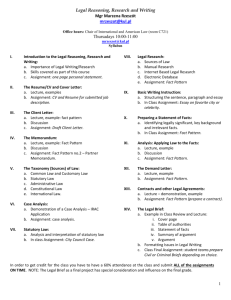

Special Feature: Trends in personal income tax

advertisement