Transport_Insight_2012 2494kb

advertisement

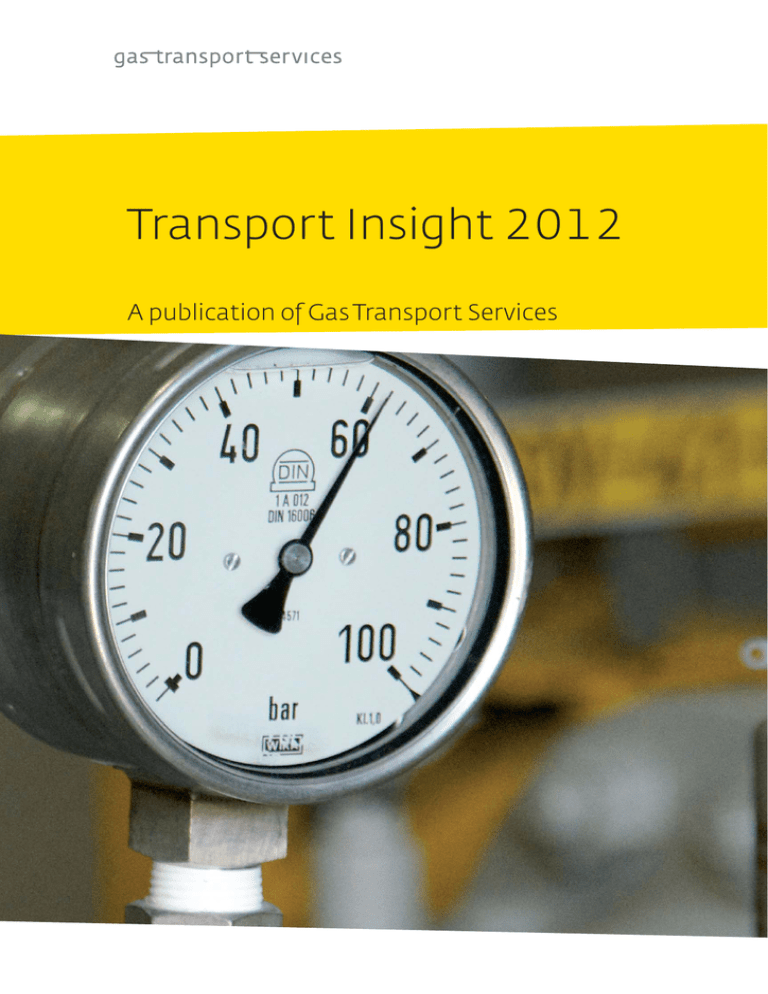

Transport Insight 2012 Transport Insight 2012 Transport Insight 2012 A publication of Gas Transport Services A publication of Gas Transport Services -1- Gas Transport Services B.V. Content Foreword 3 1 Introduction 5 2 Gas transmission in 2011 2.1 Infrastructure developments 2.2 TTF Development 2.3. Transparency 2.4 Balancing regime 2.5 European developments 2.6 Gas balance in the Netherlands 7 7 7 8 8 8 9 3 Utilisation of the GTS grid in 2011 3.1 Network clusters 3.2 General picture 3.3 Layout of the Emden/Oude Statenzijl cluster 3.4 Entry-Exit Emden-Oude Statenzijl Dutch H-gas cluster 3.5 Exit Oude Statenzijl Dutch L-gas cluster 3.6 Exit Winterswijk-Zevenaar L-gas cluster 3.7 Exit Zuid-Limburg H-gas cluster 3.8 Exit Hilvarenbeek L-gas border point 3.9 Entry-Exit Zelzate H-gas Cluster 3.10 Exit Julianadorp H-gas cluster 3.11 Other exit border points G, G+-, L- and H-gas 11 11 11 13 14 16 17 18 20 21 22 24 4 Themes Theme 1The TTF has become the most liquid gas hub on the continent Theme 2 Flow Against Price Differentials (FAPD): gas flows in relation to price differences between markets 25 25 Appendix 1 Explanatory notes on graphs showing GTS border clusters in 2011 Appendix 2 Miscellaneous 37 38 -2- 30 Transport Insight 2012 Foreword I am proud to present the fifth edition of Transport Insight. Transport Insight gives our customers and other interested parties an annual glimpse behind the scenes of gas transport and market development. When we look back at last year, the first thing that strikes us is the growth that has taken place on the Dutch gas trading exchange, the TTF. Dutch security of supply depends on our country having an adequate gas infrastructure and a liquid gas market. GTS registration indicates that traded volume has risen with more than 40% in 2011. Other sources (LEBA, ICIS, Heren) show that TTF has grown to by far the biggest gas hub in continental Europe. The number of traders on the TTF has also risen simultaneously. 95 traders were active in the fourth quarter of 2011, compared with only 82 in the first quarter. A number of important components of the gas roundabout were also completed and brought into use last year. The Netherlands now has a natural gas buffer in Zuidwending and its own LNG terminal on the Maasvlakte: Gate terminal. Transport Insight also gives you a detailed picture of the different elements involved in gas transport, such as contracted capacity, utilisation of the network and gas balance in the GTS network. This year we have prepared two special themes. The first theme concerns the traded volume and products on the TTF and also gives a fingerprint of the surrounding hubs as well. The second special focuses on a method to quantify gas flows in relation to price differences between markets, known as FAPD (Flow Aqainst Price Differences). We hope that this year, we have again given you an insight into the world of gas transport. Annie Krist CEO Gas Transport Services B.V. -3- Gas Transport Services B.V. -4- Transport Insight 2012 1 Introduction About Transport Insight Transport Insight provides customers and other stakeholders of GTS with an annual behindthe-scenes view of transport operations and market development. This publication contains information as reported by Gas Transport Services B.V. Section 2 describes the main developments and circumstances that affected gas transmission in 2011. Section 3 gives in-depth analyses of the gas that was actually transmitted at the border clusters of the GTS network. These are illustrated in graphs containing key figures from 2011 and show details of availability, contracted capacity and utilisation. The sections are followed by themes. Within these themes, a specific topic is discussed in more detail. About Gasunie Gasunie was the first independent gas infrastructure provider with a cross-border network in Europe. The Gasunie network is operated through its subsidiaries GTS and GUD. Both GTS and GUD operate their network in accordance with applicable EU and (different) national regulatory frameworks. Gasunie also provides other services in the gas infrastructure field, including gas storage and LNG. The company considers the wishes of its customers to be of prime importance. What we stand for Gasunie ensures that gas is transported in the Netherlands and northern Germany in a safe, reliable and efficient way, in line with the wishes of our individual customers. To that end we manage, operate and develop a comprehensive network of more than 15,000 kilometres of pipeline and 20 compressor stations in the Netherlands and northern Germany. However, we not only transport gas for customers but also offer additional services to the market. We provide access to independent transmission facilities based on a transparent non-discriminatory pricing structure, thereby creating a level playing field which allows all gas providers to compete throughout the Netherlands, Germany and Europe. We aim for the highest standards of safety, reliability, efficiency and sustainability. Due to the reliability and strategic location of the Gasunie network in relation to expanding international gas flows, the Gasunie network forms the core of what is called the European ‘gas roundabout’. Infrastructure The Dutch section of the high-pressure gas transmission network comprises 11,900 kilometres of pipeline, 6,000 kilometres of which are part of the medium-pressure (<40 bar) system. Gas is supplied to the grid from 53 entry points: 36 feeding points from Dutch gas fields and 17 feeding points from networks in neighbouring countries. The gas is delivered to Dutch customers (industry and domestic consumers through more than 1,000 gas receiving stations) and crossborder customers through 25 border stations. Compressor installations maintain the pressure in the network. There are twelve compressor stations in the Netherlands. The different types of gas are mixed at blending stations to safeguard the required qualities. -5- Gas Transport Services B.V. -6- Transport Insight 2012 2 Gas transmission in 2011 2.1 Infrastructure developments Many infrastructure developments are determined by the open seasons held by GTS. The final part of the 2005 Open Season was completed during 2011. For the 2012 Open Season capacity bookings for gas flows to and from Germany, Belgium and France were made in 2008. After the capacity bookings, decisions were taken concerning investments in the Dutch transport system. The measures associated with the 2012 Open Season will take effect no later than the end of 2013, with the first additional capacity already available in 2011. As a result, in 2011 an additional 130 km of high-pressure gas transmission system was taken into operation, mainly along the North-South axis. An additional compressor station was completed in the west of the Netherlands (Wijngaarden). Blending station at Pernis was also completed and compression of H-gas was made possible at the Zweekhorst compressor station. Finally, the capacity of our export station at Oude Statenzijl was expanded. An Integrated Open Season (IOS) was begun in 2009. This led to the signing of precedent agreements (binding commitments) by 25 shippers in October 2009. Half of the participating shippers booked transport capacity in both the Netherlands and Germany, confirming the cross-border nature of the Integrated Open Season (IOS). On June 30th 2011, a positive investment decision was taken and the corresponding additional capacity will be available from October 2014. Demand for additional transport capacity is related to new import projects, the need for more international transit and stronger connections between gas markets and new projects directly connected to the Gasunie grid. Examples of such projects include the natural gas storage facilities at Zuidwending and Bergermeer, the Gate terminal (LNG) and, at the Dutch-German border, the storage facilities at Etzel, Jemgum and Epe. Over the next few years, the increase in imported high-calorific gas to complete local production will lead to growing demand for quality conversion. For this reason, since 2010 additional nitrogen capacity has been being built in the form of a peak nitrogen storage facility at Heiligerlee in Groningen. This is expected to come into operation during the second half of 2012. 2.2 TTF Development The rising trend detected in 2010 continued: the volume of gas nominated on the TTF in 2011 was considerably higher (164 billion m3) than in 2010 (114 billion m3), representing a growth of more than 40%. Net volume increased by approximately 20% (from 31.8 billion m3 to 38.4 billion m3). Due to the marked increase in traded volume, the TTF strengthened its liquidity position compared to other European hubs in 2011. The introduction of the new balancing regime has resulted in a larger number of active traders. Whereas in the first quarter of 2011, an average of 82 traders were active on the TTF, in April to December the average number of active traders on a given day was 90, with a maximum of 95 in October. This had a beneficial effect on the churn factor (= average number of times that a cubic metre of natural gas is traded) , the churn factor averaged out at 17. The churn of 17 includes mutual trades that took place outside the trades reported to GTS. The -7- Gas Transport Services B.V. figures for traded volumes and churn are based on GTSs records of transactions, resulted in a churn of 4.6 in 2011 (in 2010 3.6). The liquidity and churn rate of the TTF and adjacent gas hubs is analysed and described in detail in chapter 4. As the most liquid hub in continental Europe, the TTF stands far above neighbouring gas trading hubs. 2.3.Transparency The transparency guidelines of the 3rd Energy Package came into force on 3 March 2011. The objective of these guidelines is to give market participants insight in and information about the functioning of the gas market. To comply with these guidelines, GTS has developed a new platform, on which the transparency publications are shown (see http://www.gastransportservices.nl/transportinformatie/dataport-gts). A lot of the transport information is published on a near real time basis (this is possible because the publications are based on the newly developed ICT systems of the balancing systems). The published transport information is in line with the ‘relevant point’ decision which has been taken by the Dutch NRA (Nederlandse Mededingingsautoriteit NMa). As a consequence of this decision by the NRA some of the transparency data is published at network point level (mainly crossborder points, storages, LNG terminals), and some at an aggregate level (Industries, Producers and Distribution Companies). 2.4 Balancing regime On 1 April 2011, GTS launched its current balancing regime, which is referred to as Marketbased balancing. The regime uses near real-time information provided to network users which enables them to balance their portfolio and/or the system on a 24/7 basis. As long as the balance of the combined portfolios of all network users remains within the available linepack represented by the so-called green zone, GTS will not take balancing actions towards any of the users. If a balancing action is required, GTS will do this by using a balancing platform on which market players can offer to help restore the system balance for market-based prices. The evaluation has been completed and we can conclude that the regime functions as desired. Market-based balancing as implemented in the Netherlands is, following minor adaptations, in line with the Framework Guidelines on Balancing from ACER (Agency for the Cooperation of Energy Regulators). 2.5 European developments In the context of the Third European Energy Package, which formally took effect on 3 March 2011, agreements have been concluded on the provision of transparent information. GTS has been participating in the European Network of Transmission System Operators for Gas (ENTSOG) since 2009. Members of ENTSOG spend the majority of their time cooperating and coordinating in areas such as European network codes, the ten year development plan and the promotion of market linking. In 2011, GTS worked with ENTSOG on the European Commission’s market consultation on changes to the congestion management procedures, the CMP. This consultation contributed towards a draft decision that will be handled by the European Commission during 2012. The CAM (Capacity Allocation Mechanisms) network code and the amended CMP rules represent a fundamental change, but also an improvement to the way in which capacity is currently marketed at national borders. The CAM network code will introduce auctions for cross-border capacity and bundling of the entry with the exit contract on either side of the border. GTS, GUD and neighbouring TSOs are investigating the potential for introducing these new rules more rapidly. -8- Transport Insight 2012 On 21 November 2011, the TSOs from northwest Europe launched their Gas Regional Investment Plan for 2011-2020 (NW GRIP). This is the first edition of this investment plan, which sets out the long-term development of gas infrastructure in the region. NW GRIP 2011-2020 gives an overview of future TSO projects in the region which will have consequences for capacity at the internal borders in the region and for import capacity from outside the EU. 2.6 Gas balance in the Netherlands The gas balance for the Dutch section of the GTS network is shown in Figure 2.1. It displays the average daily capacity allocated to each market segment in 2011. The figure shows a clear seasonal pattern, with daily variations. This pattern is largely determined by residential demand, which in turn is largely determined by weather conditions. The total volume of gas transported by the Gasunie TSO’s was 126.5 bcm in 2011, of which 102 bcm was transported by GTS. About 45% of this total volume was dedicated to the domestic market and the other 55% was exported. The Dutch exports also reflect a strong seasonal pattern. In order to be able to cope with fluctuating seasonal demand, domestic production is supported by storage facilities that take in gas during the summer and send it out during the winter months. With the gradual decline in residential production over the coming decades, the importance of storage is expected to increase. Capacity [mln m3/h] Gas balance GTS network 2011 daily averages 1) 25 20 15 10 5 0 -5 -10 -15 -20 -25 Import Export Feeding Industry Storage send out All hours of 2011 daily averages Storage send in Distribution Figure 2.1 Gas balance in the Netherlands in 20111. At system level, for the Dutch section of the Gasunie network, the maximum hourly throughput in 2011 was 23.7 million m³/h2. The maximum daily throughput was 518 million m³/day on January 31 20113. 1 Capacity in the graph is based on daily averages. Figures on an hourly basis can be found on the GTS website. 2 Because this is a maximum hourly value, it is greater than the maximum daily average shown on the graph. 3 Reported maximum daily throughput is different to the figure presented in the annual report. The annual report is based on measurements, while the gas balance figures presented in Transport Insight are based on allocations. -9- Gas Transport Services B.V. Throughput is the average of the volumes of gas that enter and exit the system. The maximum capacity in the Dutch part of the system will be needed on extremely cold days. The system is designed to meet demand for gas transmission services even in severe conditions. According to the “Wettelijke taken LNB van algemeen belang” [Statutory duties of the national gas transport network operator in the public interest], GTS is responsible for guaranteeing the peak supply of gas to residential consumers in the Netherlands on any given day when the average effective daily temperature in De Bilt (NL) is lower than -9°C. In 2011 due to the relatively mild winter temperatures, conditions for peak supply did not occur. - 10 - Transport Insight 2012 3 Utilisation of the GTS grid in 2011 3.1 Network clusters The Gasunie TSOs work with decoupled entry and exit systems in Germany and the Netherlands. Within this system, shippers are free to route gas flows. Entry and exit points are grouped together into a cluster when they share a constraint in their connection to the rest of the network. This means that clusters are geographical in nature. Limitations are defined within the clusters, so that each cluster can be reached from any other cluster in the system. Figure 3.1 shows the physical location within the network of the clusters that will be discussed in this section. The clusters will be discussed in clockwise sequence, beginning with the Emden-Oudestatenzijl clusters. Although quality conversion has been socialised since 1 July 2009, the actual transport system is still divided into a High(H) and Low(L) calorific system. For the same reason, the clusters are divided into H-gas and L-gas clusters. Emden/ OSZ H-Gas OSZ L-Gas julianadorp Winterswijk/Zevenaar Cluster area Hilvarenbeek Other borderpoint Zelzate Zuid-Limburg Figure 3.1: Location of the Gas Transport Services clusters 3.2 General picture Looking at the graphs in chapters 3.4-3.11, some general observations can be made concerning the contracted capacity and the utilisation of the border clusters. A more detailed analysis on the clusters is given in the following chapters. Utilisation of capacity Utilisation of capacity varies. In general, L-gas clusters with more or less closed markets show a strong seasonal dependence of allocated capacity, while most of the H-gas clusters show a more constant flow with a large volume throughout the year. - 11 - Gas Transport Services B.V. Firm capacity As a result of the 2005 Open Season, the firm capacity of the Emden-Oudestatenzijl, Zuid Limburg and Zelzate clusters was further expanded. Contracted capacity In overall terms, the level of contracted capacity is high, i.e. most of the technical capacity is contracted. The high demand for capacity is reflected in the Integrated Open Season. Entry and exit capacity at border points will increase, as can be seen in Figure 3.2. In 2011, more interruptible capacity was contracted compared to 2010. This can be seen in the Winterswijk-Zevenaar, Zuid Limburg, Hilvarenbeek and Julianadorp clusters. Contracted capacity at GTS borderpoints Capacity [mln m3/h] 15 Entry 10 5 20 17 -0 7 20 17 -0 1 20 16 -0 7 20 16 -0 1 20 15 -0 7 20 15 -0 1 20 14 -0 7 20 14 -0 1 20 13 -0 7 20 13 -0 1 20 12 -0 7 20 12 -0 1 20 11 -0 7 20 11 -0 1 0 -5 -10 -15 -20 Exit Contracted firm capacity Contracted Interruptible capacity Contracted IOS capacity (firm) -25 Figure 3.2 Contracted capacity up to 2018 Even if all the technical capacity has been contracted, the average utilisation rates may be lower than 100% for several reasons. Market parties need to book capacity in order to meet peak demand. This highest peak, however, does not occur each year, or even each decade. Maximum utilisation is determined by market demand, which in turn is strongly influenced by weather conditions. Since the Netherlands is a net exporter of both volume and flexibility, the cross-border gas flows contain both volume and flexibility, which is generally called on when temperatures are low. This difference between average and maximum utilisation rates can be seen most clearly in exits for low calorific gas such as Winterswijk-Zevenaar and Hilvarenbeek and Oude Statenzijl Dutch L-gas. In a liberalised gas market, the commercial position of shippers and trading possibilities deriving from market liberalisation creates a value for the option to use capacity. To some extent, free capacity is vital for facilitating a liberalised gas market. - 12 - Transport Insight 2012 3.3 Layout of the Emden/Oude Statenzijl cluster The Emden/Oude Statenzijl cluster comprises the Emden entry points and the Oude Statenzijl bidirectional points for high-calorific gas: Emden is connected to the EuroPipe Terminal (EPT) and the NorPipe Terminal (NPT) Oude Statenzijl is connected to the networks of Open Grid Europe, Wingas Transport, Renato/ OGE and EWE, and is also the connection point between the Dutch and the German part of the Gasunie system. The Oude Statenzijl cluster transfers low-calorific gas from the Netherlands to Germany. The Gasunie network is connected to EWE. From Figure 3.3 it is clear that the situation is not symmetrical with respect to the Dutch and German clusters in the Gasunie grid. For example, only a part of the total exit flow of the Dutch cluster is entry flow for the German cluster. The rest of the exit flow is for the connection(s) to operators such as Wingas Transport, OGE or EWE. The Netherlands GTS Germany GUD Emden NPT EPT Cluster Emden/OSZ H-gas GUD Cluster Emden/OSZ H-gas GasPool* Cluster OSZ L-gas Aequamus* WIN OGE TTF Renato EWE Cluster OSZ L-gas GUD EWE Flange to NNO Flange to Storage Figure 3.3 Schematic representation of the Emden-Oude Statenzijl cluster *On 1 October 2011, Gaspool and Aequamus merged to create a single cross-quality market area known as Gaspool. - 13 - Gas Transport Services B.V. 3.4 Entry-Exit Emden-Oude Statenzijl Dutch H-gas cluster General Most of the imported gas flowing into the Netherlands passes this cluster. Also, most of the increases in future gas imports such as Nord Stream gas are expected to be realised via this cluster. The cluster also connects several German UGS facilities to the Dutch grid. Entry-Exit Emden-Oude Statenzijl Dutch H-gas Cluster 2011 Capacity [mln m3/h] Entry 10 8 6 4 2 0 1 2 3 4 5 6 7 8 9 10 11 12 -2 -4 -6 Exit -8 Interruptible capacity with different tariff tranchers Firm capacity technical Allocated capacity Capacity contracted including interruptible Firm capacity contracted For a single network point, no interruptible capacity is sold when firm capacity is still available. At cluster level, however, it is possible to book interruptible capacity when firm is not fully contracted. This can be explained as follows: When one of the network points in the cluster is fully contracted and another network point in the same cluster is not, the total firm capacity of the cluster is below the technical capacity. For the fully contracted network point, interruptible capacity can be sold. This can happen, for example, at the entry direction of this cluster. At the Emden-Oude Statenzijl exit, a different situation with similar results can occur. For Emden, only interruptible exit capacity is available, so during months in which the cluster is not fully contracted, interruptible capacity can be seen at cluster level. The graphs showing gas transmission in 2011 are explained in more detail in Appendix 1. The most relevant data for each cluster are summarised in a table below each chapter. The definitions used are explained in Appendix 2. - 14 - Transport Insight 2012 Firm capacity Following the 2005 Open Season, the entry capacity of Emden-Oude Statenzijl was further expanded in 2011 to 6.5 mln m3/h at the start of 2011 and again to 7.5 mln m3/h from 1 October 2011. In 2012, the entry capacity will be further expanded to 8.5 mln m3/h. Contracted capacity In contrast to the previous year, entry capacity was not fully contracted. The percentage of contracted capacity increased during the year, starting at 89% in January and reaching 99% in December, resulting in an average contracted firm entry capacity of 92% (see table below). Utilisation Although the contracted entry capacity increased significantly from 2010 to 2011, the absolute maximum allocations remained constant at a level of approximately 3 mln m3/h, resulting in an average maximum utilisation of 51% in 2011, compared with 90% in 2010. Entry Firm capacity Interruptible capacity Exit 6.8 3 Firm capacity 2.5 Interruptible capacity 3.9 Contracted firm 92% Contracted firm Contracted interruptible 12% Contracted interruptible Average hourly utilisation 35% Average hourly utilisation 46% Maximum hourly utilisation 51% Maximum hourly utilisation 76% Number of interruptions 0 Number of interruptions - 15 - 90% 9% 0 Gas Transport Services B.V. 3.5 Exit Oude Statenzijl Dutch L-gas cluster General Together with the Winterswijk-Zevenaar cluster, the Oude Statenzijl L-gas cluster is the main route for the export of Dutch gas to Germany for L-gas. Most of the L-gas flowing to Germany is transmitted through the Oude Statenzijl L-gas cluster. This cluster connects the Gasunie network to the network of EWE. Contracted capacity The contracted firm exit capacity (expressed as a percentage of the technical capacity, see definitions in appendix 1.) has been growing steadily since 2008. The contracted firm exit capacity increased from 80% in 2008 to 90% in 2010 and finally to 99% in 2011. This is because more players are interested in exit capacity in combination with declining production in the German fields. Exit Oude Statenzijl Dutch L-gas Cluster 201 1 2 Capacity [mln m3/h] Entry 1 0 1 2 3 4 5 6 7 8 9 10 11 12 -1 -2 Exit -3 Interruptible capacity with different tariff tranchers Firm capacity technical Allocated capacity Capacity contracted including interruptible Firm capacity contracted Utilisation of capacity The increase in the maximum hourly utilisation has come to a halt. The maximum utilisation in 2010 was 85% compared with 83% in 2011. Cluster OSZ G-gas exit Firm capacity 1.5 Interruptible capacity 1.1 Interruptible backhaul capacity 0.4 Contracted firm 99% Contracted interruptible 16% Contracted interruptible backhaul 65% Average hourly utilisation 39% Maximum hourly utilisation 83% Number of interruptions 0 - 16 - Transport Insight 2012 3.6 Exit Winterswijk-Zevenaar L-gas cluster General The Dutch Winterswijk-Zevenaar cluster consists of two exit stations to Germany. Together with Oude-Statenzijl, this is the main export route for Dutch low-calorific gas to Germany. Contracted capacity In contrast to 2010, firm exit capacity was fully contracted. As a result, interruptible contracted capacity increased from 1% in 2010 to 11% in 2011. Exit Winterswijk-Zevenaar L-gas Cluster 2011 4 Capacity [mln m3/h] Entry 2 0 1 2 3 4 5 6 7 8 9 10 11 12 -2 -4 -6 -8 Exit -10 Interruptible capacity with different tariff tranchers Firm capacity technical Allocated capacity Capacity contracted including interruptible Firm capacity contracted Utilisation of capacity The allocations show a clear seasonal profile due to delivery to the residential market in Germany. During the months of May and November, the interruptible backhaul allocations exceed the contracted interruptible capacities. This is possible because the reported contracted capacities are averaged per month and the reported allocations are based on the maximum allocation per month. Cluster Winterswijk/Zevenaar L-gas exit Firm capacity 4.2 Interruptible capacity 3.3 Interruptible backhaul capacity Contracted firm Contracted interruptible 1.6 100% 11% Contracted interruptible backhaul 46% Average hourly utilisation 39% Maximum hourly utilisation 86% Number of interruptions 0 - 17 - Gas Transport Services B.V. 3.7 Exit Zuid-Limburg H-gas cluster General The Zuid-Limburg cluster comprises exit border points at Bocholtz, ‘s-Gravenvoeren and Obbicht. ‘s-Gravenvoeren and Obbicht connect this cluster to the network of the Belgian network operator Fluxys, while the Bocholtz stations connect our network to the TENP pipeline of Open Grid Europe (OGE) and Fluxys, and to the RTG network of Thyssengas. Most of the high-calorific gas flows to Belgium and a substantial proportion of high-calorific gas flows to Germany go through the Zuid-Limburg cluster. Gas is then transported on to Switzerland and Italy through the TENP pipeline. Firm capacity Firm exit capacity at the Zuid-Limburg cluster was increased from 2.9 mln m3/h to 3.4 mln m3 from 1 October 2011 following the 2005 Open Season. A relevant factor for the capacity increase was the completion of the Wijngaarden compressor station and 100 km of high-pressure pipeline. Contracted capacity The exit capacity was fully contracted in 2011. The contracted interruptible backhaul increased from 13% in 2010 to 18% in 2011. The only interruption in 2011 was in ‘Gravenvoeren, in the Zuid Limburg H-gas cluster. The volume of the interruption was 143 m3. Exit Zuid Limburg H-gas Cluster 2011 4 Capacity [mln m3/h] Entry 2 0 1 2 3 4 5 6 -2 -4 Exit -6 Interruptible capacity with different tariff tranchers Firm capacity technical Allocated capacity Capacity contracted including interruptible Firm capacity contracted - 18 - 7 8 9 10 11 12 Transport Insight 2012 Cluster Zuid-Limburg H-gas exit Firm capacity Interruptible capacity Interruptible backhaul capacity Contracted firm Contracted interruptible 3 1.5 1.8 100% 29% Contracted interruptible backhaul 18% Average hourly utilisation 59% Maximum hourly utilisation Number of interruptions 101% 1 - 19 - Gas Transport Services B.V. 3.8 Exit Hilvarenbeek L-gas border point General The border point at Hilvarenbeek is the main route for the export of Dutch gas to Belgium and France for low-calorific gas. Most of the low-calorific gas flows to Belgium and all the low-calorific gas flows to France are transmitted through this border point. The Hilvarenbeek border point connects our network to the Fluxys network. Contracted capacity As in 2010, the exit capacity was fully contracted. Contracted interruptible backhaul capacity decreased from 7% in 2010 to 1% in 2011. By contrast, contracted interruptible forward capacity increased from 10% to 21%. Utilisation of capacity Utilisation of capacity remained at the same level as in 2010. Exit Hilvarenbeek L-gas 2011 3 Capacity [mln m3/h] Entry 1 1 2 3 4 5 6 -1 -3 Exit -5 Interruptible capacity with different tariff tranchers Firm capacity technical Allocated capacity Capacity contracted including interruptible Firm capacity contracted Hilvarenbeek L-gas exit Firm capacity 2.9 Interruptible capacity 1.5 Interruptible backhaul capacity Contracted firm Contracted interruptible Contracted interruptible backhaul 1.4 100% 21% 1% Average hourly utilisation 42% Maximum hourly utilisation 88% Number of interruptions 0 - 20 - 7 8 9 10 11 12 Transport Insight 2012 3.9 Entry-Exit Zelzate H-gas Cluster General The Zelzate border cluster connects the Gasunie grid and the Fluxys network. On 1 October 2010, the cluster changed from an import to a bi-directional cluster. Firm capacity Firm capacity has been increasing since 1 October 2010. Entry capacity rose from 540,000 m3/h at the end of 2010 to 1,150,000 m3 in 2011. Exit capacity more than doubled as per 1 October 2011, from 525,000 m3/h to 1,200,000 m3/h. During September, limited firm entry capacity was available because due to the start-up of Gate (LNG). This was resolved on 1 October following the completion of the Wijngaarden compressor station. For the same reason as was mentioned with regard to the Zuid Limburg cluster, the capacity increase was made possible by realising the final part of the 2005 Open Season: the completion of the Wijngaarden compressor station and the realisation of 100 km of high-pressure pipeline. Utilisation of capacity The maximum utilisation in the entry direction in 2011 was 73%. In the exit direction, the maximum utilisation was 99%. This value was attained in September, just before firm entry capacity was increased. Entry-Exit Zelzate H-gas Cluster 2011 2,0 Capacity [mln m3/h] Entry 1,0 0,0 1 2 3 4 5 6 -1,0 Exit -2,0 Interruptible capacity with different tariff tranchers Firm capacity technical Allocated capacity Capacity contracted including interruptible Firm capacity contracted - 21 - 7 8 9 10 11 12 Gas Transport Services B.V. Cluster Zelzate H-gas entry Cluster Zelzate H-gas exit Firm capacity 1.1 Firm capacity 0.7 Interruptible capacity 0.2 Interruptible capacity 0.2 Contracted firm 86% Contracted interruptible Contracted firm 8% 100% Contracted interruptible 17% Average hourly utilisation 31% Average hourly utilisation 44% Maximum hourly utilisation 73% Maximum hourly utilisation 99% Number of interruptions 0 Number of interruptions 0 3.10 Exit Julianadorp H-gas cluster General The Julianadorp cluster connects our network to the UK national grid via the BBL pipeline. Highcalorific gas leaves the Dutch network at Julianadorp for Bacton on the English coast. The BBL pipeline is operated by BBL Company, which is a neighbouring network operator. Since October 1 2010, backhaul capacity has also been available at the Julianadorp cluster. As can be seen, the use of interruptible backhaul capacity is increasing. Arbitrage between the NBP and TTF will contribute to the use of interruptible backhaul capacity. Contracted capacity As in 2010, exit capacity was fully contracted in 2011. In contrast to 2010, when no interruptible exit capacity was contracted, during the summer months of 2011 interruptible exit capacity was contracted. Interruptible backhaul capacity, which has been available since 1 October 2010, was booked during the second half of 2011. Exit Julianadorp H-gas Cluster 2011 Capacity [mln m3/h] 3 Entry 1 0 1 2 3 4 5 6 -1 Exit -3 Interruptible capacity with different tariff tranchers Firm capacity technical Allocated capacity Capacity contracted including interruptible - 22 - 7 8 9 10 11 12 Transport Insight 2012 Utilisation The newly introduced backhaul has been used intensively since May 2011. This results in a yearly average of 17% of the available backhaul. During the months May and September to November, the interruptible backhaul allocations have exceeded the contracted capacities. This is possible because the contracted capacities are averaged per month and the allocations are based on the maximum allocation per month. Cluster Julianadorp H-gas exit Firm capacity 1.6 Interruptible capacity 0.4 Interruptible backhaul capacity Contracted firm Contracted interruptible 0.9 100% 13% Contracted interruptible backhaul 17% Average hourly utilisation 49% Maximum hourly utilisation 91% Number of interruptions 0 - 23 - Gas Transport Services B.V. 3.11 Other exit border points G, G+-, L- and H-gas General For reasons of confidentiality, border points at which fewer than three parties are currently active are not reported separately. This is the case at seven border points. They are: the exit points at Dinxperlo, Haanrade, Tegelen, Vlieghuis, Zandvliet-G+ and the two Zandvliet-H border points. The first four facilitate Dutch exports to Germany, the latter three to Belgium. In this report, these stations are discussed together as a ‘virtual’ cluster. In reality, however, the available capacity at one point is not influenced by another. These border points transmit different qualities of gas (G-gas, G+-gas, L-gas and H-gas). The conclusions relate only to the aggregate of these points. Contracted capacity Interruptible exit capacity increased on average from 0.2 mln m3/h to 0.3 mln m3/h. This mainly occurred in the final 7 months of 2011. Exit other border points G, G+, L and H-gas 2011 (Dinxperlo, Haanrade, Tegelen, Vlieghuis and Zandvliet-G and H) Capacity [mln m3/h] 0,5 Entry 0,0 1 2 3 4 5 6 -0,5 Exit -1,0 Interruptible capacity with different tariff tranchers Firm capacity technical Allocated capacity Capacity contracted including interruptible Firm capacity contracted Aggregate of other border points exit Firm capacity 0.6 Interruptible capacity 0.3 Interruptible backhaul capacity 0.03 Contracted firm 97% Contracted interruptible 35% Contracted interruptible backhaul 0% Average hourly utilisation 35% Maximum hourly utilisation 74% Number of interruptions 0 - 24 - 7 8 9 10 11 12 Transport Insight 2012 4 Themes Theme 1 The TTF has become the most liquid gas hub on the continent The TTF shows a continuous growth in volume and liquidity In recent years the gas trading hub TTF has experienced remarkable growth, developing into the most liquid gas market within continental Europe. For Continental Europe, the TTF gas price has become a leading reference point for gas operations. Within the European Union only the British National Balancing Point (NBP) is any larger. Three aspects are of specific interest for the importance and attractiveness of a gas hub: the volume delivered, the volume traded and product range (products traded). The last two mainly determine the liquidity of the gas hub, which is what traders aim for. Traded volume 2011 at NW European gas hubs Circle area scales with size of the hub. Traded volume Gas consumption in the gas hub area NBP TTF 6300 6340 TWh 18030 TWh 18000 Gaspool 840 TWh NCG 1200 TWh Zeebrugge 870TWh PEGs 520TWh Volume of gas delivered at the hubs The importance of a gas hub can be measured by comparing volume delivered to gas consumption in the hub region. In recent years the volume delivered at the Dutch TTF has shown a continuous growth of about 25% per year. With Dutch gas consumption of 45 bcm in 2011 and volume delivered at the TTF of 38 bcm, the net TTF volume reached 85% of the gas demand in the TTF area. This ratio of 85% demonstrates the great importance of the TTF for the Dutch gas market. - 25 - Gas Transport Services B.V. The same goes for Belgium. Although the Belgian market is much smaller, the volume delivered at the Zeebrugge hub is also comparable with 85% of the gas consumption in the Zeebrugge area. This means that the TTF and the Zeebrugge are slightly ahead of the German gas hubs. With 110% the NBP has the highest ratio, while the ratio in France is much lower: 30%. The ratio of 110% for the NBP can be explained by the fact that all transit volumes were delivered and registered at the NBP. Volume traded The attractiveness of a gas hub is related to the tradability of gas: volume traded in proportion to volume delivered at the hub. Volume traded and products traded are the main determining factors of the liquidity of a gas hub. The volume traded at the TTF reached 6300 TWh (about 645 bcm) in 2011. The TTF has all the characteristics of a liquid and mature gas market: The volume traded is more than 14 times the local consumption. The range of products traded at the TTF is similar to the NBP with more than 60% of the volume traded on the curve. Churn factor The introduction of the new balancing regime in 2011 has resulted in a larger number of active traders. Whereas in the first quarter of 2011 on average 82 traders were active on the TTF, in April to December the average number of active traders on a given day was 90, with a maximum of 95 in October. This had a beneficial effect on the churn factor (= average number of times that a cubic metre of natural gas is traded). The volume traded at the TTF in 2011 was about 6300 TWh (645 bcm). With a volume delivered of 375 TWh (38 bcm), we can therefore say that on average each TTF cubic metre was traded approximately 17 times before being delivered to the market.4 When the volume traded is related to the gas consumption in the TTF area of 440 TWh (45 bcm) a churn rate of 14 appears. 4 The TTF is a fast growing hub. Therefore at a given day X the volume of trades with a delivery date in future exceeds the volume of historical trades for day X. When the dataset is cleansed for this effect by an analysis on delivery date, a churn rate well above 13 remains. - 26 - Transport Insight 2012 Traded volume 2011 according to hub operators; ICIS Heren and Leba 20000 18000 18000 Traded Volume in TWh 16000 14000 12000 10000 8000 6300 6000 4000 1200 2000 840 870 520 0 NBP TTF NCG Gaspool Zeebrugge PEGs Published by hub operators Published by ICIS Heren and Exchanges Published by LEBA and Exchanges Please note that the volume traded reported by the hub operator can differ considerably from the volume obtained from OTC deals and exchange volumes. The reason can be found in the liquidity and maturity of the gas hubs. The GTS figures for volumes traded and churn are based on GTS’s records of transactions. Mutual trades also took place outside the reported transactions. Direct information from traders gives a traded volume that is a factor of 3 to 5 higher. For mature hubs a large share of curve trading and financial transactions (derivatives) makes the volume traded much larger than the nominations registered by the hub operator. All trades prior to the first nomination are traded away from the operator and therefore the volume as it is reported to the hub operator is small compared to the volume from agencies and exchanges. This effect can be seen at the NBP and TTF. For hubs with a large share of bi-lateral deals, the volume as reported by the hub operator may exceed the volume that follows from the agencies and exchanges. When bi-lateral deals take place without the intervention of a broker, the volume is not necessarily noticed by agencies but should be reported to the hub operator. This is for example the case in Germany. For Zeebrugge and the PEGs, ICIS Heren and LEBA report a similar volume traded to the relevant TSO. For the analysis the maximum of the three values is used as approximation for the volume traded. According to Heren, LEBA and exchanges, the TTF volume has reached a size of one third of the NBP and the volume is about twice as high as on all the other continental hubs put together. - 27 - Gas Transport Services B.V. Products on gas hubs Gas hubs can be distinguished by the products being traded. In general the first products where trade occurs are short-term products, like day-ahead and week-ahead. When confidence in the gas hub increases, the share of long-term products also increases . Based on information on traded volumes gathered by ICIS-Heren, GTS studied in detail which types of products are traded on the TTF and on other hubs. The products to be discussed below have been grouped into categories: D = Within-day and Day-ahead W = BOW (Balance Of Week), Weekend and WDNW (Working Days Next Week) M = BOM (Balance Of Month) and Month Q = Quarter S = Season (1 April - 30 Sept; 1- Oct – 31 March) Y = Year (calendar year) Characteristics of available products: the DNA of European gas hubs By composing a DNA profile we can compare product ranges of north-west European gas hubs. For the DNA profile trades were divided into three categories: short term (“spot”: D and W) and long term (“curve”: S and Y) and mid-term (M and Q). The graph below shows the DNA profile for four hubs in 2011. The positive scale shows the volume traded as an average percentage per product. The negative scale shows the same for the number of trades per product. DNA profile of NW European gas hubs Volume ---> 100% Trades on the curve From left to right the relative share of volume in long term contracts falls from 60% to 35%. A decrease is also seen in the relative number of deals, a drop from 20% to 3%. 75% 50% <--- Number of Transactions 25% 0% 25% 50% 75% 100% TTF NBP ZB NCG+GP Spot trades By contrast, the percentage volume in short term contracts Short term Mid-term Long term From the DNA profile of the north-west European gas hubs one can conclude that the NBP and TTF are trading places with sufficient liquidity on the curve: this specific profile is a feature of mature gas hubs. Sufficient liquidity on the curve ensures parties which do not take a physical position, e.g. some financial parties, are also involved in gas trades on both hubs. - 28 - Transport Insight 2012 Mature liquid hubs share similar product range characteristics and TTF and NBP appear in terms of their DNA profile to be the most similar to each other: Most of the volume (60% of the total) is related to trades on the curve. The number of trades on the curve (20% of the total) ensures the liquidity in this segment. These both makes both hubs attractive for financial trade, and illustrates the liquidity of the gas hub. Although the percentage share of short-term products in the total volume traded is significantly smaller than on the other two hubs, this is not the case in absolute terms. The DNA profile of the physical Zeebrugge hub shows a relatively large volume for long-term products and at the same time a relatively small number of trades. In general the number of trades is low compared to the volume involved. Therefore the volume per trade is large: 60% to 90% above the average of the other hubs. At the German hubs, which play an important role in balancing, the relative share of spot products and the relative number of trades is about four times the TTF and NBP. - 29 - Gas Transport Services B.V. Theme 2 Flow Against Price Differentials (FAPD): gas flows in relation to price differences between markets 1. Introduction In this special, the focus is on flows at border clusters in relation to price differences between different markets. A quantitative method called FAPD is described, and is applied to the flows between the Netherlands and the UK as well as to a parent company, and a subsidiary concentrating on trade in gas. When the price difference exceeds a threshold compared to the costs of transporting the gas from a low to a high market, one would expect this to provide an incentive to start a trade in gas. In general, one would expect gas flows to be directed from a market with a low gas price to a market with a high gas price. Before describing FAPD, we will more closely examine the flow and price data by looking at scatterplots and linear flow and price graphs. 2. Scatterplots A common way of representing flows and price differences is by means of a scatterplot. A scatterplot on the X-axis shows the price difference between two market areas. The Y-axis shows a particular characteristic of the flow, such as utilisation (% of the technical capacity) or allocation data. In the following example flow and price differences between TTF and NPB is analysed. Day ahead prices of TTF and NBP and allocation data for Julianadorp (= direct input for the BBL pipeline between the Netherlands and the UK) for 2011 were used for the analysis. The first graph shows the relationship with the net allocations (Forward minus Backhaul allocations). For the total flow, the higher flows clearly correspond with a positive price difference. There is a slight positive correlation between price difference and total flow. Nevertheless , a substantial portion of the flow which is directed from the Netherlands to the UK corresponds with a low NPB gas price as compared to the TTF. The largest price difference was minus 6 €/MWh. The reason for the low NBP gas price with respect to the TTF is the interruption of the Interconnector (Zeebrugge-UK), due to maintenance which caused an oversupply of gas to the UK with correspondingly low day-ahead prices in the UK and relatively high day-ahead prices at the TTF. Since October 1 2010, it has been possible to contract backhaul at the BBL. The second graph shows only this part of the allocations, the backhaul allocations. The backhaul ties in far better with the price differences: only two days with backflow occur in combination with a lower (> 0.5 €/MWh, yellow area) price level on the TTF. - 30 - Transport Insight 2012 A. Total netted allocation Julianadorp 2011 B. Interruptible backhaul allocation Julianadorp 2011 0,0 1,7 1,6 -0,1 1,5 1,4 -0,2 1,3 1,2 -0,3 Allocations [mln m3/h] Allocations [mln m3/h] 1,1 1,0 0,9 0,8 0,7 -0,4 -0,5 -0,6 0,6 0,5 -0,7 0,4 0,3 -0,8 0,2 0,1 -0,9 0,0 -6 -5 -4 -3 -2 -1 0 1 2 3 4 5 -6 -5 -4 -3 -2 -1 0 6 1 2 3 4 5 P r i c e d i f f e r e n c e N B P - TTF F Eu r o / M Wh P r i c e d i f f e r e n c e N B P - TTF F Eu r o / M Wh - 31 - 6 Gas Transport Services B.V. 3. Linear flow and price graph a. Total netted allocation data 2011 Julianadorp In the graph below, net allocations during 2011 are represented by the light brown line/area. The dark brown line gives the price differential between NBP and TTF in €/MWh. As we can see, most of the time the TTF price is higher than the NBP while the gas is flowing towards the UK. However, the highest flows (winter months) coincide with the situation in which the price on the NBP is higher than on the TTF. Price difference (NBP-TTF) [€/MWh] D ec -1 1 M M N ov -1 1 0 O ct -1 1 0 Se p11 2 Au g11 500 Ju l-1 1 4 Ju n11 1000 ay -1 1 6 Ap r11 1500 ar -1 1 8 Fe b11 2000 Ja n11 Allocated capacity [m3/h] Thousands Allocated net flow versus price differences, Julianadorp 2011 -2 -500 -4 -1000 Net price differential (NBP-TTF) b. Interruptible backhaul allocation data 2011 Julianadorp The next figure clearly shows that interruptible backhaul allocations are much more in line with the price differentials. A possible reason for these substantial differences could be that a large part of the allocated capacity in forward directions could be attributable to gas deliveries under longterm contractual arrangements in contrary to backhaul allocations. - 32 - Transport Insight 2012 Price difference (NBP-TTF) [€/MWh] D ec -1 1 M -500 N ov -1 1 0 O ct -1 1 0 Se p11 2 Au g11 500 Ju l-1 1 4 Ju n11 1000 ay -1 1 6 Ap r11 1500 M ar -1 1 8 Fe b11 2000 Ja n11 Allocated capacity [m3/h] Thousands Allocated backflow versus price differences, Julianadorp 2011 -2 -1000 -4 Backhaul (Entry) price differential (NBP-TTF) 4. Flow Against Price Differentials Flow Against Price Differentials (FAPD) are designed to give a measure of the consistency of the economic decisions taken by market players, based on the assumption that day-ahead prices will influence the nominations and allocations of the gas flow next day. An event referred to as FAPD occurs when commercial nominations for cross-border capacities are such that power is set to flow from a higher price area to a lower price area. The FAPD event is defined by the minimum threshold of price difference under which no FAPD is recorded. The minimum threshold is set at 0.5 €/MWh5. The FAPD chart provides detailed information on adverse flows. FAPD is used by the European Commission and presented in its quarterly reports. The following items are presented: Number of days on which the average daily allocation is directed opposite (from a higher to a lower price) the price differential between NBP and TTF. Estimation of the monetary value of energy exchanged in adverse flow. This is referred to as “welfare loss”. This monetary value is expressed as a percentage of the total mark-up which includes the monetary value exchanged in both flows (summary of Absolute price difference times flow, for all events). A graph on which the FAPDs are divided up by subcategory of pre-established intervals of price differentials. It shows the average exchanged energy(volume of gas) and monetary contribution of each subcategory on two vertical axes. 5 The actual threshold will depend on the (contractual) situation of the shipper. When nominations are used within existing transport contracts, the transport fee has already been paid and can be regarded as sunk costs. If day contracts for transport capacity are needed, costs of about 0.5 – 1.5 €/MWh can be expected. - 33 - Gas Transport Services B.V. a. Total netted allocation data The FAPD is used for the same data as shown in the previous chapters. An FAPD analysis is also performed on two shippers: the parent company and subsidiary. The first graph shows the total flow in which 15.5 mln € of the total mark-up of 24 mln € is related to the FAPD. The figure clearly shows that at larger price intervals, the money that is lost decreases as well as the energy flow involved (expressed as mln m3). Although 33% of the events are FAPD, the monetary value involved is 65%. FAPD Julianadorp 2011, NBP-TTF (gas volume & lost money involved) mln € mln m3 800 5 4,5 700 4 600 3,5 500 3 400 2,5 2 300 1,5 200 1 100 0,5 0 0 0,5-1 lost money 1-2 2-3 3-5 5-10 absolute price differential volume Results: 83 of 254 events6 are FAPD (33%) 15.5 mln € of a total mark-up of 24 mln € (65%) were exchanged during FAPDs 6 The analysis is restricted to the days to which a day-ahead price quotation applies. Sundays, Mondays and bank holidays are therefore excluded from the analysis. - 34 - Transport Insight 2012 b. Interruptible backhaul allocation data As we have seen earlier, the backflow is much more closely in line with the price differences. Only 0.07 mln € of the total mark-up of 4.9 mln € is related to FAPD. FAPD Julianadorp-2011, NPB-TTF (gas volume & lost money involved) mln € mln m3 1,0 50 0,9 45 0,8 40 0,7 35 0,6 30 0,5 25 0,4 20 0,3 15 0,2 10 0,1 5 0,0 0 0,5-1 1-2 2-3 3-5 5-10 absolute price differential lost money volume Results: 2 of 194 events are FAPD (1%) 0.07 mln € of a total mark-up of 4.9 mln € (1.4%) were exchanged during FAPDs Clearly, there is virtually no FAPD associated with the interruptible backflow allocations. c. FAPD; Parent versus subsidiary For one company, allocations of the parent company were investigated using FAPD and compared to the subsidiary which is more closely focused on trade in gas. Parent Subsidiary-1 Mark-up (mln €) 7,5 1,0 3,8 FAPD 1,1 0,003 0,03 15 % 0,3 % 0,8 % (mln €) FAPD (%) Subsidiary-2 The very low FAPD’s of 0,3 – 0,8% for the gas trading subsidiary companies, compared to an FAPD of 15% for the parent company, proofs the usefulness of the FAPD method. - 35 - Gas Transport Services B.V. Conclusions/Remarks FAPD appears to be a useful technique for quantifying the potential (lost) trade value of gas flowing from a region with a high gas price to a low gas price. In order to compile a sound analysis, it is necessary that the two hubs are liquid and virtual and that the gas flows are relevant between the two markets in terms of gas quality, and the connection between the two markets. One should be aware that price differences are not the only driver for the direction of gas flow or for the outcome of the FAPD. Sometimes long-term contracts with fixed prices and take or pay obligations take priority over trade in gas. - 36 - Transport Insight 2012 Appendix 1 Explanatory notes on graphs showing GTS border clusters in 2011 Capacity (mln m3/h) Appendix 1 Explanatory notes on graphs of GTS border cluster in 2011 8 Entry Firm Capacity Technical Contracted capacity including interruptible 6 Firm capacity: Contracted Allocation including interruptible max hour per month 4 2 Allocation firm capacity max hour per month 0 1 2 3 4 5 6 7 8 9 10 11 12 -2 Interruptible Class A -4 Interruptible Class B -6 Interruptible Class C Exit The figure is based on allocated gas transmission at a non-specified cluster. Calorific value is reported for each cluster in [35.17 MJ/m³]. Available capacities are shown in grey and in coloured areas in the graph: The grey area shows the amount of available capacity under firm conditions. Some clusters are bidirectional. This means that capacity is available under firm conditions for both entry and exit from the system. The coloured areas show the amount of capacity under interruptible conditions subdivided into classes A, B and C. These three tariff tranches have a different meaning in the Dutch and the German part of the network. GTS Class A Tariff tranche 90% Class B Tariff tranche 85% Only available as backhaul Availability is published Class C Tariff tranche 70% Availability is published Contracted capacity is indicated by lines on the graph: The unbroken line shows capacity contracted under firm conditions; The broken line shows the total contracted capacity, including interruptible capacity. In the example, entry capacity which is available under firm conditions is fully contracted. A high proportion of the entry capacity available under interruptible conditions is also contracted. Approximately two-thirds of exit capacity under firm conditions is contracted. - 37 - Gas Transport Services B.V. Allocated capacity per month is indicated by the coloured blocks: The bottom of each block shows the maximum allocation under firm conditions; The top of each block shows the maximum allocations, including the capacity under interruptible conditions. Appendix 2 Miscellaneous In order to safeguard the interests of individual parties, the report relates only to points or clusters in which transmission capacity bookings have been made by at least three independent parties. For the Dutch figures, all gas volumes are in Groningen quality equivalents: With a gross calorific value of 35.17 MJ/m³ At 1.01325 bar (1 atmosphere) At 0°C As a conversion, this produces: 1 m³ = 9.77 kWh 1 million m³/h = 9.77 GW Definitions used in the text and tables: Firm capacity The average of the technical capacity per month. Interruptible capacity The average of the interruptible capacity per month. Contracted firm Average value of the contracted firm capacity per month divided by the technical capacity per month Contracted interruptible (backhaul) Average value of the contracted interruptible capacity per month divided by the available interruptible (backhaul) capacity per month Average hourly utilisation The average of the hourly allocations per month (firm + interruptible) divided by the technical capacity per month Maximum hourly utilisation The maximum of the hourly allocations per month (firm + interruptible) divided by the technical capacity per month Number of interruptions Number of interruptions in 2011 - 38 - Transport Insight 2012 - 39 - Gas Transport Services B.V. - 40 -