market report - Colliers International

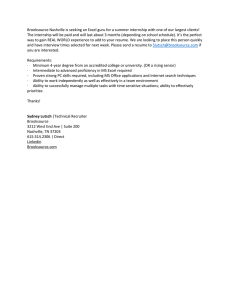

advertisement

Q1 2013 | MULTI-FAMILY NASHVILLE MARKET REPORT Music City’s Multifamily Starts 2013 with New Supply New supply and growth in single-family home sales contributed to a minor dip in Nashville’s multifamily occupancy during first quarter 2013. Nashville continues to maintain extremely resilient occupancy rates in the multifamily sector. However, occupancy was calculated at 94% at the close of first quarter 2013, the first time in nearly two years this rate has dipped below 95%. Additionally, net move-outs within existing apartments contributed to a 0.2% occupancy decline. Nashville’s new supply consisted of six multifamily developments, all of which completed construction in the first quarter. Nashville’s total supply of 537-units is accounted for by the following new developments: Elliston 23 with 331-units; Note16 with 86-units; Fatherland Flats with 48-units and Uptown Flats with 72-units. The Cool Springs/Franklin market south of Nashville saw growth of 330-units apartment units comprised of the following: Bell Historic Franklin with 218-unit and Dwell at McEwen II with 112-units. Updated April 2013 1Q NASHVILLE MULTIFAMILY SNAPSHOT RATE Existing units 110,158 Quarterly supply 867 Year-to-date supply The conclusion of first quarter 2013 showed that Nashville’s multifamily demand met market supply. First quarter’s multifamily rental rate averaged $864 per month, which exceeds the U.S. average. This rental rate also represents a net gain of 2.2% from Q1 2012. 867 Occupancy current rate 94.9% Quarterly occupancy change -0.2% Monthly rent $864 Rent per square foot $0.894 Quarterly rent change Multifamily growth is a reflection of Music City’s diverse economy with healthcare, education and a strong business community contributing. Revised job growth data showed Nashville added 24,800 jobs at the conclusion of fourth quarter 2012. Nashville’s 2012 job growth was the second largest upward revision in the United States as a whole. Nashville was also recognized as the 10th best city in the United States for retirement according to NerdWallet.com. -0.2 Source: MPF Research, Real Data Six multifamily projects are currently under construction in Nashville. These projects include 296unit Pine Street Flats, 200-unit Park 25, 244-unit West End Village and 90-unit 12 South Lofts. Because of projected delivery of this new supply for 2013, occupancy rates in Nashville are expected to dip in the year ahead as this new product is absorbed by existing and future market demand. By December 2013, 2,677 units are expected to be delivered in Nashville. Rent growth is also predicted to stabilize as these new developments gain tenants. HISTORICAL APARTMENT OCCUPANCY HISTORICAL OCCUPANCY RATES HISTORICAL RENTAL RATES $870 $860 96.4% $850 $840 94.8% $830 $820 93.2% $810 $800 91.6% $790 $780 90.0% 1Q 11 1Q 12 1Q 13 1Q 14 Source: MPF Research, Real Data www.colliers.com/nashville $770 1Q 11 1Q 12 1Q 13 1Q 14 Source: MPF Research, Real Data MARKET REPORT | Q1 2013 | MULTI-FAMILY | NASHVILLE UPDATE: LARGEST TRANSACTIONS IN THE MARKET IN 1Q 2013 SALES ACTIVITY PROPERTY BUYER SALE PRICE SIZE SF SALE DATE SUBMARKET Viera Cool Springs Apartments Viera Holdings, LLC $44,000,000 468-unit 3/7/2013 Cool Springs Metropolitan Apartments America First Real Estate Group $33,000,000 216-unit 2/26/2013 West End Valley Brook Apartments Evergreen Real Estate $9,500,000 248-unit 3/4/2013 Brentwood 2151 Acklen Avenue Mcgowan Family LP $1,450,000 8,952 SF 2/4/2013 Green Hills/Music Row SUBMARKET OCCUPANCY RANKINGS • MONTHLY RENT SUBMARKET OCCUPANCY % SUBMARKET RATE West Nashville 96.3% Central Nashville $1,350 Central Nashville 96.1% Franklin/Williamson County $1,168 Murfreesboro/Rutherford County 95.8% West Nashville $941 South Nashville 95.6% Murfreesboro/Rutherford County $894 Far East Nashvillle/Wilson County 95.3% Sumner County $823 Source: MPF Research, Real Data Source: MPF Research, Real Data United States: 147 Canada: 37 Latin America: 19 Asia Pacific: 201 EMEA: 118 KELSEY MORGAN ROBERTSON DAVIDSON 522 offices in 62 countries on 6 continents Director of Research DIR +1 615 850 2758 WILSON COLLIERS INTERNATIONAL NASHVILLE 300 Broadway Nashville, TN 37201 WILLIAMSON RUTHERFORD DIR +1 615 850 2700 FAX +1 615 244 2957 www.colliers.com This market report is a research document of Colliers International. Information herein has been deemed reliable and no representation is made as to the accuracy thereof. Colliers International-Nashville, Inc., and certain of its subsidiaries, is an independently owned and operated business and a member firm of Colliers International Property Consultants, an affiliation of independent companies with over 522 offices throughout more than 62 countries worldwide. Accelerating success. www.colliers.com/nashville