Move From Involvement to Commitment

21st Annual Meeting | August 1 & 2, 2014 | New Orleans, LA

Welcome to New Orleans!

It is my pleasure to welcome you to the 21st Annual Meeting of

the International Association of Black Actuaries. Being given the

opportunity to Chair the Annual Meeting Planning Committee is

such an incredible honor and I intend to do the role justice. It is my

hope that as we progress through the meeting, that you will see

the hard work of the entire committee who I thank wholeheartedly.

It would be very remiss of me to not mention the overwhelming

response to our call for sponsorship from our Friends of IABA,

new corporate sponsors and our tried and true Corporate

Advisory Council. We thank you for your generosity and support.

New Orleans is such a beautiful and historic city where many

cultures come together and create a melting pot. I find many

parallels between our host city and our organization as we bring

together professionals and students from all over the world with

one common purpose. Our purpose is embodied in IABA’s mission

but it is more than words simply uttered, it requires commitment

not just involvement. This is the essence of this year’s theme Mission (Im)Possible: Move From Involvement to Commitment. As a

volunteer based organization, our members and supporters are our

“workforce.” Our leaders challenge, educate and motivate us to be

the best version of ourselves. Return the favor and help make IABA

into the best that it can be.

With that said, accept this new challenge, use your talents without

abandon to help us develop our future generation, guide and

motivate the current one and hold dear the guiding principles of

our founders.

Enjoy the meeting and explore New Orleans!

Charmaine Peart-Blackman, ASA

Chair of the IABA Annual Meeting

Planning Committee

2 | International A ssociation of B lack Actuaries 21st Annual Meeting

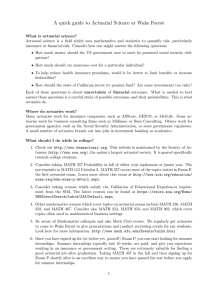

Schedule At A Glance

7:30 ‑ 2:30pm 7:30 ‑ 8:30am 8:15 - 9:00am

9:00 - 10:15am

10:30 - 10:45am

10:45 ‑ 1:00pm 10:45 - 12:00pm

La Salle C Foyer..........IABA Annual Meeting Registration

La Salle A.....................IABA Breakfast

La Salle C......................College & High School Outreach

La Salle C......................Building Mentoring Relationships: Lessons

in Selecting and Keeping Mentors

La Salle A.....................General Opening

Le Salon........................IABA Career Networking Event

La Salle B......................The Future LTC Insurance Industry

La Salle C......................Global Study of Employee Attitudes

about Benefits & Retirement

Pelican I........................Principle Based Reserves for Life Products

2:00 - 3:15pm

La Salle B......................Disaster Risk Management with a Caribbean Case Study

Pelican I........................Actuaries & the Art of Communication

La Salle C......................Beyond Excel

3:15 ‑ 3:30pm La Salle C Foyer..........IABA Afternoon Break

3:30 - 4:45pm

Pelican I........................Managing Up

La Salle B......................State of the Insurance Industry in LA

La Salle C......................Actuarial Career Tracks

5:30 – 7:30pm

Networking Reception at the House of Blues

7:30‑ 10:00am 8:00 ‑ 9:00am La Salle C Foyer..........IABA Annual Meeting Registration

La Salle A.....................IABA Breakfast

9:00 - 10:15am

La Salle B......................Louisiana Citizens Residual Market Mechanism

Pelican I........................Enterprise Risk Quanitification

Pelican II.......................Challenges with Regard to Disability in a

World of Individual Responsibility

La Salle C......................Panel I: Life/Health & Pension

Pelican I........................Longevity Risk Management – Fundamentals, Measurement

Techniques, and Current Solutions in the United States

Pelican II.......................National Flood Insurance Program

La Salle B......................Changes in Health Care Delivery & Payment

La Salle C......................Panel II: Property/Casualty & Non-Traditional

12:00 ‑ 1:30pm 1:45 - 3:45pm

7:00 ‑ 7:30pm 7:30 ‑ 9:30pm 9:30 ‑ 11:30pm La Salle A.....................Actuarial Debate & Lunch

La Salle C......................Volunteering & IABA Business Session

Le Salon........................IABA Reception & Cocktails

La Salle A.....................IABA Awards Banquet

La Salle A.....................Banquet “After Glow”

10:30 - 11:45am

MISSION:

IM POSSIBLE

| 3

PRudENTIAl IS A PRoud SPoNSoR oF THE INTERNATIoNAl

ASSoCIATIoN oF BlACk ACTuARIES CoNFERENCE

Interested in a Position

welcomes the

International

Association

of Black Actuaries

to our home city

of New Orleans

palig.com

4 | International A ssociation of B lack Actuaries 21st Annual Meeting

WE SEEK ACTUARIES. CAN WE COUNT ON YOU?

Actuaries play a valued, visible role at Prudential, providing

expertise across our enterprise. Bring your skills, acumen, and

innovation — and build your career in our growing actuarial

community.

Are you up for a challenge?

Apply today at jobs.prudential.com/actuarial — and get ready to

build your actuarial career at Prudential. or, for more information,

contact: Shanna Cole at shanna.cole@prudential.com or

deborah Hubal at deborah.hubal@prudential.com

© 2014. Prudential, the Prudential logo, the Rock symbol and Bring Your Challenges

are service marks of Prudential Financial, Inc. and its related entities, registered

in many jurisdictions worldwide. Prudential is an equal opportunity employer. All

qualified applicants will receive consideration for employment without regard to

race, color, religion, gender, sexual orientation, national origin, genetics, disability,

age, veteran status, or any other characteristic protected by law. Prudential

Financial, Inc., Newark, NJ.

Prudential is an Employer that participates in E-Verify.

0260257-00001-00

STFR-A4519

| 5

2014 IABA Leadership

IABA Leadership &

Board of Directors:

President/Director - Monique Hacker-Patterson, FSA, MAAA

Vice President/Director - Jamala Murray, FSA, MAAA

Treasurer/Director - Jonathan Applewhite, ASA

Secretary - Trisa-Lee Gaynor, ASA, MAAA

Student Liaison - Brandon Stevens

Foundation President - Jennifer Middough, FCAS, MAAA

Foundation Vice President - Tenesia McGruder, ASA, MAAA

Annual Meeting

Charmaine Peart-Blackman, ASA, Chair

Jonathan Applewhite

Nicole Harrington

Yolanda Aserweh

LuCretia Hydell

Trisa-Lee Gaynor

Jamala Murray

Becki Hall

Frances Pryce

Brandon Stevens

Kate Weaver

Corporate Solicitation

Jennifer Middough, FCAS, MAAA, Chair

Kate Weaver

Data Management Committee

Dodzi Attimu, FSA, MAAA & Stephen Cameron, FSA, MAAA Co-Chairs

Julius Appah

Tichaona Chiwandamira

Isaac Nyarko

Kwadwo Asamoah

Franklin Fotsing

Brandon Stevens

Yolanda Aserweh

Rutendo Mwaramba

Directors - Ollie Sherman, FCAS, MAAA, Sharon Robinson, FCAS, MAAA,

Linda Shepherd, FCAS, MAAA, Jeffrey Johnson, FSA, MAAA, Arthur

Randolph, FCAS, MAAA, CPCU, ARM, ARe, Acheampong Boamah, ASA,

MAAA, Nicassia Belton, Matthew Duke, ACAS, MAAA

Education

Nicassia Belton, Chair

Kamal Harris

Executive Director - Kate Weaver

Finance

City Affiliate Leaders:

Atlanta - Jessica Morse & Brian Simon

Bay Area – Joseph Kablan & Marquita Richardson

Boston – Ivy Pittman

Chicago – Glenn Yancy

DC - Kwame Davis, FCAS, MAAA & Lucretia Hydell, ASA

Hartford – Brandon Rosemond & Deitrich Davidheiser, ASA

Morgan State University – Abena Adusei & Edem Assogba

New York/New Jersey – Tjisana Kerr

Ohio Region – Ache Boamah, ASA, MAAA

Richmond – Trisa-Lee Gaynor, ASA, MAAA

Seattle – Ain Milner, FCAS, MAAA

Tampa – Monique Hacker-Patterson, FSA, MAAA

2014 Corporate Advisory Council

Committees:

Kate Weaver

Ollie Sherman, FSA, MAAA, Chair

Jonathan Applewhite

Linda Shepherd

Jasmine Schley

Kate Weaver

Membership

Nicole Harrington Chair

Special Thanks

Mentoring

Jamala S. Murray, FSA, MAAA, Chair

Archie Otu

Tetteh Otuteye

Elite Sponsors

Newsletter

Efua Mantey, Chair

Stephen Abrokwah

Fafali Adanu

Lina Boye

Stacia Brown

Claudia Hamilton

Kwabena Kesse

Scholarship

Tenesia McGruder, ASA, MAAA, Chair

Nicassia Belton

Nicole Harrington

Kate Weaver

Technology

Chisomo Sakala, Chair

Dodzi Attimu

Francis Doughan

6 | International A ssociation of B lack Actuaries 21st Annual Meeting

Premium Sponsors

Preferred Sponsors

Basic Sponsors

Ernst & Young

Gabriel, Roeder, Smith

& Company

GGYAXIS

MassMutual

Koffi Goudalo

Joel Manu

Alida Rwabalinda

Kate Weaver

| 7

Meeting Rooms

Human Resources, Benefits and

Compensation Consulting Services

When was your last

3rd Floor

Meeting Rooms

Life Changing Decision?

The Segal Group is proud to participate at the

21st Annual Meeting of the International Association of Black Actuaries

Career Networking Event in New Orleans, LA

n a ti o n

In te r

Bl

IABA

Consultant

of the Year

2012 and 2013

c tu a ri e s

We are proud to support the International Association

of Black Actuaries and welcome all attendees to the

21st Annual Meeting.

i a ti o n o f

Towers Watson

At Marsh & McLennan Companies, we value the individuality

of each of our colleagues. We believe that our different

backgrounds and points of view make us stronger as we

pursue innovation and excellence in all of our businesses

globally. Our work environment benefits from diversity —

and our clients do too.

To learn more about us and our diversity initiatives,

visit mmc.com/diversity.

soc

kA

DIVERSITY MATTERS

As

ac

al

www.segalco.com/careers/ | Offices Throughout the United States and Canada

barriers

At Towers Watson, we give talented associates access to

opportunities. And we’re proud to support the IABA’s efforts to

encourage and enable the achievements of black actuaries.

Towers Watson. A global company with a singular focus on our clients.

Benefits | Risk and Financial Services | Talent and Rewards | Exchange Solutions

2nd Floor

Meeting Rooms

towerswatson.com/careers

8 | International A ssociation of B lack Actuaries 21st Annual Meeting

| 9

Friday, Aug. 1, 2014

Field

GENERAL SESSIONS

7:30 - 2:30

7:30 - 8:30

Annual Meeting Registration

G = General

R - Risk

Breakfast

P = Pension

PC = P&C

L = Life

H = Health

College & High School Outreach Sessions

This session will outline your Mission and spotlight how IABA can help you complete it.

Tier

Building Mentoring Relationships: Lessons in Selecting and Keeping Mentors

A panel discussion covering themes including, but not limited to, developing real and earned

connections. The panelists will share their experiences as both mentors and mentees, which will

make this session extremely valuable to all audiences.

A = All

2:00 - 3:15

C = College

Location: La Salle C

10:30 - 10:45 General Opening

Location: La Salle A

Excel is often the tool of choice for most actuaries. Yet, how do we maximize its full potential? Some features are never

used. Living without other features is unimaginable. This session will present helpful Excel tools which are either new or

under-utilized. From the flexible data table to PowerPivot, PowerView, Slicer and graphical spark lines, all varieties of actuaries

can enhance their core skill-set with this Excel session.

H

A

Managing Up

Global Study of Employee Attitudes about Benefits and Retirements

P

A

G

A

G

A

C

C

State of the Insurance Industry in Louisiana

3:30 - 4:45

The Commissioner will cover a wide range of topics (spanning life, health and P&C insurance) as it relates to issues in

Louisiana. The Commissioner will cover topics, such as post-Hurricane Katrina impacts on the insurance industry.

Location: La Salle B | Presenter: Commissioner James Donelon, Louisiana Department of Insurance

L

I

Location: Pelican I | Presenters: Grace Senat & James Collingwood

10 | International A ssociation of B lack Actuaries 21st Annual Meeting

G

Location: Pelican I | Presenters: Kezia Charles and the IABA DC Affiliate, moderated by CNA

A

Principle Based Reserves for Life Products

Location: Le Salon

A

Professional Development Sessions

This session is about how to forge effective relationships with those above you. At the end of the session you will have

tips on how to actively work on the relationships with those above you and actively participate in planning of your career.

Career Networking Event

G

Location: La Salle C | Presenters: Albert Moore & SOA Technology Section, moderated by Prudential

Location: La Salle C | Presenter: Alan Glickstein

10:45 - 1:00

Historically, Actuaries have had limited participation in the strategic activities within insurance companies. As companies

look to transform their Finance and Actuarial processes, an opportunity exists for Actuaries to claim a seat at the table.

The foundation to earning this seat can be found in the analysis and communication provided by the actuaries. Focusing on

their audience, actuaries can use their insight into trends and financial results to own the message with improved analytics

combined with timely and effective communication.

Location: La Salle B | Presenter: Scott McKay

An update on Life PBR, with regards to the status of the current regulation, industry adoption status, and company

specific concerns.

I

Beyond Excel

The Future LTC Insurance Industry

During this session, the results of the Global Study of Employee Attitudes about Benefits and Retirements will be shared.

The results of this survey have important implications for plan sponsors and actuaries with respect to retirement and

healthcare program design.

R

Location: Pelican I | Presenters: Matt Clark & Anthony Johnson, moderated by SOA

Professional Development Sessions

10:45 - 12:00

Tier

Actuaries and the Art of Communication

I = Intermediate

A discussion on the future of the LTC insurance industry. First, a synopsis of the first 40 years including the maturing

“spectrum” of LTC insurance solutions, the various approaches that carriers have chosen, and the impact the product

has had on consumers both positive and negative. Then, a description of the future LTC insurance industry ideas

various organizations, including the Society of Actuaries (SOA), have published. Finally, a discussion that will put the

various disparate ideas into practical themes that begin to shift the conversation from describing the “LTC Issue” to

debating the practical path to the “LTC Solution.”

Field

Disaster Risk Management with a Caribbean Case Study

Caribbean countries are exposed to a high level of risk to meteorological and geophysical hazards, which have significant

negative impacts on communities, infrastructure and economic stability. In fact, in the last 20 years, damages from natural

disasters have exceeded US$40 billion in the region. The World Bank is working with countries to enhance their resilience to

natural disasters and the impacts of climate change. This presentation will discuss World Bank’s disaster risk management

engagement and focus on the following case study: On December 24, 2013, a tropical weather trough passed over Saint Vincent

and the Grenadines and Saint Lucia producing extraordinarily intense rainfall that resulted in severe damages, 15 confirmed

deaths and over 11 percent of the population directly impacted. This case study will present the rapid damage and loss

assessments, produced by the Governments and the World Bank, that aims to inform the recovery and reconstruction efforts.

Location: La Salle B | Presenter: Keren Charles

C = College

Location: La Salle C

9:00 - 10:15

Friday, Aug. 1, 2014 cont.

Professional Development Sessions

Key

Location: La Salle C Foyer

Location: La Salle A

8:15 - 9:00

Tier

A

Actuarial Career Tracks (College-mandatory)

This session will detail your mission’s objectives. You’ll be exposed to the main differences between the Society of

Actuaries (SOA) and the Casualty Actuarial Society (CAS), the updated exam structures, and a broad overview of the

actuarial areas of practice.

Location: La Salle C

| 11

Friday, Aug. 1, 2014 cont.

Field

Tier

Networking Reception

5:30 - 7:30

Saturday, Aug. 2, 2014 cont.

This session will present an overview of longevity risk management and measurement techniques in the context of today’s

insurance and pension solutions.

Field

10:30 - 11:45

Breakfast

Professional Development Sessions

PC

This session will provide you with the opportunity to clarify your mission’s objectives. Panelists from the Property, Casualty,

and Non-Traditional areas of practice will share their experience-based advice and answer any questions you may have.

C

Location: La Salle C

Enterprise Risk Quantification

GENERAL SESSIONS

R

I

12:00 - 1:30

Actuarial Debate and Lunch

An interactive lunch session where 2 teams of actuaries across

levels and practice areas will debate hot topics in the industry.

Location: La Salle A | Moderator: Anthony Weatherspoon

Location: Pelican I | Presenters: David Wicklund & Abhinav Dendukuri, moderated by MetLife

1:45 - 3:45

Challenges with Regard to Disability in a World of Individual Responsibility, with a Pension Context

Volunteering & IABA Business Session

Location: La Salle C

P

I

7:00 - 7:30

Networking

Reception at the

House of Blues

Scholarship & New Designee Cocktail Reception

Location: Le Salon

Location: Pelican II | Presenter: Anna Rappaport

7:30 - 9:30

Panel I: Life/Health & Pension (College-mandatory)

Location: La Salle C

C

Panel II: Property/Casualty & Non-Traditional (College-mandatory)

A

Location: La Salle B | Presenter: David Thomas

This session will provide you with the opportunity to clarify your mission’s objectives. Panelists from the Life, Health,

and Pension areas of practice will share their experience-based advice and answer any questions you may have.

A

Location: La Salle B | Presenter: Tyler Lester

Louisiana Citizens Residual Market Mechanism

The public does not understand the importance of long term disability - there are gaps in the coverage, and the situation

is growing worse as more responsibility is shifting to employees. This presentation will focus on how disability can derail

retirement security in a world of defined contribution plans and also on the low coverage of long term disability benefits.

It will include several policy recommendations and provide an update on a 2014 regulatory development.

H

Pharmacy Trends and the Affordable Care Act

Prescription drug trends have been at historic lows over the past three years as patents expire on many blockbuster

drugs. Going forward, high cost specialty drugs will become the biggest driver of pharmacy trends. This session will cover

recent pharmacy trends and changes in pharmacy management to deal with rising costs. Special attention will be given

to changes driven by the Affordable Care Act in the individual market.

Location: La Salle A

9:00 - 10:15

A

Location: Pelican II | Presenter: Matthew Duke, moderated by Liberty Mutual

Location: La Salle C Foyer

Insurance is a risk-taking business. Risk managers must ensure that the risks taken are intentional and understood, as

well as aligned to the organization’s objectives. This can be achieved only through a well-designed risk management

framework, with effective governance and high-quality risk information. To provide management with the information it

needs, risks should be quantified through various lenses, at aggregate and more granular levels. This session focuses on

risk quantification at an enterprise level.

PC

National Flood Insurance - Biggert/Waters Legislation

Congress recently passed legislation that delays the implementation of moving to actuarial rates for flood insurance. During

this session, issues relating to flood insurance and the implications of recently passed legislation will be discussed.

Annual Meeting Registration

The property insurance market in Louisiana collapsed after Hurricane Katrina. The state created Louisiana Citizens as an

insurer of last resort. This session will explore the dynamics of the market, the political pressures, the financial results of

this entity, the ratemaking process.

I

Location: Pelican I | Presenters: Francisco Orduna, Phil Hur & David Yang

Tier

GENERAL SESSIONS

8:00 - 9:00

P

Longevity Risk Management – Fundamentals, Measurement Techniques, and Current Solutions

in the United States

Location: 225 Decatur St., New Orleans, LA

7:30 - 10:00

Tier

Professional Development Sessions

House of Blues

Saturday, Aug. 2, 2014

Field

Awards Banquet

Location: La Salle A

C

C

9:30 - 11:30

After Glow

Location: La Salle A

August 1, 2014

5:30 – 7:30 pm

12 | International A ssociation of B lack Actuaries 21st Annual Meeting

| 13

Who knows how big data will impact

the world of business?

We do.

Every day, members of the Society of Actuaries (SOA)

work to analyze collections of big data from around

the globe, using state-of-the-art predictive modeling

tools to help their employers make informed decisions

on pricing models, target marketing, healthcare

economics, risk management and more.

The world is full of unknowns. That’s why we’re here.

With unmatched research and education, and a

global network of almost 25,000 of the highest-skilled

actuarial professionals, organizations turn to members

of the Society of Actuaries to help them mitigate

ever-growing risks and lead them to the right

decisions for their businesses.

Take a closer look at soa.org/impact

Thanks to you,

we are leading the way with innovative and

caring solutions.

WellPoint is proud to support and celebrate the

achievements of Black Actuaries.

As one of the nation's leading health benefits companies,

we continue to leverage the diversity of our associates

and their thoughts to help us transform health care. From

the workplace to the marketplace, our associates' unique

perspectives impact every aspect of our business. Our

commitment to diversity is the guiding principle in the

relationship between our associates, partners, consumers,

and particularly in the communities in which we live and

work. This is one of the reasons why we are consistently

recognized for our efforts in this area.

Better health care, thanks to you.

Diversity reflects who

we are.

We are an insurance company dedicated to creating an inclusive

environment full of many perspectives. A diverse workforce

helps us learn, grow and share fresh insights. Travelers provides

varied opportunities for employees to network and develop

their leadership skills.

We invite you to consider joining us. You can apply for current

openings at travelers.com/Careers.

Travelers was recognized by DiversityInc magazine for its commitment to diversity and inclusion.

To learn more about actuarial careers at WellPoint,

please visit: www.wellpoint.com

Educating actuaries. Impacting society.

SOA_4546-K1_Stu_v1a.indd 1

14 | International A ssociation of B lack Actuaries 21st Annual Meeting

5/23/14 10:05 AM

® Registered Trademark, WellPoint, Inc.

© 2014 WellPoint, Inc. All Rights Reserved.

® Registered Trademark, DiversityInc Media LLC

EOE. M/F/Disability/Veteran.

travelers.com

© 2014 The Travelers Indemnity Company. All rights reserved. Travelers and the Travelers Umbrella logo are registered

trademarks of The Travelers Indemnity Company in the U.S. and other countries. M-17282-9 Rev. 5-14

| 15

Dr. Carl B. Mack was born in

Jackson, Mississippi, is a graduate

and Distinguished Engineering

Fellow of Mississippi State

University (Bachelor of Science,

Mechanical Engineering) and

was also awarded an honorary

Doctor of Science degree by

Clarkson University in 2010. He

currently serves on the Board of

Trustees for Clarkson University,

the Society of Automotive

Engineers and the advisor board

for the College of Engineering

at Mississippi State University.

each of the cities SEEK was held. He received recognition in Ebony

magazine as one of the Top 150 Black Leaders in America. In July

2009, Adm. Gary Roughead, Chief of Naval Operations, presented

Mack with the National Naval Officers Association’s top honor for

work in the field of diversity: the Capt. Charles L. Tompkins Award.

On March 1, 2005, Mack

became the fourth executive director of the National Society

of Black Engineers (NSBE), one of the nation’s largest studentgoverned organizations.

To help fill the pipeline to engineering careers with greater

numbers of minorities, in the Summer of 2007, Mack founded

NSBE’s free three week Summer Engineering Experience for

Kids (SEEK) Academy. SEEK represented the largest engineering

camps in the history of the nation for African American children

and other minorities. As an example, both the 2013 Washington,

D.C. and San Diego programs were attended by nearly 700

children each. Another example was the 2013 Jackson, MS. AllGirls SEEK program, never in the history of America has there

been an engineering camp attended by 360 3rd-5th grade African

American girls! From its humble beginning in 2007, by 2013

SEEK had expanded to 10 cities: Washington, D.C., San Diego,

CA, Oakland, CA, Denver, CO., Houston, Texas, New Orleans, LA,

Jackson, MS. Philadelphia, PA., Brooklyn, NY. and Detroit, Mich.

His presence at NSBE was immediately felt. In each of his first

five years, the organization set records for membership, reaching

35,493 members in 2010, up from its previous high of 12,842

before his arrival. He has also been instrumental in increasing

NSBE’s financial resources to record highs: helping expand the

organization’s cash reserves from $3.5 million to $11.0 million;

securing a largest-ever grant of $1 million from a NSBE sponsor;

helping build NSBE’s top-level sponsorship to record levels;

bringing in hundreds of thousands of dollars to strengthen

NSBE’s IT infrastructure; pushing attendance at NSBE’s Annual

Convention to nearly 10,000 attendees and working with NSBE’s

National Executive Board to pay off the mortgage on NSBE’s

new World Headquarters building, among other highlights.

Before joining NSBE, Mack worked as an engineer with METRO

– King County in Seattle, Wash. Designing and starting up waste

water treatment plants. He also coordinated the county’s awardwinning Minority Engineering Internship Program. From November

2003 – February 2005 he served as president of the Seattle King

County Branch of the National Association for the Advancement

of Colored People (NAACP). During his tenure, the branch won

the 2004 Class 1-A Thalheimer Award as the top branch in the

country. Because of his significant contributions in the arena of

civil rights, Mack was listed as one of the 25 Most Influential people

in the greater Seattle area. Upon his announcement to leave

the greater Seattle area, both the City of Seattle and the King

County government named February 12, 2005, Carl B. Mack Day.

His extraordinary leadership led to an increase in visibility for the

organization, with appearances on CNN’s Lou Dobbs Tonight and

ABC’s Good Morning America, features in the Washington, Post,

San Francisco Chronicle, and news coverage by major networks in

Mack resides in Fort Washington, Md., with his sons, Joshua and

Jonathan, and his wife, Jamiyo (Jamie-Yo), a chemical engineer

whom he met at NSBE’s 2000 Annual National Convention.

His daughter, LaShaundra Johnson resides in Jackson, MS.

16 | International

16 | International

A ssociation

A ssociation

of B lack

ofAB

ctuaries

lack A ctuaries

21st A nnual

21st AMnnual

eetingM eeting

Chris Cooper is one of

the most dynamic, engaging

and accomplished speakers,

trainers and coaches in America.

With three academic degrees

(Morehouse College, The Georgia

Institute of Technology and

New York University), countless

professional certifications, and

numerous awards and honors

Chris has dedicated his life

to the service of others!

Chris is the President/CEO of

Execute Your Passion, LLC an Atlanta based professional

services firm specializing in motivational seminars and leadership

and professional development training and services. The firm

offers innovative ways to assist in the complete development

of individuals and organizations through innovative coaching

practices and techniques, best in class training solutions,

and subject matter expertise focused speaking services.

Chris has a wealth of knowledge from more than a decade of

professional experience working and consulting for several

Fortune 500 Companies including: AT&T, BellSouth, AutoTrader.

com, Cingular Wireless, Cox Communications, Deloitte Consulting,

General Motors, The Home Depot, IBM, Intercontinental Hotels

Group (IHG), Kimberly Clark, Texaco, and Verizon Wireless.

Chris saved these companies millions and became the youngest

Senior Manager ever at age 26 while working at Cingular

Wireless World Headquarters (now the New AT&T). In addition,

Chris served for 4 yrs. as an Adjunct & Corporate Instructor

with Emory University’s Center for Lifelong Learning teaching

Professional Development and Communications Courses to

adult learners of all ages including C-Level Executives. With

Book Smarts, Street Smarts, Vision, Passion, Charisma and

even the courage to run with the Bulls in Spain, Chris’ life has

indeed been and continues to be an exciting adventure!

Chris’ recent accolades include being featured on the UNCF

Empower ME Tour, The AT&T 28 Days Movers & Shakers

Campaign, being named to the MS Leadership Class, being

named an Unsung Hero and Quiet Achiever, being featured

as an Entrepreneur Author on the Atlanta Business Radio

Show, being named one of Power 30 under 30, being

named one of GXL Magazine’s Most Influential People, and

Outstanding Atlanta and LEAD Atlanta to name a few.

Chris’ first book- Achieve Your Dreams…26 Quick Keys to Succeed

in Life has been embraced all over the world by professionals,

entrepreneurs and students of all ages, accompanied with the

Achieve Your Dreams College Success Tour which is currently

touring domestically and internationally. Chris’ newest book- Get

Sh*t Done, How to Stop Quitting & Start Succeeding releases this

Summer and is accompanied by Limitless- The Ultimate Personal

and Professional Development Bootcamp – A One Day GSD

Experience coming to city near you! Chris is an amazing coach,

speaker, trainer, instructor, motivator, author and entrepreneur.

He is committed to his lifelong aspiration of investing and

assisting in the development of people who he believes are

the world’s hidden treasures. He is spiritual, fun, energetic and

engaging. His mission is simple: To Ignite the Fire Inside!!

| 17

| 17

2014 Speakers

Keren Charles is a Disaster Risk Management (DRM)

Specialist at the World Bank in the Latin American and

Caribbean DRM and Urban Unit. Keren works on developing

strategies and implementing projects which aim to enhance

a country’s resilience to natural disasters and the impacts

of climate change. In addition, Keren is part of a regional

technical assistance program which aims to strengthen

financial protection mechanism and risk transfer strategies

in the region. Before the World Bank, Keren had six years

of experience in the Property and Casualty Insurance field as

an Actuarial Analyst at Tillinghast – Towers Perrin. Keren has

a Masters in City Planning from the Massachusetts Institute

of Technology (MIT) and graduated Summa Cum Laude from

Howard University with a Bachelors in Insurance – Actuarial

Science.

Kezia Charles, FSA, EA, MAAA is an actuary in Towers

Watson (TW) with 10 years of experience in retirement

consulting. She works on re-designing pension and retiree

medical plans; divestitures, mergers & acquisitions; and

experience studies on demographic assumptions. In the

TW DC office, Kezia leads the Multicultural Associate

Resource Community, which focuses on promoting cultural

awareness and leveraging cultural differences to maximize

business results. Kezia also leads the education committee

of the associate engagement team, and is the learning and

development representative for the DC retirement LOB.

Kezia was the IABA DC affiliate lead from 2006 – 2013;

she received a Bachelor of Science in Mathematics from

Massachusetts Institute of Technology (MIT); and she has

participated in medical missions in Haiti and El Salvador.

18 | International A ssociation of B lack Actuaries 21st Annual Meeting

due diligence; Life insurance litigation support; Economic

capital consulting; Solvency II and MCEV review; Extensive

experience with existing and emerging financial reporting

standards including US statutory, GAAP, IFRS and Solvency II;

Implementation of Actuarial Transformation projects; Analysis

regarding long term care and continuing care retirement

communities.

Matthew P. Clark, FSA, MAAA is a Principal, Deloitte

Consulting LLP in the Actuarial, Risk, and Analytics group.

Matt joined Deloitte in 2012. He is a Fellow of the Society

of Actuaries and a Member of the American Academy of

Actuaries. Prior to joining Deloitte, Matt was the Chief

Actuary at Genworth where he worked for 3 years. Prior

to that, he spent 12 years at Ernst & Young LLP. Matt is

Chair of the Financial Reporting Section of the Society of

Actuaries and a frequent speaker at Society of Actuaries

meetings, valuation actuary symposiums, and other industry

events. He is a graduate of University of Michigan, BS,

Actuarial Mathematics. Matt’s experience includes: Reserve

analysis and review for life, annuity, and health business in the

context of audits of major insurers; Merger and acquisition

analyses, including actuarial appraisal analysis and buyer side

James Collingwood, ASA, MAAA is a Manager in the

Insurance and Actuarial Advisory Services practice of Ernst &

Young LLP’s Financial Services Office. He is based in the firm’s

Chicago office. James has been with the firm for over 8 years.

He serves as an advisor to insurance companies, reinsurance

companies, and banks, and he has worked for clients in the

United States and Europe.

He has experience and expertise in tracking domestic and

international capital and solvency regulatory change and

developing solutions to help clients meet the challenges

posed by the changing regulatory environment.

James J. Donelon is the Louisiana Commissioner of

Insurance. Prior to becoming Commissioner of Insurance,

Jim Donelon served the Louisiana Department of Insurance

in leadership positions as Chief Deputy Commissioner and

Executive Counsel. Jim’s public service career includes 33

years of military experience in the Louisiana Army National

Guard where he retired with the rank of Colonel. He was first

elected to office in 1975 as Chairman of the Jefferson Parish

Council and then served in the House of Representatives

from 1981-2001 where he served as Chairman of the

Committee on Insurance. In 2001 Jim joined the staff of the

Department of Insurance and was appointed Commissioner

of Insurance in February 2006. He was elected to fill the

unexpired term later that year and was re-elected in 2007

and again in 2011. Jim serves on the National Association

of Insurance Commissioners’ (NAIC) Executive Committee

as Immediate Past President and also serves as Chairman

of the Surplus Lines Task Force. He is also on the Board of

Directors of the New Orleans Alliance for the Mentally Ill

and the Blood Center for Southeast Louisiana. Jim is a native

New Orleanian, graduate of Jesuit High School, the University

of New Orleans and Loyola School of Law. Jim and his wife

Merilynn reside in Jefferson Parish. They are the parents of

four daughters and several grandchildren.

Matthew Duke, ACAS, MAAA, ARe is a Vice President and

Senior Actuary at Guy Carpenter who provide actuarial and

financial modeling consulting services to colleagues and

clients. Prior to this, Matt worked at Arch Insurance Group

performing quarterly reserve valuations, implementing new

actuarial techniques and methods, fulfilling statutory and

GAAP requirements and performing special studies. He also

worked at Travelers for several years, performing various

roles and responsibilities which included managing the

profitability of a $1.4 billion countrywide Commercial MultiPeril book of business and led advance credibility modeling

R&D. Matt graduated from Stony Brook University in Applied

Mathematics & Statistics, Economics, and a minor in Business

and is currently pursuing his MBA for Executives at Wharton.

He has served as Co-Chair of the Education Committee and

Hartford CT Affiliate Lead in the past. Matt enjoys riding

his motorcycle, traveling and playing Trinidad and Tobago’s

national instrument, the Steel Pan (Drums).

| 19

2014 Speakers

Abhinav Dundukuri, ASA, CERA is an Associate Actuary for

Prudential Financial. Abhinav joined Prudential’s International

Insurance department in 2010 after graduating from

University of Waterloo with a degree in Mathematics. He

was responsible for the Economic Capital project which dealt

with valuing the assets and liabilities of various international

operations of Prudential on an economic basis. Abhinav then

rotated to Group Insurance’s Long Term Care department

in 2012 and was responsible for valuing Group Long Term

Care clientele takeover opportunities from other companies

by Prudential. His third and current position, which began in

2013, is in Pension risk transfer (Retirement Division) where

Abhinav is responsible for transaction pricing and assumption

setting of pension plans’ buy-outs.

Alan Glickstein, ASA, EA is the North American Retirement

Leader for Policies and Procedures, responsible for many of

the positions that Towers Watson takes on retirement issues

of the day and for advocacy on behalf of our clients. Alan has

more than 25 years of experience as an actuary and benefit

consultant. He works extensively with many large clients in

several industries and services, increasingly focused on the

financial and risk management aspects of benefit plans to

some of Towers Watson’s largest clients. Alan specializes

in the strategic design and financing of total compensation

packages, with a particular concentration in the retirement

benefits area. Alan holds a B.A. in Mathematics from

Queens College, City University of New York.

Phil Hur is a member in the Human Capital Talent and

Reward (T&R) practice of Ernst & Young. Phil works on

valuations for pension, post-retirement health care, and

20 | International A ssociation of B lack Actuaries 21st Annual Meeting

Modernization and Information Management of Actuarial

Data; Implementation of Actuarial Transformation projects;

and extensive experience with existing and emerging financial

reporting standards including US statutory and GAAP; Risk

and Capital Management.

We are proud to be a Corporate Partner of the

International Association of Black Actuaries.

Marsh & McLennan Companies is a global

professional services firm offering clients

advice and solutions in risk, strategy, and

human capital.

To learn more about us and our market-leading

brands, visit www.mmc.com.

other post-retirement benefits. He also assists audit teams

with analyzing the assumptions disclosed in clients’ financial

statements under various accounting standards.

Tony Johnson, ASA, MAAA is a manager at Deloitte

Consulting LLP in the Actuarial, Risk, and Advanced Analytics

group. Tony joined Deloitte in 2010. He is an Associate of the

Society of Actuaries and a Member of the American Academy

of Actuaries. Prior to joining Deloitte, Tony spent 4.5 years at

Ernst & Young LLP. Tony is a graduate of Maryville University

– St. Louis, BA, Actuarial Mathematics. Tony’s experience

includes: Reserve analysis and review for life, annuity, and

health business in the context of audits of major insurers;

Finance Transformation with specific focus on Actuarial

Tyler Lester, FSA, MAAA is an Actuarial Manager at Cigna

with responsibility for Pharmacy Pricing and Economics

located in Raleigh, NC. His current work focuses on helping

develop solutions to manage pharmacy costs through

formulary management, clinical programs, and site of service

optimization. Prior to his current role he managed actuarial

functions for Cigna’s Limited Medical business that provided

employers with options to provide low cost coverage for

part-time and hourly workers. Tyler has past experience in

provider contract analysis, medical pricing, and medical trend

forecasting. He also had a short stint away from healthcare,

serving as the lead pricing actuary at North Carolina Mutual

Life Insurance Company in Durham, NC. Tyler is a graduate

of the University of North Carolina, a Fellow of the Society

of Actuaries, and a Member of the American Academy of

Actuaries. He is also the proud father of three.

Scott J. McKay is Senior Vice President of Genworth Financial.

Since 1993, Mr. McKay has been a key player helping build

Genworth Financial by participating in technology programs,

acquisition integrations, sourcing and globalization initiatives.

Most recently he was responsible for leading the development,

design and implementation of the company’s long-term care,

life insurance and fixed annuity products.

Albert J. Moore, ASA, MAAA is the 2nd VP, Actuarial

Systems at Ohio National Financial Services. For nearly

30 years Albert has served in various actuarial roles, from

valuation to pricing. Since 2006, Albert has directed a

team of actuaries, programmers and software support

in developing Ohio National’s Life Insurance Illustrations

Software Suite that encompasses illustrating life, disability

income and annuity products and various agent compensation

contracts. In addition to the illustration systems work, Albert

has spearheaded efforts to develop models in preparation

for ERM, C3P3 and PBR. He has served on Ohio National’s

Systems Enterprise Architectural Committee. He currently

serves on the companies Life Operational Planning committee.

He serves as the Chairman of the Technology Section of

the SOA and has volunteered for several other actuarial

committees.

Francisco Orduña, FSA, MAAA is a member in the Insurance

and Actuarial Advisory Services practice of Ernst & Young. He

has over six years of experience in life insurance and workplace

benefits in the United States and Mexico. Francisco has

experience in actuarial modeling of life insurance and annuity

products, including model conversion and model validation. He

is proficient in the modeling and design of pension risk transfer

strategies, and has extensive experience in US statutory and

GAAP life insurance financial reporting regimes.

Anna Rappaport, FSA, MAAA is an actuary, consultant, author,

and speaker, and is a nationally and internationally recognized

expert on the impact of change on retirement systems and

workforce issues. Anna is a past- President of the Society of

| 21

2014 Speakers

Actuaries and chairs its Committee on Post-Retirement

Needs and Risks. Anna is a phased retiree and formed Anna

Rappaport Consulting in 2005 after retiring from Mercer

Human Resource Consulting at the end of 2004 after 28

years with the firm. She served on the ERISA Advisory

Council from 2010-2012 and currently serves on the

GAO Retirement Security Advisory Panel. She serves

on the WISER Board and the Advisory Board of the

Pension Research Council. For more information about

Anna, see www.annarappaport.com.

Grace Senat, FSA, MAAA is the Life Corporate Actuary

at Lincoln Financial Group, and is based in their Radnor

office. She has worked with the company for 1 year. Her

responsibilities include corporate governance and oversight,

economic modeling, foundational ERM and monitoring

industry regulations. Prior to that, she worked in various

pricing and valuation roles for Life, LTC and Retirement

products at Genworth Financial and Buck Consultants for

a combined total of 8 years. She graduated from Ohio

Wesleyan University in 2004 with a Bachelors of Arts degree

in Mathematics, Computer Science and Economics.

Dave Thomas has 42 years of experience in the propertycasualty industry. He has held CEO and CFO positions in

several organizations including regional multi-line and national

specialty insurers, and most recently served as the CEO of an

independent insurance agency in northern Indiana. He has also

held C-level positions in operations, marketing, administration,

and information technology in companies ranging from startups to mature organizations. In addition, Dave has served

on the Boards of several national and state insurance trade

associations, as well as, a variety of non-profit, charitable and

educational foundations. A native of Indianapolis, Dave spent his

entire career in the Midwest prior to joining Louisiana Citizens

in 2013. He holds a Bachelor of Science degree in Computer

Science from Purdue University and the Honeywell Institute of

Information Science.

David Wicklund, FSA, MAAA, CFA is an actuarial advisor

in EY’s Insurance and Actuarial Advisory Services practice,

specializing in risk and capital management. In this role, David

has assisted life insurance companies in the following areas:

asset-liability management (ALM), economic capital, ERM

framework development, and model validation. David also

has significant experience in mergers & acquisitions, financial

reporting, and variable annuities. David has ten years of life

insurance industry experience. He joined EY in 2008 and

previously worked for a large global life insurer. David graduated

from the University of Michigan with concentrations in

Actuarial Science and Economics. He is a Fellow of the Society

of Actuaries, a Member of the American Academy of Actuaries,

and a CFA Charterholder.

David Yang, FSA, CERA, FCIA currently serves as Vice

President and Actuary in the Life and Health Business

Management division of Swiss Re. David joined Swiss Re

in 2012 and has been leading a number of Actuarial

Transformation projects. Prior to his current role, he was a

Manager in the Life Actuarial Practice of PricewaterhouseCoopers where he provided consulting services to life insurers,

reinsurers and independent marketing organizations. Areas of

focus include reserve analysis, financial reporting, actuarial

appraisal, audit reviews and stochastic modeling.

Quality health plans & benefits

Healthier living

Financial well-being

Intelligent solutions

Our diversity is part of what

gives our company its heart.

Wanna check our pulse?

At Allianz, we know our diverse employee population drives the

success of our company – so we’re able to offer our customers financial

and retirement products they can depend upon for the rest of their lives.

Creating a healthier tomorrow

Learn more about our company by visiting www.allianzlife.com

or www.firemansfund.com.

Aetna is a proud sponsor of the

International Association of Black Actuaries.

©2014 Aetna Inc.

2014015

ENT-1578 (R-6/2014)

22 | International A ssociation of B lack Actuaries 21st Annual Meeting

| 23

ENT-1578_425x7125.indd 1

6/4/14 2:51 PM

SAVE THE

DATE

miami

DCnashville

IABA 22nd Annual Meeting

AUGUST 7-8, 2015 | Location TBD

Get All Study Materials For Your Next Exam From The Experts!

Discover ACTEX:

3 Easy Ways To Order:

ActexMadRiver.com

1(800)-282-2839

Support@ActexMadRiver.com

68

#

Embracing

diversity

PUTS US ALL

IN GOOD HANDS

SM

Take time to recognize

the good around you.

For more information about

New York Life visit us at

www.newyorklife.com/diversity

© 2014 New York Life Insurance Company, 51 Madison Avenue, New York, NY 10010

Life Insurance. Retirement. Investments.

Allstate is a proud sponsor of the

International Association of

Black Actuaries Annual Meeting.

KEEP

© 2014 Allstate Insurance Co.

26 | International A ssociation of B lack Actuaries 21st Annual Meeting

| 27

CASUALTY

ACTUARIAL

SOCIETY

Y U

Congratulations on another successful

year and Annual Meeting!

Do what’s best for your future

Visit Deloitte Consulting at

mycareer.deloitte.com/us/strengthenyourlead

DO WHAT MATTERS.

Proud Sponsor of the

IABA Annual Meeting

Visit us on the Web:

www.casact.org

www.CASstudentcentral.org

www.VarianceJournal.org

DW Simpson specializes in the placement of Actuaries. We work

on an international basis and at all levels of experience, from

entry level to Fellow. This encompasses those individuals with

expertise in Life, Health, Pension, Property & Casualty, and,

increasingly, non-traditional areas such as Risk Management,

Catastrophe Modeling, Predictive Modeling, Financial

Modeling and Analytics. We are the largest of the firms that

exclusively places Actuaries, and our objective is to be the

foremost resource for Actuarial talent globally.

4121 North Ravenswood Avenue, Chicago, IL 60613

(800) 837-8338 | www.dwsimpson.com

28 | International A ssociation of B lack Actuaries 21st Annual Meeting

Achieve financial security

with a plan that addresses risk first.

Create your financial plan with a Northwestern Mutual

Financial Advisor. Together, we’ll design a disciplined and

balanced approach to protecting, accumulating and managing

your wealth, so you can take advantage of life’s opportunities.

Who’s helping you build your fi nancial future?

northwesternmutual.com

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company,

Milwaukee, WI (NM) and its subsidiaries. Securities offered through Northwestern Mutual Investment

Services, LLC, broker-dealer, registered investment adviser, subsidiary of NM, member FINRA and SIPC.

NCAA is a trademark of the National Collegiate Athletic Association.

All qualified applicants will receive consideration for

employment without regard to race, color,religion,

sex, national origin, or any other basis protected by

federal, state or local law. All qualified applicants

will receive consideration for employment without

regard to race,

As used in this document, “Deloitte” means Deloitte

Consulting LLP, a subsidiary of Deloitte LLP. Please

see www.deloitte.com/us/about for a detailed

description of the legal structure of Deloitte LLP and

its subsidiaries. Certain services may not be available

to attest clients under the rules and regulations of

public accounting.

Member of Deloitte Touche Tohmatsu Limited.

All rights reserved.

36 USC 220506

Copyright © 2014 Deloitte Development LLC.

| 29

We’ll help you stand out from the crowd.

At Liberty Mutual, we develop exceptional actuarial insurance professionals.

Liberty Mutual’s Actuarial Development and Internship Programs offer aspiring

CAS and SOA actuaries the opportunity to apply their strong academic foundation,

build upon their personal strengths, and acquire critical business experience in

an environment that supports continuous learning. Training, rotations, mentoring,

networking, and our many Actuarial Student Leadership programs offer the chance

to develop as an insurance professional, explore new areas of interest, and

advance your career across a growing global Fortune 100 company.

EY is a proud sponsor of the 2014

IABA Annual Meeting. At EY, striving

for excellence, demanding consistency

and performing to our full potential is

how we build our business every day.

ey.com/us/insurance

30 | International A ssociation of B lack Actuaries 21st Annual Meeting

© 2014 Ernst & Young LLP. All Rights Reserved. ED None.

Achieving excellence

is equal parts

determination and skill.

MetLife congratulates the

International Association of

Black Actuaries for its

unparalleled commitment to

leadership and achievement

in our industry.

Visit us at: www.libertymutualgroup.com/insurance-careers

Visit us at:

Responsibility. What’s your policy?®

Metropolitan Life Insurance Company (MLIC), New York, NY 10166.

© 2013 PNTS 1305-1549

| 31

Hi, I’m

Rachel

I’m an actuarial analyst

at Towers Watson,

and today I did

something

extraordinary.

%

68

#

Take time to recognize

the good around you.

EXPLORE ACTUARIAL CAREER

OPPORTUNITIES AT CNA!

As one of the country’s largest writers of commercial and specialty insurance, CNA depends

on the talent, expertise and enthusiastic engagement of our employees. We provide insurance

protection to more than 1 million businesses and professionals in the U.S. and internationally,

offering unique expertise for the businesses and industries we serve. Our commitment to

diversity and inclusion enables us to serve a broad range of customers while supporting

our communities through charitable contributions and employee volunteerism.

Who We’re Looking For

• Results-oriented individuals with strong analytical, technical

and communication skills

• Intellectually curious thinkers eager to learn

yourexpectations

After years of preparation, you want a job that will inspire you,

make you think and put your skills to the best use. But what if

you could have even more?

The Towers Watson team includes over 1,500 credentialed

actuaries across all of our business segments in the U.S.

alone. If you join us, you’ll often be challenged to do something

extraordinary. And you’ll partner with your manager to direct

your own career.

Sound good? Then plan to Go Beyond at Towers Watson.

At New York Life, we recognize

that employees’ unique qualities

often lead to innovation, positive

change, and a more productive

and dynamic workplace.

For more information about

• Individuals with a bachelor’s degree in Actuarial Science, Statistics,

Mathematics or a related discipline

• Professionals who can readily adapt to a fast-paced, dynamic

corporate environment

“Our people are the cornerstone of our commitment to excellence.

Through them we provide real-world solutions, inspire confidence

and trust, and sustain valuable relationships with our customers

and distributors.”

– Larry Haefner

Executive Vice President and Chief Actuary

New York Life visit us at

Towers Watson. A global company with a singular focus on our clients.

www.newyorklife.com/diversity

Benefits | Risk and Financial Services | Talent and Rewards | Exchange Solutions

© 2014 New York Life Insurance Company, 51 Madison Avenue, New York, NY 10010

CNA • 333 S. Wabash Avenue • Chicago, IL 60604 • www.cna.com/careers

towerswatson.com/careers

32 | International A ssociation of B lack Actuaries 21st Annual Meeting

Life Insurance. Retirement. Investments.

KEEP

CNA is a registered trademark of CNA Financial Corporation. Copyright © 2014 CNA. All rights reserved.

| 33

PRUDENTIAL IS A PROUD SPONSOR OF THE INTERNATIONAL ASSOCIATION OF BLACk ACTUARIES CONFERENCE

PROOF#: 3

OPERATOR: TOM

DATE: 5/21/14 - 2:07

PM

JOB#: STFR-A4529

DESC: Diversity So

Special

Picture yourself at AIG, an inclusive workplace where differences

WE SEEK ACTUARIES.

CAN WE COUNT ON YOU?

PUB: IABA

areFull

embraced. Our people are encouraged to share their diverse

page perspectives and collaborate to fuel creativity and unleash innovative

ideas and solutions.

PUBDATE:

06/01/2014

Now, consider joining the ranks of more than 500+ actuaries, in the Life

LIVE: Insurance, Property Casualty, and United Guaranty businesses, located

throughout

TRIM: 8.75

x 7.125 the United States and internationally.

BLEED: At AIG, Actuarial professionals, with their expertise in quantitative

GUTTER:analysis, insurance pricing, loss reserving, and risk quantification, have

GCD: a pivotal role in driving results and are integral to the company’s success.

Our Actuaries have the opportunity to help develop new processes, drive

CD:

change, and help make the function at AIG best in class.

AD:

We are also firmly committed to our Actuaries’ professional growth

CW:

and development within AIG. That’s why we developed the Actuarial

AE:

Professional Development Program, to promote the education and

TRAFFIC:

training of AIG employees pursuing actuarial examinations in the

PROOF: knowledge and professional skills relating to actuarial practices.

At Prudential, we’re significantly expanding our team of actuaries to help drive

our success in an evolving regulatory environment. Are you up to the challenge?

Actuaries play a valued, visible role at Prudential, providing expertise across our

enterprise. Bring your skills, acumen, and innovation – and build your career in

our growing actuarial community.

Apply today at jobs.prudential.com/actuarial —

and get ready to build your actuarial career

at Prudential. Or, for more information, contact:

Shanna Cole at shanna.cole@prudential.com or

Deborah Hubal at deborah.hubal@prudential.com

We’ve done the math.

Now our team can

get to work.

Because at AIG, world-class opportunities translate into exciting global careers.

Visit www.aig.com/careers for information about career opportunities

and to search our current openings.

Apply now at www.aig.com/careers

T:7.125 in

© 2014. Prudential, the Prudential logo, the Rock symbol and Bring Your Challenges are service marks of Prudential Financial, Inc. and its related

entities, registered in many jurisdictions worldwide. Prudential is an equal opportunity employer. All qualified applicants will receive consideration

for employment without regard to race, color, religion, gender, sexual orientation, national origin, genetics, disability, age, veteran status, or any other

characteristic protected by law. Prudential Financial, Inc., Newark, NJ.

Prudential is an Employer that participates in E-Verify.

0260257-00001-00

STFR-A4519

So Special_IA

of B Conf_8.75x7.125.indd

1

34 |2_Diversity

International

A ssociation

of B lack A ctuaries

21st A nnual Meeting

Proud to sponsor the

2014 IABA Annual Meeting

Commitment Beyond Numbers

Follow us on LinkedIn (www.linkedin.com/company/aig) and

Twitter (@AIGinsurance)

visit us at pinnacleactuaries.com

5/21/14 2:08 PM

Expertise

Superior Communication

Better Business Decisions

Empathetic Customer Service

| 35

We have a strategy for your career.

At Liberty Mutual, we excel in helping actuaries achieve their career goals.

Liberty Mutual has CAS and SOA actuaries working in commercial and personal lines actuarial,

product, claims, marketing, and other parts of the company that require technical and predictive

modeling skills combined with practical business decision-making. Our actuaries are encouraged to

explore multiple career paths and have held roles that include SVP Chief Actuary, EVP Distribution,

SVP Chief Financial Officer, SVP Chief Product Officer, SVP Chief Marketing Officer, Innovation

Architect, and, Chairman & CEO, just to name a few.

Find your career strategy. Visit us at: www.libertymutualgroup.com/insurance-careers

Whether you’re still in school, an actuarial candidate, or an experienced actuary, we’ve got

an opportunity for you.

To learn more, visit: www.libertymutualgroup.com/insurance-careers

Responsibility. What’s your policy? ®

Whether you’re an experienced actuary, a

candidate, or you’re just out of school, we’ve got

the right opportunity for you. To learn more, visit:

www.libertymutualgroup.com/insurance-careers

Visit us at: