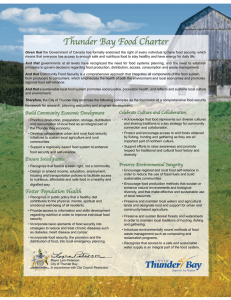

Poverty in Thunder Bay - Kinna

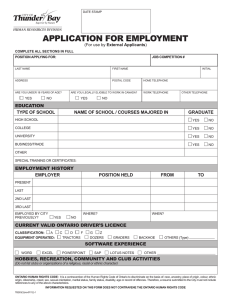

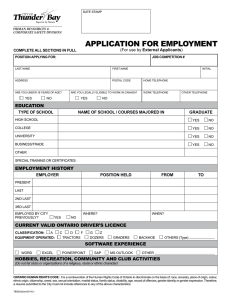

advertisement