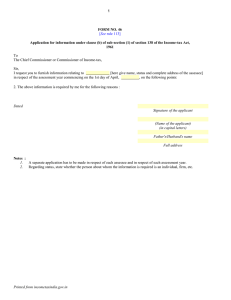

Finance Bill 2015

advertisement