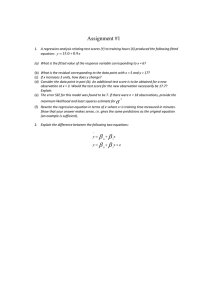

CHAPTER 4: INTRODUCTION TO REGRESSION 1. Fitting Trends

advertisement