Accounting, Organizations and Society 29 (2004) 27–49

www.elsevier.com/locate/aos

Control of inter-organizational relationships: evidence on

appropriation concerns and coordination requirements

Henri C. Dekker*

Vrije Universiteit Amsterdam, Amsterdam Research Center in Accounting (ARCA),

De Boelelaan 1105, 1081 HV Amsterdam, the Netherlands

Abstract

This paper presents a framework of the control of inter-organizational relationships. Building on transaction cost

economics and organizational theory, two control problems are identified that arise when firms engage in interorganizational relationships: the management of appropriation concerns and the coordination of tasks. The control

mechanisms used to manage these control problems and their interrelationships with informal (trust-based) mechanisms are discussed. The explanatory power of the framework is assessed by a case study of a strategic alliance between a

buyer and a supplier of railway safety equipment.

# 2003 Elsevier Ltd. All rights reserved.

Introduction

Following its widespread dispersion in practice,

research into the inter-organizational relationship

(IOR) is proliferating. In several social science

disciplines, such as economics, strategy, organizational and management research, the IOR has

become a research topic of substantial importance.

Accounting researchers, however, have been slow

to incorporate the concept of the IOR into their

research. It has been for some years that more

attention to this issue is called for (e.g. Hopwood,

1996; Otley, 1994). Since then, a few accounting

studies have explored accounting and control

issues in IORs, for instance in the context of

international joint-ventures (Groot & Merchant,

2000), outsourcing relationships (Anderson,

Glenn, & Sedatole, 2000; Gietzman, 1996; Van der

* Corresponding author. Tel.: +31-20-444-6066; fax: +3120-444-6005.

E-mail address: hdekker@feweb.vu.nl (H.C. Dekker).

Meer-Kooistra & Vosselman, 2000) and integrative buyer–supplier arrangements (Frances &

Garnsey, 1996). These boundary-spanning forms

of organizing economic activities have several

implications for the role of management control in

and in particular between firms, as ‘‘the scope of

the activity of management control is enlarged and

it no longer confines within the legal boundaries of

the organization’’ (Otley, 1994, p. 293). For

example, with respect to buyer-supplier arrangements Otley (1994, p. 293) notes that ‘‘there is

increased monitoring and control between organizations along the supply chain’’. And as Hopwood

argues (1996, p. 589) ‘‘planning, budgeting and

control processes flow from one organization into

others, creating, as they do, a more explicit

awareness of the interdependency of action and

the role which joint action can play in organizational success’’. Further, the literature reports high

failure rates of IORs, which are often attributed to

the difficulty of managing them (Ireland, Hitt, &

Vaidyanath, 2002). Management accounting and

0361-3682/03/$ - see front matter # 2003 Elsevier Ltd. All rights reserved.

doi:10.1016/S0361-3682(02)00056-9

28

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

control thus seem to be of substantial importance

for the management and performance of IORs.

The structure chosen to govern an IOR is often

argued to be critical to its success (Ittner,

Larcker, Nagar, & Rajan, 1999; Osborn &

Baughn, 1990) and effective governance is even

argued to be a source of inter-organizational

competitive advantage (Dyer & Singh, 1998; Ireland et al., 2002).

Despite the extensive attention towards IOR

governance in the literature, research into the

actual structuring, management and control of

these relationships has had less attention (Gulati

& Singh, 1998; Sobrero & Schrader, 1998). To

understand the management and control of

IORs, and its consequences, it is suggested that

researchers study and describe the coordination

mechanisms and processes used for IOR management (Grandori, 1997; Ireland et al., 2002).

Similarly, with respect to management accounting research, Tomkins (2001) argues that ‘‘the

area warrants more empirical research with a

greater emphasis upon business processes and

the use of accounting in action/negotiation’’ (p.

164).

This paper, in the next section, develops a

framework for explaining control in IORs, which

builds on transaction cost economics (TCE),

organization theory and notions of formal and

social control. The explanatory power of this

framework is evaluated in the light of empirical

evidence from a case study of a strategic alliance

between a buyer and supplier on the supply and

joint innovation of railway safety equipment. An

in-depth analysis of the structuring, management

and control of the strategic alliance is provided

and then the empirical evidence is related to the

constituent parts of the theoretical framework,

providing an explanation of the data. This case

study demonstrates the importance of acknowledging both the concepts of ‘appropriation concerns’ from TCE and ‘coordination requirements’

from organizational theory to explain the use of

control mechanisms in IORs. Furthermore, the

study signifies the importance of management

accounting mechanisms in the management of the

alliance. The paper ends with conclusions and

directions for future research.

The control of inter-organizational relationships

Generally, when discrete market exchange is

abandoned, some form of organizational relationship is crafted, either in the form of hierarchical

governance, referring to one firm, or in the form

of ‘hybrid governance’. Hybrid governance

encompasses a variety of IOR forms, varying from

joint ventures, buyer–supplier relationships, franchising and licensing agreements to inter-organizational networks. The organizational literature

focuses mainly on three interrelated issues in

IORs: (1) the motivations for IOR formation, (2)

the choice of governance structure and (3) the

effectiveness and performance of IORs (Kale,

Singh, & Perlmutter, 2000). The issue of control

relates directly to the second issue, the choice of

governance structure. In the literature this choice

has primarily been studied from a governance

perspective, which, informed predominantly by

transaction cost economics (TCE), predicts the

institutional form chosen to govern a transaction.

The governance of IORs: a transaction cost economic

perspective

TCE maintains that in principle a transaction

can be governed by three discrete structural

mechanisms: market, hierarchy or hybrid governance (Williamson, 1991).1 The choice of mechanism to govern a transaction depends on a

comparative analysis of the transaction costs of

these alternatives, which costs relate to writing,

monitoring, adapting and enforcing contracts.

Assuming equal production costs, TCE predicts

that the governance structure associated with the

lowest transaction costs will be chosen to govern

the transaction (Williamson, 1985, 1991). Transaction costs depend on a combination of certain

characteristics of the transaction taking place (i.e.

asset specificity, uncertainty and frequency) and

certain characteristics of human nature (i.e. bounded rationality and opportunism). When collaborating firms make investments specifically for

the IOR, which have little alternative use, and

1

Speklé (2001) recently provided an analysis of how TCE

can be used to inform the study of management control.

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

hence little alternative value outside the IOR,

appropriation concerns arise. They therefore need

to safeguard their investments from being appropriated by the potentially opportunistic other.

When these investments are made in a situation

characterized by uncertainty about the future state

of events, over time partners may face adaptation

problems as unexpected contingencies arise. However, bounded rationality limits them to write

contingent claim contracts, covering every possible future contingency. Therefore, they are left

with the use of incomplete contracts, which can

become subject of adaptation problems and leave

room for opportunistic behavior. These incomplete contracts need to be managed by alternative

control mechanisms of which hierarchical controls

are conceived to be particularly effective by aligning incentives, providing monitoring and realizing

control by fiat (Gulati & Singh, 1998).

TCE considers ‘the hybrid’ to be an intermediate form of governance, encompassing all

alternative exchange mechanisms between the

extremes of market and hierarchy. It is regarded

as a mixture of market and hierarchical governance, as it sacrifices some of the high powered

incentives of the market in favor of superior coordination and some cooperativeness of the hierarchy

in favor of superior market incentives (Gulati, 1995;

Williamson, 1991). The extent to which hybrid

governance will resemble market or hierarchical

elements depends on the magnitude of appropriation concerns. Increasing appropriation concerns

lead to increasing use of hierarchical controls.

In recent years TCE has received many critiques

and it has been argued that for understanding

IOR governance the theory has not been very

useful (Larson, 1992). TCE’s main ability is to

predict the form of governance structure (i.e.

market, hybrid, hierarchy, or ‘the degree of hierarchical governance’) as a function of transaction

characteristics (Chiles & McMackin, 1996). This

prediction, however, is insufficient to adequately

explain the management and control of IORs for a

number of reasons. First, due to its singular focus

on the notions of opportunism and transaction

cost minimization TCE lacks recognition of the

variety in IORs’ forms and goals. Second, TCE’s

static nature has resulted in a negligence of the

29

organizational mechanisms used in IOR governance. Furthermore, due to its lack of dynamism

TCE has taken little account of the social

mechanisms of governance, while IORs often are

embedded in a rich and influential social context.

The heterogeneity of IORs: goals and forms

In contrast to TCE’s treatment of the hybrid

form as a homogeneous category of organization

structures somewhere between market and hierarchy, in recent years it is increasingly being

acknowledged that ‘the IOR’ actually comprises a

rather heterogeneous phenomenon. IORs may use

a wide range of transaction forms (Osborn &

Baughn, 1990) and can serve a great variety of

functions, of which economizing on transactions

may only be a part (Osborn and Hagedoorn,

1997). Because IORs are initiated for many reasons and are structured in many ways, it can be

questioned whether treating them as a generic

intermediate mode between market and hierarchy

is very insightful. Osborn and Hagedoorn (1997)

argue that different administrative forms of IORs

may better be viewed as separate and unique entities. Although Williamson (1999) agrees that

economizing on transaction costs may not be the

only goal of organizing transactions in particular

governance forms, he argues it to be ‘‘the main

case’’ (p. 1090). However, as argued by Osborn

and Hagedoorn (1997), ‘‘some alliances may be

designed to reduce transaction costs, but this is

not their only function’’ (p.274). And ‘‘focusing

exclusively on transaction costs [. . .] may hide

more than it reveals’’ (p. 274). For this reason they

and other authors suggest to apply different theoretical perspectives to the study of IORs, as it is

unlikely that a single theoretical perspective can

provide a thorough understanding of the complexities of this phenomenon (Chiles & McMackin,

1996; Smith, Carroll, & Ashford, 1995).

What other purposes may control in IORs then

relate to? According to Fisher (1995) in intra-firm

settings ‘‘control is used to create conditions that

motivate the organization to achieve desirable or

predetermined outcomes’’ (p. 25). Translated to an

inter-organizational setting the primary purpose of

control can be described as creating the conditions

30

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

that motivate the partners in an IOR to achieve

desirable or predetermined outcomes. This definition suggests that managing transaction risks is

only part of the control challenges in the pursuit

of desirable or predetermined outcomes. Firms

establish IORs for realizing mutually beneficial

outcomes by cooperatively performing valuecreating activities (Borys & Jemison, 1989; Dyer &

Singh, 1998; Zajac & Olsen, 1993). When adopting

a value-creation perspective on IORs, then TCE’s

value-appropriation concerns reduce to only a

subset of organizational issues in IORs. To create

transactional value, IOR partners pool resources,

determine tasks to be performed and decide on a

division of labor. The resulting interdependence

between the subtasks the partners agree to perform subsequently needs to be coordinated across

organizational boundaries to ensure a fit between

their points of contact. A second purpose of control in IORs therefore can be described as the

coordination of interdependent tasks between partners. Different logics of value creation, as determined by the strategic rationale of an IOR, result

in different levels of interdependence, requiring

different degrees of mutual adaptation and

adjustment (Borys & Jemison, 1989). As the IOR’s

tasks become more interdependent and more

uncertain, the need for coordination and joint decision making increases (Dyer, 1996; Galbraith, 1977;

Gulati & Singh, 1998; Thompson, 1967). Hierarchical control mechanisms are considered to be

effective mechanisms to manage increasing information processing requirements (Galbraith, 1977;

Gulati & Singh, 1998; Thompson, 1967). Consequently, different (higher) degrees of interdependence result in different (more complex)

administrative forms of organization. Gulati and

Singh (1998) stress the importance of using control

mechanisms for managing task interdependence by

arguing that ‘‘concerns about anticipated coordination costs are particularly salient in alliances,

which can entail significant coordination of activities

between partners and yet have to be managed without the benefit of the structure and systems available

in traditional hierarchies’’ (p. 784). In addition, task

characteristics influence appropriation concerns, as

more complex and uncertain tasks lead to increasing

contracting difficulties (Anderson et al., 2000).

The level of interdependence in IORs can vary

from very low, requiring few coordination efforts,

to very high, requiring continuous communication

and decision making between partners. This can

be described well by Thompson’s (1967) categorization of pooled, sequential and reciprocal interdependence. In IORs characterized by pooled

interdependence each partner renders a discrete

contribution to and can draw from the common

pool of resources (Thompson, 1967). Coordination requirements are low as partners have little

need for any ordering of activities. In a situation

of sequential interdependence, for instance a typical buyer–supplier relationship, resources are

transferred from one partner to another and

coordination is characterized by ensuring an

appropriate fit between the points of contact

(Borys & Jemison, 1989), for instance by crossactivity programming (Grandori, 1997; Thompson, 1967). IORs characterized by reciprocal

interdependence, in which partners’ activities are

necessary inputs for each other’s activities, generally ask for fit between a wider range of partner

operations and require more complex coordination mechanisms for communication and ongoing adjustment to each other’s situation (Borys &

Jemison, 1989). Examples are IORs focusing on

sharing complementary technology, jointly reducing innovation time and jointly developing new

technology, in which partners actively seek to

deepen and broaden skills or to learn and develop

new skills (Gulati & Singh, 1998).

Summarizing, appropriation concerns and coordination requirements are powerful concepts in

explaining IOR management and control, by

jointly describing collaborating firms’ need to

manage the creation and to safeguard the appropriation of value.2 Governance mechanisms are

useful in the management of these problems.

2

Tomkins (2001) recently described two similar management problems in relationships, alliances and networks, which

he labels ‘the generation of trust’ (i.e. the management of

appropriation concerns) and ‘the mastery of events’ (i.e. the

coordination of activities). The framework in this paper provides a theoretical rationale for the presence and magnitude of

those two problems in IORs and the use of control mechanisms, which he labels as ‘type I’ and ‘type II’ information.

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

The mechanisms of governance

A second limitation of TCE for adequately

explaining IOR control lies in its recognition of

the mechanisms of governance. As a consequence

of TCE’s singular focus on the notion of opportunism, the primary mechanisms to govern IORs

or ‘hybrid forms’ are often considered to consist

only of legal and private ordering (Nooteboom,

Berger, & Noorderhaven, 1997). Legal ordering

comprises the writing and third party enforcement

of contractual agreements. Private ordering comprises formal self-enforcing mechanisms or ‘hostages’ created intentionally to align the economic

incentives of the transacting parties, such as equity

stakes and symmetrical investments in specialized

assets. This primarily contractual view of governance is incomplete, as it lacks the examination of

the organizational mechanisms of governance

(Grandori, 1997; Sobrero & Schrader, 1998; Zaheer & Venkatraman, 1995; Zajac & Olsen, 1993).

Gulati and Singh (1998), for instance, identify five

important types of control mechanisms in IORs

that include such organizational elements: command structures and authority systems, incentive

systems, standard operating procedures, dispute

resolution procedures and non-market pricing

systems. Sobrero and Schrader (1998) argue that

while in general the contractual structuring is used

to provide the institution for aligning the partners’

incentives, the procedural (or organizational)

structuring concerns mainly how firms actually

align their joint processes through organizational

mechanisms.3

A second form of governance not well recognized

by TCE is informal or social control. By isolating the

transaction from its context and treating it as an

independent event, TCE ignores the (governance)

3

Although Sobrero and Schrader (1998) argue that contractual and procedural mechanisms serve different purposes

and can be separated empirically, this does not necessarily hold

true. A contract is not only used to reduce a partner’s incentives to behave opportunistically, but in addition serves as a

framework for coordination in which the cooperation proceeds

(Gulati, 1995). And a joint venture’s administrative hierarchy

not only coordinates the joint venture’s day to day functioning

and addresses problems as they arise; simultaneously it is used

to detect opportunism when it occurs.

31

effects of prior and repeated interactions between

firms and individuals (Gulati, 1995; Ring & Van

de Ven, 1992). Repeated interactions can cause an

IOR to become embedded in an influential economic and social context, which may strongly

influence its formal structure. This social context,

which can result in informal coordination and

monitoring and high trust between partners, touches upon some of the key assumptions of TCE

(Klein, Palmer, & Conn, 2000). For instance, with

similar or even increasing levels of asset specificity

in the IOR, it enables the partners to gradually use

less hierarchical elements in organizing their relationships (Gulati, 1995, 1998). Many alternative

views on the nature of IOR governance exist, such

as reciprocity norms, reputations, trust, personal

relationships and the embeddedness of relationships in a social network of current and prior ties.

These ‘informal self-enforcing safeguards’ (Dyer,

1996; Dyer & Singh, 1998) differ substantively

from control by prices in the market and the

administrative authority in the hierarchy. These

critiques on TCE’s limited recognition of both

formal and social mechanisms of governance warrant a broader classification of control mechanisms in IORs.

A classification of control mechanisms in IORs

A useful classification of control forms that

complies with the previous critiques is the distinction between formal and informal control

mechanisms (Smith et al., 1995). Formal control

consists of contractual obligations and formal

organizational mechanisms for cooperation and

can be subdivided into outcome and behavior

control mechanisms (Ouchi, 1979). Informal control, also referred to as social control and relational

governance, relates to informal cultures and systems influencing members and is essentially based

on mechanisms inducing self-regulation (Ouchi,

1979). Outcome, behavior and social control are

often equated with the conceptions of market,

hierarchy and clan/community types of governance

(e.g. Adler, 2001; Ouchi, 1979) and are useful

mechanisms for both managing appropriation

concerns and coordinating interdependent tasks.

Based on the extant literature on IOR governance,

32

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

Table 1

Formal and informal control mechanisms in inter-organizational relationships

Outcome control

Ex-ante mechanisms

Goal setting

Incentive systems/reward structures

Ex-post mechanisms

Performance monitoring and rewarding

Behavior control

Social control

Structural specifications:

Planning

Procedures

Rules and regulations

Partner selection

Trust (goodwill/capability):

Interaction

Reputation

Social networks

Behavior monitoring and rewarding

Trust building:

Risk taking

Joint decision making and

problem solving

Partner development

Table 1 identifies and classifies several behavior,

outcome and social control mechanisms in IORs.

Ex-ante control mechanisms mitigate control

problems by aligning partners’ interests and by

reducing coordination needs before implementing

the IOR. Because ex-ante formal control mechanisms are often incomplete, during the relationship

unresolved control problems are managed by expost control mechanisms that achieve control by

processing information and evaluating performance (Ittner et al., 1999; Ouchi, 1979).

Formal control: outcome and behavior control

Outcome control mechanisms specify outcomes

to be realized by the IOR and by its partners and

monitor the achievement of these performance

targets. Goal setting sets directions for task performance, clarifies mutual expectations and

increases goal congruence (Das & Teng, 1998), in

particular when rewards are explicitly linked to

goal attainment.

Behavior control mechanisms specify how IOR

partners should act and monitor whether actual

behaviors comply with this pre-specified behavior.

Typical ex-ante behavior controls used in IORs are

planning, programs, rules, standard operating

procedures and dispute resolution procedures

(Gulati & Singh, 1998). Das and Teng (1998) suggest that behavior monitoring consists of elements

such as ‘‘reporting and checking devices, written

notice of any departure from the agreement,

accounting examination, cost control, quality control, arbitration clauses, and lawsuit provisions’’

(p. 507). They argue that because IORs are often

characterized by goal incongruence and performance ambiguity, behavior control mechanisms

can be important to ensure desirable behavior.

Informal control: social control mechanisms

Trust often is argued to be the principal mode of

social control in IORs (e.g. Adler, 2001; Ring &

Van de Ven, 1992).4 Rousseau, Sitkin, Burt, and

Camerer (1998) define trust as ‘‘a psychological

state comprising the intention to accept vulnerability based upon positive expectations of the

intentions or behavior of another’’ (p. 394). They

argue that ‘‘trust is not a behavior (cooperation),

or a choice (e.g. taking a risk), but an underlying

psychological condition that can cause or result

from such actions’’ (p. 395). Trust manifests itself

in different ways and can have several origins.

Trust can relate to distinct firm characteristics, of

which in IORs a partner’s goodwill and capabilities

are of particular importance (Sako, 1992). Goodwill

trust is the expectation that another will perform in

the interests of the relationship, even if it is not in

the other’s interest to do so, and essentially relates

4

Das and Teng (1998) argue that trust cannot be considered

being a control mechanism, as ‘‘self-control does not involve

influencing behavior of others’’ (p. 495). However, as self-control is the basic principle of social control, trust can be regarded

being an important component of social control.

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

to not behaving opportunistically. Capability trust

relates to expectations about another’s competencies to perform a task satisfactorily.

Rousseau et al. (1998) differentiate calculusbased trust, relational trust and institution-based

trust as different origins of trust. Calculus-based

trust is based on utilitarian considerations and

relies on credible information, such as reputations

and information from network relationships about

another’s goodwill and competencies. Furthermore, it relies on opportunities for deterrence

whenever malfeasance may occur, such as withdrawing future business opportunities and

spreading of information about one’s behavior

among networked partners, affecting other current

and future relationships the partner is and may get

involved in. Relational trust emerges from repeated interaction between trustor and trustee and

is based on information available to the trustor

from within the relationship itself. It is often

found in IORs with a long-lasting history of prior

interaction (Gulati, 1995; Kale et al., 2000).

Although relational trust is an emergent characteristic and cannot simply be implemented, over

time it can be built. Mechanisms to build trust are

deliberate risk taking and increasing interaction,

for instance by joint goal setting, problem solving,

decision making and partner development activities (Das & Teng, 1998; Kale et al., 2000; Saxton,

1997; Uzzi, 1997).5 Close interaction further leads

to commitment to and interest in the outcomes of

the relationship, and, by reducing information

asymmetry, results in a decreasing likelihood of

opportunistic behavior and a better recognition of

it when it occurs (Saxton, 1997). Moreover, interaction enables partners to learn about another’s

skills and expectations and to establish standardized communications and routines, influencing

formal coordination (Jones, Hesterly, & Borgatti,

1997). Institution-based trust, finally, is based on

5

For trust to arise, two necessary conditions, risk and

interdependence, must be present (Rousseau et al., 1998). Risk

refers to a perceived probability of loss, as there is uncertainty

whether another intends to and will act appropriately. Nooteboom et al. (1997) in addition suggest the size of loss to be an

important component of relational risk. Interdependence exists

when a firm cannot achieve its goals without reliance upon

another.

33

institutional controls the relationship is subject to,

such as the ability to rely on legal forms and societal norms and values, which may as well undermine trust.

Another way of deliberately generating trust

and thereby mitigating control problems before a

governance structure is designed and implemented

is selecting an appropriate partner, based on good

predictors of desirable cooperative behaviors

(Grandori & Soda, 1995; Ireland et al., 2002; Jones

et al., 1997; Ouchi, 1979). Ireland et al. (2002)

argue that effective alliance management begins

with selecting a good partner, which influences the

need to design and implement expensive formal

control mechanisms by increasing confidence in

another’s goodwill and capabilities. Selecting a

partner with appropriate skills, for instance based

on quality criteria, technological capabilities and

supplier certification, influences expected future

coordination efforts. And goal incongruence and

related appropriation concerns can be reduced by

assessing a potential partner’s norms, values and

motivation to perform, for instance through

information collection at joint network relationships. Similar to the use of formal controls,

increasing anticipated appropriation concerns and

coordination requirements will induce firms to

invest more efforts in selecting a good partner.

The relationship between trust and formal control

A much-debated question in the IOR literature

is the relationship between formal control

mechanisms and trust; i.e. whether (goodwill) trust

is a substitute or a complement for formal control

mechanisms in the management of appropriation

concerns (Adler, 2001; Chiles & McMackin, 1996;

Das & Teng, 1998; Gulati, 1995, 1998; Jones et al.,

1997; Nooteboom et al., 1997; Poppo & Zenger,

2002; Ring & Van de Ven, 1992; Rousseau et al.,

1998; Tomkins, 2001; Zaheer & Venkatraman,

1995). A substitutive relationship suggests that

trust and formal control are inversely related; more

trust results in less use of formal control mechanisms and vice versa. When, for instance, a firm has a

reputation for being trustworthy, its partners may

choose to use less formal control mechanisms compared to a firm with a less favorable reputation.

34

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

Because trust reduces goal conflict, the need for

formal control mechanisms to deter opportunism

reduces, as parties are inclined to act in each other’s interest (Ouchi, 1979). Furthermore, the use of

formal controls is argued to signal one’s trust in

another. Extensive use of formal control suggests

a lack of belief in one’s goodwill or competence

and therefore results in a damaging effect on relational trust (Das & Teng, 1998).

A complementary relationship, on the other hand,

suggests that trust and formal control are additively

related; an increase in the level of either trust or

formal control simply results in a higher level of

control (Das & Teng, 1998; Poppo & Zenger, 2002).

In addition, the use of formal control mechanisms

may actually enhance a trusting relationship, by

narrowing the domain and severity of risk (Poppo &

Zenger, 2002) and by their objectivity and provision

of a track record about the other’s performance,

behaviors and skills (Das & Teng, 1998).

Three observations may advance this discussion

whether formal controls substitute or complement

and damage or enhance trust. First, the arguments

above indicate that this relationship may actually

be nonlinear. Until a certain threshold (determined

by the IOR’s transaction hazards) the use of formal controls may be complementary and enhancing to trust. However, as trust is the low-cost

solution, it will substitute formal controls whenever a sufficient level of control is realized for

safeguarding the transaction. Partners will not

unnecessarily use expensive formal control

mechanisms and in addition risk damaging the

quality of their relationship. Similarly, this implies

that relational trust will only be damaged when

the use of formal control exceeds this threshold.6

6

Tomkins (2001) likewise discusses the relationship between

trust and information during different stages of the relationship

life cycle as an inverted U-shape; in the early stages of the

relationship trust and information are additively related, while

later on they become substitutes. Here the argument relates not

necessarily to the stage of the relationship, but to the level of

trust at a certain point in time (which may also result from

other sources than interaction over time alone) and the need for

control. Only when trust is insufficient will formal control

mechanisms be utilized to resolve control problems. Note that

in this static argument no dynamic view is taken on increasing

commitments and the (deliberate) generation of trust over time,

as Tomkins does.

Second, the effect of trust may better not be

expressed as a direct effect on the use of formal

control mechanisms, but rather as a moderating

effect on the relationship between control problems and use of control mechanisms. A moderating effect suggests that the use of formal control

mechanisms to manage transaction hazards

depends on the level of trust. Tomkins (2001), in

his discussion of the relationship between building

trust and using control mechanisms to absorb

uncertainty from economic interdependence, suggests that ‘‘it is the level of uncertainty absorption

effort that has to be related to economic interdependence, not trust per se’’ (p. 167). Thus, it is

the magnitude of the transaction hazards that

induces the use of formal control mechanisms,

while the level of trust only influences the strength

of this association.

Third, it is important to differentiate between

the different purposes of control. While high

mutual goodwill trust may diminish partners’

concerns about transaction hazards, formal control mechanisms may still be used for task coordination. The relationship between trust and the use

of formal control mechanisms for task coordination is less often addressed in the literature. Kale

et al. (2000) suggest that in learning alliances relational trust not only helps to protect the firm’s

core specific assets from partners, in addition it

significantly influences the ability of a firm to

manage learning from them. And Gulati and

Singh (1998, p. 791) argue that ‘‘firms that trust

each other are likely to have a greater awareness or

willingness to become aware, of the rules, routines,

and procedures each follows [. . .] firms may have

developed routines together to enable ease in joint

interaction with each other from their prior

experience’’. Uzzi (1997) illustrates how socially

strong embedded ties between a designer and manufacturer positively influence the coordination and

performance of outsourced garment production:

If we have a factory that is used to making

our stuff, they know how it’s supposed to

look. They know a particular style. It is not

always easy to make a garment just from the

pattern. But a factory that we have a relationship with will see the problem when the

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

garment starts to go together. They will know

how to work the fabric to make it look the

way we intended. A factory that is new will

just go ahead and make it. They won’t know

any better (Uzzi, 1997, p. 46).

Whereas the design pattern serves to coordinate

the manufacturer’s activities, the manufacturer

independently decides to modify the garment

manufacturing from the design. The manufacturer’s knowledge of the designer’s needs, and

the designer’s trust in the manufacturer’s skills

thus complement the design pattern as a formal

coordination mechanism to achieve a higher level

of control and performance.

These arguments suggest that increasing (capability) trust in and knowledge of a partner can

result in either a reduced need for formal coordination or in improved coordination. Analogous to

the relation between trust and appropriation concerns, it is suggested that (capability) trust complements the use of formal control mechanisms for

task coordination until a sufficient level of control

is realized, after which the relationship becomes

substitutive. The influence of trust may also best

be presented as a moderating effect on the relationship between coordination requirements and

formal control.

Finally, a similar effect of trust may be expected

on the relation between control problems and the

partner selection process, which is postulated as

an alternative to the use of formal controls. For

given transaction characteristics and coordination

requirements increasing goodwill and capability

trust are expected to moderate the efforts invested

in searching among alternative IOR partners.

Summary of the framework

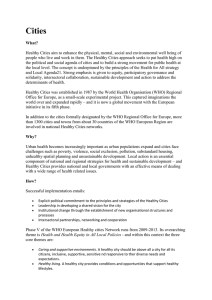

Fig. 1 summarizes the main predictions of the

theoretical framework. It suggests how control

problems, as described by variables from TCE and

organization theory, influence collaborating firms’

need to invest effort in selecting a good partner to

mitigate the problems and to design and implement formal control mechanisms to manage the

problems. Investing more efforts in finding a good

partner reduces the need for formal control.

35

Increasing trust in goodwill and capabilities, after

thresholds, are expected to reduce the strength of

the association between respectively appropriation

concerns and coordination requirements and the

use of formal controls and partner selection

efforts.

The next sections assess the explanatory power

of this framework, using data from an in-depth

investigation of the initiation and design of a

strategic alliance.

A case study on the control of a strategic

alliance

Research method and design

In November 1999 NMA Railway Signalling

(NMA), a supplier of railway safety systems, and

Railinfrabeheer (RIB), a task organization of the

Dutch government responsible for the Dutch rail

infrastructure, formally agreed to engage in a

strategic alliance for the supply and innovation of

automatic half-barrier installations. A detailed

analysis of this alliance’s formal governance

structure was made to provide empirical evidence

on the theoretical framework. The extent to which

the framework contributes to a satisfactory

explanation of the structuring and control of this

alliance is indicative of its explanatory power

(Yin, 1994). Furthermore, the evidence may suggest shortcomings in the explanation, providing

directions for extensions or modifications.

Although the explanation of the governance

structure is at the dyadic level of analysis, the

constructs of interest, such as appropriation

concerns and trust are studied from both partners’ perspectives. This focus on the firms within

the dyad allows to account for heterogeneity

between the partners and for their differential

influence on the governance structure (Klein et

al., 2000).

The data collection started 2 weeks before the

partners signed the alliance contract. Semi-structured interviews and informal discussions were

held with boundary spanners of both firms, who

were the designers of the governance structure and

are involved in the management and operation of

36

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

Fig. 1. A representation of the main predictions of the framework.

the alliance.7 Further, an analysis of the alliance

contract was made and several other internal and

external documents that relate to the initiation

and design of the alliance were studied.8

The context of the alliance

For over 120 years NMA has supplied components for railway safety systems to the Dutch Railways (in Dutch: Nederlandse Spoorwegen, from

now on NS), that until 1995 was a public organization. The components NMA delivered to NS

relate to three types of systems, which historically

7

The interviews were structured by an interview protocol

based on the theoretical framework, but left ample room for

the interviewee to discuss what in his or her perception was

important. The interviews were tape recorded and fully transcribed for analysis.

8

The analysis of the contract was a good opportunity to

obtain a good picture of the alliance’s formal governance

structure, as it in detail describes its structuring and functioning. Other documents used included a brochure and internal

slides about the alliance and general company and product

information. The use of multiple sources of evidence (triangulation) enables to crosscheck findings, making conclusions

more reliable and convincing (Yin, 1994). Further, each source

can provide explanations for and additions to findings from

other sources.

have been developed in joint cooperation with NS:

electronic point machines, railway crossing protection systems and color light signals. As there

are no competitors with comparable products that

would fit directly into the existing rail infrastructure, NMA is monopolist in the Netherlands.

NS (and later RIB) has always been NMA’s largest domestic customer and accounts for a significant part of its turnover.

In 1995 NS was privatized from the Dutch

State. Its tasks were divided among several task

organizations of the Dutch Ministry of Transport,

Public Works and Water Management and several

commercial units that together form the NS Group,

in which the State is the only shareholder. The task

organizations became responsible for the building,

maintenance and use of the rail infrastructure; functions that were considered socially too important to

be commercialized. RIB became the task organization responsible for the building, installation and

maintenance of the Dutch rail infrastructure.

In general two types of activities are performed

on the railways, which are almost completely outsourced to contractors: the building of new rail

infrastructure and the maintenance and control of

existing rail infrastructure. While building activities

are outsourced to project contractors on a project

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

basis, maintenance and control are outsourced to

process contractors for a fixed time period. After

the privatization, RIB’s new management decided

that contractors should also become responsible

for the purchasing of components and materials.

In its ordering to contractors RIB then would

specify the required quantities and quality. RIB

recognized, however, that many of its supply

chains were characterized by large inefficiencies. In

the supply chain of the half-barrier installation,

for instance, NMA delivered components to

assembling firms, which subsequently delivered

assembled systems to RIB’s contractors to be kept

in stock and installed on the railways. Without

adding much value these parties added significant

cost to the supply chain.

An important goal of RIB’s management was to

better control purchasing costs. It decided to pursue different purchasing strategies for different

types of products, as categorized by their financial

risks and delivery risks (based on Kraljic, 1983).

NMA’s products were classified as ‘bottleneck

products’, as their cost impact is modest, but their

delivery risks are high, because of the monopolistic supply situation and the serious consequences of inadequate delivery. These products

are relatively difficult and costly to specify and to

secure continuous and adequate supply a closer

long-term relationship with the supplier is desired.

Following the purchasing strategy, for this type of

products RIB agrees on a call-off contract with the

supplier. Contractors must use this supplier and are

bound tot the contractual conditions. The alliance

with NMA is RIB’s first formal long-term relationship in this segment of the purchasing portfolio.

The initiation of the alliance

RIB had several reasons to initiate an alliance

with NMA. First, RIB’s management expected to

achieve significant cost reductions by reorganizing

the half-barrier installation’s supply chain. Second, to moderate delivery risks the new purchasing strategy suggested to engage in a long-term

relationship with NMA. Third, an alliance was

considered a good vehicle to internally manage a

cultural change towards more market orientation

and cost consciousness. RIB’s management

37

describes the organization as predominantly

‘‘technology driven’’, with less recognition of its

associated costs. Traditionally RIB technicians

have always made and exchanged technical product specifications with NMA. A better trade-off

between cost, quality and safety should be

achieved by having them to write ‘functional specifications’, describing the essential functions the

product should be able to perform at a certain

level of performance, for which a cost efficient

solution must be developed in joint cooperation

with NMA. This requires RIB technicians to shift

their internal technological focus towards cost and

functionality. Fourth, RIB initiated this first alliance with a long-related supplier to gain experience in the building, designing and outcomes of a

close relationship. As RIB’s management believed

that cultural differences are important impediments to alliance success, ‘having the right fit’ was

an important criterion in selecting NMA.

At the time RIB approached NMA with the

proposition to collaborate (in 1998), NMA’s

management had just finished a study about the

firm’s future. This study concluded that NMA,

similar as in its export markets, domestically

should achieve to become a systems supplier, by

integrating forward into the supply chain. This

meant NMA should also take care of component

assembly to systems, stock keeping and transportation to the installation site. Therefore, NMA was

eager to accept RIB’s proposition to collaborate.

The alliance contract

RIB and NMA boundary spanners spent

approximately 1 year on negotiating and designing

the alliance. The 5-year during legal contract that

resulted from this process in detail handles a wide

range of agreements about the alliance and is central in its governance.9 It includes its scope, goals

9

Informally, the partners have agreed on subsequent contract extensions, as long as the alliance results in ‘mutual satisfaction’. This is realized when the alliance achieves the partners’

joint and individual goals and as long as no better (long-term)

alternative is available in the market. The contract mentions that

NMA’s systems, compared to similar functions of other suppliers, have to be ‘good’ products, in which safety, maintenance

and operational aspects and standardization are key aspects.

38

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

and plans for achieving those goals, the organizational and personnel structuring, a financial

incentive system, the partners’ mutual responsibilities, the distribution and protection of intellectual property rights, and the exchange of cost

information. The contract’s appendices describe

agreements in more detail to be used in the operation of the alliance, including product descriptions and prices, a ‘program of improvement’ to

coordinate innovations, quality plans and guidelines for calamities and operational mechanisms.

These appendices are used in the operations of the

alliance and are revised annually, as a result of

completion of and progress on activities, and due

to changing circumstances, such as learning about

activities and outcomes and changing market

conditions. Thus, although the contract is relatively detailed, it is intentionally left incomplete, to

provide the contracting parties room to maneuver

within uncertainties and changing contingencies.

The scope and goals of the alliance

The partners decided to focus the alliance on

automatic half-barrier installations for level crossings, in particular because of the high cost reducing potential of its supply chain. In 1999 RIB had

an installed base of approximately 2800 automatic

half-barrier installations on level crossings in the

Netherlands and yearly dozens of new systems are

installed.10 NMA manufactures all important

components of the installation and because it has

been developed in cooperation with and specifically

for NS, it is unique to RIB. Therefore, as expressed

in the contract, for RIB securing supply and further

development of the installation is a driver to engage

in the alliance, while for NMA securing turnover

for a longer time period is an important goal.

The first specific goal the partners agreed on was to

reorganize the supply chain, by relocating tasks and

reducing the number of firms operating in it. NMA

took over component assembly from the assembling

firms and stock keeping and transportation from

10

This number is growing rapidly as in 2001 a program has

been initiated to improve railway safety by converting warning

systems on level crossings without barriers to automatic halfbarrier installations on a reasonable large scale. For 2001, 120

conversions were planned.

the contractors, while RIB bound both project and

process contractors to purchase at NMA. For

NMA this change resulted in exclusive business

and an augmentation of its supply task. RIB gained

a significant price reduction, as many non valueadded costs in the supply chain were eliminated.

This supply chain reorganization, however, was

not sufficient to realize all goals the partners

wished to achieve by collaborating and they also

did not perceive it to be a sufficient reason for

establishing an alliance. Reductions in the costs of

components, operation and maintenance could be

achieved by improving the installation’s cost inefficient design. Furthermore, RIB wanted to use this

first alliance for learning purposes and to support

the establishment of an internal cultural change.

For these reasons, the goal of the alliance was

defined as the joint innovation of the half-barrier

installation to realize additional cost savings and to

enhance its quality and safety. As stated in the

contract: ‘‘By entering into an alliance, the parties

wish to save money on, and make innovations to, halfbarrier installations for level crossings, which savings

and innovations will benefit both parties’. The alliance

embodies an ‘intensive cooperation in the area of

development and extension of half-barrier installations, which have been produced or will be produced,

to improve continuity. In addition, the parties expect

economies of scale and a lower price for half-barrier

installations’’. Both parties benefit from innovations

by ‘‘compensating NMA for the reduced price’’ and

‘‘creating financial possibilities for innovations to

automatic half-barrier installations focused on cost

reductions (in price and RIB’s total cost of ownership), quality improvement and safety improvement’’.

The main focus of innovation thus is to design

costs out of the product, to reduce RIB’s total cost

of ownership (TCO). This can be achieved either

by changes reducing the installation’s product

costs, resulting in a price reduction, or by changes

reducing activity costs by improving the efficiency

of its maintenance and operating activities.11 A

11

An example of such an innovation is to replace an expensive high quality motor, which works safely for at least 30

years, with a less expensive motor, which works safely for at

least 10 years. This results in more replacements over time.

However, as the price reduction outweighs the costs of extra

replacements, RIB’s TCO is reduced.

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

second goal of the innovation is improving the

installation’s quality and safety, for instance by

improving visibility and by increasing resistance

against wind and vandalism. To achieve these

objectives and to manage the alliance a governance structure has been developed that builds on

five interrelated mechanisms: (1) a supply

arrangement, (2) an organizational structure, (3)

a program of improvement, (4) a financial incentive system and (5) the protection of the proprietary knowledge transferred to the alliance.

The supply arrangement

The reorganization of the supply chain changed

the relationships between RIB, NMA and the

contractors. The ‘promotion’ of NMA from component to systems supplier re-established the

business relationship with RIB and changed the

ordering and delivery processes with the contractors. Project contractors now must purchase

complete systems at NMA, who delivers at the

installation site on the day of installation. This

just-in-time delivery requires NMA to have more

timely ordering information and contractors

therefore are bound to order at least 12 weeks in

advance, to prevent disturbances in NMA’s production process. Similarly, for maintenance and

replacement, process contractors are required to

purchase components, and occasionally complete

systems, at NMA.12 Product descriptions and

price lists at the system and component level are

used to coordinate purchases with contractors.

While for the alliance’s first year prices were

based on historical data and assumptions about

expected ordering quantities, the years thereafter

prices are adapted to NMA’s new cost data (as

discussed further on). Further, NMA can adapt

its production process to the yearly and quarterly

forecasted ordering quantities that RIB provides

to the alliance.

12

In addition, NMA has taken over responsibility for keeping emergency stock from the process contractors, which is

used when installations need to be repaired or replaced

instantly, for instance after an accident on the railways.

39

The organizational structure

The partners have transferred several activities

to the alliance that they used to perform individually, enabling NMA to augment its control over

RIB’s product specifications and RIB to augment

its control over NMA’s production process. The

alliance is organized as a separate organizational

structure, which includes an alliance board and

alliance staff. The board consists of four members,

two of both firms including their general managers, and serves as an authority structure in

which both partners have control over the alliance

activities performed. The board first has set out an

‘alliance strategy’, focused on innovation, to realize the alliance’s goal (reducing RIB’s TCO). The

board further is responsible to turn this strategy

into action, by setting or approving on short-term

(yearly) goals to be included in the program of

improvement, which at least include the expected

cost reduction and a forecast of ordering quantities. The expected cost reduction is based on

specific proposals for innovations made by the

alliance staff. Quarterly, the board members

meet to discuss the acceptance of proposals and

to review the progress on the short-term goals.

Yearly, they meet to review and discuss the alliance’s performance and its future direction.

Informal meetings and communication take

place whenever contingencies arise that require

coordination.

The alliance staff that performs operational and

support tasks is organized in six functional task

groups called Development, Production, Cost Control, Quality Control, Installation & Service and

Purchasing. Each task group includes employees

of both firms and contributes to implementing the

alliance strategy, either by directly working on

innovations or by facilitating and monitoring this

process. The technicians from Development are

most important for generating and realizing ideas

for innovations through direct communication.

Proposals for innovations must remain within the

boundaries of RIB’s functional specifications,

which are also approved by the board. Approved

proposals for innovations are included in the program of improvement and are realized by the task

groups following the mechanisms of this program.

40

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

The program of improvement

For each proposal for innovation the program

of improvement specifies a planning and progress

scheme, a budget scheme and an estimation of the

expected cost reduction. The planning scheme

specifies five general activities required to realize

the innovation: (1) definition of functional requirements, (2) attainability study, (3) development, (4)

release, and (5) adoption for use. During execution,

progress on these activities is measured and compared with the planning scheme. For each innovation the alliance fund (as discussed further on)

provides a budget for the costs of the attainability

study, the development and the release of the

innovation, after testing and quality checks. RIB

takes care of the definition of functional requirements and adoption for use. The program further

specifies the hour wages to be charged for NMA’s

engineering and mechanical assembly activities in

the alliance.

As the installation’s safety and quality are of

utmost importance, innovations have to meet high

standards. Quality plans, following NMA’s

ISO-9001 quality procedures, are used to safeguard the quality of the innovation process. These

plans describe agreements and methods that have

to be followed when working on innovations and

relate to the quality of the alliance, its systems and

the lower product (subassembly and component)

level. Quality Control annually performs quality

audits to assess the conformance to and effectiveness of the quality plans in the realization of

innovations. To measure the attainment of the

alliance’s main goal, Cost Control annually measures the cost consequences of realized innovations, using cost data that NMA provides to the

alliance on basis of ‘open book accounting’.

The financial incentive system

To induce mutual collaborative behavior in the

innovation process the partners have developed a

financial incentive system, called the alliance fund.

This fund focuses on aligning the partners’ individual (financial) objectives with the alliance’s

objectives by financing all planned innovations,

accruing their financial results and dividing the

residual. As a startup capital the partners have

made an equal financial contribution. Yearly

expected cost reductions from planned innovations are forecasted. Multiplying these with the

forecasted ordering quantities delivers the total

expected cost reduction. When an innovation has

been realized, its value, called the ‘Total Value’

(TV), is determined by multiplying the realized

cost reduction with the forecasted number of

sales.13 The TV is used to determine the contribution each partner should make to the alliance

fund. NMA contributes the actual realized cost

savings, i.e. the realized cost reduction multiplied

with the actual ordering quantities. When actual

ordering quantities are less than forecasted, RIB

contributes the missed savings, i.e. the difference

between the TV and the realized cost reduction.

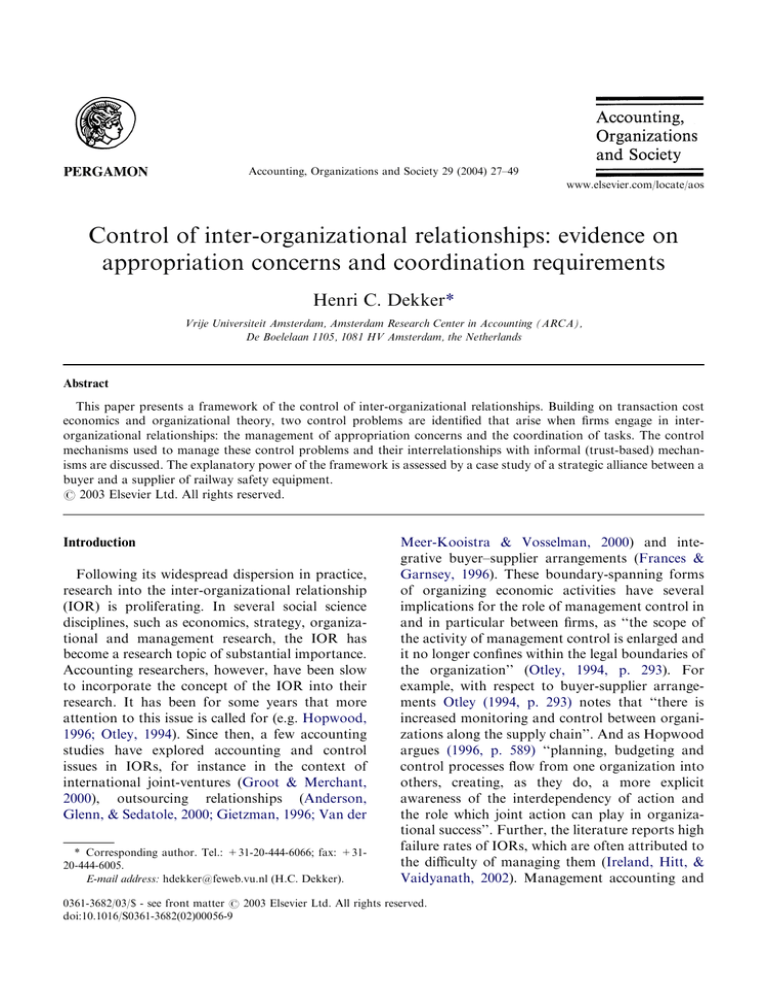

Fig. 2 provides an illustration of these calculations

of and contributions to the alliance fund.

NMA thus sells the installation for X and contributes (RS + RP)Z=130,500. Because actual

sales lag expectations, RIB contributes the missed

savings equaling (Y Z)/Y TV=14,500.

As over time cost–reducing innovations are successfully realized the alliance fund increases in

size. Yearly the fund is evaluated and when

exceeding a certain threshold, following an allocation scheme, the surplus is allocated among the

partners and a second alliance fund, that is used to

finance further innovations that cannot be

financed from the general fund. Similarly, whenever this fund exceeds a certain threshold, the

residual is shared between the partners. When,

however, the alliance fund becomes insufficient to

finance further innovations, after approval of the

board, the partners will make equal reinvestments.

The alliance fund can be thought of as a ‘truth

inducing mechanism’. RIB has incentives to predict

a high demand, because higher expected total cost

savings provides NMA with stronger incentives to

13

The calculation of the realized cost reduction, however,

only measures savings in product costs. Due to a lack of

appropriate cost data, reductions in RIB’s costs of operating

and maintenance activities are not calculated, while this is

required to make a fair division of the alliance’s financial

benefits. The partners explicitly left this question open for the

future and will negotiate in good faith about a reasonable

estimation of this cost reduction.

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

41

Fig. 2. Illustration of the alliance fund.

accomplish cost reducing innovations and increases the budget available for innovation. However,

when purchases lag expectations, RIB must compensate for the difference, providing incentives to

forecast future demand accurately and honestly.

The protection of proprietary knowledge

Because NMA’s knowledge of and experience

with the installation is regarded a key factor for the

alliance’s success it is agreed in the contract that:

NMA will completely place its current and

future knowledge and experience related to

design, construction, installation and maintenance of the automatic half-barrier installation at the disposal of the alliance.14

This transfer of intellectual property to the alliance

caused an explicit concern about the boundaries of

14

A similar agreement included in the contract specifies that

RIB, as far as possible will place its knowledge and experience

at the disposal of the alliance, which NMA is allowed to use to

improve the installation.

this knowledge. NMA has always used product

coding and drawings for product specification.

The absence of detailed technical specifications

complicated the specification and protection of

intellectual property rights by formal mechanisms.

In addition, there were little incentives to do so.

Because of the confidence in RIB’s (and before

NS’s) goodwill, NMA perceived the risks of

opportunistic behavior, such as information spillover (the conscious leaking of information to

other suppliers) to be small. The only effort NMA

undertook was simply labeling the product drawings with its company logo.

Because the alliance explicitly brought this issue

to the surface the partners decided to make better

agreements on the specification and allocation of

intellectual property rights. NMA agreed to specify the installation’s configuration by drawings

and product coding and share this with RIB.

NMA contractually was assigned all intellectual

property rights on the installation, its subsystems,

components and related products and services.

These property rights are adjusted whenever new

innovations are realized. In return RIB received a

nontransferable and nonexclusive license for the

42

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

use of the technology. Despite this safeguard,

NMA’s managing director commented that it is

difficult to measure whether RIB uses this information according to the agreement. However,

similar to the prior situation, this is not perceived

to be a large risk, because of NMA’s confidence in

RIB’s goodwill. In addition, it was suggested that

negative reputational effects would also be an

effective deterrent for the opportunistic use of

intellectual property.

Explaining the governance structure

The management of appropriation concerns

Although other suppliers offer systems with

comparable functionality, worldwide no systems

are available with similar technological specifications, that would fit well into the existing rail

infrastructure. As stated by the contract:

The automatic half-barrier installations have

been developed in close cooperation with

(and for) NS, and are unique in the sense that

no comparable systems and subsystems exist

which have similar specifications.

The case study was designed as explanatory

(Yin, 1994). First, a theoretical framework was

developed after which data were collected on the

variables and relationships of this framework,

enabling a test of its explanatory power. Satisfactory explanatory power is attained when the

observations in the case study comply with the

proposed linkages between the variables in the framework, meaning the framework is able to make

sense of the data. Thus the concepts of appropriation concerns, coordination requirements and

trust should contribute to explaining the alliance’s

governance structure.15 In the alliance a great

variety of formal and informal control mechanisms is used, which are summarized in Table 2.16

The formal control structure of the alliance

thus consists of a mixture of outcome and behavior control mechanisms. The next sections analyze how the case evidence relates to the

constituent parts of the framework (as depicted in

Fig. 1).

Switching to manufacturers with technologically

different systems would result in large transaction

costs for RIB. The contract expressed the specificity of the installation as follows:

15

An alternative explanation when an alignment or ‘fit’

between control problems and governance structure is not

found, is that a misfit exists, which over time would result in an

escalation of control problems in the alliance and declining or

lower performance. With the current data it is impossible to

assess the longer-term performance effects of the alliance,

although this possibility did not seem to be the situation.

16

The structure of the alliance has much in common with a

joint venture. Joint financial investments are made, a separate

organizational structure with a joint board and joint task

groups is installed, specific tasks and resources are dedicated to

it, and separate rules, regulations and costing and non-market

pricing are used.

incompatibility of other systems with existing systems,

amongst others resulting in inefficient control of the

systems, which in addition has consequences for safety;

technical difficulties in the operation and maintenance of

systems, which in addition has consequences for safety;

a necessary replacement of existing systems;

new training of employees and contractors’ employees,

resulting in a disproportionate destruction of capital,

which in addition has consequences for the safety of the

systems.

The reason for including this description is that RIB has to

comply with European regulations and needs to prove that these

products does not have to be tendered in European competition.

The development of identical automatic halfbarrier installations by other manufacturers

would take a long period of time, especially

because no functional specifications are

available for the installation, while because of

safety considerations the utmost care should

be fostered.17

Because the installation has been developed with

and specifically for NS, it is also specific to NMA.

NMA depends strongly on RIB, as it is its largest

buyer and there are no other buyers to switch to.

17

The partners recognize these transaction costs well and the

implications of switching to another supplier are also specified

in the contract. If RIB would switch to another supplier, then

transaction costs would arise due to:

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

43

Table 2

Formal and informal control mechanisms used in the alliance

Outcome control

Ex-ante mechanisms

Goal setting:

Strategic goals

Short-term goals: cost reductions

and ordering quantities

Incentive systems:

Alliance fund

Behavior control

Social control

Structural specifications:

Ordering and supply procedures

Functional specifications

Program of innovations

Quality plans

Specification and division

intellectual property rights

Partner selection:

Long-lasting joint history and

cultural ‘fit’

Interactive goal setting:

Joint governance design

Short-term goals

Reputation:

Trustworthiness RIB for

other alliances

Trust:

Long-lasting relationship

Reputation RIB

Open book agreement

Intentional incomplete contracting

Organizational structuring:

Alliance board

Task groups

Ex-post mechanisms

Performance monitoring:

Open book accounting: cost

reductions

Rewarding:

Benefit sharing

Behavior monitoring:

Pre-action review of ideas for

innovations

Board monitoring

Auditing use quality plan

Moreover, the uncertainty caused by the privatization of NS and RIB’s changes to become an

autonomous governmental agency made securing

this turnover more important for NMA.

Thus, while RIB cannot switch to alternative

systems from other suppliers without incurring

considerable transaction costs, NMA cannot

switch to other buyers. Although this situation of

mutual dependency to a great extent aligns the

partners’ interests, it was not sufficient to manage

the additional transaction hazards that were created by engaging in an alliance. RIB’s main concern was that NMA would have little incentives to

work actively on innovating the half-barrier

installation and just would use the alliance to

secure turnover for another 5 years. NMA’s concern was to earn a fair share of the cost savings

realized by innovations and to realize sufficient

turnover from RIB. For this purpose, according to

the contract, ‘the alliance contains such incentives

that, when successful, it provides benefits to both

parties’. The financial incentive system was developed to align the partners’ interests and to motivate

Shared decision making and goal

setting:

Joint alliance board

Joint task groups

them to perform adequately. This mechanism

provides the partners a prospect of fair rewards

for their individual contributions, which, as Tomkins (2001) argues, is a precondition for partners’

willingness to participate in IOR activities. Further, RIB allows NMA to exploit quality and

safety enhancing innovations in its product

assortment for export markets. These externalities

provide NMA important additional incentives to

participate actively in the alliance.

A second mechanism for managing appropriation concerns is the behavior monitoring by the

alliance board. This command and authority

structure oversees the functioning and performance of the alliance and serves to reduce information asymmetry between the partners, by

regular information sharing, pre-action reviews,

joint decision making and problem solving. This

joint supervision provides both partners with significant control over the alliance activities and

resources involved and prevents them from using

resources for personal benefits (such as when NMA

would use alliance resources for innovations to its

44

H.C. Dekker / Accounting, Organizations and Society 29 (2004) 27–49

other products). Furthermore, the specification of

intellectual property rights contributes to minimizing NMA’s concerns about information spillover of the specific and valuable knowledge

transferred to the alliance.

The explanation so far indicates that the use of

the formal control mechanisms described above

indeed seem to be related to TCE arguments.

However, these arguments do not provide a complete account of the governance structure, that

exists of more mechanisms and also other uses of

these mechanisms. This may be accounted for by

the alliance’s task coordination requirements.

The coordination of tasks

Following the strategic rationale of the alliance,

two types of tasks are performed, a supply task

and an innovation task. The supply task focuses on

the delivery of half-barrier installations to contractors, which can be characterized by sequential

interdependence. NMA’s production and supply

activities depend on RIB’s demand, which is the

main cause of task uncertainty. For RIB it is difficult to forecast perfectly how many new installations in a period will be ordered. Although the

addition of assembly and (just-in-time) delivery to

the supply task has somewhat increased interdependence, the consequences for coordination

are fairly limited. This limited interdependence

and uncertainty is reflected by the mechanisms

used to coordinate the supply task. To be able to

adapt its processes, NMA needs more timely

information about ordering quantities and expected demand. As agreed in the supply arrangement

contractors are required to follow standard ordering procedures and order at least 12 weeks in

advance. Further, RIB shares (imperfect) forecasts

of quarterly demand with NMA.

The innovation task relates to the joint innovation of the half-barrier installation to reduce

RIB’s TCO. For this more complex task the partners pool resources (personnel, knowledge, technology and financial resources) and jointly work

on innovations. This task is characterized by reciprocal interdependence. Task performance is characterized by more uncertainty, as it is unclear at

the outset what innovations should be performed

and what they will result in, limiting the possibility

to completely program these activities and

measure relevant outcomes and behaviors. The

theoretical framework suggests that a broader set

of more complex mechanisms will be required to

manage the information processing requirements