Global Aromatics Supply

advertisement

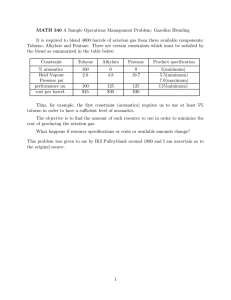

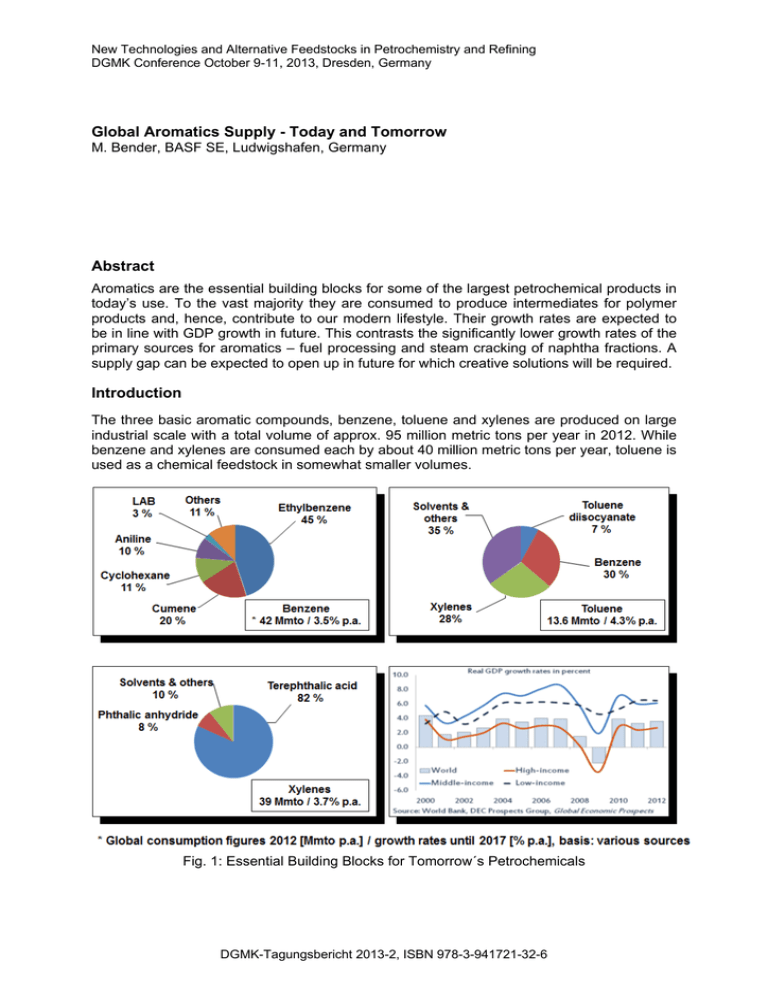

New Technologies and Alternative Feedstocks in Petrochemistry and Refining DGMK Conference October 9-11, 2013, Dresden, Germany Global Aromatics Supply - Today and Tomorrow M. Bender, BASF SE, Ludwigshafen, Germany Abstract Aromatics are the essential building blocks for some of the largest petrochemical products in today’s use. To the vast majority they are consumed to produce intermediates for polymer products and, hence, contribute to our modern lifestyle. Their growth rates are expected to be in line with GDP growth in future. This contrasts the significantly lower growth rates of the primary sources for aromatics – fuel processing and steam cracking of naphtha fractions. A supply gap can be expected to open up in future for which creative solutions will be required. Introduction The three basic aromatic compounds, benzene, toluene and xylenes are produced on large industrial scale with a total volume of approx. 95 million metric tons per year in 2012. While benzene and xylenes are consumed each by about 40 million metric tons per year, toluene is used as a chemical feedstock in somewhat smaller volumes. Fig. 1: Essential Building Blocks for Tomorrow´s Petrochemicals DGMK-Tagungsbericht 2013-2, ISBN 978-3-941721-32-6 New Technologies and Alternative Feedstocks in Petrochemistry and Refining Benzene is mainly consumed for manufacturing polystyrene (PS) via ethylbenzene. Xylenes are mostly produced for making polyethylene terephthalate (PET) via terephthalic acid. Toluene itself is used as a solvent and to a smaller extent in the strongly growing production of toluene diisocyanate (TDI), a building block for polyurethanes. Most of the toluene, however, is converted into benzene and xylenes by catalytic transalkylation, thereby adding to the volumes of the two major aromatics. PET and PS will remain the growth drivers for benzene and xylene volumes. Growth rates for the next five years are projected to be around 3.5-4.0 % for all three aromatics, in line with long-term global GDP growth rates (~3.5 % p.a.). Supply of aromatics mainly hinges on three different sources: Catalytic reforming represents the main source for aromatics by more than half of the global production volume. Steam cracking of naphtha is the main petrochemical source for aromatics. Thirdly, coke-oven light oil (COLO) represents an opportunistic source for aromatics from coal processing into coke. Fig. 2: Aromatics´ production still largely depends on oil As a mere by-product COLO is not always used to recover aromatics but in some cases also processed energetically. Since combustion values of aromatics are lower than their chemical feedstock value their recovery from COLO should always be the preferred option for coke producers. However, total available volumes are small compared to demand and a significant contribution from COLO to aromatics growth cannot be expected. By region Asia Pacific dominates demand & supply for aromatics as the predominant plastics & fibers producer region. Shutdown of refineries, mainly in Europe, have significantly reduced reformate capacities while the Middle East is growing its aromatics capacities rapidly and will become a significant global supplier for aromatics in future. In North America naphtha is increasingly substituted by shale gas liquids as the cheaper cracking feedstock for olefin production. As a side effect aromatics volumes from steam cracking are decreasing. On the other hand higher naphtha contents in shale oil (e.g. from the BAKKEN play) supply the market with additional volumes of feedstock for the primary aromatics production in steam crackers and catalytic reformers. It remains to be seen if this effect will counterbalance the aforementioned negative effects in catalytic reforming and steam cracking in future. Slide 4: Apart from coke-oven light oil the vast majority (97%) of today’s aromatics production relies on crude oil in the first place. With current global crude oil consumption of 85 Mbpd a total volume of 600 to 1,200 Mmto of full-range naphtha (15-30% of crude oil), mostly containing linear and cyclic paraffinic hydrocarbons, is potentially available for producing aromatics. Light naphtha contains hydrocarbons with up to 6 carbon atoms and is processed mainly by steam cracking (265 Mmto p.a.) and to a minor extent by isomerization (70 Mmto p.a.). The latter does not yield any aromatics while the former stands for a quarter of the global aromatics production. Thermal steam cracking of linear naphtha hydrocarbons yields mainly olefins plus a blend of aromatic compounds, so-called pyrolysis gasoline (53 Mmto p.a.) that can be used as feedstock to recover aromatics. DGMK-Tagungsbericht 2013-2 New Technologies and Alternative Feedstocks in Petrochemistry and Refining Fig. 3: Oil to aromatics route Heavy naphtha contains longer hydrocarbons and can be processed by catalytic reforming, a combination of cyclization and dehydrogenation of the linear and cyclic paraffins contained in heavy naphtha. The product is called reformate gasoline and represents an aromaticscontaining, high-octane blend component for the gasoline pool. While global mass balances for aromatics from steam cracking are in line with current aromatics production the situation is different in catalytic reforming. A heavy naphtha feedstock volume of 460 Mmto p.a. would translate into 350 Mmto per year of crude reformate gasoline, equivalent to a potential of 175 Mmto p.a. of BTX product, the acronym BTX standing for the combined volumes of benzene, toluene and xylenes. However, only 28 percent of this theoretical volume is currently utilized. More than 70 percent (125 Mmto p.a.) of the BTX volume produced by catalytic reforming goes into the gasoline pool, boosting its octane value. This suggests that enough primary aromatics are available to be separated from reformate gasoline provided that economics are appropriate. However, withdrawing aromatics from the gasoline pool undermines the primary target of producing reformate gasoline, i.e. to increase the octane value of the gas pool by adding mostly toluene and xylenes. In summary of this Fig. 3 the future availability of aromatics hinges mainly on two facts, namely the growth rate of crude oil supply and the further processing of the two naphtha slates into aromatics. Growth in crude oil consumption is expected to remain constant at 1.2 Mbpd per year. This will bring growth rates down from today’s 1.5 % p.a. to 1.2 % p.a. by 2020, thereby falling short of the required aromatics supply growth. Technologies for the optimization of product slates between steam cracking and catalytic reforming are available but will not contribute significantly to the required aromatics supply. DGMK-Tagungsbericht 2013-2 New Technologies and Alternative Feedstocks in Petrochemistry and Refining A closer look at the crudes that are used to produce clean aromatics shows that reformate gasoline is mostly processed into xylenes, while benzene is recovered primarily from pyrolysis gasoline and to some extent from COLO. Total BTX content in these streams ranges from 35 to 96%, high content levels required to make BTX extraction economic. Table 1: BTX content and price range Content Reformate Pygas COLO Price range [2012] Benzene 3-12 % 25-34 % 60-80 % 1,100…1,500 US$/ton Toluene 12-25 % 15-22 % 9-14 % 1,000…1,300 US$/ton Xylene 15-30 % 5-12 % 1-3 % 1,200…1,600 US$/ton TOTAL 35-65 % 45-65 % 70-96 % Market prices for the BTX components show that xylenes and benzene are higher valued as feedstocks than toluene – understandable on the background of their individual uses as chemical feedstocks as mentioned before. Further to the aforementioned dependences the availability of aromatics hinges mainly on the supply demand balance of Diesel versus gasoline. Dieselization is a global trend, currently with a strong focus on Europe. Diesel is expected to grow worldwide at 1.5 to 2 % p.a. in future, well above the expected growth for gasoline (0.7-0.9 % p.a.). Fig. 4: Trends in global fuels The ideal Diesel compounds are linear paraffinic hydrocarbons, while gasoline ideally has a high content of aromatic compounds. With increasing demand of Diesel fuel paraffins will become less available for steam cracking as well as for reformate gasoline production. Also, less reformate gasoline will be produced in the first place. Steam cracking will shift to shale-gas-derived LPG, continuing growth in olefin production, but reducing the availability of aromatics from pyrolysis gasoline. At the same time aromatics will also become less available from reformate gasoline. Overall, the trend from gasoline to Diesel will create pressure on aromatics availability from both ends of the value chain – hydrocarbon feedstock for the primary aromatics production as well as available aromatics product slate. Unconventional oil reserves will have a mixed impact on aromatics availability, mostly from the naphtha side. While shale oil may contain even more naphtha than conventional crude oil, heavy oil from e.g. oil sands contains less naphtha per barrel of synthetic crude. Finally, processing heavier crudes will also give rise to more delayed coking, thereby producing additional naphtha volumes, however, in small amounts. The net effect of the developments around unconventional oils on naphtha availability is difficult to assess and remains to be followed in the future. However, since the entire volume of unconventional oils is only a fraction of the total crude oil arena the quantitative effect of unconventional oil on the aromatics supply scenario can be expected to be marginal rather than gradual. DGMK-Tagungsbericht 2013-2 New Technologies and Alternative Feedstocks in Petrochemistry and Refining With oil becoming scarcer and more expensive over time a gas- and coal-based economy is developing for the foreseeable future. Access to liquid hydrocarbons is possible from these resources mainly via three different technologies, i.e. the Fischer-Tropsch and the Methanolto-Gasoline process as well as the direct liquefaction of coal to hydrocarbons. Fig. 5: Fossil fuel prices All three processes require the production of significant amounts of synthesis gas, in turn creating significant amounts of carbon dioxide per ton of hydrocarbon produced. The fastest growing of these routes to higher hydrocarbons is obviously Fischer-Tropsch. With its mainly Diesel-directed aliphatic product slates it is expected to grow by significant rates until 2020, however, still contributing in small amounts only to the Diesel pool. A methanol-to-gasoline process is available e.g. from ExxonMobil to add directly to the gasoline pool. However, MTG-gasoline contains less BTX and is, thus, a sub-par feedstock for aromatics extraction when compared to conventional gasoline types. Also, since methanol and some of its derivatives (e.g. MTBE) themselves are already octane boosters in the gas pool the MTG process can be expected to play only a minor role for the production of gasoline in future. Today, no large-scale MTG capacities are in operation. Finally, direct liquefaction of coal produces a slate of mostly linear and cyclic paraffins, but no aromatics. As a sibling to the Fischer-Tropsch process it applies harsh temperature and pressure conditions for catalytic conversion of coal particles in oil-based slurries. Direct liquefaction will grow only selectively, since environmental concerns hamper the technology on both ends – at the fresh water supply as well as at the carbon dioxide disposal. Both – slates from FT as well as from direct coal liquefaction will require an upgrading step, e.g. catalytic reforming or steam cracking to generate BTX from them. In essence, none of the coal- or gas-based processes will contribute significant volumes of aromatics directly. Slide 8: Today, no paper on petrochemicals can be complete without mentioning the impact of biorenewable resources. In the fuels arena the by-far most important bio-based feedstock is bioethanol. Bioethanol is adding to the gasoline pool by about 10 % today and is expected to grow to 12% of the gas pool until 2020. With technology under development it could be produced from e.g. cellulose shielding it from competition with animal or human nutrition. Its high octane value reduces the need for blending reformate gasoline into the gas pool, thereby freeing up catalytic reforming capacity. One of the key questions is what refinery operators will do with these available reforming capacities. DGMK-Tagungsbericht 2013-2 New Technologies and Alternative Feedstocks in Petrochemistry and Refining Fig. 6: Aromatics as structural elements in lignin The situation looks different for biodiesel. Today’s biodiesel addition to the diesel pool is minute, i.e. less than 2 percent of the pool volume. Even its ambitious growth of 6 % p.a. will only bring it marginally closer to a more significant contribution. Since biodiesel competes directly with food or feed its growth will be limited by the availability of corresponding crop and land, thereby putting it into the political arena. From today’s perspective biodiesel will be less of a relief to the growing diesel demand than bioethanol is for the gasoline demand. Finally, production of aromatics, mostly benzene, from lignin as a naturally occurring aromatic compound was considered in the recent past by various authors. The total lignin volume co-produced today in the pulp industry would translate into a theoretical benzene volume of 52 Mmto p.a. However, most of the lignin is used locally to fuel boilers in the pulp plants. Only about 1 million tons of lignin are processed each year e.g. into construction materials. It remains to be seen whether lignin can be utilized more efficiently than by downgrading it into BTX and reassembling these into more complex compounds again. Concluding, the only bio-based compound that will have significant impact on the aromatics supply situation is bioethanol. However, its addition to the gas pool removes the need for adding reformate gasoline. As a result it can be suspected that bioethanol will cause more catalytic reformer units to be decommissioned and corresponding aromatics volumes to be unavailable in future. Slide 9: Summing up the overview of the aromatics market today and of its growth perspectives we can conclude that a healthy demand growth at par with GDP will meet some major unresolved issues on the supply side that mainly result from a below-GDP growth of the fuel markets and less naphtha steam cracking. The resulting market imbalance for aromatics will become more severe by a redistribution of mostly naphtha volumes from gasoline to diesel, further shortening the supply of aromatic compounds. The key question seems to focus on the way refinery operators are going to decide on their catalytic reformer capacities. The decision is between idling and finally scrapping those units on one hand and opportunistically keeping them in operation to produce reformate-based crude aromatics for the petrochemical industry. Their decision will hinge on two things, the availability of reformer feedstock, i.e. heavy naphtha and on the operators’ perception of the petrochemical market and its future need for aromatics. In the near future we can expect markets to reflect the mentioned mechanics by increasing aromatics prices, hopefully generating incentives for the refinery operators – to extend the operation of catalytic reformer units that may seem obsolete in times of slowing gasoline demand and tightening naphtha supply. On the long run, however, the shear volumes that are expected to move from gasoline into diesel will put a permanent pressure on operators to consider on-purpose technologies for the manufacturing of aromatics, mostly from coal and from natural gas. DGMK-Tagungsbericht 2013-2