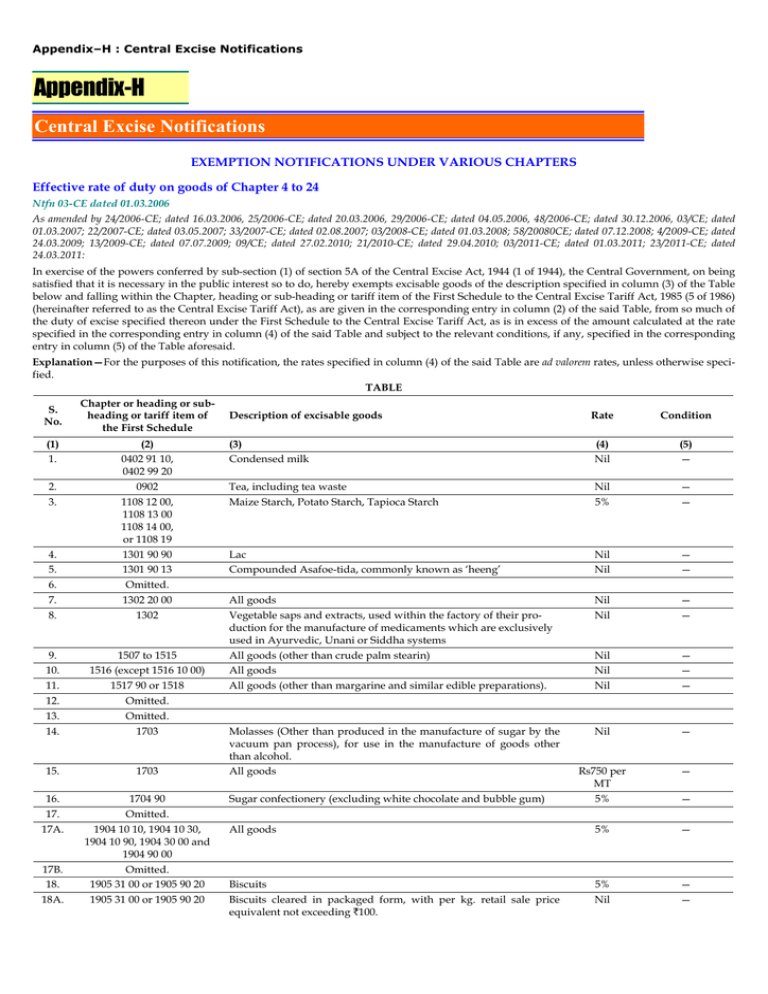

Central Excise Notifications (Appendix-H)

advertisement