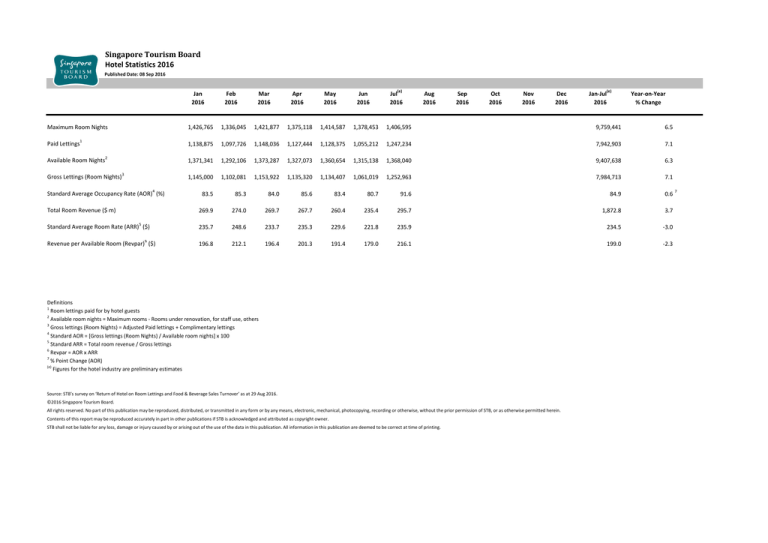

Singapore Tourism Board

Hotel Statistics 2016

Published Date: 08 Sep 2016

Jan

2016

Feb

2016

Mar

2016

Apr

2016

May

2016

Jun

2016

Jul(e)

2016

Aug

2016

Sep

2016

Oct

2016

Nov

2016

Dec

2016

Jan-Jul(e)

2016

Year-on-Year

% Change

Maximum Room Nights

1,426,765

1,336,045

1,421,877

1,375,118

1,414,587

1,378,453

1,406,595

9,759,441

6.5

Paid Lettings1

1,138,875

1,097,726

1,148,036

1,127,444

1,128,375

1,055,212

1,247,234

7,942,903

7.1

Available Room Nights2

1,371,341

1,292,106

1,373,287

1,327,073

1,360,654

1,315,138

1,368,040

9,407,638

6.3

1,145,000

1,102,081

1,153,922

1,135,320

1,134,407

1,061,019

1,252,963

7,984,713

7.1

83.5

85.3

84.0

85.6

83.4

80.7

91.6

84.9

0.6

269.9

274.0

269.7

267.7

260.4

235.4

295.7

1,872.8

3.7

235.7

248.6

233.7

235.3

229.6

221.8

235.9

234.5

-3.0

196.8

212.1

196.4

201.3

191.4

179.0

216.1

199.0

-2.3

Gross Lettings (Room Nights)

3

Standard Average Occupancy Rate (AOR)4 (%)

Total Room Revenue ($ m)

5

Standard Average Room Rate (ARR) ($)

6

Revenue per Available Room (Revpar) ($)

Definitions

1

Room lettings paid for by hotel guests

2

Available room nights = Maximum rooms - Rooms under renovation, for staff use, others

3

Gross lettings (Room Nights) = Adjusted Paid lettings + Complimentary lettings

4

Standard AOR = [Gross lettings (Room Nights) / Available room nights] x 100

5

Standard ARR = Total room revenue / Gross lettings

6

Revpar = AOR x ARR

7

% Point Change (AOR)

(e)

Figures for the hotel industry are preliminary estimates

Source: STB’s survey on ‘Return of Hotel on Room Lettings and Food & Beverage Sales Turnover’ as at 29 Aug 2016.

©2016 Singapore Tourism Board.

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of STB, or as otherwise permitted herein.

Contents of this report may be reproduced accurately in part in other publications if STB is acknowledged and attributed as copyright owner.

STB shall not be liable for any loss, damage or injury caused by or arising out of the use of the data in this publication. All information in this publication are deemed to be correct at time of printing.

7

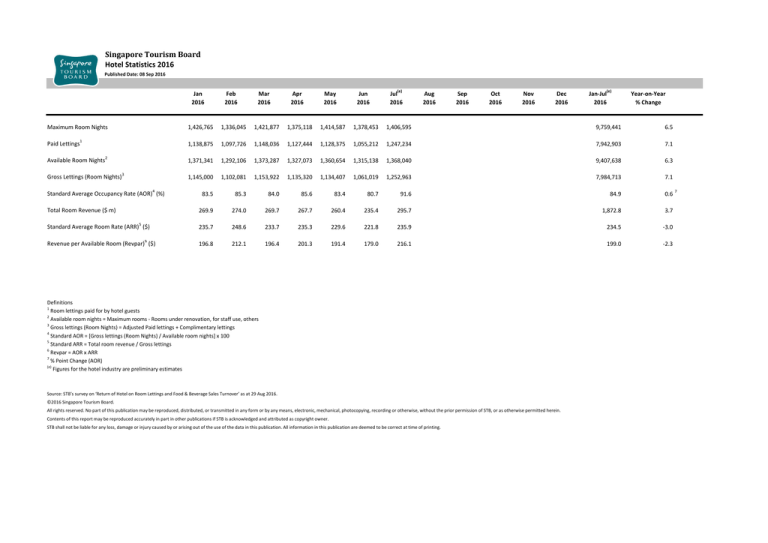

Singapore Tourism Board

Hotel Statistics 2016

Published Date: 08 Sep 2016

Monthly Hotel Paid Lettings with Y-o-Y Percentage Change

(Aug 2015 to Jul 2016)

2.0

1.8

20%

12%

12%

11%

9%

9%

7%

6%

6%

7%

6%

6%

10%

1.6

0%

Paid Lettings (Millions)

1.4

1.23

1.18

1.2

1.14

1.08

1.03

1.02

0.96

1.0

1.15

1.14

1.05

0.99

1.04

1.10

1.05

1.16

1.13

1.06

1.01

0.99

0.98

1.13

1.09

-10%

1.05 1.06

-20%

0.8

0.6

-30%

0.4

-40%

0.2

0.0

-50%

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Hotel Paid Lettings a Year Before

Jan-16

Feb-16

Hotel Paid Lettings

Mar-16

Apr-16

May-16

Y-o-Y % change in Paid Lettings

Jun-16

Jul-16

Y-o-Y % change in paid lettings

1%

Singapore Tourism Board

Hotel Statistics by Tier 2016

Published Date: 08 Sep 2016

Year

2016(e)

(Jan-Jul)

Luxury

%

85.2

% point ∆

0.0

85.2

88.4

85.5

84.4

82.1

81.5

89.7

0.3

0.4

-0.2

1.7

0.6

-2.8

-0.4

Jan

Feb

Mar

Apr

May

Jun

(e)

Jul

Aug

Sep

Oct

Nov

Dec

Standard Average Occupancy Rate

Upscale

Mid-Tier

%

% point ∆

%

% point ∆

85.6

-0.2

86.1

1.6

84.6

87.3

84.8

86.7

83.7

79.9

92.0

1.0

0.1

-2.3

4.1

0.4

-5.4

0.6

85.3

86.6

85.0

86.8

84.5

81.7

93.1

Economy

%

% point ∆

79.7

0.6

2.5

1.9

1.1

6.0

1.0

-3.3

1.9

74.5

74.4

77.9

81.6

81.4

78.3

89.3

-1.0

-1.3

1.6

3.7

0.2

-1.9

3.0

Luxury

S$

%∆

435.5

-0.9

Standard Average Room Rate

Upscale

Mid-Tier

S$

%∆

S$

%∆

261.0

0.1

170.9

-1.5

Economy

S$

%∆

100.6

-3.0

436.6

471.4

424.9

421.5

431.1

401.6

457.6

261.9

275.2

259.0

263.4

259.2

248.3

259.6

103.1

98.2

99.8

102.8

99.5

98.3

101.9

-5.7

2.8

-1.7

-3.3

-0.7

-4.4

6.0

-0.5

5.0

-1.7

1.7

1.6

-5.3

-0.3

168.4

173.6

172.3

176.3

168.8

166.2

170.7

-3.1

3.2

-4.1

2.1

-1.2

-7.4

0.4

-0.2

-3.7

-3.5

2.0

-1.5

-9.0

-4.0

Note:

The hotel tiering system is a reference system developed by the Singapore Tourism Board (STB) to categorise the different hotels in Singapore into tiers based on a combination of factors that include average room rates, location and product characteristics.

The current hotel tiers published are based on the hotels’ performance in 2015. The response rate across the tiers may vary.

Luxury - Includes hotels in the luxury segment and are predominantly in prime locations and/or in historical buildings

Upscale - Includes hotels in the upscale segment and are generally in prime locations or hotels with boutique positioning in prime or distinctive location

Mid-Tier - Includes hotels in the mid-tier segment and are primarily located in prime commercial zones or immediately outlying areas

Economy - Includes hotels in the budget segment and are generally located in outlying areas

(e)

Figures for the hotel industry are preliminary estimates

Source: STB’s survey on ‘Return of Hotel on Room Lettings and Food & Beverage Sales Turnover’ as at 29 Aug 2016.

©2016 Singapore Tourism Board.

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of STB, or as otherwise permitted herein.

Contents of this report may be reproduced accurately in part in other publications if STB is acknowledged and attributed as copyright owner.

STB shall not be liable for any loss, damage or injury caused by or arising out of the use of the data in this publication. All information in this publication are deemed to be correct at time of printing.

Luxury

S$

%∆

371.2

-0.9

Revenue Per Available Room (RevPar)

Upscale

Mid-Tier

S$

%∆

S$

%∆

223.4

-0.1

147.2

0.3

Economy

S$

%∆

80.1

-2.2

371.7

416.6

363.4

355.6

353.8

327.1

410.6

221.6

240.4

219.7

228.4

217.0

198.5

238.8

76.8

73.0

77.7

83.8

81.0

77.0

90.9

-5.3

3.3

-2.0

-1.3

0.0

-7.5

5.5

0.7

5.2

-4.3

6.7

2.1

-11.3

0.4

143.7

150.3

146.5

153.0

142.5

135.7

158.9

-0.3

5.6

-2.9

9.6

-0.1

-11.0

2.5

-1.5

-5.4

-1.5

6.8

-1.3

-11.1

-0.6