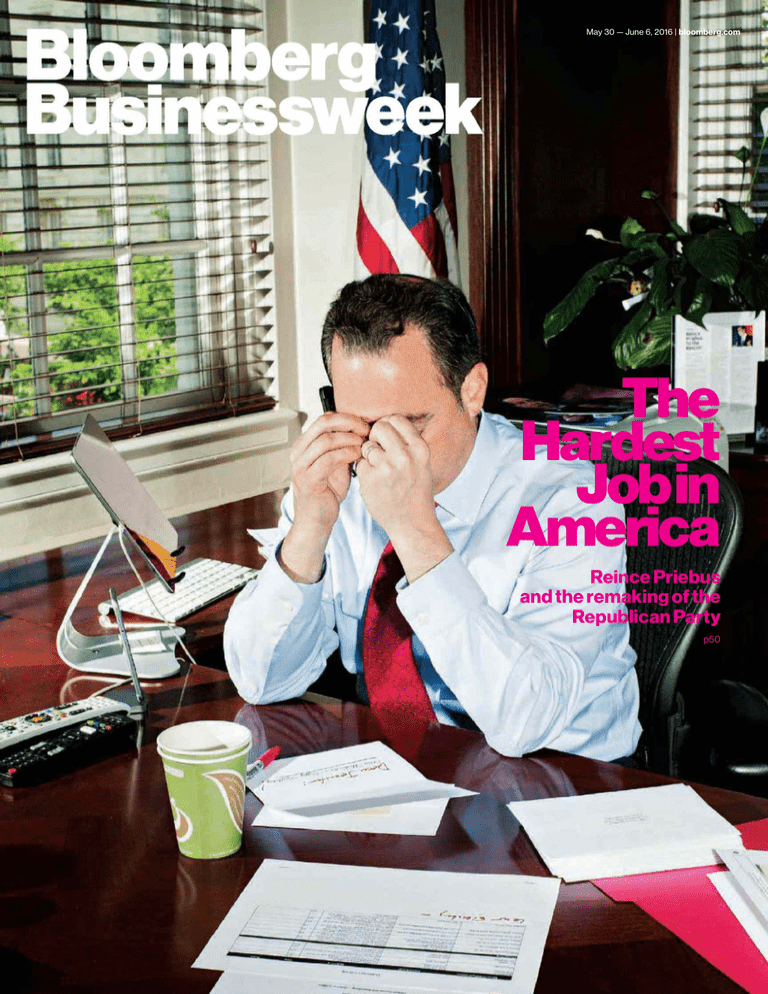

May 30 — June 6, 2016 | bloomberg.com

The

Hardest

Job in

America

Reince Priebus

and the remaking of the

Republican Party

p50

far co

Helping you see global markets as more

familiar than foreign. That’s the power of

a local neighbor, connecting you with over

200 countries, multiple time zones and

140 currencies worldwide.

bofaml.com/yourcorner

“Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking

activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Securities, strategic advisory, and other investment

banking activities are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, Merrill Lynch, Pierce,

rners

Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp., both of which are registered broker-dealers and Members of SIPC, and, in other jurisdictions, by locally registered entities.

Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA.

Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed. ©2015 Bank of America Corporation

06-15-0895.D

MANY STATES STRUGGLE TO REDUCE THE BARRIERS TO DOING BUSINESS.

WE JUST ELIMINATED THEM ALTOGETHER.

Consistently ranked one of the best states for business, Florida is committed to keeping regulatory requirements

and business taxes low. That, along with a strong economy and zero personal state income tax, makes it a great

place to do business. We won’t stand in the way of your success. We’ll pave the way for it. Discover what a

future in Florida means for your business at floridathefutureishere.com or call 877-YES-FLORIDA.

sign

docu

and

Go

Seal the deal

from 30,000 feet.

With DocuSign, you can sign safely and securely from

anywhere on your mobile device. So you can sign and

close deals any time—even when you’re offline.

www.docusign.com/go

“Even people who don’t

eat pork tell me they

had to try it, and it absolutely

blows their minds”

p43

PHOTOGRAPH BY BOBBY SCHEIDEMANN FOR BLOOMBERG BUSINESSWEEK

5

“Five years ago,

self-publishing

was a scar.

Now it’s a tattoo”

p44

“You people in the media,

you think we’re all like monkeys,

like we’re just sitting around

waiting for the bananas, and when

we get the bananas, we jump

up and down and eat them”

“Here you are,

fine-tuning the system

to deliver a victory,

when the system became

the enemy”

p56

p50

Cover

Trail

May 30 — June 6, 2016

How the cover gets made

Opening Remarks In South Africa, empty stadiums may be a bad omen for the ANC

10

Bloomberg View Suing the Saudis only hurts the U.S. • So does impeaching the IRS chief

12

Global Economics

Bailout and austerity are sideshows. Puerto Rico’s failing economy is the main event

14

Volcker, Greenspan, Bernanke, Yellen … and Hal?

15

The black market in greenbacks is thriving in Libya

16

Layoffs at South Korea’s shipbuilders will set thousands of workers adrift

18

Companies/Industries

Can Carlos Ghosn’s cost-cutting tactics also save Mitsubishi?

21

Shanghai Disney works a little magic with its Chinese performers

22

Fill up the cooler with cold-coffee brews

24

Briefs: Toyota hails Uber; New York state looks to give Domino’s workers a big tip

26

①

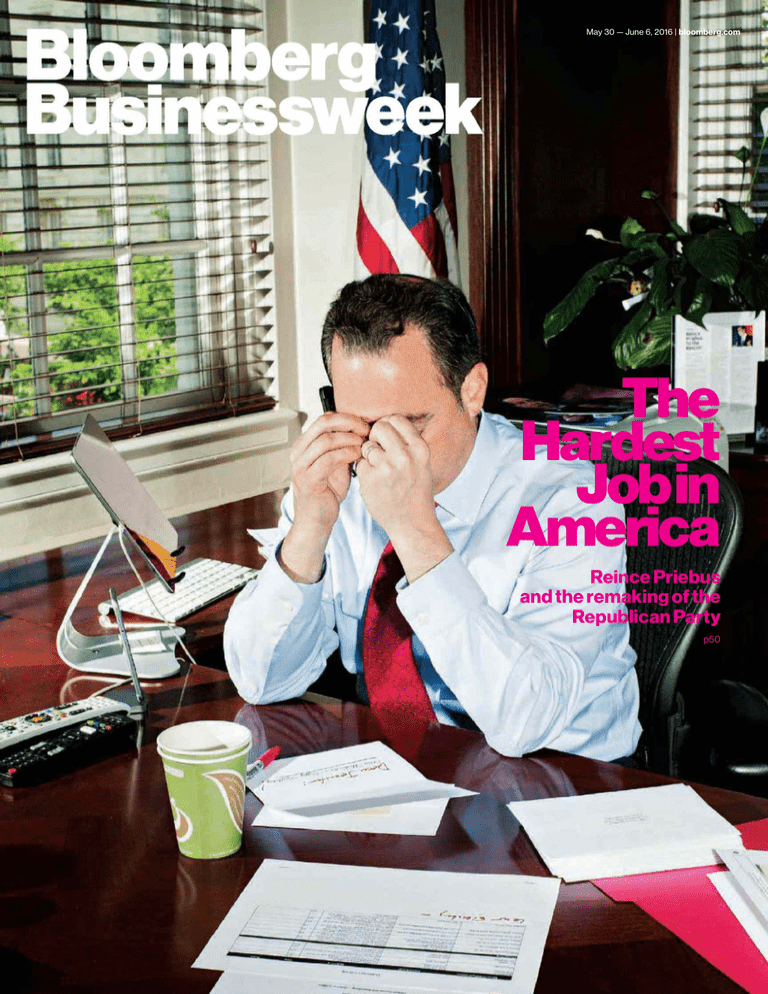

“The cover is on Reince Priebus.”

“I’m sure this is a famous banker

I’m supposed to know who made a

billion dollars doing something

incomprehensible. Well, lay it on me.

Who’s this guy?”

“He’s the head of the RNC.”

“Oooohhh, I probably should’ve

known that. So what exactly does

he do?”

“Among other things, uniting the

Republican Party.”

“Oh, wow! Oh, wow!

Can we shoot him?”

Politics/Policy

Donald Trump invented a new model for campaign advertising. But it only works for him

28

An Oregon court will decide if a bakery can have its wedding cake and not sell it, too

29

Why is Larry Kotlikoff running for president? To warn of looming economic doom

30

A Referendum: A Maine initiative to tax the rich is one of several proposed across the country

31

Technology

6

Nervve’s visual-search tools open up a new frontier for advertisers

33

Machines that turn commercial food waste into smart garbage

34

Want some love from the VC crowd? Don’t start a toy company

35

Training Chinese eyes on alternate realities

36

②

“This pretty much

sums it up.”

Markets/Finance

Poor Indonesians change trash for cash, and find a way to save

38

The bulls predicting a rise in Tesla’s stock come under scrutiny

39

Bond traders: From Masters of the Universe to order takers

40

Bid/Ask: Monsanto holds out for more; GE will help the Saudis move beyond oil

41

COVER AND COVER TRAIL: PHOTOGRAPH BY BRIAN FINKE FOR BLOOMBERG BUSINESSWEEK

Focus On/Small Business

A Spanish delicacy arrives in Texas—hoofs and all

43

Why even best-selling authors turn to self-publishing startups

44

Adding theater, fun, intrigue, and urgency to the slow-moving world of luxe shoes

45

Small to Big: Build the candy emporiums, and they will come

46

Features

Mr. Switzerland Reince Priebus dug the Republicans out of a hole. Then came Trump

50

Par for the Course Why Phil Mickelson wasn’t charged with insider trading

56

Surf’s Up Forever How Kelly Slater plans to roll out his near-perfect man-made wave

60

Etc.

The risqué Snapchat account ArsenicTV is spawning a generation of influencers

67

Design: Neon signs help restaurateurs on social media

70

Astrology: There is a better break room in your future

72

Rant: It’s time to get comfortable with office-appropriate yoga pants

73

Travel: Why hit the beach when you can help struggling business owners in Detroit?

74

What I Wear to Work: Bartender Igor Hadzismajlovic has strong feelings about when an untucked shirt is suitable

75

How Did I Get Here? AARP chief Jo Ann Jenkins has worked with Potuses and Flotuses since 1981

76

③

“This REALLY

sums it up.”

Index

People/Companies

Jonas, Adam

39

JPMorgan Chase (JPM) 15, 39

A rare site

in San Juan

K

Kantar Media (WPPGY)

Kasich, John

Kelly Slater Wave Co.

KKR (KKR)

Klein, Aaron

Klein, Melissa

Klukowski, Ken

Koch, Charles

Koch, David

Koskinen, John

Kotlikoff, Laurence

Kroger (KR)

28

51

62

51

29

29

29

28

28

12

30

24

L

A

8

ABC (DIS)

68

Aberdeen Asset

Management (ADN:LN)

40

Acornseekers

43

Adidas (ADS:GR)

26

Adrià, Ferran

43

Advanced Research Japan 21

Aecom (ACM)

22

Aikawa, Tetsuro

21

Airbnb

68

Alibaba Group Holding (BABA)

36

Allen, Mike

51

Amazon.com (AMZN)

44

American Apparel

68

American Capital (ACAS)

41

Anagnostakos, Louis

34

Andrés, José

43

Anheuser-Busch InBev (BUD)

68

Archambault, Patrick

39

Arena Ventures

68

Ares Capital (ARCC)

41

Ariel Investments

28

Armstrong, Peter

44

ArsenicTV

68

Athleta (GPS)

73

Axa (CS:FP)

41

B

Bachelor, Andrew

68

Baidu (BIDU)

36

Barbour, Haley

51

Bayer (BAYN:GR)

41

Bharara, Preet

58

BioHiTech (BHTG)

34

BlackRock (BLK)

31

BMI Research

21

Boesky, Ivan

58

Borrell Associates

28

Bowman-Cryer, Rachel 29

BrandSnob

68

Breakout

74

Brody, Josh

44

BTIG

28

Bush, Jeb

28, 51

C

Carbon38

73

Carnival (CCL)

74

CastleOak Securities

40

Celli, Frank

34

Ceresney, Andrew

58

CF Industries Holdings (CF) 41

Chaffetz, Jason

12

Chameleon Cold-Brew

24

Chen, Tianqiao

41

Chiasson, Anthony

58

Chobani

24

Clinton, Bill

28

Clinton, Hillary

28, 30, 51

Coca-Cola (KO)

24

Codex-Group

44

Cohen, Graham

74

Computer Sciences (CSC) 26

Costco (COST)

24

Craig, Paige

68

Creative Artists Agency

68

Credit Suisse (CS)

21, 40

Cruz, Ted

51

41

Tianqiao

Chen

Fischman, Ben

Flanders, Scott

FlockU

Frank N. Magid Associates

45

68

68

28

G

Gangemi, Maria

45

Gannett (GCI)

41

General Electric (GE)

41

General Motors (GM)

26

GetTaxi

26

Ghosn, Carlos

21

Gingrich, Newt

51

Goellner, Jacob

33

Gogolak, Caroline

73

Goldman Sachs (GS)

21, 39

Google (GOOG) 15, 28, 39, 51

Graham, Janice

44

Grand Central Publishing

44

H

D

Daewoo Shipbuilding & Marine

Engineering (042660:KS) 18

Dalian Wanda Group

26

Davis, Thomas

58

Dean Foods (DF)

58

Dell

58

Diplo

69

Dole, Elizabeth

76

Domino’s Pizza (DPZ)

26

Douglas, Michael

76

Dr Pepper Snapple

Group (DPS)

24

DreamWorks Animation (DWA)

22

Drummey, Corbett

68

Duff, Hilary

68

Dunkin’ Donuts (DNKN)

34

Dylan’s Candy Bar

48

E

Economic Security Planning 30

Eisenberg, Lewis

51

Elliott Management

41

EMediaStar

68

Employees Only

75

Energizer (ENR)

41

Ericsson (ERIC)

33

Euromonitor International 24

Evans, Colleen

68

F

Facebook (FB) 28, 36, 62, 68

FAO Schwarz

48

Farber, Michael

74

Fiat Chrysler

Automobiles (FCAU)

39

Fincham, Adam

62

Firewire Surfboards

62

Hadzismajlovic, Igor

Haichang Ocean Park

Holdings (2255:HK)

Haldane, Andy

Hampton Creek

Hana Financial

Investment (086790:KS)

HandStands

Hardy, Terry

Hawkins, Billy

Hershey (HSY)

Hewlett Packard

Enterprise (HPE)

High Brew Coffee

Hildick-Smith, Peter

Hilton Hotels (HLT)

Honda Motor (HMC)

HTC (2498:TT)

Hye, Park Geun

Hyundai Heavy

Industries (009540:KS)

75

22

15

26

18

41

62

68

48

26

24

44

34

21

36

18

M

M.Gemi

45

Macy’s (M)

68

Magic Leap

36

Magna Global

28

Malema, Julius

10

Manolo Blahnik

45

Marsal, Sergio

43

Martin, Garrett

31

McKnight, Bob

62

Mejias, Jason

73

Meredith (MDP)

28

Micallef, Amanda

68

Mickelson, Phil

58

Mitsubishi Motors (7211:JP) 21

Modi, Narendra

10

Moeller, Philip

30

Mondelēz International

(MDLZ)

48

Monsanto (MON)

41

Morgan Stanley (MS)

39, 40

Mulholland, Bill

34

Murga, Manolo

43

Murphy, Mike

51

Musical.ly

68

N

Nant Capital

41

Nataf, Emmanuel

44

NBC (CMCSA)

68

Nervve Technologies

33

Nestlé (NESN:VX)

24, 48

Net-a-Porter (YNAP:IM)

45

Newman, Todd

58

Nielsen (NLSN)

28, 73

Nike (NKE)

73

Nissan Motor (7201:JP)

21

Nomura Holdings (NMR)

40

Nordstrom (JWN)

68

O

36

24

24

62

44

68

34

36

36

48

J

JAB Holding

Jeep (FCAU)

Jenkins, Jo Ann

Jenner, Kylie

Jimmy Choo (CHOO:LN)

24

44

41

73

45

73

26

18

I

IiMedia Research

Illy, Andrea

Illycaffè

InBev (BUD)

Ingram Content Group

Instagram (FB)

Intel (INTC)

IQiyi.com

IResearch

It’Sugar

La Colombe

Leanpub

LendingClub (LC)

Levi Strauss

Lids (GCO)

Lululemon Athletica (LULU)

Lyft

24

62

76

68

45

Obama, Barack

OCI (OCI:NA)

O’Connor, Caitlin

Original Force

Ostrovsky, Josh

Outdoor Voices

Outerknown

12, 76

41

68

36

68

73

62

P

Pandora Media (P)

PayPal (PYPL)

PepsiCo (PEP)

Perrow, Kieren

Peterson, Amy

Pizer, Jennifer

Playboy Enterprises

Popular Pays

Power Knot

28

68

24, 68

62

74

29

68

68

34

Prada (1913:HK)

Priebus, Reince

Procter & Gamble (PG)

Pronoun

Prouty, Nicholas

Pulse Evolution

45

51

68

44

14

36

Toyota (TM)

21, 26

Tribune (TPUB)

41

Tribune Media (TRCO)

28

Trump, Donald

28, 30, 51

21st Century Fox (FOX)

68

Twitch

68

Twitter (TWTR)

51, 68

Two Sigma Investments

15

62

U

Q

Quiksilver

R

Rajaratnam, Raj

Rebecca Minkoff

Rebel Nell

Reedsy

Renaissance Technologies

Renault (RNO:FP)

Romney, Mitt

Royal Dutch Shell (RDS/A)

Rubin, Jeff

Rubio, Marco

Rue La La

Russell, Tara

Ryan, Paul

58

68

74

44

15

21

51

26

48

51

45

74

51

Uber

26, 39

UBS (UBS)

39

Ulukaya, Hamdi

24

Under Armour (UA)

26

Unilever (UL)

68

Unilever Indonesia (UNVR:IJ)

38

United Talent Agency

68

V

Varian, Hal

VaynerMedia

Vice Media

Volkswagen (VOW:GR)

15

68

68

26

S

W

Samsung (005930:KS)

62

Sanders, Bernie

51

Saynt, Daniel

68

Scavino, Dan Jr.

51

Serraj, Fayez

16

Sessions, Jeff

51

Silver, Nate

51

Singh, Manmohan

10

Six Flags Entertainment (SIX)

22

Skat Consulting

38

Slater, Kelly

62

Slowe, Thomas

33

Smith, David

24

Snapchat

68

Socialyte

68

Solman, Paul

30

Sony (SNE)

36

Soon-Shiong, Patrick

41

Speaker, Paul

62

SportsOneSource

73

SsangYong

Motor (003620:KS)

18

Star Avenue Capital

48

Starbucks (SBUX)

24

Steele, Michael

51

StubHub (EBAY)

33

Walker, Scott

51

Walmart Stores (WMT) 24, 26

Walt Disney (DIS)

22, 26

Walters, William

58

Wang Jianlin

26

Wasserman

33

Waterhouse Press

44

White, Greg

44

Whitman, Meg

26

Whole Foods Market (WFM) 26

Wild, Meredith

44

William Morris Endeavor

Entertainment

68

YouTube (GOOG)

68

10

Jacob

Zuma

T

Target (TGT)

Tegna (TGNA)

Tencent Holdings (700:HK)

Tesla Motors (TSLA)

TheStreet

Totally Green (TLGN)

Y

26

28

36

39

39

34

Z

Ziff, Dirk

Zuma, Jacob

62

10

How to Contact

Bloomberg Businessweek

Editorial 212 617-8120 Ad Sales 212 617-2900

Subscriptions 800 635-1200

Address 731 Lexington Ave., New York, NY 10022

E-mail bwreader@bloomberg.net

Fax 212 617-9065 Subscription Service

PO Box 37528, Boone, IA 50037-0528

E-mail bwkcustserv@cdsfulfillment.com

Reprints/Permissions 800 290-5460 x100 or

businessweekreprints@theygsgroup.com

Letters to the Editor can be sent by e-mail, fax,

or regular mail. They should include address,

phone number(s), and e-mail address if available.

Connections with the subject of the letter should

be disclosed, and we reserve the right to edit for

sense, style, and space.

MAIN IMAGE: ERIKA P. RODRIGUEZ FOR BLOOMBERG BUSINESSWEEK; CHEN: QILAI SHEN/BLOOMBERG; ZUMA: WALDO SWIEGERS/BLOOMBERG

14

RIGHT NOW,

YOUR BUSINESS

CAN GO

IN A MILLION

DIFFERENT

DIRECTIONS.

AND ONE OF

THEM IS RIGHT.

)'(-J8GJ<fiXeJ8GX]Ôc`Xk\ZfdgXep%

8cci`^_kji\j\im\[%

GROWTH IS LIVE.

SAP® S/4HANA gives

midsize companies constant

control over their business.

Live and in the moment.

On premise or in the cloud.

So you can make the right

decision – right now.

sap.com/growth

Opening

Remarks

The ANC

Is Not

Aging

Well

By Krista Mahr

10

With growth stalled, calls

for President Zuma to

step down are coming

from all sides

It’s election season in South Africa.

Small planes drag political slogans

across autumn’s blue skies while parliamentary sessions dissolve into scenes of

protest and fisticuffs far below. In April

the nation’s three largest political parties

staged rallies to unveil lengthy election

manifestos far ahead of municipal polls

on Aug. 3, with thousands of would-be

voters packing into sports stadiums to

show their support.

Some stadiums were more packed

than others. For the governing African

National Congress, the optics of its launch

weren’t ideal, with awkward swaths of

empty seats pictured in Nelson Mandela

Bay Stadium in the southern city of Port

Elizabeth, where President Jacob Zuma

spoke. The rally’s spotty attendance

didn’t escape the attention of South

African reporters, whose “preoccupation

with stadium seat-counting” was later

lambasted by an ANC spokesman, calling

it “the new science of ‘stadiumology.’ ”

Science or no, stadiumology is a triedand-true part of the electoral theater. I

moved to South Africa in March after

working as a journalist in India for

four years. As India prepared for its

own heated election in 2014, the media

drew regular comparisons between the

thinly attended rallies of the incumbent

Indian National Congress and the frenetic

crowds drawn by the opposition’s frontman, soon-to-be Prime Minister Narendra

Modi. Nobody expected Congress to lose

as big or Modi to win as big as they did

in May 2014. In retrospect, the mood in

the stands was a clear omen.

The ANC, the party that led South

Africa out of apartheid, has historic parallels and ties with India’s Congress party,

which was instrumental in freeing the subcontinent from British rule. And the travails of the two Congress parties—Indian

and African—have a lot to say about the

challenges faced by young democracies.

Calls for Zuma, who’s led the country

since 2009, to step down have come

from both an energized opposition and

freedom-struggle stalwarts. The party

leadership has backed Zuma, easily carrying him through a parliamentary vote

in April that attempted to remove him

from office. Since then, a court ruled that

a decision by state prosecutors to drop

almost 800 corruption charges against

Zuma was “irrational” and that he should

face charges. The president has applied

for leave to appeal the decision.

Zuma has continued to campaign

enthusiastically. On May 17, members of

the ultra-left Economic Freedom Fighters

(EFF) party calling for his ouster were

Nelson Mandela

Bay Stadium

during the ANC’s

manifesto launch

thrown out of parliament amid brawling and lobbed water bottles. Zuma proceeded to address the house, taking the

podium with a chuckle.

Not everyone is amused. For many,

22 years after South Africa’s first democratic elections brought to power the

party that fought apartheid, the optimism

that once defined the Rainbow Nation is

flagging. Protests over the state’s failure to

deliver basic services, such as water and

electricity, have become a fixture of civic

life. Economic growth has fallen from an

annual average of 5 percent from 2004

through 2007 to less than 1 percent, projected for this year. In early May the government announced that unemployment

reached 26.7 percent in the first quarter,

the highest in at least eight years.

Zuma has said South Africa is still a

success story—and it is—but for some, the

ANC has lost its luster. “When our leading

party took power, we thought all would

be well,” says Johanna Nomvete, a politician and member of a small ANC breakaway party, Congress of the People, at a

Johannesburg protest. Today, “the poor

remain poor, and the rich become richer.”

The mood is strikingly similar to New

Delhi in the runup to India’s national

LUCKY NXUMALO/GETTY IMAGES

South Africans hoped for

broad changes, but “the

poor remain poor, and

the rich become richer”

elections in 2014. Public sentiment had

turned against then-Prime Minister

Manmohan Singh, whose government

also faced allegations of large-scale corruption. The heady growth that had

captured the world’s imagination had

slowed. With widespread unemployment and few prospects for new jobs,

India’s young majority was instrumental in voting Congress out—a move their

grandparents wouldn’t have dreamed

of. “The system could no longer deliver,”

says Mohan Guruswamy, a fellow at the

Observer Research Foundation in New

Delhi. “Younger people were entering

the workforce in large numbers, and you

didn’t have jobs for them.”

Some say the ANC is repeating

Congress’s mistakes. “The ANC, the last

of the iconic liberation movements, is

falling in the trap of all of them,” says

William Gumede, executive chairman of

the African nonprofit Democracy Works

Foundation. Political parties born out of

liberation struggles often retain strong

majorities during their early years in

power for good reasons. Their supporters

have deep and emotional ties to the organizations, and as the parties start to

govern, there are credible excuses for

them to take time to rebuild weak institutions. But voter loyalty also means such

a party “can mess up for a while,” says

Gumede. “People support it for much

longer than they should.”

For any party, a clear majority means

there’s no urgent impetus to do the kind

of introspection and reform an electoral

defeat can spark. Problems that emerge,

be it a corruption scandal or poor administration, can linger, widening the gap

between party leaders and supporters to

the point of genuine disconnect. It happened in 1977, when India’s Congress

party lost power for the first time since

independence, and again in 2014. And

that’s what the ANC’s critics say is happening now in South Africa.

Of course, there are clear and important differences between South Africa’s

ANC and India’s Congress—among them

the size of the countries, the nature of

the struggles, and the rule they fought

against. The ANC has been in power for

a little over two decades; Congress was

in power for three before its first ouster.

By the time of its most recent victory,

Modi’s Bharatiya Janata Party had already

run India before and presented a much

broader challenge to Congress than

either of South Africa’s two main opposition parties, the Democratic Alliance (DA)

and the EFF, presents to the ANC today.

At last count, the ANC was still going

strong, capturing 62.1 percent of the 2014

vote, down slightly from 65.9 percent in

2009. Whether a sizable number of those

voters have lost faith won’t be clear until

August. Even if opposition parties perform

well in cities, the ANC could remain the

party of choice among rural voters,

where it dominates. National elections

aren’t scheduled until 2019: If the party

does perform badly in August, there will

be a window of opportunity for the ANC

to be introspective and alter its course.

“Personally, I believe if you got the right

leadership in place, you have a party

that has the greatest commitment and

empathy for the poor people, the people

in the street,” says Mavuso Msimang, one

of several ANC veterans who have recently

called for Zuma to step down. “But that

will only happen if you employ the right

people to do these things.”

India’s problems, for the record, didn’t

disappear under new management. Modi

has hit many of the same walls Congress

faced, and his much touted bid to make

India a manufacturing hub hasn’t taken

off. In the end, notes Guruswamy of

Observer Research, the BJP’s inability to

make a dent in joblessness among young

voters—who helped bring the party to

power in 2014—could be its undoing and

Congress’s next opportunity. That kind

of power struggle is healthy for democracies such as India and South Africa, says

Democracy Works’ Gumede: “That’s what

you want in a developing country. You

need a sense of competition.”

Whatever happens at the polls, that

sense of competition is growing. At the

end of April, Soweto’s Orlando Stadium

outside Johannesburg was overflowing

with EFF supporters, eagerly awaiting

the arrival of the party chief, former ANC

youth leader Julius Malema. They roared

as the firebrand politician entered the

stadium wearing the party’s trademark

red jumpsuit, beret, and his own signature gold aviators. The stadiumologists

had a field day. Mahr, now based in Johannesburg, was

a special correspondent for Reuters and

Time magazine’s bureau chief in India.

11

Bloomberg

View

To read Adam Minter

on why climbers are

still dying on Everest

and Noah Smith on

workers getting more

of the income pie, go to

Bloombergview.com

Sue the Saudis, and

The U.S. May Be Next

Guess which nation benefits the most

from sovereign immunity

and justice. They’ve already received billions from the

victim compensation fund established by Congress, and two

government investigations spent years producing the 9/11

Commission Report.

A more productive exercise of congressional authority

would focus on that report—specifically, the so-called 28 pages

from the initial Sept. 11 investigation that remain under seal.

Some lawmakers who’ve seen them say there’s nothing damaging to national security in them and they should be released.

Others say they’re filled with hearsay implicating prominent

Saudi citizens. A compromise isn’t hard to envision: Release

the pages, along with an explanation from the commission

as to why the allegations don’t hold up. Such an agreement

would also serve the cause of truth and justice—without jeopardizing America’s moral and legal standing in the rest of

the world.

Stop Trying to Impeach

The Head of the IRS

House Republicans are wasting taxpayers’

money to hobble an agency they despise

John Koskinen agreed to take one of the worst jobs in America.

Now he’s being punished for it. In 2013, President Obama asked

Koskinen to take over at the IRS amid budgetary chaos and a

simmering scandal. House Republicans, still angry about that

scandal—and about the concept of taxation generally—are trying

to impeach him.

Their case is weak. Start with the scandal. An inspector

general report in 2013 found that IRS employees had been

improperly scrutinizing conservative groups seeking taxexempt status. This was wrong, and blame was duly apportioned. The agency’s boss resigned, a top deputy retired, and

the director of the offending unit was placed on leave and

declared in contempt of Congress. The Department of Justice

investigated and found no evidence of criminality.

Representative Jason Chaffetz of Utah, chairman of the

House Oversight and Government Reform Committee, has

made a professional specialty of berating civil servants. He

appears to view Koskinen, who, recall, joined the agency after

the scandal, as obstructing further investigation.

Impeaching Koskinen—a punishment not invoked against

an executive branch appointee since Ulysses S. Grant occupied the White House—probably isn’t the objective anyway. The

point is to embarrass the IRS. And congressional Republicans

have already done a fine job of that by slashing the agency’s

budget while helping to vastly expand its responsibilities, with

predictably frustrating results.

Taxpayers are the ones who ultimately suffer when Congress

ignores more pressing business in favor of needlessly antagonizing the IRS. They’re also the ones footing the bill for 8,000-page

reports and shambolic impeachment proceedings.

ILLUSTRATION BY TOMI UM

12

It’s not easy to defend an obscure legal doctrine against claims

for justice from the victims of the worst terrorist attack on U.S.

soil. But doing so has become a necessity, because Congress

has decided to rewrite U.S. law on sovereign immunity.

On May 17 the Senate unanimously passed the Justice Against

Sponsors of Terrorism Act, which authorizes U.S. courts to

hear civil claims for monetary damages against a foreign state

accused of direct involvement in a terrorist act harming an

American citizen in the U.S. Under current law, almost all

foreign nations are immune from lawsuits in U.S. courts.

While the bill doesn’t name any particular country, it would

enable the Sept. 11 families to sue Saudi Arabia. Fifteen of the 19

hijackers were Saudi citizens, and some officials and members

of the royal family have long been accused of involvement in

the plot. President Obama has promised to veto the bill.

A veto would be well-deserved, and before members of

Congress try to override it, they might want to consider the

value of sovereign immunity—and the nation that benefits

from it the most. (Hint: They represent it.) If other nations

follow the Senate’s lead, no country would be a bigger, better,

richer target for lawsuits than the U.S. In Cuba and Iran, courts

have already issued billions of dollars in judgments against

Washington. This potential legal liability would hang over the

U.S. fight against global terrorism and leave the government

liable for actions by U.S. troops in Afghanistan, Iraq, Syria,

and elsewhere. U.S. aid to Israel, for example, could leave it

open to suits from Palestinians injured by Israeli troops. The

entirety of U.S. foreign policy could be put on trial under the

guise of seeking monetary justice.

Acknowledging the importance of sovereign immunity

doesn’t require overlooking the Saudis’ role in the rise of

Muslim extremism. But the response to that activity properly

resides in the realm of diplomacy and trade policy, not in court.

No one can deny the right of the Sept. 11 families to truth

G ob

Eco o ics

M y 30 — June 6, 2016

May

6

Without growth,

g

it can’t hope to pay off its debtt

Tax breaks for investors could spark “tremendous resentment”

On the day after Puerto Rico’s latest

debt default, one of the island’s richest

men, developer Nicholas Prouty, is

less concerned about his $110 million

building project in the heart of

San Juan than he is about the emptiness that surrounds it. “Those are the

only cranes you’ll see on the skyline,”

Prouty says in his office next to the

condominium construction site. While

politicians are preoccupied with a debt

deal, he sees little attention being paid

to Puerto Rico’s real problem: its stagnant economy. “There’s talk of either

a bailout or austerity, and I think those

are false choices,” Prouty says. “You

need to have a growth-based model

here in order to emerge.”

Puerto Rico’s debt debacle entered a

new phase with its $370 million default

on May 1. Washington is gearing up to

put the island’s finances under federal

oversight, so a deal can be worked out

with bondholders and more revenue

can be raised to pay them. Missing from

the effort so far is a plan to end the economic malaise that’s lasted a decade—

even though a return to growth is

creditors’ only chance to get some of

their $70 billion back.

If that sounds familiar, it’s because

it pretty much describes the situation

in Greece, says Desmond Lachman,

a resident fellow at the American

Enterprise Institute and former

deputy director of the International

Monetary Fund’s Policy Development

and Review Department. As with

Greece, policymakers have set out to

squeeze extra cash from a country

without its own currency or central

bank. “We saw in Greece that all that

does is, it weakens the economy,”

he says. “Then the budget doesn’t

improve like you thought it would. The

debt ratios keep rising.”

In the past, Puerto Rico has been able

to use its limbo status as neither a sovereign nation nor a U.S. state to its advantage, mostly through tax gimmicks. For

decades, pharmaceutical companies

flocked to the island to avail themselves

of a federal rule that allowed them to

get a tax break on profits. The incentive was eliminated in 1996, although

companies were given a 10-year grace

period to move elsewhere before taxes

went up. They did—and in 2006, Puerto

Rico’s slow-motion economic collapse

began. “Since then, the Puerto Rican

government has been improvising,” says

Antonio Fernós Sagebién, an economics

professor at the Interamericana

ILLUSTRATION BY 731; CYBORG: SHUTTERSTOCK. DATA: GOVERNMENT DEVELOPMENT BANK OF PUERTO RICO; U.S. CEN

NSUS BUREAU

U

14

The illegal dollar trade

prospers in Libya 16

Korea’s shipping

industry is sinking

fast 18

University of Puerto Rico in San Juan.

Among the latest tax breaks the government has tried is a controversial provision from 2012 that sought to attract

wealthy foreign investors by offering

a tax exemption for interest and dividends. That’s partly what led Prouty to

move there in 2013 from Connecticut,

where he’d set up a distressed real

estate fund in Greenwich. As an owner

mostly of real estate rather than financial assets, Prouty says he doesn’t

personally gain much from the tax

program, but that Puerto Rico could be

benefiting more from the investment it

does attract. “It’s hot money,” he says,

warning that some in the program may

simply move on when a better deal

appears elsewhere. “Those people need

to become engaged in Puerto Rico, or

that program runs the very real risk of

creating tremendous resentment.”

Although wealthy migrants enjoy

their tax breaks, Puerto Ricans who

run domestic businesses feel they get

stuck with higher taxes, says Ricardo

Alvarez-Díaz, who runs an architecture

and interior design firm and is chairman of the island’s builders association.

“Every day there is another permit they

need to open their business,” he says.

“It gets to a point where you either close

your business or you leave.”

Puerto Ricans have the right to live

on the mainland, and as the economy

slumps, they’re exercising it. The population fell 7 percent, to 3.5 million, from

2010 to 2015, according to U.S. Census

Bureau data. Recent migrants to the

U.S. have tended to be less educated,

but many professionals are leaving, too:

Doctors departed at the rate of more

than one a day last year. Stemming the

outflow will require fixing the economy.

For now the focus is on finding revenue

to prevent further defaults. As a result,

everything, including water bills and

sales taxes, has been increased.

The next important date in Puerto

Rico’s crisis is July 1, when a $2 billion

payment comes due. Puerto Rican

authorities project a 2 percent decline

in gross national product for the year

starting on July 1, which would be

the fifth straight, after a projected

1.2 percent drop for the fiscal year

that ends on June 30. Unemployment

is running at 11.7 percent, and the

labor participation rate—the portion

of the labor force that’s economically

active—is barely above 40 percent.

Local business leaders say Puerto

Rico must again make use of its

in-between status. In tourism, for

example, it has the white-sand

beaches of a Caribbean island but with

an infrastructure that’s closer to U.S.

standards than that of some competitors. It has a bilingual professional

class and labor costs that are low for

the U.S., if not for Latin America.

Fernós Sagebién, the economics professor, says Puerto Rico can get back

into manufacturing sophisticated

products such as medical devices by

taking advantage of its engineering

programs to make products for the

U.S. market. Prouty says the island can

lure retirees with a combination of

mainlandlike emergency medical care

and year-round sunshine.

One step that Congress will probably

take in its rescue package is a reduction of the minimum wage to below

mainland levels. Lachman, the former

IMF official, says that makes sense. But

he also says the U.S. will probably have

to take more drastic action to revive

Puerto Rico’s economy—“give them

some sort of tax break,” or maybe even

inject funds, though only to stimulate

the economy, not to pay off creditors.

Congress is adamant that whatever

measures it adopts won’t be a “bailout.”

Prouty says he’s pushing for a

growth-friendly plan for Puerto

Rico by knocking on every door he

knows. That includes lawmakers in

Washington, and even Hillary Clinton:

Prouty has a photo of himself with the

Abandon Ship

4%

3.8m

Puerto Rico

population

2%

0%

Change in Puerto Rico’s

gross national product

-2%

3.5m

’05

’15

-4%

Democratic presidential candidate on

display in his office. “Businesses like

certainty, and there’s a lot of uncertainty for sure,” he says. But Prouty

says he doesn’t regret his decision to

move to the island and invest there. “I

don’t make those decisions based on

my gut,” he says. “I also believed—and

still do—in the Puerto Rican economy.”

—Jonathan Levin

The bottom line Puerto Rico’s $370 million debt

default exposes structural weaknesses of an

economy that’s smaller today than a decade ago.

Monetary Policy

Will a Computer Set the

Federal Funds Rate?

Machine learning may soon help

central bankers decide policy

15

“The capability is here. The

biggest hurdle is … cultural”

Artificial intelligence (AI), which is

already steering cars, could help

steer the world’s biggest economies

i

in the next half-decade. Brritain’s

a

central bank has been dev

velopping computer algorithms ffor

diforecasting economic conditions and helping determine

interest rate policy. Other

monetary authorities are

y

close behind. “The capabiility

is here,” says Andrew Lo,

director of MIT’s Laborato

y

ory

for Financial Engineering.. “The

biggest hurdle is the cultural

barrier. You’ve got a lot off central

bankers who are not as op

pen

to technology.”

The Bank of England, un

nder the

direction of Chief Economiist Andy

y

Haldane, has quietly becom

p

me a pacesetter in exploring the possibilities

of AI. Paul Robinson, who heads

the bank’s two-year-old Advanced

Analytics unit, says the goal is to assist

rather than replace humans. He says

“many” central banks are at roughly

the same stage of research and predicts that AI will make a meaningful

Global Economics

FRB/US doesn’t learn on its own.

“For the foreseeable future, the best

approach will involve a combination

of empirical rigor captured in models,

together with human judgment,” says

David Wilcox, director of the Fed’s division of research and statistics.

Some AI champions, such as Google

Chief Economist Hal Varian, are also

skeptical about AI’s ability to make

economic forecasts, but for different

reasons. As he sees it, the technology is

ready, but the data—the copious supply

of raw numbers that AI programs sift

through to reach conclusions—are

wanting. “The data sets are so small.

GDP is released quarterly, so 50 years of

data is only 200 observations and only

seven recessions,” he wrote in an e-mail.

AI will soon have a lot more data to

chew on. Web scrapers such as MIT’s

Billion Prices Project are already

combing the internet for real-time

price points relevant to inflation.

Economists and computer scientists

agree there will always be a role for

human beings in central banking. As

Michael Feroli, chief U.S. economist at

JPMorgan Chase, puts it: “I don’t see

why, in principle, you couldn’t have a

computer set monetary policy. Having

it testify before Congress is another

matter.” —Christopher Condon

The bottom line The machine-learning branch of

artificial intelligence could help central bankers set

interest rates within five years.

Currency

The Dollar Plays a Role

In Libya’s Woes

The black market in greenbacks

is undermining the government

“We aren’t breaking the law … there’s no law to be obeyed”

Amid the upmarket apparel and

jewelry shops along Benghazi’s Dubai

Street another luxury good is for sale:

crisp U.S. dollar notes. In plain view

of Libyan police, stores deal in illegal

foreign exchange. “The black market

is seen as the bad guy, but we just offer

services the state has failed to provide,”

says Muhsin Ahmed, a money changer.

“We aren’t breaking the law, because

there’s no law to be obeyed.”

Rival political factions control Libya.

Islamic State has captured about

250 miles along a central stretch of

the country’s Mediterranean coast.

Attacks on oil installations by militias

and a slump in crude prices are draining state coffers. Smuggling of migrants

and arms is rampant.

The illegal dollar trade shows how

little the public trusts the government. It fuels corruption among

businessmen and

finances the militias, complicating

billion

Prime Minister

Fayez Serraj’s

Libya’s foreign

efforts to unify

currency reserves,

the country

down from

under a United

$106 billion

in 2013

Nations-backed

administration.

“The deterioration of the state has

pushed individuals to black-market

activities,” says Claudia Gazzini, senior

analyst for the International Crisis

Group, a think tank in Brussels. Libyans

involved in the black market say they

want a unified government to provide

legal economic opportunities, she says.

“But at the same time, they appear

to have more to gain by continuing in

this state of economic chaos.” In May

the well-respected official audit court,

which monitors public finances, said

the black market is “causing extreme

harm to the economy and escalating

the collapse of the state.”

Oil is almost the only thing Libya

exports, and in the past it was a steady

source of foreign currency. The state’s

inability to sustain production in the

face of militia attacks as well as lower

oil prices have put the economy in critical shape. The fields currently pump

about 175,000 barrels a day, down from

about 1.6 million before the 2011 revolution. Foreign currency reserves are

$68 billion. They were $106 billion in

2013. The central bank bars Libyans

from exchanging dinars for dollars at

commercial banks. So they turn to the

black market, which is so much a part of

life that TV channels report daily rates.

Those rates are up to 2.8 times the

official rate, which is 1.39 dinar to the

dollar. Haitham Abou Zaid, a pharmacist, says he has bought hard currency

from the central bank at the official

rate to import medicine. “I used to

$68

RON SACHS/REX/SHUTTERSTOCK

16

contribution to monetary policymaking “certainly within five years.”

Improvements would be welcome.

Economists are, by their own admission, notoriously bad at making predictions. Consider the forecasts for

2015’s U.S. gross domestic product

issued by Federal Reserve policymakers at the end of 2014. All 17 overestimated the eventual rate of growth,

the closest by 0.2 percentage point, the

furthest by 1.3 percentage points. The

actual number was 1.9 percent.

Machine learning allows a computer

to acquire a skill for which it hasn’t

been explicitly programmed. Google’s

self-driving car learns to drive by

detecting patterns in vast amounts of

driving data. Hedge funds, such as Two

Sigma Investments and Renaissance

Technologies, are already using AI to

help make investment choices.

At central banks the principal task

is to set an interest rate on short-term

borrowing that guides the economy to

a sweet spot between unemployment

and inflation. Because rates work with

a lag, doing so depends on forecasting

economic conditions 6 to 12 months

down the road.

One thing that makes monetary

policy tricky is that a rate change will

alter the conditions you’re trying to

predict. And long-established connections among ecconomic variables can

ti

change.

ch

g For ex

xample, the inverse relattionship

h p between unemployment and inflation—what

m

econ

e

nomists call the Phillips

ccurrve—seems to have disap

appeared

in recent years.

R

Robinson,

of the Bank of

England, concedes that

AI works well when the

structure of the economy

is “invariant,” or stable,

bu is “less useful when it

but

do undergo shifts.”

does

T U.S. Federal Reserve

The

iis moving

g gradually on AI. It uses

mod

ccomputer

p

dels, in particular one

called FRB/US (pronounced “ferbus”),

to help with forecasts. FRB/US is a “selfcontained set of equations, data, programs, and documentation,” according

to the Fed’s website. It’s useful for

generating answers to specific what-if

questions: What will happen to

unemployment if 10-year Treasury

yields rise by 2 percentage points?

Unlike a machine-learning system,

Reinvent:

Healthcare

The AWS Cloud helps Philips

turn clinical data into actionable insights. Through a global network and

deep data repository, Philips HealthSuite helps clinicians around the world

draw on the wisdom of petabytes of health data to create personalized

patient diagnoses and treatments.

Global Economics

The bottom line Since Libya’s oil industry

contracted, a thriving black market in U.S. dollars

has sprung up.

Jobs

Layoffs Come to

Korea’s Shipyards

Slower growth, fewer orders, and

rivalry with China have an impact

Being fired was “like being pushed

into a desert with no water”

With the South Korean government

formulating a plan to restructure

many of the country’s indebted companies, the shipbuilding industry—the

source of about 8 percent of the country’s exports last year—is bracing for

only by his surname, Kim, initially

delivered newspapers and worked

Value of orders received

in construction after losing his

by Korean shipbuilders

job. He’s now on a temporary con$48b

tract at a retailer and taking night

shifts as a driver to get by. Even

$36b

though he’s working two jobs, his

income is half what it was. Being

$24b

fired was “like being pushed into a

desert with no water,” Kim says.

$12b

In an April cabinet meeting,

President Park Geun Hye said

0

procrastinating on restructuring

is like a sick person frightened

2012

2016*

*PROJECTION. DATA: EXPORT-IMPORT BANK OF KOREA;

about

undergoing lifesaving surgery.

CLARKSON; MINISTRY OF TRADE, INDUSTRY, AND ENERGY

Korean exports have fallen for more

especially deep layoffs. Many of the

than a year, and mounting levels of

job losses will come in industrial hubs

corporate debt are weighing down

companies that need to find new

along the southeast coast where shipsources of growth.

yards and ports dominate the landDaewoo Shipbuilding & Marine

scape. These heavy industries helped

Engineering plans to cut about

propel growth in previous decades

10 percent of its workforce, or about

but have been battered more recently

1,300 people, by the end of 2018.

by a slowdown in the global economy,

Hyundai Heavy Industries says it’s

overcapacity, and rising competition

offering some employees early retirefrom China. Korea’s government and

ment, after reducing the number

state-run banks are pushing compaof executives by 25 percent.

nies to cut back on staff and “The possibility of

me getting a new

Layoffs are expected to balloon

sell unprofitable assets.

job that offers

as the downsizing at major

About 205,000 workers

similar income and

companies ripples through the

were employed in Korea’s

benefits is about

1 percent.”

shipbuilding industry as of

rest of the industry. Ha Chang

—An employee

the end of 2014, according

Min, an official at the subwho was laid off at

to the Korea Offshore &

contractors’ labor union for

SsangYong Motor

Shipbuilding Association. Lee

Hyundai Heavy, says the union

Mi Seon, an analyst with Hana

expects about 10,000 workers

Financial Investment, wrote

to lose jobs this year.

in a report that an estimated

In Ulsan, a major indus10 percent to 15 percent of those

trial city on the southeast coast,

workers will lose their jobs.

claims for unemployment benefits

In Korea, losing a permanent, fullrose 18 percent in the first quarter

from a year earlier, compared

time position often means sliding

with a 1.3 percent increase for the

toward poverty, one reason why

labor unions stage strikes that at

whole country, data from the labor

times escalate into violent confronministry show.

tations. Because Korean companies

The worst may be yet to come. The

value of new orders at Korea’s shiptypically prefer hiring and training

young employees, rather than recruitbuilders fell 94 percent in the first

ing experienced hands, many laid-off

quarter from a year earlier, and it’s

workers drift into low-wage, temporary forecast to fall 85 percent for all of 2016,

jobs that lack insurance and pension

says the Export-Import Bank of Korea.

benefits, says Lee Jun Hyup, a research

The slide suggests companies will no

fellow for Hyundai Research Institute.

longer be able to hold on to employees

“The possibility of me getting a

once current projects end. —Jiyeun Lee

new job that offers similar income

The bottom line The government of South Korea

and benefits is about 1 percent,” says

is pressuring heavily indebted manufacturers,

especially shipbuilders, to lay off thousands.

one of about 2,600 employees who

were laid off in 2009 in the restructuring of SsangYong Motor, Korea’s

Edited by Christopher Power

No. 4 automaker. The 45-year-old

and Matthew Philips

worker, who asked to be identified

Bloomberg.com

Run Aground

ILLUSTRATION BY 731

18

sell at satisfactory prices, and

customers were happy,” he says.

“Now I have to buy dollars from

the black market. The prices got

very high, and some people cannot

afford to buy what they need.”

Companies forge invoices from

foreign suppliers to buy dollars

from the central bank to pay the

phony bills, say bankers, money

changers, and importers. They then

arrange phantom shipments to

make these fake invoices seem legitimate. Eight containers supposedly

carrying aluminum bars were found

empty in the port of Khoms, local

security forces said on May 7. They said

the containers were part of a moneysmuggling scheme. Other strategies

include businessmen opening up a

company in Libya and another in Dubai

and sending themselves fake invoices.

Next they sell the dollars gotten from

the central bank on the black market

for two to three times what they paid.

Libyans who get dollars often wire the

money to Dubai banks, says a manager

at one of Libya’s biggest private banks

who’s in charge of letters of credit.

Ten exchange shops flourish

on Dubai Street. “Everyone here

knows that we deal with our customers with more integrity than

banks do,” says Ahmed, the money

changer. “And in lawlessness, trust is

everything.” —Ghaith Shennib and

Caroline Alexander, with Saleh Sarrar

Make your holiday

mail irresistible

Now is the time to prepare yourself to break through the holiday clutter, and our

Irresistible MailTM book may be just the place to start. It’s full of interactive experiences

using digital technologies and innovative printing techniques to help drive sales.

Go to usps.com/physicalmail and order your FREE limited edition copy of our

Irresistible MailTM book† now, or fill out and return the attached Business Reply Card.

†Limit one book per customer per address. Offer available while supplies last.

Privacy Notice: For information regarding our privacy policies, visit usps.com/privacypolicy

©2016 United States Postal Service®. All Rights Reserved. The Eagle Logo is among the many trademarks of the U.S. Postal Service®.

A272

Give your health

coverage wings.

70 percent of employees say

they’d likely purchase voluntary

insurance if it were offered by

their employers.1

The question is, who will you choose?

You could opt for a voluntary option from another

carrier, or you could offer coverage from Aflac — the

provider whose promise is to process and pay, not

deny and delay.

There’s no direct cost to employers for offering it,

and our portfolio of coverage options are sure to

complement any major medical plan.

Just add a payroll deduction, notify your workforce

and let it fly.

Contact your Broker, local Aflac Agent,

or go to aflac.com

Critical Illness

1

Accident

Hospital

2015 Aflac WorkForces Report, a study conducted by Research Now on behalf of Aflac, January 20 - February 10, 2015. Includes somewhat, very and extremely likely; of those employees who are not

currently offered voluntary insurance benefits by their employers. 1One Day PaySM available for most properly-documented, individual claims submitted online through Aflac SmartClaim® by 3 p.m. ET. Aflac SmartClaim®

not available on the following: Disability, Life, Vision, Dental, Medicare Supplement, Long-Term Care/Home Health Care, Aflac Plus Rider, Specified Disease Rider and Group policies. Aflac processes most other claims

in about four days.. Processing time is based on business days after all required documentation needed to render a decision is received and no further validation and/or research is required. Individual Company Statistic,

2015. Individual coverage is underwritten by American Family Life Assurance Company of Columbus. In New York, coverage is underwritten by American Family Life Assurance

Company of New York. Worldwide Headquarters | 1932 Wynnton Road | Columbus, GA 31999

Z160063

1/16

Companies/

Industries

The Disneyfication

of China 22

Briefs: Toyota hails

Uber; New York’s

Domino’s theory 26

Everybody wants to

sell you a cold coffee

24

May 30 — June 6, 2016

Le Cost Killer

21

Carlos Ghosn, the auto industry’s superhero, is trying to save Mitsubishi Motors

PHOTO ILLUSTRATION BY 731; PHOTO: GETTY IMAGES

“There’s a huge reward if we are successful”

When Carlos Ghosn was brought

in to rescue loss-ridden Renault in

1996, it took him only a year to turn

the French carmaker around. The

20 billion French francs of expense

cuts he imposed earned him the nickname Le Cost Killer. Three years later,

Ghosn was sent to revive Renault

partner Nissan Motor, which had

been unprofitable in seven of the previous eight years and was the most

indebted carmaker in the world. By

fiscal 2003 it had become the globe’s

most profitable major automaker.

His revival of Nissan remains one of

the industry’s extraordinary success

stories. Ghosn even became the

subject of a comic book series that

reached 300,000 Japanese readers in

monthly installments in 2001.

Now he’s being called in to play

superhero again, as part of Nissan’s

agreement in May to pay $2.2 billion

for a controlling stake in Mitsubishi

Motors, which saw its shares plunge

40 percent after a scandal broke

in April. The peripatetic Ghosn—

he’s chief executive officer of both

Yokohama-based Nissan and Franceheadquartered Renault—will need to

quickly clean up Mitsubishi’s image,

which has been tainted by the company’s recent admission that for more

than two decades it used improper

fuel-economy testing methods and

since 2011 has overstated the fuel efficiency of its minicars sold in Japan.

He’ll also likely have to get out his scissors again, to eliminate overlap in purchasing and vehicle development.

An embattled Mitsubishi faces

big scandal-related costs in Japan.

Production losses, penalties, and compensation to customers could total as

much as 376 billion yen ($3.4 billion),

estimates Goldman Sachs analyst Kota

Yuzawa. Yet it isn’t in as bad financial shape as Renault and Nissan were

when Ghosn arrived to rescue them

in the 1990s. Mitsubishi had about

450 billion yen in net cash as of

Companies/Industries

22

March 31 and has been profitable for

seven years.

So if Ghosn can squelch the fuelefficiency scandal and put in place cost

cuts that restore investors’ faith in the

company’s future, Nissan stands to

get a healthy return on its Mitsubishi

stock—and protect the steady supply

of minicars Mitsubishi builds for sale

under the Nissan name.

“I don’t think we can say what’s

coming is much more difficult than

what we have seen,” says Ghosn. “It’s

going to be challenging. There’s a huge

reward if we are successful.”

A Renault-Nissan-Mitsubishi alliance—

which would create the world’s fourthlargest automotive group—could yield

big savings by combining parts and

materials purchasing, sharing powertrains, and jointly developing minivehicles, according to Credit Suisse

analyst Masahiro Akita. “If you lay out

everything that’s known currently, the

deal could represent quite a smart decision,” says Thomas Glendinning, an

auto analyst at BMI Research.

Mitsubishi and Nissan set up their

minicar venture in 2011 and have been

Desperately Seeking Carlos

Even before Mitsubishi’s fraudulent emissions

testing was exposed, the automaker had been

reporting slowing sales around the world.

Annual change in Mitsubishi Motors

vehicle sales

30%

15%

0%

-15%

-30%

’05

’15

After the news, investors quickly jumped ship.

Share price in yen

1020.5¥

549¥

12/30/15

5/23/16

FIGURES REPRESENT ANNUAL CHANGE FROM YEAR ENDED ON MARCH 31

OF FOLLOWING YEAR. DATA COMPILED BY BLOOMBERG

looking to strengthen ties, Ghosn says;

the fuel-economy scandal just accelerated the talks. He lists common

vehicle platforms, shared electric-car

technologies, and financial-services

ventures among the areas in which

Nissan and Mitsubishi can cooperate more. He’s also sending Nissan

managers to run vehicle development

at Mitsubishi.

What Ghosn wants most from the

tieup may be more exposure to fastgrowing Southeast Asia, where Nissan

trails Toyota Motor, Honda Motor,

and even the much smaller Mitsubishi.

After closing plants in Europe and the

U.S., Mitsubishi is focusing on expansion in Southeast Asia, where its

popular Triton pickup and Pajero SUV

help it sell twice as many vehicles as it

does in Japan. It has said the mileage

scandal didn’t occur there.

“They assured me that there are no

problems outside Japan,” says Ghosn.

“These are people we trust—we have

been working with them for four years,

and they never told us something

which was completely out of whack.”

Nissan, whose engineers were the

whistleblowers who initially noticed

discrepancies in the fuel economy of

minicars supplied by Mitsubishi, will

have to help its new partner overcome

the crisis first. Investigations into

Mitsubishi’s overstating of mileage

are still under way,

Sales gains in

and the company

Asia didn’t fully

offset declines in recently found that

Europe and Japan

models other than

minicars were also improperly tested

in Japan. Mitsubishi President Tetsuro

Aikawa has said he’ll step down after a

shareholder meeting in June.

Mitsubishi could burn through

its cash quickly, says Koji Endo, an

analyst at Advanced Research Japan.

That’s because Endo expects sales

of Mitsubishi vehicles to fall in Japan

as news of the scandal spreads—its

minicar sales fell 45 percent in April—

and liabilities regarding the mileage

misstatements to be large. In the worst

case, says Endo, Ghosn may even have

to shut down Mitsubishi’s Japanese

operations and rely solely on its

healthy business in Southeast Asia.

Under Nissan’s agreement with

Mitsubishi, Ghosn has a year to complete the investment deal. Yet BMI

Research’s Glendinning says even that

might not be enough time to carry out

a thorough investigation and “pinpoint all of the misconduct by the corporate management.”

Ghosn says Nissan won’t be

“jumping into a black box” and will

be able to confirm all the facts before

completing the Mitsubishi investment

deal within four months. If somehow

Mitsubishi doesn’t confirm its numbers

and projections, he says, it’s a reason

to “stop whatever we are engaging.”

If things go as planned, analysts

expect a repeat of the very nonJapanese management style—

fast-paced, sharp-penciled—Ghosn is

known for. “He is a different animal,”

says Edwin Merner, president of

Atlantis Investment Research in

Tokyo. “He sees things in a very objective way.” Mitsubishi is about to learn

that firsthand. —Kae Inoue and Ma Jie

The bottom line Nissan is trying to revive Mitsubishi

Motors, whose stock fell 40 percent in April after it

admitted overstating mileage of its minicars.

Entertainment

Disney’s New

Cultural Revolution

At its Shanghai park, it’s pushing

a novel art form: Musical theater

It’s “doing something in China

that has never been done before”

When Niu Tianlong graduated from

the Shanghai University of Sport

last year, the 22-year-old planned to

pursue his passion for a full-contact

Chinese martial art known as wushu.

Then Walt Disney came calling.

Nowadays he’s lacing up his kneehigh boots, donning pantaloons and

a blue bandanna, and rehearsing a

sword-fighting scene to prepare for

the June 16 opening of the $5.5 billion

Shanghai Disney Resort theme park.

“The physical part is not tough at

all compared to wushu, but the performance, the expressions on my face

and acting—that’s very challenging,”

says Niu, who has been hired to play a

swashbuckler and entertain park visitors between attractions.

In Disney’s effort to expand its signature character-based entertainment

to China, figuring out millions of small

Shanghai

Disney

Companies/Industries

Rehearsing for a

show at Shanghai

Disney

QILAI SHEN/BLOOMBERG (2)

Li will play Nala in

the Mandarin

version of The Lion

King

details such as the Mandarin translation for hakuna matata have been the

least of its worries. Instead, managing an epic, yearlong casting call for

the 1,000 performers for marquee

musicals such as The Lion King and all

manner of other acts that make the

Magic Kingdom such a powerful draw

has proved more challenging.

Performance arts training on the

mainland tends toward classical

Chinese forms in major urban areas,

and is pretty much nonexistent everywhere else. In the U.S., there’s a surplus

of people who can act, sing, dance, or

do all three. In China, the relatively few

performers who’ve studied Western

musical forms are more likely to have

studied operatic bel canto pieces than

belt-it-out Broadway tunes.

That’s forced Disney to improvise.

Years ago, when Shanghai Disney was

in the concept phase, the company

started building its own talent development network from scratch by partnering with 30 arts institutes around

the country. “Disney is doing something in China that has never been

done before,” says University of

Virginia Darden School of Business

professor Elliott Weiss, who has

written a case study on Shanghai

Disney. “The question is when the

park can be profitable, given the additional investment they have had to

make finding and training talent.”

Disney has long cultivated its brand

with Chinese millennials, many of

whom first encountered Mickey Mouse

only in 1986, when the state-controlled

China Central Television network

started to broadcast Disney animation. In 2008 the company launched

its Disney English-language training

schools in China, starting in Shanghai.

Disney now has 28 learning centers

in seven cities across China that teach

kids ranging from age 2 to 12, with class

materials featuring Disney characters

such as Buzz Lightyear and Nemo. It’s

also searching for talent through an outreach program with drama and dance

programs, such as the one at Shanghai

Normal University, where it discovered

Yu Liang, 24, who landed the female

lead role in a Shanghai Disneyland

production based on the Pirates of the

Caribbean character Jack Sparrow.

When Li Weiling, 28, got a callback from Disney after a year of auditioning, it was a huge career break.

The graduate of the prestigious

Shanghai Conservatory of Music had

been teaching full time after finishing a two-year run in 2014 as Silibub

in a Chinese-language production of

Cats. “In my second year of university, my teacher gave me Nala’s song,

Shadowland, to sing,” she says. “I

didn’t know about this musical then.

Now I am trying to cope with the pressure of being China’s first Nala.”

With less than a month to go before

the Shanghai Disney opening, Chinese

performers are rehearsing with directors and trainers flown in from the

U.S. After Disney gets its troupe ready

for prime time, the next challenge

may be keeping them.

Starting next year, Shanghai

Disney will face greater competition. DreamWorks Animation has a

$2.4 billion DreamCenter park scheduled for 2017 in Shanghai, while

China’s Haichang Ocean Park

Holdings will open China’s largest

marine park there next year. And Six

Flags Entertainment will open a park

on the mainland, its first outside North

America, in 2019. Industry consultant

Aecom forecasts that 59 more theme

parks will open in China by 2020,

serving an estimated 220 million

parkgoers annually. That’s roughly the

current size of the entire U.S. market.

“After it has invested in training,”

says Darden’s Weiss, Disney “might

23

We see

opportunities

when others

don’t.

Where do focus,

The bottom line The $5.5 billion Shanghai Disney

park is hiring 1,000 performers to act, sing, or

dance their way into Chinese consumers’ hearts.

Drinks

relentless

The Hot Business

Of Cold Coffee

commitment

and higher

Companies are betting big on

canned and bottled java

expectations

“Maybe you want to have a

six-pack for your picnic”

get you?

To places you’ve

only dreamt of.

We are Athene.

And we are driven

to do more.

ATHENE

lose the talent to competitors.”

Niu, the martial arts student turned

pirate, says he’s enjoying his crash

course in show business, though his

proud parents back in Henan province

are a little puzzled by the career change.

“In the village, we know characters like

Snow White and the Seven Dwarfs, but

you don’t really know that they belong

to a company called Disney,” he says.

Shanghai Disney is all about changing

that. —Bloomberg News

Driven to do more.

®

Athene.com

ANNUITIES

REINSURANCE

INSTITUTIONAL PRODUCTS

America’s seemingly insatiable thirst

for a good hot cup of joe has helped

coffee shops grow into a $21.2 billion

industry and turned java joints like

Starbucks into societal fixtures. Now

coffee makers are betting U.S. grocery

shoppers will embrace an even cooler

way of getting their caffeine jolt:

chilled bottled and canned coffee.

Global giants such as

Illycaffè and upstarts

such as High Brew

Coffee and Chameleon

Cold-Brew are rushing

to put their products

on ice. Coca-Cola,

Dr Pepper Snapple

Group, and other

beverage makers

are jumping in.

And a StarbucksPepsiCo partnership, which has long

dominated packaged cold

coffee, is introducing new

chilled brews.

While sugary iced-coffee concoctions,

like Starbucks’s

Frappuccinos, have

been popular for

years, baristas and tony coffee bars

are seeing an increasing demand for

more sophisticated iced espressos

and lattes. Some say they serve more

cold coffee than hot—even during

winter. For the fourth quarter of

2015, Starbucks reported a 20 percent

increase in iced drink sales nationwide following its introduction of

cold-brew coffee in its retail stores.

Unlike iced coffee, such drinks are

brewed cold, taking 12 hours. Now

coffee makers are pressing to get more

of those high-end, lower- calorie and

less-sugary cold brews and lattes on

the shelves of stores such as Walmart,

Kroger, and Costco.

“When given a choice, people tend

to make the healthier, better-for-you

choice as long as it’s within a reasonable cost premium,” says Chris

Campbell, co-founder of Chameleon,

where sales are growing at triple-digit

annual rates.

The U.S. market for canned or bottled

ready-to-drink coffee has been growing

by double digits annually since 2011,

and Euromonitor International expects

the market to reach

Ready-to-drink

close to $3.6 billion

U.S. coffee sales by 2020—up sixfold

$2.4b since 2001. The

global market for

such drinks was

$1.2b $18 billion in 2015.

Michael

Butterworth, cocreator of the

0

Coffee Compass

2001

2015

blog, says the cold

coffees on U.S. grocery shelves

“have a long way to go” in terms

of quality and taste. “But there’s a

proven market for these products,

and you’re going to see more and

more of them,” he says.

One of the promises of canned and

bottled coffees, which are portable

and durable, is that they’ll open up

the universe of high-end coffee

to folks who may not live around

the corner from a hipster cafe, says

Chermelle Edwards, creator of a

blog called Coffeetographer. “Maybe

you want to have a six-pack for your

picnic,” she says. “You don’t go to

a coffee shop and buy 10 coffees for

your party, but you’ll buy

cold-brew. It’s like beer,

like craft beer.”

Beverage industry

ILLUSTRATION BY JOSH FREYDKIS; DATA: EUROMONITOR

Companies/Industries

We see you reaching places

you’ve only dreamt of.

We see opportunity when others don’t. Our innovative ⇒nancial solutions combined

with relentless focus take performance to a whole new level. And for you, that

means never settling for status quo. If you see things like us, visit ATHENE.COM.

Driven to do more.

®

ANNUITIES • REINSURANCE • INSTITUTIONAL PRODUCTS

Athene © 2016

Companies/Industries

executives hope that ready-to-drink

cold coffee in the U.S. could someday

rival the brew’s popularity in Japan.

That’s the largest such market in the

world, according to Andrea Illy, chief

executive officer of Illycaffè. CocaCola, which partners with Illy in

the U.S. and other countries, sells

more bottles and cans of coffee

than anyone else globally, largely

○q○ Toyota is buying a small stake in ridebecause of sales in Japan.

hailing leader Uber and will begin offering leases

The Starbucks-PepsiCo venture

is introducing sweetened and