U.S. Department of Energy Disclaimer

advertisement

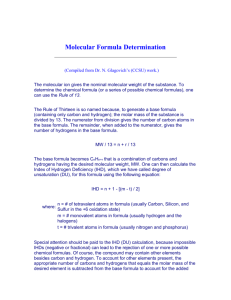

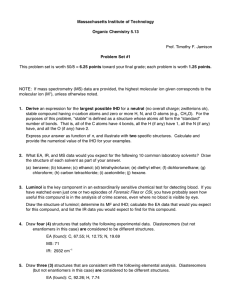

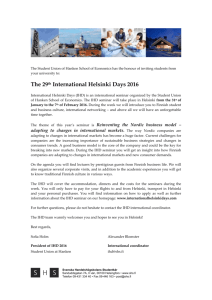

U.S. Department of Energy Disclaimer § Acknowledgement: “This material is based upon work supported by the Department of Energy under Award Number OE000214.” § Disclaimer: “This report was prepared as an account of work sponsored by an agency of the United States Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any informaKon, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily consKtute or imply its endorsement, recommendaKon, or favoring by the United States Government or any agency thereof. The views and opinions of authors expressed herein do not necessarily state or reflect those of the United States Government or any agency thereof.” Page 1 Key features of SPO pilot & enrollment Residential Default CPP With IHD Offer (701) TOU-CPP With IHD Offer (588) Opt In TOU With IHD Offer (2,018) CPP With IHD Offer (1,651) TOU No IHD Offer (223) Total enrollment, including deferred groups = 12,027; Total # of customers receiving offers, including deferred groups = 53,798 Total # of customers in SPO, including controls = 99,661 Page 2 With IHD Offer (2,199) No IHD Offer (1,229) The SPO was well designed & implemented § Rigorous adherence to sound experimental design principles Ø SMUD used the “gold standard” for experimental design, a randomized control trial (and equivalent designs) § ImplementaKon meets high research standards Ø Detailed valida@on analysis shows SMUD did an excellent job adhering to design Ø All marke@ng materials were iden@cal except for treatment differences Ø Extensive market research as input to development of marke@ng and educa@onal material Ø Effec@ve tracking of offers, enrollment and aIri@on § Addressed many of the most important policy issues of interest to the industry Ø Side-­‐by-­‐side comparison of opt-­‐in and default enrollment and load impacts for same rate plans Ø Comparison of customer acceptance rates for different @me-­‐varying rate plans Ø Examina@on of the impact of the offer of informa@on feedback technology on customer acceptance of opt-­‐in rates and load impacts Page 3 Key findings on customer acceptance § SMUD’s mulK-­‐faceted markeKng strategy produced opt-­‐in rates that exceeded the target of 15% and were quite high by industry standards Ø Acceptance rates ranged from 16.4% to 18.8% across four opt-­‐in treatments § Acceptance rates were very similar for CPP and TOU pricing plans § Offer of enabling technology in the form of a free IHD did not materially increase customer acceptance of the opt-­‐in CPP or TOU pricing plans § Default treatment groups displayed extremely high enrollment rates, ranging from almost 93% to 98% and significantly exceeded 50% target § Once enrolled, less than 2% of opt-­‐in customers and 4% of default customers chose to drop rate over the course of the 2012 summer Ø A greater number of customers leR the rate because of account closures due to customer reloca@on (in actual program, customer could take rate with them) Page 4 Acceptance rates for different pricing plans were very similar within each recruitment strategy (opt-­‐ in vs. default), but very different across strategies Acceptance Rate Summer Dropout Rate 98% 96% 100% 93% 90% 80% Recruitment Goal 70% 60% 50% 50% 40% 15% 30% 20% 10% 19% 18% 2% 2% 0% Opt-in CPP, No IHD Offer 18% 16% Opt-in CPP, IHD Offer 1% 0% Opt-in TOU, No IHD Offer Opt-in TOU, IHD Offer Page 5 3% Default CPP, IHD Offer 2% Default TOU, IHD Offer 4% Default TOUCPP, IHD Offer % load reducKons for TOU pricing plans were significant for both opt-­‐in and default parKcipants Load impacts for opt-in TOU are in the top quartile of those found in other TOU pilots Average % Load Impact During Summer Weekday Peak Period 14% 13% Load impacts for default TOU were statistically significant which differed from what happened in the only other default pilot conducted in the industry 12% 10% 10% 8% 8% 6% 6% 4% 2% 0% Opt-in TOU, No IHD Offer Opt-in TOU, IHD Offer Page 6 Default TOU, IHD Offer Default TOU-CPP, IHD Offer % peak load reducKons for CPP pricing plans were significant for both opt-­‐in and default parKcipants CPP load impacts are in the top third of those found in other CPP pilots Average % Load Impact During CPP Event Day Peak Period 30% 26% 25% Load impacts for default CPP were large and statistically significant which, again, differed from what happened in the only other default pilot conducted in the industry 22% 20% 15% 12% 13% 10% 5% 0% Opt-in CPP, No IHD Offer Opt-in CPP, IHD Offer Page 7 Default CPP, IHD Offer Default TOU-CPP, IHD Offer Based on SPO acceptance rates and average load impacts per customer, aggregate load impacts are much larger for default enrollment than for opt-­‐in enrollment Estimated Aggregate Demand Reduction (MW) During Peak Period If Pricing Plans (With IHD Offer) Were Offered to 100,000 SMUD Customers Average CPP Day Impact Average Weekday Impact 35 30.7 MW 30 MW 25 20 15 16.6 MW 12.6 MW 11.4 MW 10 6.7 MW 4.2 MW 5 0 n/a Opt-in CPP n/a Default CPP Page 8 Opt-in TOU Default TOU