Gator Aid Handbook - UF Office for Student Financial Affairs

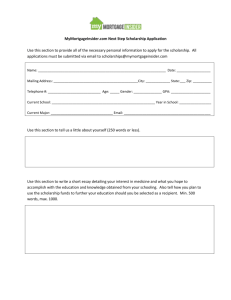

advertisement