ifo conference on “survey data in economics – methodology

advertisement

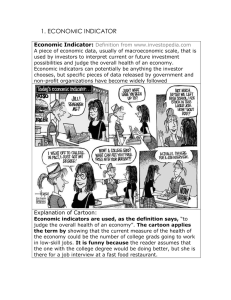

IFO CONFERENCE ON “SURVEY DATA IN ECONOMICS – METHODOLOGY AND APPLICATIONS” CESifo Conference Centre, Munich 14 – 15 October 2005 A Multi-Sectoral Flash Indicator for the Swiss Business Cycle Michael Graff, Sibylle Gübeli and Marc Wildi Ifo Institute for Economic Research at the University of Munich e.V. Poschingerstr. 5, 81679 Munich, Germany Phone: +49 89 9224-0 Fax: +49 89 985 369 ifo@ifo.de http://www.cesifo-group.de Michael Graff Sibylle Gübeli Marc Wildi A Multi-Sectoral Flash Indicator for the Swiss Business Cycle Zurich, September 2005 Dr. Michael Graff Sibylle Gübeli PD. Dr. Marc Wildi Swiss Institute for Business Cycle Research ETH Zentrum WEH CH-8092 Zurich Phone.: ++41 +44-6325360 graff@kof.gess.ethz.ch guebeli@kof.gess.ethz.ch wia@zhwin.ch A Multi-Sectoral Flash Indicator for the Swiss Business Cycle 1. Introduction A fundamental issue for policy oriented business cycle research is access to reliable leading indicators of a country’s economic activity. In Switzerland, the barometer, which is released by the Swiss Institute for Business Cycle Research (KOF) is such an instrument. The barometer was developed in 1976 and revised in 1998. As might be expected, the targeted lead is meanwhile getting less and less pronounced. Instead of merely revising our traditional instrument along the old lines, we now propose a different, multi-dimensional design. To this end, let us start with some general considerations. Economic forecasts are always based on observation of regularities in the past. This is true for both structural models that try to replicate the underlying macro mechanics of an economy and for indicator models that rely on correlations between economic time series or on time series properties of single series. In practice, full blown economic forecasts usually refer to a combination of these basic approaches where theoretically founded macro models are fed or calibrated with indicator models and amended by time series interpolations. The forecast horizon of these models is usually a few years. On the other hand, indicator models are usually empirically derived. Apart from the process of selecting potential indicators for a given reference series which refers to economic knowledge or intuition, these models are inductive and determined by the data. The forecast horizon of this type of models is much more restricted and usually no longer than a few months. In this paper, we present a hybrid approach that tries to improve indicator driven short term forecasts by imposing economic structure to the indicators. In particular, we refer to a priori knowledge about sectoral shares from the production account to design a multi-sectoral composite flash indicator for GDP growth in Switzerland. While the new instrument combines over 20 single indicators, the current barometer depends on the information of six. Apart from the enlarged database, the new flash indicator is devised to incorporate the following characteristics: First, it drops the one-dimensional approach of its predecessor and instead aims at capturing different trends and cycles of important sectors of the Swiss economy. In particular, we model the growth rate of the banking sector, the construction sector, and the remaining sectors of the Swiss economy taken together. The banking 2 and construction sectors' contribution to GDP is only about 15%, but they both follow highly volatile tracks that are largely uncorrelated with the rest of the economy. Therefore, our new multi-sectoral approach should give superior results whenever the banking or the construction sector deviate strongly from the rest of the Swiss economy. Secondly, we explicitly scale all modules as well as the resulting aggregate in terms of yearon-year growth rates of the corresponding reference series. Accordingly, with an amplitude scaled in the growth rate of the reference series, our new instrument is informationally richer than its predecessor. Thirdly, it is now well known that while most low pass filters are doing fine in the middle of a time series, they are prone to massive revisions at the margins as new data points are added. As we demonstrate in detail, the barometer makes no exception from this unfortunate fact. At the right margin, the real-time series of the barometer gives a considerably less precise picture of the Swiss economy than the ex post series. Accordingly, for our new flash indicator, we refrain from low pass filtering, and we are cautious to use seasonal filters. This will make the new instrument considerably less prone to revisions, so that the real-time information from the rightmost position of the series – which is what a leading indicator is basically needed for – should give a more reliable picture on the situation of the Swiss economy. Each model consists of a reference series and a sectoral indicator. Since the sectoral data for the reference series are only available on an annual basis, we should find an appropriate quarterly pattern for the growth rates. Given the quarterly reference series, it takes several further steps to construct the sectoral indicator. The single indicators need to be selected and combined to indicator bundles. The aggregation of the bundles to the sectoral indicator is made by applying principal components analysis (PCA). Finally, the common variance of the three resulting sectoral indicators of the modules is represented in the first principal component the so-called new flash indicator. The outline of the paper is as follows. In section 2, the current barometer is presented. As a background for comparing our leading flash indicator’s design we describe in section 3 the methodologies used by other institutions in Europe and the U.S. In section 4, we discuss the reasons for revisions of the barometer as a forecast instrument. In section 5, we focus on the design and the construction of the new flash indicator, while we present its first testing in section 6. Section 7 concludes. 3 2. The Current KOF Barometer The Swiss Institute for Business Cycle Research (KOF) currently publishes a composite flash indicator for the Swiss business cycle – henceforth the barometer– which combines six indicators. It was developed in 1976 to signal the trend and the turning points of Swiss real GDP year-on-year growth rate (henceforth real GDP yoy growth) with a lead of six to nine months. However, it was not designed to signal the level of the reference series. It has been revised several times since 1976. The last major revision occurred in the mid-1990s when a selection of new indicators was substituted for indicators that had revealed a deterioration in their lead to the reference series. The barometer is published in its present form since 1998. 2.1. Design The barometer combines six synchronised indicators from business and consumer sentiment surveys into a single series by extracting their first principal component. When chosen, each of the incorporated indicators showed a high correlation and a lead to the reference series. Before applying PCA, all indicators are low pass filtered. Thus, we do not use the raw data but apply the Census X-11 process (smooth component) to smooth them. 1 Since the principal component represents the common variance of the indicator set, the underlying concept of the business cycle is essentially one-dimensional, and the multivariate measurement model aims at capturing the underlying process using numerous related manifestations. This makes the composite indicator more robust to the idiosyncrasies and noise of the single indicator series. The barometer consists of the following monthly (m) or quarterly (q) leading indicators. Information about the data source, type, transformation and frequency is given in brackets. – – – – – – Orders, change year-on-year (KOF industry survey, balance, m) Order backlog, change to previous month (KOF industry survey, balance, m) Primary product purchases, expectation (KOF industry survey, balance, m) Wholesale inventory, assessment (KOF wholesale trade survey, balance, change of sign, q) Backlog of orders in months, growth year-on-year (KOF construction survey, index, q) Financial circumstances of households, expectation for next 12 months (Swiss State Secretariat for Economic Affairs –Seco – consumer survey, balance, q) Hence, five of the six indicators are items from KOF surveys: three are items of the monthly 1 The problems associated with this filter are discussed below. 4 KOF industry survey, one is from the quarterly KOF wholesale trade survey and one is drawn from the quarterly KOF construction survey. The sixth indicator is from the quarterly consumer survey that is conducted by Seco. The indicators differ in dimension (indices or results of company decisions). To quantify the qualitative items, we compute the balance (difference between percentages of positive and negative reports). The index range of backlog of orders is scaled to the growth compared to the month in the previous year. To identify the common trend of these six indicators, the first principal component is computed. No further transformations are performed, and the resulting series is the current KOF barometer. As a principal component, it is a non-dimensional zvariable, i.e. normalised to a mean of 0 and a standard deviation of 1. Having outlined the components of the barometer, we now focus on the co-movement of the barometer and the reference series over time. 2.2. Features in Comparison to the Swiss Business Cycle The KOF barometer is an established leading indicator of the Swiss business cycle. In the media, it is usually presented together with the real GDP yoy growth. The co-movement of the real GDP yoy growth – also normalised – and the non-dimensional barometer is depicted in figure 1.2 The time period ranges from 1984 to 2005q. The data are from the Swiss Federal Statistical Office (SFSO) and Seco as of April 2005. The figure shows that the two series indeed follow a similar pattern, with the barometer leading the normalised reference series in some instances. Hence, to some degree it fulfils the expectations of a leading indicator. However, while the lead of the barometer is relatively stable in the first period (to the mid-1990s), it practically vanishes in the right half of the figure. It is also noticeable that the barometer does not presage the amplitude, nor does it capture the higher frequencies. What are the reasons for this behaviour? In general, they are due to the construction of the barometer and the features of its incorporated indicators. As a consequence of the smoothing of the incorporated indicators, the higher frequencies are filtered out and therefore cannot be forecasted. The lack of lead of the barometer toward the end of the series is due to the fate of 2 Both time series are depicted ex post. 5 practically all indicator models: the empirically detected interrelations between indicators and reference series – in force at the time of design – have gradually changed and are no longer exploitable for forecasting. Figure 1: Real GDP YoY Growth and the Current KOF Barometer, 1984–2005 The barometer depicted in figure 1 is ex post. However, it has been noticed that its correlation with the reference series is considerably less precise in real-time.3 We now turn to this topic. 2.3. Sources of Revisions and the Filter Problem We identify five sources of revisions. Revisions occur both on the levels of the single indicators and first principal components. The first source regards the raw data of the indicators before filtering. In a limited number of cases, the barometer is updated with survey data that are not definitive, in the sense that answers from firms are delayed and not yet incorporated into the results.4 When using the raw data a month later, they might have changed to now include 100% of the answers. This revision concerns only the last observation and constitutes a small fraction of the revision in total. The second source concerns the extrapolation of the quarterly indicators The third source of revisions originates from the aggregation of the indicators for the first principal component. Each month the indicators are updated and the barometer is calculated 3 4 See Stulz (2005). As opposed to many other economic data, survey data is generally not revised . 6 anew. The weights (loadings) of the itemised indicators are the same for the whole time span of an estimation, but with the data updates the estimation period is enlarged. Therefore the weights tend to undergo slow changes as the series becomes longer. Dealing with hundreds of observations, the shifts in the endogenous weight schema are hardly detectable. Over time, however, they may become more obvious, affecting the entire past values of the series and not only the most current value. However, the revisions are quite small. Unlike the third source, the fourth source of revisions affects the stability of the rightmost position substantially. The revision concerns the low pass filtering of the raw data. The Census X-11 process that is used is a symmetric filter. It smoothes the series with the help of values of the right and left side. These kinds of filters work well in the middle of a time series, while they pose as asymmetric filters in the rightmost position. This filter problem has been increasingly discussed recently. The first forecast of flash indicators – based on indicators smoothed by symmetric filters – is often misleading. Sometimes, this value may differ greatly from the future newly filtered values of the same observation. In the first case, the filter does not work properly because of the missing data on the right side. As new data are added and the particular observation moves to the middle of the time series, the filtering works well. In other words, the first published value of an observation (real-time) and its ex post values – later in time – do not have to be identical.5 As a consequence, we shall not use any symmetric low pass filters for our new instrument. If filtering is necessary (because of seasonal fluctuation), we draw on a more stable filter.6 The degree of revisions can be recorded by quantifying the difference between the ex post and the real-time series and by analysing the performance of the two vis-à-vis the reference series. 2.4. Real-Time versus Ex Post Performance To compare the ex post and the real-time performance of the barometer, we construct a realtime series. To this end, the first published values of each barometer observation are stringed together. Hence, the real time series consists only of boundary values. In figure 2 we show the ex post – true – barometer values7 and the corresponding real-time 5 6 7 This fact is often ignored when assessing the performance of smoothed flash indicators. However in the particular case of a flash indicator, the real-time performance, i.e. the actual forecast at a certain point in time, is crucial. See Wildi/Schips (2005). If an observation is in the middle of the time series, the low pass filter works symmetrically. 7 numbers. The vertical difference between the two amounts to the revisions – these are the errors that originate from the problem of the instability of the current values. The time range is from 1998 to 2005.8 The figure shows that the signals of the real-time barometer considerably depart from those of the ex post barometer. The correlations of the two with the real GDP yoy growth is not apparent from the figure. In figure 3 three series are shown: the normalised real GDP yoy growth, and the normalised ex post and real-time barometers. Theoretically, the ex post barometer should outplay the real-time series by showing a higher correlation to the reference series. As anticipated, the ex post barometer indeed does show better agreement with the reference series. With a lead of a quarter, the maximal correlation amounts to 0.93 instead of 0.89 (real-time). Additionally, a systematic phase shift becomes visible. The real-time barometer lags behind the ex post barometer, implying that signals of the rightmost position that are apparent ex post could not be registered real-time. At turning points, these misleading real-time signals occurred more often. This analysis confirms that the problem of stability of current values is indeed severe. Figure 2: Current KOF Barometer; Ex Post and Real-Time, 1998–2005 8 The barometer was published in 1998. The first documented marginal value concerns April 1998 (according to the revision at the end of 2003). 8 Figure 3: Real GDP YoY Growth and the Barometer (Ex Post and Real-Time) In the following section, we analyse whether an alternative filter design could be useful. 2.5. The Direct Filter Approach (DFA) At the current time-point (last observation) of a time series symmetric filters cannot be used, because the right tail of the filter goes out of the sample (future values are trivially unobserved). For solving this problem, Census X-11 relies on particular asymmetric filters9. Newer model-based methods like TRAMO/SEATS and Census X-12-ARIMA supply forecasts for the unknown future realisations of the time series so that symmetric filters may be applied towards or at the current time point. The resulting concurrent (asymmetric) filters generally improve over X-11 by inheriting information retained by the forecasting models. However, one can show that this intuitively straightforward strategy is misleading, because traditional model-based (identification) procedures favour specific forms of model misspecification, see Wildi/Schips 200510. As a consequence model-based concurrent filters are inefficient and 9 10 So-called Mushgrave surrogates. In particular severe unit-root misspecification in the context of business survey data (which are often bounded by definition). For the representative data set considered in Wildi/Schips the identification procedures of X-12-ARIMA and TRAMO selected integrated processes for almost every bounded time series which is an obvious misspecification. So for example more than 50% of the series were wrongly identified as being integrated of order two. Furthermore, the identification procedures of TRAMO and X-12-ARIMA disagreed for more than half of the time series considered. 9 turning points cannot be detected rapidly enough. A new solution called direct filter approach (DFA, see Wildi 2004) is used here for improving real-time filter estimates. Basically, the DFA proposes an estimation method relying on the direct minimization of the relevant (mean square) filter error11. As a result, real-time estimates track the signal more closely and the detection of turning points is fast and reliable. In order to demonstrate the additional prospective gains that may be obtained with the DFA, plots of the barometer are compared with the DFA-concurrent filter (real-time) in figures 4 to 8. Recall that the barometer has been designed to reveal trend and turning points. Therefore the DFA-filter has been optimized accordingly and our attention is restricted to this particular topic12. In figure 4 the symmetric filter of X-11 (shaded line) dates the latest (asserted) turning point in June 2004 which is confirmed by the GDP series (solid line). The DFA concurrent filter (dotted line) detects it without delay in real-time. A closer look at the real-time series based on X-11 in figure 5 reveals that the barometer detects this turning point in October only which implies a lag of four months. Besides larger time delays, traditional signal extraction procedures also suffer from a lack of reliability. Consider for example the turning point occurring in July 2002 in figure 6. A tighter time span in figure 7 reveals the real-time behaviour of the DFA (dotted line) and X-11 (shaded line). Whereas the former has a delay of one month (detection in August) one cannot decide on the basis of the latter whether or not a turning point occurred in July: an upswing (in June) is followed by successive downswings (from July to September) until a new upswing is detected in October. In practice, one has to wait until the signal stabilises so that the observed unreliability adds to the already larger time delay of traditional filter approaches. 11 12 More precisely, coefficients of the concurrent filter minimize an efficient estimate of the (unknown) meansquare filter error. Note that traditional model-based approaches rely on one-step ahead forecasting performances only, which are not directly related to the computation of optimal concurrent filters in particular in the context of heavy model-misspecification, see Wildi/Schips 2005. Aspects related to the approximation of the level are ignored here. 10 Figure 4: Real GDP yoy Growth and the Barometer (Census X-11 and DFA), 2003–2005 Figure 5: the Barometer: Census X-11 and DFA, 2004 11 Figure 6: Real GDP yoy Growth and the Barometer (Census X-11 and DFA), 2001–2003 Figure 7: the Barometer: Census X-11 and DFA, 2002 These examples demonstrate that optimal filter techniques may lead to a substantial improvement of the quality of leading indicators in real-time. 3. Other Composite Indicators and Previous Empirical Work The search for suitable indicators of economic activity is a major topic in policy-oriented business cycle research. Once we try to combine these reliable indicators into composite indi12 cators, we need to address some seminal issues concerning the weighting and aggregation of the indicators. In this section, we describe the methodologies used by other institutions in Europe and the U.S. as a background for comparing our leading flash indicator’s design. Furthermore, we introduce a time-series technique that enables us to pool common information of large data sets. In Europe, the Economic Sentiment Indicators (ESI) and the Composite Leading Indicators (CLI) are among the most best-known composite indicators. The former are published by the European Commission (EC) and the latter by the Organisation for Economic Co-operation and Development (OECD). Both are available at different country-specific and aggregate (EU, euro area, etc.) levels and are (weighted) averages of their component series. While the ESI design allows only qualitative data as component series, the CLI design combines both qualitative and quantitative data. The two indicator types are discussed below. The ESIs were designed in 1985 by EC and help to evaluate the current and future states of the economy in EU and its member states. For instance, in Germany the ESI is based on confidence indicators for different sectors in Germany. These confidence indicators combine several qualitative results quantified in balances of the Business and Consumer Surveys (BCS) of Germany that have been harmonised since 1961. Before aggregating to form a country’s or area’s confidence indicator, the results are transformed (seasonally adjusted, normalised etc.). The included results receive equal weights for aggregation. When aggregated to the ESI, however, the confidence indicators’ weights differ depending on the sector and their correlation to the business cycle. The following weights are assigned to the countries’ confidence indicators: industry 40%, service 30%, consumer 20%, construction 5%, and retail trade 5%. The ifo institute in Munich (Germany) is one of the numerous institutes that conduct BCS for the EC. Since 1965, they use the results of the German industry survey for their Ifo Business Climate Index as well. It is a widely observed early indicator for economic developments in Germany that combines two balances: the assessment of the business situation and the expectations for the next six months/two quarters. The component series (seasonally adjusted, linked to a base year, currently 1991) are weighted according to the importance of the industry branches and aggregated to a geometric mean for east and west Germany, respectively. Since the 1980s, the OECD has compiled CLIs. The design originates from the Diffusion Index’ of the U.S. National Bureau of Economic Research (NBER), discussed below. The CLIs of the OECD summarise information contained in a number of key short-term economic indicators known to be linked to Gross Domestic Product (GDP), for 23 member countries. The 13 CLI Germany e.g. combines several country-specific component series. They are selected according to the following criteria: – economic significance: there is an economic reason for a leading relationship with the reference series; – cyclical behaviour: cycles should lead those of the reference series, there should be no missing or extra cycles, the lead at turning points should be homogeneous over the whole period; – data quality: e.g. timely and easily available, not revised frequently. The country-specific component series are aggregated by weighting (equal weights) and averaging the de-trended (deviation from long-term trend), smoothed, normalised component series. When aggregated to a CLI for a zone e.g. «Big 4 European Countries» the country results are weighted to calculate the component series’ average. The weights are as follows: France 20.9%, Germany 34.4%, Italy 22.5%, and United Kingdom 22.3%. In U.S., the old-established Diffusion Index and its component series are published by The Conference Board. The indicator-approach was pioneered by two NBER researchers Mitchell and Burns (1938, 1946). They studied the bi-variate interrelation of over 450 economic variables (leading, coincident, or lagging) and the U.S. business cycle, in order to present a list of around six indicators that show the desired features. Over subsequent decades, the lists of indicators were enlarged and shortened by different NBER researchers like Moore (1961), Moore and Shiskin (1962), Zarnowitz and Boschan (1975), Hertzman and Beckman (1989). The current list was presented in 1996 by The Conference Board, a private organisation that still runs the maintenance and refinement of the lists.13 In addition to the updating of the lists, the NBER researchers started to examine the multivariate interrelation and to combine the indicators into composite indexes. The leading composite index’s change, being the average of the weighted changes in each of the component series, was supposed to reflect the current unobservable future state of the economy. The traditional composite index methodology applied equal weights once the volatility in each component series was standardised. The motive was the following: “Since business cycles are defined as broad-based contractions and expansions, combinations of indicators or composite indexes are generally better at tracking the cycles than any single indicator (Moore 1950)”. The NBER fellows Stock and Watson (1989) have been involved in the construction and use of economic indicators since the late 1980s. They use dynamic factor analysis also known as 13 See Klein (2004). 14 the PCA to extract the common factors from large panels of U.S. data to forecast the underlying, unobservable characteristic of the U.S. business cycle. The estimated future state of the economy is their alternative leading index. The component series’ weights are determined implicitly and in accordance with their predicting power. Thus, the index with optimal weights provides a better definition of the underlying future state of the economy than the index with equal weights. Along the lines of the generalized dynamic factor model for the real EU GDP (Forni et al 2000), Forni et al (2001) analyse large panels of EURO area data, in order to extract the common components of the European Monetary Union (EMU)-aggregate business cycle. Marty (1998) uses the first principal component of seven leading qualitative indicators as composite index for the Swiss business cycle. This was the proto-type of the current KOF barometer. 4. Why Revise an Established Indicator? There are several reasons for revising the barometer. First of all, we can show that the barometer is no longer informationally efficient, as it does not use the available data to the extent possible. Two sources have not yet been utilised. First, qualitative information on Swiss industry, wholesale trade and consumers became available in the 1980s. Today, we possess a substantially enlarged database about different Swiss sectors and their developments. New KOF surveys have been launched, namely in the banking and construction sectors. This enables us to make differentiated statements on Swiss business cycle developments. Secondly, the BCS of the European Union (EU) were established in the early 1960s. Around 45 years later, survey data on the current 25 EU member states have been harmonised and are published regularly, e.g. the ESI and its components for each member state and different aggregates (EU and Euro Area). Information about the business cycle of the most important Swiss export destinations in the EU (Germany, France, Italy, Austria and the United Kingdom) are of special interest to us. Today, the broader database enables us to use a multi-dimensional approach. Therefore, the new flash indicator is designed at capturing different trends and cycles of multiple important sectors of the Swiss economy. As in the traditional barometer’s design, we use PCA to aggregate the indicators. Unlike the old barometer, however, the new flash indicator is a first principal component of several sectoral first principal components. In other words, it is aggregated in several steps rather than a single step. The period of analysis ranges from 1991q1 to 15 2002q4 concerning the quarterly data’s world. The newly published instrument will be based on monthly updates. From the current viewpoint, the barometer shows two further undesirable and unnecessary features that can be changed in a new instrument. First, as it is communicated today, it signals the trend but not the level of the reference series. In the new design, we explicitly focus on the scale of real year-on-year growth because of the better database. Secondly, its numeric values are not fixed for the past but are subject to revisions with every update. The biggest revisions are caused by the symmetric filter. To keep the revisions small, we refrain from low pass filtering and are cautious about seasonal filtering. In general, as potential indicators for the new flash indicator, we examine only raw and seasonally adjusted indicators. In a future step, we will apply the direct filter approach to the potential indicators. In the next section we focus on the new instrument for forecasting the Swiss business cycle: the new flash indicator. 5. Design and Construction of the Multi-Sectoral Leading Flash Indicator In order to outperform the barometer, the new flash indicator shows the following favourable characteristics: it is a relatively volatile, quantitative monthly composite indicator with a high correlation to the Swiss business cycle, which it indicates with a lead of six months/two quarters. The new instrument incorporates all sectoral indicators with a high correlation to the sectoral reference series. Therefore it is a multi-sectoral indicator constructed in several stages. 5.1. Multi-Sectoral Design We try to quantify an immeasurable process with the help of a range of observable and measurable indicators. However, while the old barometer supposes one underlying process (the Swiss business cycle), we now refer to several immeasurable underlying processes (the Swiss and sectoral business cycles). Therefore, the new flash indicator is modelled as a multidimensional phenomenon of simultaneous sectoral business cycles. As far as the weights of different sectors and indicators are concerned, we adhere to the following strategy: if information about proper weights are available, we use them for our calculations. Otherwise, we refer to PCA. Our in-sample period (performed in the first months of 2005) ranges from 1991q1 to 2002q4, bounded by the length of the sectoral Value Added (VA) based on the Swiss Federal Statistical Office’s sectoral Production Account (sectoral PA of the SFSO). For these analyses, our out-of-sample forecast – with a lead of six months/two quarters – stretches to 2005q3. 16 In the following section, we present the design and components of the multi-dimensional flash indicator. Furthermore, this part provides an answer to the question why these sectors are separated from the rest and not others. In section 5.1.2 we present the general strategy of finding appropriate reference series. In section 5.1.3 the steps in selecting the sectoral leading indicators are described. 5.1.1. Design and Reasoning for Choice of Modules The new flash indicator should correlate with the Swiss business cycle, indicating it with a lead of at least six months/two quarters. Economic activities is measured by real GDP yoy growth. The design and components of the new flash indicator are illustrated in figure 8. The new flash indicator combines indicators from three separate modules. These modules are the banking sector without the financial intermediation services indirectly measured (FISIM), the construction sector and – as the residual – the total economy exclusive of the banking without FISIM and construction sectors. Henceforth the modules are called banking without FISIM, construction and Core GDP. Technically speaking, the new flash indicator is the weighted average of the resulting module indicators, where the weights are given by the sectoral VA. Each module has its own reference series and set of indicators. A peculiarity of the third module is its construction as a one-dimensional process (the business cycle of the Core GDP), but expressing itself through three different phenomena on the surface, namely the business cycle of the Swiss industry, consumption demand and export destinations in the EU. These three phenomena are captured in three measurement models (or sub-modules) Swiss industry, Swiss consumption and Swiss export destinations EU. The reference series remains the same for all theses three sub-modules. For Core GDP, there are hence three sub-module indicator sets which we combine into first principal components, and these in turn are combined into a meta first principal component. 17 Figure 8: Design and Components of the Multi-Sectoral Leading Flash Indicator Real GDP YoY Growth Forecast horizon at least two quarters Module Banking without FISIM Module Construction Module Core GDP Measurement model Swiss Industry Measurement model Swiss Consumption Measurement model Swiss Export Destinations EU Why do we chose the banking without FISIM and construction sectors to treat them separately? Primarily, the choice of the three modules is based on empirical considerations. We assume that the business cycles of some sectors do not follow the pattern of the Swiss business cycle. Therefore, the separate coverage of these sectors could enrich the information of a leading indicator. A one-dimensional indicator model is worse if and only if the developments of the separate sectors differ greatly from the overall picture. Therefore, we are looking for sectors that follow their own cycles and show a low correlation to the real GDP yoy growth. Examining Swiss data, the banking and construction sectors are such candidates, possessing distinct tendencies. Whether these distinct tendencies were of importance between 1990 and 2002 can be seen in the sectoral PA of the SFSO. The year-on-year growth of the sectoral VA should show a low correlation to the real GDP yoy growth. Swiss VA is divided into 16 sectors. Table 1 shows the correlations and the shares of all sectoral VA of these sectors, sorted by descending share. However, the impact of sectors with a share of less than 5% can be disregarded. The two largest sectors – Industry, processing branch and Trade and repair – are positively correlated to real GDP in terms of year-on-year growth. As expected, the third largest sector, Public administration, does not follow the general business cycle. This is also true for the sectors Rental income of private households and Health and social work, which develop steadily. Therefore, these three sectors do not generate variance in the business cycle but rather lessen it, so that we abstain from separate modelling. The sectors Real estate, rental, IT, R&D, Banking and Transport and communications correlate positively with the real GDP yoy growth. 18 Table 1: Swiss Sectors (16): Correlation to GDP Growth, sorted by Share of VA Sectors r Industry, processing branch 0.47 Trade and repair 0.42 Public administration -0.02 Real estate, rental, IT, R&D 0.49 Banking 0.53 Banking without FISIM 0.16 Rental income of private households 0.02 Transport and communications 0.62 Construction 0.23 Health and social work 0.06 Insurance and pension funds 0.22 Hotels and restaurants 0.52 Electricity, gas, steam and distribution of water -0.56 Other public and private services 0.42 Agriculture, hunting, forestry, fishing/fish farming 0.62 Education 0.12 Mining and quarrying 0.24 FISIM: Financial intermediation services indirectly measured Share in % 20.0 13.1 10.3 10.0 8.0 2.0 6.9 6.5 6.3 5.3 4.0 2.9 2.7 2.6 1.9 0.7 0.2 What are the characteristics of the two sectors that we separate from total Swiss VA? The construction sector does not correlate significantly with the general business cycle (r = 0.23); therefore, it makes sense to model this sector separately. At first sight, a separation is less reasonable for the banking sector. The correlation amounts to 0.53. The reason for this significantly positive interrelation are FISIM. These services are closely connected – according to the construction – to the business cycle. The SFSO assigns FISIM – in accordance with international conventions – to the banking sector. If we deduce FISIM from the rest of the banking sector it becomes obvious that the independent business cycle of the banking sector without FISIM is uncorrelated with real GDP yoy growth (r = 0.16). Hence, we use the annual VA of the banking without FISIM and construction sectors as the bases of the reference series in the corresponding modules. The shares of VA of the banking and construction sectors are available from 1990 to 2002. These are shown in figure 9. The share of VA of the construction sector fluctuates between 5% and 8% and the share of VA of the banking sector without FISIM varies from 1% to 4%. 19 Figure 9: Share of VA of Banking ex FISIM and Construction Sectors, 1990–2002 5.1.2. Reference Series The design of the Gross Domestic Product (GDP) represents and measures the total economic activity within a country (demand side). Therefore, it is predestined to serve as a basis for the ultimate reference series. To break down GDP into our three sectoral reference series (supply side), we refer to the sectoral PA of the SFSO. The data are only available on an annual basis, whereas the Swiss GDP is published quarterly. Therefore, the VAs of the banking and construction sectors need to be transformed from annual into quarterly series.14 To this end, we look for quarterly series that represent each sector’s VA appropriately. The results are sectoral VA with quarterly patterns, i.e. sectoral reference series for the banking without FISIM and construction modules. The reference series of the module Core GDP is calculated as the residual of the real GDP yoy growth in total minus the two other sectors’ reference series. In this way, all reference series are comparable to each other, and therefore of the same dimension: real year-on-year growth. 14 To maintain the sum of VA within a year we use the software ECOTRIM. 20 5.1.3. Selection Criteria of Leading Indicator Series The modules of the new flash indicator and the sectoral reference series are thus determined. The potential sectoral indicators15 can now be confronted to the sectoral reference series for each module and sub-module. We use bivariate cross correlation analysis to assess the interrelation between each potential sectoral indicator and the respective sectoral reference series. The period of analysis ranges from 1991q1 to 2002q4. All indicators with high maximal correlations to the reference series at a lead of at least two quarters are identified. They are our potential leading indicators. To keep the information content high, for each of the modules and sub-modules, the following selection criteria are applied: – Theoretical considerations: expected algebraic sign; – For survey data: of the transformations of an item, only the highest correlated indicators at a lead of at least two quarters are chosen. If items are similar in content they are treated as the same; – Timely availability of the data. Above we have described the different common elements of the three modules in general. In the following section, we outline the modelling of the three modules of the new flash indicator in more detail. 5.2. Construction of the Multi-Sectoral Flash Indicator The theoretical background of the construction is based on identifying and summarising theoretically founded indicators with an empirically detectable lead to Swiss business cycle developments. The procedure is principally the same for every module and sub-module. Once a set of leading indicators is determined, they are synchronised with respect to their lead – measured in quarters – to the reference series. We then extract the first principal component as basis for the sectoral or sub-module indicator. Then we regress the first principal components on the sectoral reference series, which results in estimates of the sectoral real year-on-year growth rates. These sectoral results are then weighted by their share in total VA. Finally, the weighted sum is the new flash indicator, measured in real GDP yoy growth.16 15 16 We try the balance of items of qualitative KOF surveys in different transformations (raw data, seasonally adjusted, for items with assessment character: year-on-year growth, year-on-year difference) as well as hundreds of qualitative and quantitative series from other sources. At this stage of consolidation, we could also apply PCA. However, Since we have information from the sectoral PA of the SFSO about the sectoral shares, we rather refer to these. 21 5.2.1. Banking without FISIM Module From the sectoral PA of the SFSO we obtain data on an annual basis. First, we define a quarterly pattern of the annual data in order to correlate the reference series and the potential indicators. The quarterly pattern is given by the interest spread, the service business, and the commission business (banking statistics of VA). In figure 10 the sectoral VA of the banking sector without FISIM (growth rate in %) and its quarterly pattern are shown. The figure shows that the quarterly data fluctuate moderately around the annual values. Figure 10: Banking without FISIM: Annual and Quarterly Growth Rate in % For the banking sector, we use two sets of indicators: five items of the quarterly KOF banking survey (a business sentiment survey of the KOF) as well as indicators for the money supply, the asset portfolio, and the Swiss secondary share market. The five items from the quarterly banking survey reflect the expectations of the participants. The survey was launched as recently as 2000. Because of this short timeframe, the correlations with the reference series and the judgements of the seasonality and noise of the items are not particularly informative. Furthermore, the survey data are only available on a quarterly basis, whereas the flash indicator should be updated monthly. Given this situation, we do the following: we select the items of our banking survey as usual – if they show a high maximal correlation at a lead – and aggregate them to a first principal component ranging from 2000 to 2002. In addition, we assemble a second indicator set. The included indicators go back to 1991 and also carry monthly information. The indicators are again aggregated to a first principal component. Between 1991 and 2000 we use the first prin22 cipal component of the second indicator set as sectoral indicator. After 2000 we operate with both first principal components by first synchronising them and then using each with a weight of 0.5. The sectoral reference series and its estimates using the assembled sectoral indicator are shown in figure 11. Both time series are scaled in growth rates in %. The adjustment of the estimation to the reference series improves in the right half of the graph. The reason for this is probably the reference to more data. This is important for the quality of the forecast of the rightmost position of the reference series. The out-of-sample forecasts from this module can be seen on the right side of the vertical line. They cannot be compared to a reference series since the data are not yet available. Figure 11: Banking without FISIM and the Sectoral Indicator (Growth Rate in %) 5.2.2. Construction Module From the sectoral PA of the SFSO we again obtain data on an annual basis. We then define the quarterly pattern of the annual data in order to correlate the reference series and the potential indicators. The real construction activity of Switzerland is used for this purpose. In order to obtain the real series of the nominal construction activity of the Schweizerischer Baumeisterverband (SBV), we refer the building investments deflator of the SFSO. The VA of the construction sector and the reference series on a quarterly basis are shown in figure 12. 23 During the first few years the quarterly data oscillate strongly around the annual value. It may well be that the variance produced by Ecotrim is too high to be true, but for lack of other indicators to quarterlise with, nothing can be done about this at that stage.17 Figure 12: Construction: Annual and Quarterly Growth Rate in % As flash indicator of the construction sector we combine six items from quarterly KOF surveys: five items from the building survey and an item from the architecture/engineering survey. These items reflect the expectations of the participants and provide information on the judgement of the current situation. Five of the seven items are taken as raw data and two are filtered (seasonal filter). The surveys were launched as recently as in 1994q3 (building survey) and 1996q1 (architecture/engineering survey). The search for longer leading indicators – ideally monthly data – has not yet been successful, but will continue. Therefore, we take the reference series for the backward extension. Figure 13 shows the reference series of the module construction and its estimates using the sectoral indicator. The two time series are again scaled in growth rates in %. The lead of the indicators concerning the reference series is quite stable and amounts to at least two quarters providing accurate estimates. The strong fluctuations of the reference series cannot be captured by the sectoral indicator.18 With the data available, we are able to forecast the reference series to the third quarter of 2005. 17 18 We shall watch this aspect closely while optimising our new instrument. Work is going on to be done to find a better in-sample representation of the reference series. 24 Figure 13: Construction and the Sectoral Indicator (Growth Rate in %) 5.2.3. Core GDP Module The reference series of the module Core GDP results from the ultimate reference series and the two modules’ reference series. From the quarterly real GDP yoy growth of the SFSO the weighted growth contributions of the respective sectors are deducted. The sectoral shares of annual VA of the preceding year are used as weights according to the following formula: Formula 1: Reference Series of the Module Core GDP Real Core GDP YoY Growth = Ultimate Reference Series – Reference Series Banking Sector without FISIM * Share VA (PY) – Reference Series Construction Sector * Share VA (PY) with: GDP YoY FISIM VA PY Gross Domestic Product Year-on-Year Financial Intermediation Services Indirectly Measured Value Added of respective Sector Preceding Year The effect of the deduction of the two sectoral growth contributions is shown in figure 14 which plots real GDP yoy growth and the reference series of the Core GDP module. The figure shows that the deduction of the contributions to growth of the sectors does not result in a large overall difference. However, minor modifications are evident. For example, the decline of the banking sector in 2000/2001 (after the last stock market bubble) started earlier 25 than in the other sectors. If we deduce this collapse, the decline in the Core GDP follows with a delay. Figure 14: Comparison of Real YoY Growth in %: GDP and Core GDP, 1991–2002 The module Core GDP carries a modification compared to the other two modules. The indicator is developed from three independent measurement models. These are intended to measure the underlying phenomenon in three different ways, captured by the business cycles of the Swiss industry, consumption and export destinations EU. a) Measurement Model Swiss Industry We use three items from the monthly KOF industry survey to form a composite indicator of the first sub-module of Core GDP. These survey data reflect the expectations of the participants. They show a strong seasonal pattern, and are therefore seasonally adjusted. Figure 15 shows the reference series and its estimates using the measurement model Swiss industry. The ex post forecast of Core GDP with the KOF survey indicator bundle has a very good fit. The lead of the business cycle of the Swiss industry is stable and amounts to two quarters providing accurate estimates. 26 Figure 15: Core GDP and the Indicator Swiss Industry (Growth Rate in %) b) Measurement Model Consumption We use four different sources to construct an indicator for the measurement model consumption: two items from the quarterly KOF hotel and restaurant survey, one item from the monthly KOF retail trade survey, two items from the quarterly Seco consumer survey and monthly data of the import statistics of the Federal Customs Administration are combined in one indicator. The data are not filtered. The reference series and its estimates using the sub-module indicator are reproduced in figure 16. The lead of the measurement model indicator is consistently stable providing accurate estimates. Thus, the Core GDP can be indicated quite well by the cycle of Swiss consumption. Figure 16: Core GDP and the Indicator Consumption (Growth Rate in %) 27 c) Measurement Model Swiss Export Destinations EU In the member states of the EU, the BCS are conducted in different sectors.19 Survey data are provided for the member states and two aggregates (European Union and Euro Area). In order to obtain the key information for Swiss exports, we consider Germany, France, Italy, Austria and the United Kingdom as the most important Swiss export destinations in the EU. For this purpose, we aggregate the results of the industry surveys of these countries – concerning their shares of Swiss exports in total – to a trade-weighted aggregate. We use the country-specific shares of Swiss exports in total to construct the vector. We examine the described country-specific data and the trade-weighted aggregate to find indicators for the reference series. The trade-weighted expected production (monthly data) and the trade-weighted orders (quarterly data) show high correlations and stable leads. We also consider overall order books in Germany in order to obtain more monthly information. To get rid of seasonal fluctuations, we filter these three indicators. The reference series and its estimates using the indicator forecast are reproduced in figure 17. Obviously, Swiss Core GDP can be indicated quite well with the selected indicators from abroad. This is consistent to the general finding that the driving forces of Swiss economic activity are to a large extent set in motion by foreign countries around Switzerland and affect it through the demand for exports. Figure 17: Core GDP and Indicator Swiss Export Destinations EU (Growth Rate in %) 19 See European Commission 2002. 28 d) Aggregation of Measurement Models The three measurement models with their separate indicators prove to be of substantial value. They are now aggregated into the module Core GDP. To this end, we combine up the three first principal components of the three measurement models to a new first principal component. This indicator hence consists of a successive reduction of the underlying indicators. By doing so, we ensure that the three measurement models are weighted according to their impact on the underlying process. If we constructed a first principal component of all indicators of the module – without the steps in-between – this could not be guaranteed. The result of the aggregation in two steps and the Core GDP are shown in figure 18. The reference series and its estimates using the sectoral indicator show a good accordance. The maximal correlation between the Core GDP and the sectoral indicator amounts to 0.88 at a lead of two quarters. This maximal correlation corresponds to the correlation in the submodule Swiss export destinations EU, while the connections between the two variables in the sub-modules Swiss industry and Swiss consumption are a bit lower, amounting to 0.87 and 0.74. However, concerning the out-of-sample performance of an indicator – given the same in-sample fit – it is wise to use an extensive set of information.20 Figure 18: Core GPD and the Sectoral Indicator (Growth Rate in %) So far, we have demonstrated the co-movements of the sectoral reference series and the sectoral indicators. Now, we aggregate the three resulting first principal components of the mod- 20 On the problem of overfitting, see Clark (2004). 29 ules into the new flash indicator, which is intended to forecast real Swiss GDP year-on-year growth (reference series) with a lead of six months/two quarters. Whether it achieves this goal can be seen in the next section. 6. Performance of the Multi-Sectoral Flash Indicator This section presents the performance of the new flash indicator (in terms of real GDP yoy growth). On the one hand we check its fit to the ultimate reference series in the period of analysis (1991 to 2002), on the other hand the out-of-sample performance is of great interest. The forecast horizon reaches up to 2005q3 with a lead of six months/two quarters. Accordingly, eleven quarters can be used for the out-of-sample analysis of the new flash indicator, where we look for evidence whether a good in-sample fit is the result of a stable correlation or an accidental overfitting to the indicators’ peculiarities. 6.1. In-Sample Performance The ultimate reference series and the new flash indicator are at hand, so we are now able to check the in-sample performance. In order to measure the performance of the new instrument, we use the barometer (ex post; closer to the true values) as a benchmark. Figure 19 shows the real GDP yoy growth reference series. While the data from 1991q1 to 2002q4 are definitive, those after 2002q4 are only provisional. In addition, the figure shows two estimations: the estimates using 1) the barometer and 2) the new flash indicator between 1991q1 and 2005q1. In order to illustrate the lead of two quarters, both estimates are shifted backward by two quarters. Concerning the whole time period, the new flash indicator is convincing in two ways: it leads the real GDP yoy growth steadily and it hits the level of the ultimate reference series very well. In the first time period (1991 to around 1996) the performance is less convincing than in the second period. The reason probably lies in the smaller set of available indicators, where we need to fall back on second-best estimations for the implementation. However, for practical purposes, this data problem is not too severe since leading indicators should prove of value in the rightmost position. Moreover, the old barometer obviously shows a poorer performance compared to the new flash indicator. Hence, the sectoral differentiation and the access to a broader information base of the new instrument seem to pay off. 30 Figure 19: Real GDP YoY Growth (SFSO/Seco), Barometer and New Instrument The in-sample performance of the new flash indicator is very promising. However, the following analysis shows whether the good fit also holds out-of-sample. 6.2. Performance Out-of-Sample At the time of writing (April 2005), annual data for the sectoral PA of the SFSO were available from 1990 to 2002 (whereas the data for 2002 were provisional). Therefore, the real GDP yoy growth (ultimate reference series) beyond 2002 must be based on other sources. We use two different provisional databases for the out-of-sample performance (from 2003q1): the data from SFSO/Seco and the model-supported KOF data are two best estimators. The former goes up to 2004q4 (eight observations) and the latter to 2005q3 (eleven observations). We discuss these two quarterly provisional GDP devolutions separately. The timeframe spans from 2002q1 to 2005q3, determined by the end of the forecast horizon. Figure 20 shows the provisional real GDP yoy growth (SFSO up to 2003q4/Seco 2004q1 to q4) and its estimates using 1) the old barometer and 2) the new flash indicator. The performance of the new instrument is visibly better than the barometer’s. It indicates the provisional real GDP yoy growth (SFSO/Seco) more closely. Numerical evidence confirms that the correlation of the eight out-of-sample observations amounts to 0.98 while it is 0.75 for the barometer. 31 Figure 20: Real GDP YoY Growth (SFSO/Seco), the Barometer and New Instrument, % If we use the KOF macro model (estimation at mid-April 2005) for the provisional real GDP yoy growth as best estimator, we get an enlarged out-of-sample period. We can then compare eleven observations. Figure 21 shows the provisional real GDP yoy growth (estimation/forecast of KOF 2003q1 to 2005q3) and its estimates using 1) the old barometer and 2) the new flash indicator. The correlation between the provisional ultimate reference series (KOF) and the new instrument amounts to 0.95, while it is 0.90 for the barometer. The superior performance is clearly visible in the figure. Figure 21: Real GDP YoY Growth (KOF), the Barometer and the New Instrument in % 32 7. Conclusion While the new flash indicator combines over 20 single indicators and aggregates them in an hierarchical way that follows the empirical structure of the Swiss economy. It enables us to forecast the real GDP yoy growth with a lead of roughly two quarters and with remarkable accuracy. This new multi-sectoral approach is superior to the current – old – one-dimensional KOF barometer in predicting Swiss GDP growth ex post and out-of-sample, and this holds true with respect to both lead and amplitude. The data for this exercise are from Switzerland, but the method to address GDP forecasts in a multi sectoral way might be just as promising for other countries. 8. References Clark, T. E. (2004), Can Out-of-sample Forecast Comparisons Help Prevent Overfitting? In: Journal of Forecasting, 23, 115-139. European Commission (2004) EU Harmonised Business and Consumer Surveys: User guide (May 2004) European Commission (2004) Methodical Changes of the Economic Sentiment Indicator: Inclusion of the Services Survey and Overall Streamlining o f its Calculation (May 2004) Forni M., Hallin M., Lippi M. and Reichlin L. (2000) The Generalized Factor Model: Identification and Estimation, The Review of Economics and Statistics 82, 540-54. Forni M., Hallin M., Lippi M. and Reichlin L. (2001b) Coincident and Leading Indicators for the EURO area, Economic Journal 101, 62-85. Graff, M. (2004), Estimates of the Output Gap in Real Time: How well have we been doing? Reserve Bank of New Zealand Discussion Paper DP2004/04, Wellington, May 2004. Klein, Philip A. (2004) Leading Indicators in Historical Perspective, Ed. Zbigniew Matkowski, S. 75. Marty, R. (1995), Die Vorlaufeigenschaften der Indikatoren des KOF/ETH-Industrietests, in: Konjunktur, Nr. 9, 58. Jahrgang, Konjunkturforschungsstelle der ETH Zürich, pp. 11–23. Marty, R. (1998), Revision des KOF/ETH-Konjunkturbarometers: Ziel, Methode, Ergebnisse, in Konjunktur, Nr. 6, 61. Jahrgang, Konjunkturforschungsstelle der ETH Zürich, pp. 13– 20. Mitchell, Wesley C., and Arthur F. Burns (1938). Statistical Indicators of Cyclical Revivals, Bulletin 69 (New York: National Bureau of Economic Research, May 28, 1938). Reprint, Geoffrey H. Moore (ed.). Business Cycle Indicators (Princeton University Press, for National Bureau of Economic Research, 1961). Moore, Geoffrey H. (1950) Statistical Indicators of Cyclical Revivals and Recessions. Occasional Paper 31. NY: National Bureau of Economic Research, 1950. OECD Statistics Directorate (2004) OECD Composite Leading Indicators, Ed. Zbigniew Matkowski, S. 95 33 Stalder, P. (1989), Verfahren zur Quantifizierung qualitativer Konjunkturtestdaten, KOFArbeitspapier Nr. 26, ETH Zürich, Dezember 1989. Stock, James H., and Mark W. Watson (1989) New Indexes of Coincident and Leading Economic Indicators, NBER Macroeconomics Annual (1989) pp. 351-94. Stulz, J. (2005), The KOF Economic Barometer – What Does It Tell Us and When?, Swiss National Bank Economic Analysis The Conference Board (2001) Business Cycle Indicators Handbook. The Conference Board http://www.conference-board.org/economics/indicators.cfm Wildi, M. (2004), Signal Extraction: Efficient Estimation, Unit-Root Tests and Early detection of Turning-Points. Lecture Notes in Economics and Mathematical Systems, 547, Springer Verlag. Wildi, M. and B. Schips (2005), Signal Extraction: How (In)efficient Are Model-Based Approaches? An Empirical Study Based on TRAMO/ SEATS and Census X-12-ARIMA. KOF Working Paper No. 96, ETH Zurich, December 2004. 34