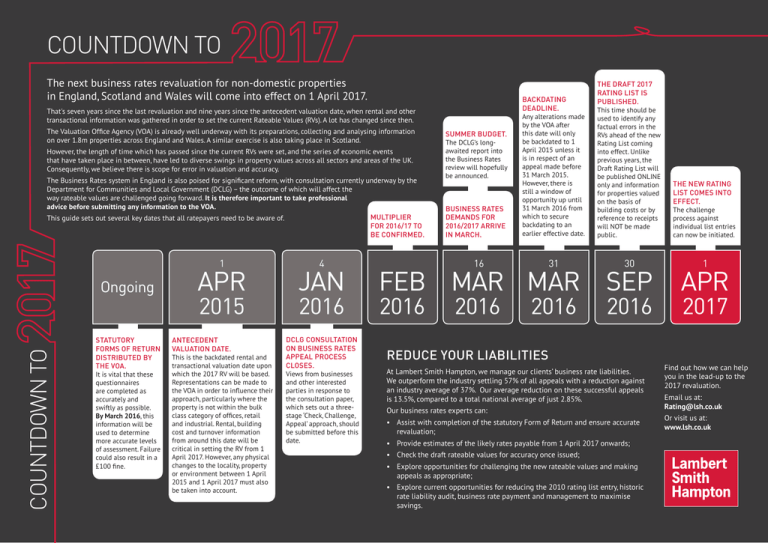

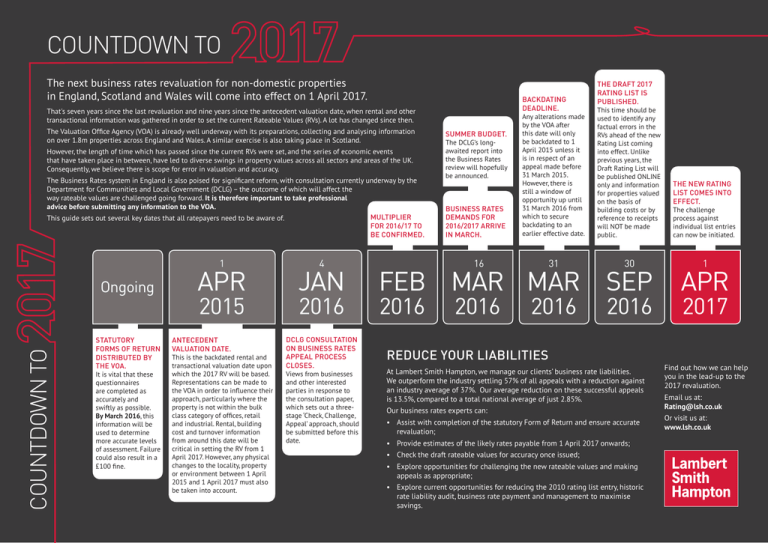

COUNTDOWN TO

The next business rates revaluation for non-domestic properties

in England, Scotland and Wales will come into effect on 1 April 2017.

BACKDATING

DEADLINE.

Any alterations made

by the VOA after

this date will only

be backdated to 1

April 2015 unless it

is in respect of an

appeal made before

31 March 2015.

However, there is

still a window of

opportunity up until

31 March 2016 from

which to secure

backdating to an

earlier effective date.

THE DRAFT 2017

RATING LIST IS

PUBLISHED.

This time should be

used to identify any

factual errors in the

RVs ahead of the new

Rating List coming

into effect. Unlike

previous years, the

Draft Rating List will

be published ONLINE

only and information

for properties valued

on the basis of

building costs or by

reference to receipts

will NOT be made

public.

THE NEW RATING

LIST COMES INTO

EFFECT.

The challenge

process against

individual list entries

can now be initiated.

16

31

30

1

2016

2016

2016

That's seven years since the last revaluation and nine years since the antecedent valuation date, when rental and other

transactional information was gathered in order to set the current Rateable Values (RVs). A lot has changed since then.

The Valuation Office Agency (VOA) is already well underway with its preparations, collecting and analysing information

on over 1.8m properties across England and Wales. A similar exercise is also taking place in Scotland.

However, the length of time which has passed since the current RVs were set, and the series of economic events

that have taken place in between, have led to diverse swings in property values across all sectors and areas of the UK.

Consequently, we believe there is scope for error in valuation and accuracy.

The Business Rates system in England is also poised for significant reform, with consultation currently underway by the

Department for Communities and Local Government (DCLG) – the outcome of which will affect the

way rateable values are challenged going forward. It is therefore important to take professional

advice before submitting any information to the VOA.

MULTIPLIER

This guide sets out several key dates that all ratepayers need to be aware of.

FOR 2016/17 TO

BE CONFIRMED.

1

COUNTDOWN TO

Ongoing

STATUTORY

FORMS OF RETURN

DISTRIBUTED BY

THE VOA.

It is vital that these

questionnaires

are completed as

accurately and

swiftly as possible.

By March 2016, this

information will be

used to determine

more accurate levels

of assessment. Failure

could also result in a

£100 fine.

4

APR

JAN

ANTECEDENT

VALUATION DATE.

This is the backdated rental and

transactional valuation date upon

which the 2017 RV will be based.

Representations can be made to

the VOA in order to influence their

approach, particularly where the

property is not within the bulk

class category of offices, retail

and industrial. Rental, building

cost and turnover information

from around this date will be

critical in setting the RV from 1

April 2017. However, any physical

changes to the locality, property

or environment between 1 April

2015 and 1 April 2017 must also

be taken into account.

DCLG CONSULTATION

ON BUSINESS RATES

APPEAL PROCESS

CLOSES.

Views from businesses

and other interested

parties in response to

the consultation paper,

which sets out a threestage ‘Check, Challenge,

Appeal’ approach, should

be submitted before this

date.

2015

2016

SUMMER BUDGET.

The DCLG’s longawaited report into

the Business Rates

review will hopefully

be announced.

BUSINESS RATES

DEMANDS FOR

2016/2017 ARRIVE

IN MARCH.

FEB MAR MAR SEP

2016

REDUCE YOUR LIABILITIES

At Lambert Smith Hampton, we manage our clients’ business rate liabilities.

We outperform the industry settling 57% of all appeals with a reduction against

an industry average of 37%. Our average reduction on these successful appeals

is 13.5%, compared to a total national average of just 2.85%.

Our business rates experts can:

• Assist with completion of the statutory Form of Return and ensure accurate

revaluation;

• Provide estimates of the likely rates payable from 1 April 2017 onwards;

• Check the draft rateable values for accuracy once issued;

• Explore opportunities for challenging the new rateable values and making

appeals as appropriate;

• Explore current opportunities for reducing the 2010 rating list entry, historic

rate liability audit, business rate payment and management to maximise

savings.

APR

2017

Find out how we can help

you in the lead-up to the

2017 revaluation.

Email us at:

Rating@lsh.co.uk

Or visit us at:

www.lsh.co.uk

COUNTDOWN TO

ABOUT US

We are a commercial property consultancy working with investors, developers and occupiers in both the public and private

sectors across the UK and Ireland.

Amazon to Zurich: we have partnerships with the complete A to Z of the best organisations in Britain and Ireland.

Transport to telecoms: we have experience of an extremely wide range of sectors.

Capital markets to construction consultancy: we serve an incredibly diverse range of commercial property disciplines.

We value lateral thinking and celebrate enterprise, with a focus on delivering more for our clients.

By looking beyond the obvious, we consistently generate impressive results.

For further information please contact:

Paul Easton

National Head of Business Rates

+44 (0)191 338 8277

peaston@lsh.co.uk

Philip Clarkson

Director, Leeds

+44 (0)113 887 6757

pclarkson@lsh.co.uk

Bob Harlow

Director, Wales

+44 (0)1792 702 82

bharlow@lsh.co.uk

Beverley McDougall

Director, Manchester

+44 (0)161 242 8032

bmcdougall@lsh.co.uk

David Rainsford

Director, Birmingham

+44 (0)121 237 2351

drainsford@lsh.co.uk

Mark Clapham

Director, Birmingham

+44 (0)121 237 2373

mclapham@lsh.co.uk

Paul Fallon

Director, Scotland

+44 (0)141 226 6792

pfallon@lsh.co.uk

Andrew Martin

Director, Nottingham

+44 (0)115 976 6616

amartin@lsh.co.uk

Paul Nash

Director, London

+44 (0)20 7198 2150

pnash@lsh.co.uk

Paul Stevens

Director, Bristol

+44 (0)117 914 2006

pstevens@lsh.co.uk

OUR OFFICE NETWORK

Belfast

+44 (0)28 9032 7954

Chelmsford

+44 (0)1245 215521

Galway

+353 (0)91 865 333

Leicester

+44 (0)116 255 2694

Maidenhead

+44 (0)1628 676001

Northampton

+44 (0)1604 664366

Sheffield

+44 (0)114 275 3752

Birmingham

+44 (0)121 236 2066

Dublin

+353 (0)1 673 1400

Glasgow

+44 (0)141 226 6777

Liverpool

+44 (0)151 236 8454

Nottingham

+44 (0)115 950 1414

Solent

+44 (0)2380 461 630

Bristol

+44 (0)117 926 6666

Edinburgh

+44 (0)131 226 0333

Guildford

+44 (0)1483 538181

Oxford

+44 (0)1865 200244

Southampton

+44 (0)23 8033 0041

Cambridge

+44 (0)1223 276336

Exeter

+44 (0)1392 880 180

Reading

+44 (0)118 959 8855

Southend-on-Sea

+44 (0)1702 417 951

Cardiff

+44 (0)29 2049 0499

Fareham

+44 (0)1489 579579

Leeds

+44 (0)113 245 9393

+44 (0)113 245 8454

London

+44 (0)20 7198 2000

+44 (0)20 7955 8454

Manchester

+44 (0)161 228 6411

+44 (0)161 833 1197

St Albans

+44 (0)1727 834234

Swansea

+44 (0)1792 702800

Luton

+44 (0)1582 450444

Milton Keynes

+44 (0)1908 604630

Newcastle upon Tyne

+44 (0)191 232 6291

Details of Lambert Smith Hampton can be viewed on our website www.lsh.co.uk

Due to space constraints within the report, it has not been possible to include both imperial and metric measurements.

© Lambert Smith Hampton December 2015.

This document is for general informative purposes only. The information in it is believed to be correct, but no express or implied representation or warranty is made by Lambert Smith Hampton as to its accuracy or completeness, and the opinions in it constitute

our judgement as of this date but are subject to change. Reliance should not be placed upon the information, forecasts and opinions set out herein for the purpose of any particular transaction, and no responsibility or liability, whether in negligence or otherwise,

is accepted by Lambert Smith Hampton or by any of its directors, officers, employees, agents or representatives for any direct, indirect or consequential loss or damage which may result from any such reliance or other use thereof.

All rights reserved. No part of this publication may be transmitted or reproduced in any material form by any means, electronic, recording, mechanical, photocopying or otherwise, or stored in any information storage or retrieval system of any nature, without the

prior written permission of the copyright holder, except in accordance with the provisions of the Copyright Designs and Patents Act 1988.

Warning: the doing of an unauthorised act in relation to a copyright work may result in both a civil claim for damages and criminal prosecution.