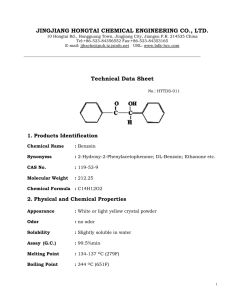

Contract for Residential Sale and Purchase

advertisement