User Guide - ATB Financial

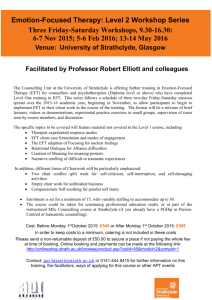

advertisement