saskatchewan provincial sales tax rulings - Finance

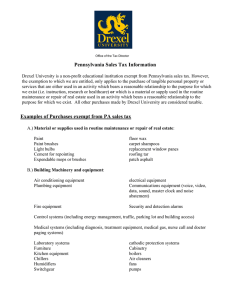

advertisement