Assessment of Industrial Load for Demand Response across U.S.

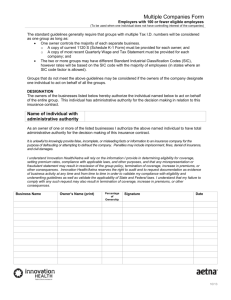

advertisement