(A White Paper) - Indian Railway

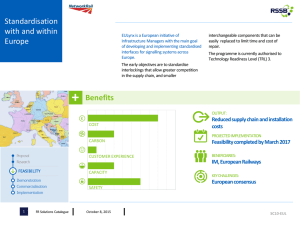

advertisement