to change the legal form in which they act. The trend towards demutualization is significant in the recent years. Increasing competition makes the main principles of mutual insurers, i.e. non-profit principle and collective ownership of funds difficult. Insurers acting as a mutual look for a form more suitable to the varying market conditions, e.g. a join stock company. Larger spectrum of products - Local and foreign insurers introduce new services or innovate already existing products to improve own market position and gain more customers. On the other hand clients have better choice of services which were not accessible before 1994. It is the case within the life insurance sector as well. There are no more administrative borders (theoretically) between the national insurance markets what makes the products available to all EU consumers. Reduction of the costs - Growing competition works upon reduction of the business (administrative) cost. This new trend is strong throughout the European insurers and becomes an indispensable element of their strategy. 2.1 Concentration on the market In 2000, the 3.217 insurance companies active in the EU consisted of 1.812 non-life insurers, 805 life insurers, 418 specialist reinsures and 182 composite insurance firms. The composite insurers are allowed only in 9 Member States and they have right to offer both life and non-life products. Since 1995 to 2000 the general reduction of companies on a level 6,4% was stated. It concerned the non-life and life sectors by 11% and 6% respectively. In turn composite insurers increased by 8,3% and reinsures by 13,3% by the same time. Both the decline of the life and non-life companies and the increase within the reinsures and composite firms has been illustrated in Figure 3. In the analyzed period 70% of all non-life insurers within the SIM had their seats in only 5 Member States such as: Germany (17,4%), France (16,7%), the Netherlands (14,7%), Spain (10,7%) and UK (10,5%). Moreover, one can observe a similar tendency among the life insurers. Up to 67,8% of all life insurers were concentrated in UK (17,6%), Germany (15,3%), the Netherlands (12,5%), Denmark (11,3%) and France (11,1%). Restructuring within the SIM Establishment of the SIM originated many structural changes on the market. First they concern rising concentration of companies both in the non-life and life sector. Second, one can observe intensive alterations of the turnover. According to the definition used in the Protocol 22 of the EEA Agreement12, the turnover for within the undertaking's ordinary scope of activities after deduction of sales rebates and of value-added tax and other taxes directly related to turnover. According to the article 3 of the Protocol 22 to the EEA Agreement in place of turnover, the following shall be used for insurers undertaking: the value of gross premiums received from residents in the territory covered by the Agreement, which shall comprise all amounts received and receivable in respect of insurance contracts issued by or on behalf of the insurance undertakings, including also outgoing reinsurance premiums, and after deduction of taxes and parafiscal contributions or levies charged by reference to the amounts of individual premiums or the total value of premiums [OJ L 377 , 31.12.94 P. 0028]. 12 According to the Article 2 of the protocol 22 of the EEA Agreement “turnover” shall comprise the amounts derived by the undertaking concerned, in the territory covered by this Agreement, in the preceding financial year from the sale of products and the provision of services falling 45 Figure 3: Evolution of total EU-15 insurance enterprises by types of enterprises, 1995-2000 (e xluding Be lgiu m, Gree ce and Irel an d) 2200 2063 2041 2000 1800 1990 1945 1905 845 844 1812 1600 1400 1200 1000 800 858 870 369 168 374 393 398 404 418 174 183 194 182 182 862 805 600 400 200 0 1995 1996 1997 Non-life insurance 2.2 1998 Life insurance Specialist reinsurance Changes of the volume of the gross premiums 2.3 From 1995 until 2000 a serious increase of the gross premium is observed. It is due to significant progress both in the life insurance sector and in the composite insurance where the increase of the gross premium reached the level of 93% and 144% respectively during 5 analyzed years. The average premium written by all types of insurers increased by 260 million EUR. This amount corresponds to a growth of 81% during 5 at the same time. The main reason for changes in the structure of the turnover is the concentration of enterprises in the same time. Furthermore, these modifications are due to slow increase in the prices of insurances because of the rising competition. Moreover, the slow increase in the prices has been caused by the natural catastrophes as the effects of the winter storm Lotar and Martin in 1999 and 2000 (e.g., Eurostat, 2002). 1999 2000 Composite insurance Dominance of life insurance The life insurance sector has taken a lead over the non-life enterprises. For the first time in 1996 the life premiums overtook non-life operations. This tendency was confirmed one year later when life sector accomplished 55,2% of the total market share in direct insurances. The sharp growth of life insurance reached 16,8% in 2000, while at the same time non-life volume achieved the growth of 3,7%. Life insurance registered the highest level of gross premium written at 399.4 billion EUR. In contrast to non-life enterprises which reached 217.9 billion EUR, composite insurers achieved a threshold of 160,2 billion EUR and specialist reinsurers accumulated 59.8 billion EUR. These changes are shown below in Figure 4. F ig ure 4 : E v o lutio n o f to ta l E U -1 5 g ro ss pre m ium w ritte n by type s o f e nte rprise , 1 9 9 5 -2 0 0 0 in M io E uro (e x l u di n g B e l g i u m , G re e c e a n d Ir e l a n d ) 400000 399382 350000 321347 300000 270545 250000 200000 249490 219866 207028 195772 179110 217922 189356 190746 203802 160187 150000 142152 124197 109090 100000 90455 65579 50000 44141 43466 44541 44737 50832 59816 0 19 9 5 19 9 6 L ife in sura n c e 19 9 7 19 98 N o n - lif e in suran ce 46 C o m p o sit e in sura n c e 19 99 Sp ecialist r ein sur an ce 20 00 There are several reasons that explain the rapid growth within the life insurances sector, such as: • • • do not respond, however, to the growing market’s needs. The differences in the insurance contract laws are evident among those with Anglo-Saxon and Roman legal tradition (e.g. between UK and Germany or Austria). Believe in growth of stocks markets – until 2000 one can observe an increase in the sales of unit-linked insurance products. The European clients expected growing profits due to positive stock market results during the analyzed time period. Easier market access for foreign companies - liberalization of national markets by the implementation of the Third Generation of Insurance Directives enabled to reach the products which have not been accessible before 1994. The number of cross-border transaction among the SIM was constantly rising until 2001 (e.g., Eurostat, 2002). Complementary role of life insurances – the lead position of life insurances resulted from expectations that these services play an important role as a substitute to the troubled public pension system. 2 The synchronization of tax rules within the European Union has not been fully established yet. Different regulations are still in force. This means that e.g. a German insurer with a seat in Germany providing its business within the SIM is subjected to pay taxes according the German tax law. In turn, an insurer based in Luxemburg selling the same products also within the SIM pays taxes in Luxemburg, where tax tariffs are evidently lower. Thus, different national tax thresholds and dissimilarities within direct and indirect taxation still have discrimination effects on those based in some European countries. Such a situation infringes in a visible way a basic rule of free competitiveness (e.g., Skipper, 2002). The life insurance boom stopped in 2001. The growth slowed down as a result of generally bad conditions in the world capital market. This coincided with September 11th and the ensuing slowdown in the world economy. This situation hit most of the European life insurers causing their premiums to seriously decline. The negative trend in European capital market led to the breakdown in the sales of unit-linked insurances as well. The bad situation also caused problems for insurers because of their significant stock holdings. After 2001 the positive tendency on the life insurance market reversed. The non-life insurers registered small growth of 6,0%, while the life sector suffered a 7,0% decline at the same time. A comprehensive study of the life insurance market after 2001 would require a separated analysis. Although this topic is not an object of this paper, it is an interesting issue worth for subsequent exploration. 3 The “public interest” clause Every member state is allowed to refuse market access of new local or foreign insurers or to refuse the distribution of a new insurance product if they might, in their opinion, infringe the “public interest”. The main problem focuses on the interpretation of the term - “public interest” which has not been done clearly in an official way yet. This creates a lot of free interpretation space for each Member States. The clause might be easily misused and hence could lead to disturbance of the free competitiveness. 4 Marketing and economic barriers Besides legal obstacles, there are problems of (psychological) marketing and economic nature, such as: IV Limitations of the liberalization and deregulation on the Single Insurance Market • • • Although the three Generations of Insurance Directives built a new framework for European insurers, the market is not free from some dangerous shortcomings. The Directives did not establish an ideal insurance market where customers would be able to freely choose the best products and where insurers would not have any obstacles regarding the distribution of their own goods. The main barriers to meeting the thoroughly integrated SIM consist of legal obstacles, consumer’s habits and economic dissimilarities. In generally, they concern the free market access and further realization of insurance activity (e.g., Skipper, 2000). 1 Tax discrimination Dissimilarity of distribution channels, Dissimilarity of the level of the insurance premium, Dissimilarity regarding the statistics of damages, death rate or interest rate. These facts make the creation of standards for distribution channels and standards for general settlement of insurance products throughout the European Community difficult. There are countryto-country different consumer’s habits and particular local circumstances, i.e. the level of mortality or the frequentness of car accidents. Comparing with legal problems removal of these limitations on the path to thoroughly integrated European insurance market seams rather impossible in the short time period. The European insurance contract law 4.1 Standards concerning the contract law of insurance operations within the European Union have not been worked out yet. There are still 15 different contractual rules inside the European Union which makes procedures of cross-border transactions expensive and legally complicated. The Directive’s structures in this respect are of a very general nature related either to the law of risk location or to the law of the domicile which apply to the non-life contract and to the life contract respectively.13 These “solutions” Distribution channels The way to purchase insurance depends vastly on the client’s preference itself. However, it might be (theoretically) influenced and transformed by a multiple long-term marketing strategy. Insurances products might be sold in different ways. The most applied methods are selling via an intermediary or representative. Distribution of insurance services is also possible via Portugal by a German insurance company the law of risk location applies to the contract. Regarding life insurance policies, the law of the domicile of the insured person is relevant. Such a construction seems to be only a temporary solution, especially regarding next year EU enlargement. 13 This means that if a British citizen buys a non-life insurance policy (e.g. covering risks arising from natural catastrophes) to protect his home in 47 bancassurance which means that a bank sales insurance products parallel to its regular activity. Finally, insurances might be sold using the e-commerce distribution channel or by telephone sale. From country to country insurers use different distribution channels according to the local consumer habits. They follow client’s needs (expectations) trying to achieve higher or maintain current sale’s level. In Figure 5, the example of bancassurance shows how widespread and dissimilar are market’s behavior throughout different Member States (e.g., SwissRe, 2001). While bancassurance is becoming very popular in for selling life insurance in certain European countries, in others the percentage of sold insurance services (via bankassurance) does not reach a level of 20%. This means that a Portuguese life insurance company will mainly offer his products in Portugal via the bancassurance system. However, in order to penetrate or survive on the German or the British market, the same company is forced to choose another distribution channel. To work out a new strategy for each local market is an expensive undertaking. This may make a Portuguese insurer reluctant to enter new market. 4.2 Conclusions and final remarks The financial services market plays a main role within the European economy. Liberalization and deregulation of this market are important processes in view of the goal to make this market the most competitive in the world, but also because of next year’s EU enlargement. In this paper, we focused on the processes of liberalization and deregulation of the insurance market. The insurance industry plays a main role within the European financial services market. In the year 2000 total investments of the non-life, life and composite firms reached 4.213 billion EUR. Comparing with 1995 the participation of the insurance sector on the European financial market has been doubled (e.g., Eurostat, 2002). Without liberalization and deregulation there is no chance to achieve the really integrated insurance structure. The Third Generation of Insurance Directives removed by deregulation certain restrictions on the market and introduced concepts as the solvency supervision and the system of Home Country Control. In turn liberalization facilitated an easier entry and exit from the market. We have show, that the SIM is still not free from limitations. The barriers are widespread. They occur mostly as legal shortcomings especially on the level of the national insurance contract law, country-to-country different tax regulations and the “public interest” clause. These obstructions hamper the integration process. Furthermore, the described problems cause an unequal development of the EU regions by favoring those where investment conditions are definitely easier. Such a diversification infringes basic rule of free competitiveness. Statistical and economical limitations There appears the question about the level of the insurance premiums too. They are adjusted to the local economic conditions. Therefore, the premiums vary due to the member’s statistics of damages or death rate. So, to work out one standard, valid within the SIM will often be impossible from a pure statistical point of view. Moreover, the foreign companies interested to extend their activity towards new markets are confronted with high entering costs. They have to agree with expensive complex legal assistance. It concerns an examination of suitable legal forms e.g. according to particular rules of the local company law and usually intricate tax regulations. Additionally the entering cost will be increased by cultural and language differences. Figure 5: Bancassurance in the Member States, 2000 Other distribution channel Life insurance in % Bancassurance Non-life insurance in % 17,5 26,9 36,6 40,0 81,0 91,9 93,0 95,7 99,2 8,1 7,0 4,3 0,8 92,0 94,6 8,0 5,4 89,0 82,5 73,1 63,4 60,0 19,0 Portugal Spain Italy France Germany UK Portugal 48 Spain Italy France Germany 11,0 UK Besides problems resulting from pure economic obstacles, there are also shortcomings due to particular consumers habits. They make that companies are unable to create a standard program both for the offered products and for the distribution channels all across Europe. Therefore, firms are limited in taking advantage of economies of scales. Also entering costs often remain very high. Fortunately, the SIM is changing over time, thanks to the efforts of both the European Commission and the European Parliament meant to reduce existing problems and obstacles. ACKNOWLEDGEMENTS The author would like to thank Jan Dhaene of K.U. Leuven for helpful comments and discussion. REFERENCES [1] [2] Eurostat (2002), Insurance Services Statistiques, 43. Farny, D. (1987), Über Regulierung und Deregulierung von Versicherungsmärkten, ZfB. [3] Farny, D. (1989), Erwartungen europäischer Versicher an den Binnenmarkt, ZversWiss. [4] Farny, D. (1992), Versicherung im Jahr 2010, Strukturelle Stabilität verabschiedet sich, VersVem. [5] Frutos, M. (1994), EC Insurance Law – General Introduction, in: Insurance and EC Law Commentary. [6] Gieger, R. (1997), EG-Verttrag, Kommentar zu dem Vertrag zur Gründung der Europäsicher Gemeinschaft. [7] Mogowitz, H. (1958), Liberaliesierung, in: Handwörterbuch des Versicherungswesen. [8] Skipper, H. D. Starr, Jr., C.V., Mack Robinson J. (2000), Liberalization of insurance market: issues and concerns, Insurance and private pensions compendium for emerging economy, Book 1, Part 1:6) b, OECD. [9] Sterzynski, M. (2003), The structure of insurance supervision in the European Union, Magazine of the University of Economics in Poznan, Chair of Insurances, 140-179. [10] Sterzynski, M. (2004), The Insurance Supervision in the European Union: liberalization and deregulation of the European Single Insurance Market, unpublished Ph.D. dissertation, University of Economics in Poznan, Poland. [11] SwissRe (2001), The Statistics. [12] Webb, I. P. (2000), The Effect of Banking and Insurance on the growth of Capital and Output, unpublished Ph.D. dissertation, Georgia State University 49