KPMG Highlights

KPMG IN INDIA

KPMG Tax Highlights

31 December 2012

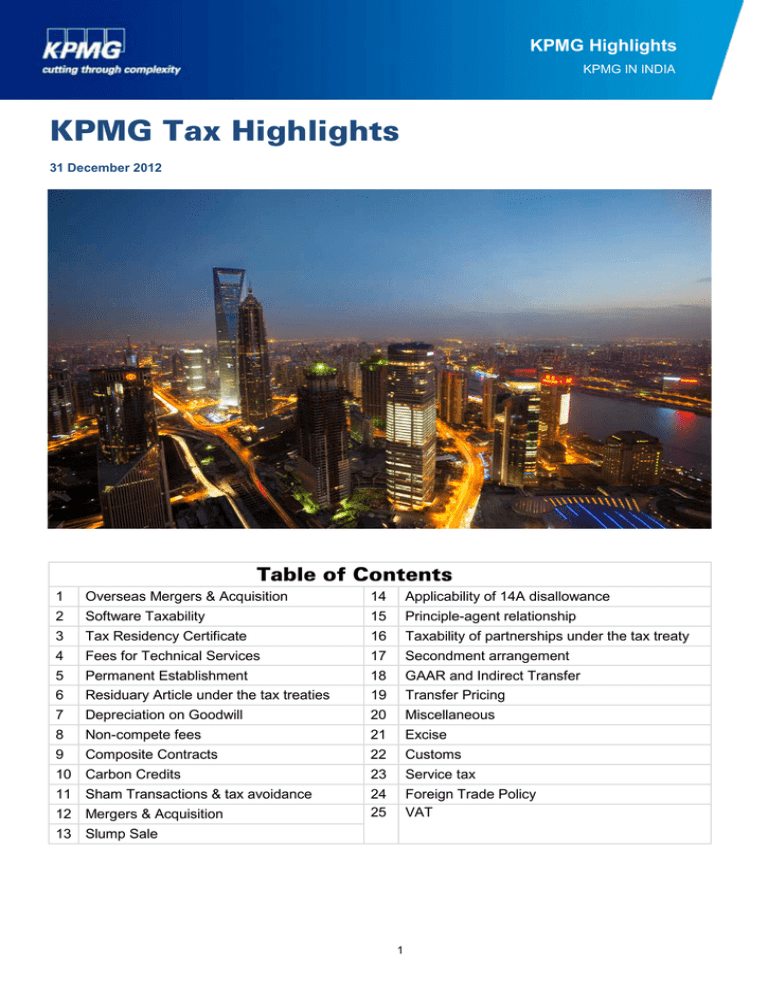

Table of Contents

1

Overseas Mergers & Acquisition

14

Applicability of 14A disallowance

2

Software Taxability

15

Principle-agent relationship

3

Tax Residency Certificate

16

Taxability of partnerships under the tax treaty

4

Fees for Technical Services

17

Secondment arrangement

5

Permanent Establishment

18

GAAR and Indirect Transfer

6

Residuary Article under the tax treaties

19

Transfer Pricing

7

Depreciation on Goodwill

20

Miscellaneous

8

Non-compete fees

21

Excise

9

Composite Contracts

22

Customs

10 Carbon Credits

23

Service tax

11 Sham Transactions & tax avoidance

24

25

Foreign Trade Policy

VAT

12 Mergers & Acquisition

13 Slump Sale

1

Overseas Mergers & Acquisition

Apex Court ruling in the case of Vodafone

The Apex Court in the case of taxpayer has ruled on the jurisdiction of the Indian tax authorities. The tax authorities

had alleged that Vodafone International Holdings B.V., Netherlands failed to withhold tax on the payment of

consideration to Hutchison Telecommunications International Limited (HTIL) for acquisition of a controlling interest

in an Indian company which is now a part of the Vodafone group. The controlling interest was obtained by acquiring

the shares of a Cayman Island company that indirectly held more than 50 percent of the shares of the Indian

company. In this context, the Apex Court, inter alia, observed and held as follows:

Interpretation of Section 9(1)(i) of the Act

• Charge to capital gains under Section 9(1)(i) of the Act arises on existence of three elements, viz, transfers, the

existence of a capital asset and the situation of such asset in India.

• Section 9(1)(i) of the Act does not have ‘look through’ provisions, and it cannot be extended to cover indirect

transfers of capital assets/property situated in India.

• Accordingly, the transfer of the share in CGP (which was not situated in India) did not result in the transfer of a

capital asset situated in India, and thus the gains from this transfer could not be subject to Indian tax.

Extinguishment of HTIL’s interests

• The tax authorities argued that the rights of HTIL over the control and management of the Indian company

constituted ‘property’ in the hands of HTIL. Accordingly, the extinguishment of such rights under the Share

Purchase Agreement (SPA) resulted in a taxable transfer of a capital asset situated in India.

• The Supreme Court held that extinguishment took place because of the transfer of the Cayman Island share and

not by virtue of the various clauses of the SPA.

Role of Cayman Islands company in the transaction

• The sole purpose of the Cayman Island company was not only to hold shares in subsidiary companies but also to

enable a smooth transition of business. Therefore, it could not be said that the Cayman Island company had no

business or commercial substance.

Rights and entitlements

• As a general rule, in a case where a transaction involves transfer of shares, such a transaction cannot be broken

up into separate individual components, assets or rights. The present transaction was a ‘share sale’ and not an

‘asset sale’ and concerned sale of an entire investment.

• A controlling interest is an incident of ownership of shares in a company which flows out of the holding of shares

and hence is not an identifiable or distinct capital asset independent of the holding of the shares.

• In essence, the character of the transaction was an alienation of shares, and when the parties had agreed on a lump

sum consideration; there was no question of any allocation of such consideration for the transfer of any other rights or

entitlements.

Applicability of Section 195 of the Act

• The question of withholding tax at source would not arise as the offshore transfer between the two non-residents

was not liable to capital gains tax in India.

• For the purposes of Section 195 of the Act, tax presence has to be viewed in the context of the transaction that is

subjected to tax, and not with reference to an entirely unrelated matter.

Vodafone International Holdings BV v. Union of India [2012] 341 ITR 1 (SC)

For further details please refer to our Flash News dated 20 January 2012 available at this link

Buy-back of shares held by Mauritian Company held to be a colourable device to avoid taxes in India

The Board of directors of the applicant, a closely held public limited company, proposed a scheme of buy-back of

its shares in accordance with Section 77A of the Company Act, 1956. Only one shareholder, A Mauritius accepted

the offer of buy-back.

2

The question before the AAR, inter alia, was whether capital gains that would arise to A Mauritius would be exempt

from tax in India under the India-Mauritius tax treaty and whether the Applicant had any liability to withhold tax at

source on the remittance of buy-back proceeds to A Mauritius?

In connection with the above, the AAR observed and held as follows:

• No dividends were paid by the applicant after the introduction of Section 115-O of the Act. The applicant had

allowed its reserves to accumulate.

• There was no proper explanation on the part of the taxpayer as to why no dividends were declared subsequent

to the introduction of Section 115-O of the Act while the company was making regular profits and while dividends

were being distributed before its introduction.

• Other shareholders have not accepted the offer of buyback because it would have been taxable in India in their

hands as capital gains.

• The proposal of buy-back was a scheme devised for tax avoidance and was a colorable device for avoiding tax

on distributed profits under Section 115-O of the Act.

• Therefore, the distribution in question would satisfy the definition of dividends under the Act and consequently

would be taxable under the Act as well as under Article 10 of the India-Mauritius tax treaty, and liable to

deduction of tax at source.

A Ltd [2012] 343 ITR 455 (AAR)

For further details please refer to our Flash News dated 5 April 2012 available at this link

Legal ownership prevails over beneficial ownership for determining capital gains

CRL Mauritius, a company based in Mauritius sold its entire holding in CRIL, India to Moody’s Analytics Inc, Cyprus

(M Cyprus). Further, CMRL Mauritius sold its entire holding in Exevo US (E Inc) to another US company, Moody’s

US (M US).

The question posed by the Moody’s and Copal Group (Group entity included CRL, CMRL) for consideration before

the AAR, inter alia, was whether the capital gains arising on direct and indirect transfer of shares in Indian

companies (i.e. sale of shares of CRIL by CRL Mauritius to M Cyprus and sale of shares of E Inc by CMRL

Mauritius to M USA) would be chargeable to tax in India under the provisions of the India-Mauritius tax treaty.

The revenue contended before the AAR that the transaction was a scheme for avoidance of tax in India for the

following reasons:

• The place of effective management of CRL Mauritius and CMRL Mauritius was the UK, for the reason that the

whole transaction under consideration was left to the discretion and management of an individual, a resident of

the UK, who was the CEO of CPL Jersey and was also a common director of E Inc and CRIL.

• The beneficial ownership of shares rested with CPL Jersey, since the shares in Indian companies were held by it

through its wholly owned subsidiaries.

The AAR, based on the facts of the case, observed and held as follows:

• The role of the resident of UK did not appear to be a role in connection with the running of business of CRL

Mauritius and CMRL Mauritius. Also, as there is no sufficient or cogent material to deny that the control and

management of these companies is with their board of directors, it cannot be concluded that the place of

effective management of these companies is not in Mauritius.

• The AAR is bound by the decision of the Supreme Court in the case of Azadi Bachao Andolan, wherein it was

held that what is relevant in the context of a tax treaty is not whether the income is actually taxed in Mauritius,

but whether in terms of the tax treaty, it can be taxed in Mauritius.

• Company law recognizes the recorded owner of the shares and not the person on whose behalf it may have

been held. The theory of legal ownership prevails over the apparent legal ownership.

Therefore, the benefit of tax treaty to the Applicant cannot be denied and the capital gains on sale of shares by

Mauritian companies cannot be taxed in India.

3

Moody's Analytics Inc. [2012] 24 taxmann.com 41 (AAR)

For further details please refer to our Flash News dated 7 August 2012 available at this link

Transfer of shares in Indian company by a Mauritius holding company to a Singapore company as a part of

internal re-structuring is not liable to capital gains tax under the India-Mauritius tax treaty

The Applicant, a company incorporated in Mauritius, holds investments in a listed company in India viz., Glaxo

Smithlkine Pharmaceuticals Limited (Indian company). As a part of the group restructuring exercise, the Applicant

proposes to transfer its holding in Indian company by way of off-market sale to its group company in Singapore.

The question for consideration before the AAR, inter alia, was whether the gains arising on sale of shares of the

Indian company would be chargeable to tax in India under the provisions of the India-Mauritius tax treaty and

whether Section 115JB of the Act would be applicable to foreign companies.

The AAR, based on the facts of the case, observed and held as follows:

• In terms of the India’s tax treaty with Mauritius and the decision of the Supreme Court in the case of UOI v. Azadi

Bachao Andolan [2003] 263 ITR 706 (SC), the capital gains on sale of shares of an Indian company by a

Mauritius company will not be taxable in India;

• The term ‘company’ used in Section 2(17) of the Act includes a company incorporated outside India. Also,

Section 115JB of the Act on its wording makes no distinction between a resident company and a non-resident

company. Hence, Minimum Alternate Tax (MAT) provisions would equally apply to foreign companies and this

would be irrespective of the existence of a PE of the foreign company in India. In this regard, the AAR has

deviated from its earlier ruling in the case of Timken Co. [2010] 326 ITR 193 (AAR).

• Also, the application of Section 115JB of the Act cannot be limited to domestic companies for the reason that

there are practical difficulties for the foreign companies to prepare their accounts in terms of Schedule VI of the

Companies Act, 1956 (Companies Act).

Castleton Investment Limited [AAR No. 999 of 2010 dated 14 August 2012]

For further details please refer to our Flash News dated 22 August 2012 available at this link

No capital gains on transfer of Indian shares if foreign companies are merged without consideration

The Applicant, a company incorporated in Switzerland, was a wholly owned subsidiary of another company

incorporated in Switzerland (Company C). Pursuant to the proposed merger of the Applicant with Company C, all

the assets and liabilities of the Applicant would be assumed by Company C, including its holding in a subsidiary in

India (Indian company). On merger, no consideration would pass to the Applicant.

The question for consideration before the AAR, inter alia, was whether on merger, any capital gains under Section

45 of the Act would arise to the Applicant and whether such capital gains would be exempt under Section 47(via) of

the Act.

In connection with the above, based on the facts and arguments of the case, the AAR, inter alia, observed and held

as follows:

• The change of ownership of the shares of the Indian company from the Applicant to Company C would involve

the transfer of shares and be within the inclusive definition of ‘transfer’ given under Section 2(47) of the Act;

• The transaction does not fulfill the condition specified under section 47(via) of the Act i.e. at least 25 percent of

the shareholders of the amalgamating foreign company continue to remain shareholders of the amalgamated

foreign company. This is because the shareholders of the Applicant merging with Company C will not or cannot

become shareholders of Company C, as Company C is the only shareholder of the Applicant;

• As the gain, if any, in the instant case is not determinable within the scope of Section 45 and Section 48 of the

Act, no capital gains arises to the applicant as a result of the merger.

Credit Suisse (International) Holding AG [2012] 210 Taxman 412 (AAR)

For further details please refer to our Flash News dated 11 September 2012 available at this link

4

Expert Committee issues draft report on retrospective amendments relating to indirect transfer

The expert committee constituted by the Prime Minister of India has issued its draft report on retrospective

amendments relating to indirect transfer on 9 October 2012. The key recommendations made by the committee are

as follows:

• Amendments relating to taxation of indirect transfer of assets made by the Finance Act, 2012, should be applied

prospectively;

• The word ‘substantially’, used in Explanation 5 to Section 9(1)(i) of the Act, should be defined as a threshold of

50 per cent of the total value derived from the assets of the company or entity;

• The phrase ‘directly or indirectly’, used in Explanation 5 to Section 9(1)(i) of the Act, may be clarified as

representing a ‘look through’ approach. This implies that, for determination of value of share of a foreign

company, all intermediaries between the foreign company and the assets in India may be ignored; and

• Interest and penalty should not be charged/ levied under the provisions of the Act in cases where a tax demand

is raised on account of a retrospective amendment relating to indirect transfer of assets.

Source: www.itatonline.org

For further details please refer to our Flash News dated 10 October 2012 available at this link

Software Taxability

Taxability of supply of equipment comprising hardware and software

The taxpayer, a tax resident of Finland, supplied GSM equipment comprising both hardware and software to Indian

telecom operators under independent buyer-seller agreements. The installation activities were undertaken by the

wholly owned subsidiary of the taxpayer, Nokia India Private Limited (NIPL) under independent contracts with the

Indian telecom operators.

The issue for consideration before the Delhi High Court was whether the consideration received by the taxpayer for

the supply of hardware and software would be chargeable to tax in India under the Act and the India-Finland tax

treaty.

Based on the facts of the case, the Delhi High Court, inter alia, observed and held as follows:

Whether payments for supply of equipment are taxable

• In a transaction relating to the sale of goods, the relevant factor would be as to where the property in the goods

passes.

• Even in the case of one composite contract, offshore supply is to be segregated from installation.

• Relying on the decision of the Supreme Court in the case of Ishikawajima-Harima Heavy Industries Ltd v. DIT

[2007] 288 ITR 408 (SC), the High Court concluded that where the property in goods passed to the buyer outside

India (i.e. on the high seas), the equipment was manufactured outside India, and the sale had taken place outside

India, the income from the supply of equipment would not be taxable in the hands of the taxpayer in India.

Whether payments for software constitute royalty

• The language of the tax treaty differs from the language in the amended section 9(1)(vi) of the Act.

• The Bombay High Court in the case of CIT v. Siemens Aktiongesellschaft [2009] 310 ITR 320 (Bom) has held

that the amendments in the Act cannot be read into the treaty.

• In its earlier decision in the case of DIT v. Ericsson A.B. [2012] 343 ITR 370 (Delhi), which had a similar fact

pattern as that of the taxpayer, it was held that a copyrighted article does not fall within the purview of ‘royalty’.

• Accordingly, the payment for software was held to be not taxable as ‘royalty’ in India.

DIT v. Nokia Networks OY [2012] 25 taxmann.com 225 (Del)

5

For further details please refer to our Flash News dated 15 September 2012 available at this link

Payment for use of dedicated servers does not amount to Royalty

The taxpayer, an Indian company, was the owner/ host of a website where individuals could register and exchange

relevant information for matrimonial alliances. The taxpayer, inter alia, availed the following services from

Rackspace USA:

• Dedicated servers and a support team for the taxpayer.

• Direct and unlimited access to live experts and guaranteed 100 percent network uptime and hardware

replacement guarantee.

• Bandwidth of 100 GB per server which was increased based on the usage rate.

• High level of security for the data stored on the servers including backups and restorations The Assessing

Officer (AO) treated the payment made by the taxpayer to Rackspace USA as ‘royalty’ under the Act, as well as

under the India-USA tax treaty.

Based on the facts of the case, the Mumbai Tribunal observed and held as follows:

• Rackspace USA provided web hosting services with all backup, security and uninterrupted services;

• All the equipment and machines relating to the services provided to the taxpayer were under the control of

Rackspace USA and situated outside India;

• The taxpayer could not operate nor had any physical access to the equipment that provides service, and

therefore, the taxpayer was not using the equipment but was only availing the services provided by Rackspace

USA;

• Therefore, the payments made for procuring the services of Rackspace USA cannot be treated as ‘royalty’ under

the Act as well as the tax treaty;

• Accordingly, no tax was required to be deducted from the payments made by the taxpayer to Rackspace USA.

ITO v. People Interactive (I) P Ltd [ITA No. 2180/Mum/2009]

For further details please refer to our Flash News dated 22 March 2012 available at this link

Payments for purchase of software is not royalty

The Mumbai Tribunal in the case of Sonata Information Tech. Ltd held that payments made to Indian residents for

purchase of software are not treated as royalty. Therefore, tax was not liable to be deducted on the aforesaid

payments under Section 194J of the Income-tax Act, 1961 (the Act).

The Tribunal relied on the decision of Solid Works Corporation wherein the Mumbai Tribunal relying on the Delhi

High Court’s decision in the case of Ericsson A.B.3 held that the consideration received by the taxpayer was not

royalty and therefore, the business income of the taxpayer could not be taxed in the absence of a Permanent

Establishment (PE) in India.

The Tribunal held that though the decision of Solid Works Corporation was rendered in context of tax treaty, the

ratio is equally applicable to the definition of royalty under the Act.

ACIT v. Sonata Information Tech. Ltd [ITA No.4446/Mum/2011 (AY 2007-08)]

For further details please refer to our Flash News dated 11 May 2012 available at this link

Payments for subscription services amounts to royalty

The Applicant, a tax resident of Singapore, is engaged in providing social media monitoring service for companies,

brands or products. The clients who subscribed for the Applicant’s service could login to its website to do a search

on what is being spoken about different brands on various blogs, forums, social networking sites etc. The question

for consideration before the AAR was whether the subscription fee received by the Applicant from its Indian

customers was taxable in India.

Based on the facts of the case, the AAR held that the subscription payments are taxable as ‘royalty’ on account of

6

the following:

• The Applicant was engaged in the business of gathering, collating and making available or imparting information

concerning industrial and commercial knowledge, experience and skill, and consequently, the payment received

from the subscribers/clients in India would be taxable as ‘royalty’ under the Act; and

• The said payment would also qualify as ‘royalty’ under the India-Singapore tax treaty since the payment was for

the grant of use or right to use the process or information concerning industrial, commercial or scientific

experience, for consideration.

Thought Buzz Pvt. Ltd. [2012] 346 ITR 345 (AAR)

For further details please refer to our Flash News dated 18 May 2012 available at this link

Payments made towards acquisition of cable capacity taxable as ‘royalty’

The Applicant is an Indian company engaged in the business of providing telecommunication services in India. The

Applicant entered into an agreement with a Saudi Arabian Company (STC) for transfer, to the Applicant, the right to

use the capacity in the EIG cable system (Europe India Gateway submarine cable linking Indian subcontinent and

the United Kingdom) for a consideration of USD 20 million.

The applicant contended, inter-alia, that, as the amounts payable to STC represented payment made for acquiring

a ‘capital asset’ which was entirely situated outside India, such payment could not be taxed in India both under the

Act and under the India-Saudi Arabia tax treaty.

The issue for consideration before the AAR was whether the payment made by the Applicant to STC for acquisition

of the cable capacity would be chargeable to tax in India.

In connection with the above, based on the facts and arguments of the case, the AAR observed and held as

follows:

• No right of ownership, property in or title to the capacity, facilities or network infrastructure, equipment or

software was conveyed to or vested in the Applicant;

• The transfer of capacity by STC to the Applicant amounted to ‘making available’ the right to use the capacity in

the EIG cable system;

• In view of the clarificatory amendment in Section 9(1)(vi) of the Act, the payments made by the Applicant to STC

for the acquisition of cable capacity were for a right to use a process and a right to use commercial or scientific

equipment and would therefore be taxable in India as ‘royalty’.

Dishnet Wireless Limited [2012] 24 taxmann.com 298 (AAR)

For further details please refer to our Flash News dated 31 August 2012 available at this link

No tax to be deducted at source under Section 194J of the Act from 1 July 2012 on software acquired from

a resident if such software is acquired without any modifications and tax has already been deducted

No deduction of tax shall be made on payment to a transferor, being a resident, by the transferee for acquisition of

software, where(i) The software is acquired in a subsequent transfer and the transferor has transferred the software without any

modification,

(ii) Tax has been deducted- (a) Under Section 194J on payment for any previous transfer of such software; or

(b)Under Section 195 on payment for any previous transfer of such software from a non-resident, and

(iii) The transferee obtains a declaration from the transferor that the tax has been deducted either under sub-clause

(a) or (b) of clause (ii) along with the Permanent Account Number of the transferor.

Notification No. 21/2012 [F.No.142/10/2012-SO (TPL)] S.O. 1323(E), dated 13-6-2012]

7

Tax Residency Certificate

Capital gains on transfer of shares in Indian company by Mauritius Company holding valid TRC is not

chargeable to tax under the India-Mauritius tax treaty

The AAR, in the case of Dynamic India Fund - I, held that the capital gains arising to a Mauritius entity, which holds a

valid TRC, from a proposed sale of investment in India shall not be taxable in India under Article 13(4) of the IndiaMauritius tax treaty. Further, it was held that the provisions of GAAR which are effective from 1 April 2013 are not relevant

at this stage. However, as and when they come into force, it will be open to the tax department to consider those

aspects; notwithstanding this ruling.

Dynamic India Fund I [2012] 209 Taxman 417 (AAR)

For further details please refer to ourFlash News dated 20 July 2012 available at this link

CBDT prescribes details to be included in the Tax Residency Certificate to be obtained by non-resident and

resident of India

Recently, the Central Board of Direct Taxes (CBDT) has issued notification with effect from 1 April 2013 which

prescribes that certain details should be included in the Tax Residency Certificate (TRC) to be obtained by the nonresident to claim tax treaty benefit. Further, the CBDT also notifies the Form 10FA and Form 10FB for resident of

India to obtain TRC from the Assessing Officer (AO).

CBDT Notification No. S.O. 2188(E), dated 17 September 2012

For further details please refer to our Flash News dated 26 September 2012 available at this link

Fees for Technical Services

Provision of services taxable only if ‘made available’

The taxpayer, an Indian company, is engaged in the business of prospecting and mining for diamonds and other

minerals. The taxpayer engaged the services of a non-resident, based out of the Netherlands, to conduct the air

borne survey for providing high quality, high resolution, and geophysical data suitable for selecting probable mining

targets. The AO treated the payment made by the taxpayer to the non-resident for its services as FTS under Article

12 of the India-Netherlands tax treaty and treated the taxpayer as an assessee in default for failure to deduct tax at

source. The Karnataka High Court observed and held as follows:

• The service provider, in order to render technical services uses technical knowledge, experience, skill, know how

or processes. To attract tax liability under the India-Netherland tax treaty, that technical knowledge, experience,

skill, know how or process which is used by the service provider to render technical service should also be ‘made

available’ to the recipient of the services, so that the recipient also acquires technical knowledge, experience,

skill, know how or processes so as to render such technical services;

• The use of a product which embodies technology shall not per se be considered to make the technology

available;

• In the instant case, the non-resident performed the surveys using substantial technical skills. However, it had not

made available the technical expertise in respect of such collection or processing of data to the taxpayer, which

expertise the taxpayer could apply independently and without assistance of the non-resident.

• Therefore, the payment does not satisfy the requirement of FTS under the tax treaty. Hence the taxpayer could

not be treated as an assessee in default for failure to deduct tax at source.

8

CIT v. De Beers India Minerals Pvt. Ltd. [2012] 346 ITR 467 (Kar)

For further details please refer to our Flash News dated 25 May 2012 available at this link

Payment for online advertisement on the portal of a foreign company is not royalty

The Mumbai Tribunal has held that the payments made to a foreign company for services rendered relating to

uploading and display of the banner advertisement on its portal is not taxable in India as royalty or Fees for

Technical Services (FTS). In rendering this decision, the Tribunal has followed its earlier decision in the case of

Yahoo India (P.) Ltd v. CIT [2011] 46 SOT 105 (Mum).

Pinstorm Technologies Pvt. Ltd. v. ITO [2012] 24 taxman.com 345 (Mum)

For further details please refer to our Flash News dated 1 August 2012 available at this link

Fees paid to a foreign company for registering on its website are not FTS

The taxpayer, a tax resident of Switzerland, operated India specific websites for providing an online platform to

users based in India for the purchase and sale of goods and services. The taxpayer derived income in the form of a

‘User fee’ from sellers registered on the taxpayer’s website. For availing certain support services in connection with

its India-specific websites, the taxpayer also entered into a Marketing Support Agreement (MSA) with its Indian

group companies.

In connection with the above, based on the facts of the case, the Income-tax Appellate Tribunal (the Tribunal),

inter-alia, observed and held as follows:

• By making its website available in India to the sellers for displaying their product, the taxpayer is not rendering

any managerial, technical or consultancy services to the sellers and therefore the services do not qualify as

FTS within the meaning of section 9(1)(vii) of the Act;

• As the Indian group companies provide services exclusively to the taxpayer and have no other source of

income, they constitute dependent agents of the taxpayer in India. However, the activities performed by the

India group companies do not satisfy the conditions set out in Article 5(5) of the India-Switzerland tax treaty to

constitute a Dependent Agent Permanent Establishment (DAPE) of the taxpayer in India;

• The Indian group companies, performing only marketing support services, cannot be said to be taking any

managerial decisions on behalf of the tax payer to qualify as a place of management under Article 5(2) of the

tax treaty; and

• Therefore, the taxpayer does not have a Permanent Establishment (PE) within the meaning of Article 5 of the

tax treaty.

eBay International AG v. ADIT [2012] 25 taxmann.com 500 (Mum)

For further details please refer to our Flash News dated 3 October 2012 available at this link

Geophysical services are taxable under special provisions (Section 44BB) and not as Fees for Technical

Services

The taxpayer engaged in the business of providing geophysical services to oil and gas exploration industry entered

in to the contract for procuring data, processing and interpreting the data in respect of an offshore exploration block

in India. The taxpayer received mobilisation as well as de-mobilisation charges for providing services in connection

with the prospecting for extraction or production of mineral oils. The taxpayer applied for lower withholding tax

certificate to the concerned authority under Section 197 of the Act. However, the concerned authority did not grant

the same and directed the taxpayer to deduct tax at the rate of 10 percent in respect of all revenues received. The

Authority for Advance Ruling (AAR) accepted the taxpayer’s claim and held the ruling in favour of the taxpayer.

The High Court held that Section 44BB of the Act is a special provision applicable to the business of providing

services or facilities in connection with, or supplying plant and machinery on hire, used or to be used, in the

prospecting for, or extraction or production of mineral oils including petroleum and natural gas. However, Section

44DA is broader and more general in nature. It is a well settled rule of interpretation that if a special provision is

made respecting a certain matter, that matter is excluded from the general provision under the rule which is

9

expressed by the maxim ‘Generallia specialibus non derogant’. If Section 44DA of the Act covers all types of

services rendered by the non-resident that would reduce Section 44BB to a useless lumber or dead letter and such

a result would be opposed to the very essence of the rule of harmonious construction.

Section 44DA of the Act requires that the foreign company should carry on business in India through a PE situated

therein and the right, property or contract in respect of which the royalty or FTS is paid should be effectively

connected with the PE. However, such requirement has not been spelt out in Section 44BB of the Act. If both the

Sections have to be read harmoniously and in such a manner that neither of them becomes a useless lumber then

the only way in which the conditions can be given effect to is to understand them as referring only to the

computation of profits, and to understand the amendments as having been inserted only to clarify the position.

Where the services are general in nature and fall under the sub-section read with Explanation 2 to Section 9(1)(vii)

of the Act, then the taxpayer rendering such services as provided in Section 44BB of the Act cannot claim the

benefit of being assessed on the basis that 10 percent of the revenues will be deemed to be the profits as provided

in Section 44BB of the Act. In other words, If both the Sections have to be read harmoniously and in such a manner

that neither of them becomes a useless lumber then the only way in which the conditions can be given effect to is to

understand them as referring only to the computation of profits, and to understand the amendments as having been

inserted only to clarify the position. Where the services are general in nature and fall under the sub-section read

with Explanation 2 to Section 9(1)(vii) of the Act, then the taxpayer rendering such services as provided in Section

44BB of the Act cannot claim the benefit of being assessed on the basis that 10 percent of the revenues will be

deemed to be the profits as provided in Section 44BB of the Act. In other words,

DIT v. OHM Ltd [2012] 28 taxmann.com 120 (Del)

For further details please refer to our Flash News dated 14 December 2012 available at this link

Permanent Establishment

Mere presence of a computer server in India amounts to existence of a PE in India

Areva T & D India SAS France (Areva France) proposed to enter into an Information Technology Sharing Services

Agreement (the Agreement) with the applicant, to provide information technology support services. The services,

inter alia, comprised of worldwide network for data transfer between group companies which would connect to all

global applications of Areva France, intranet and internet traffic, messaging system for all e-mail communication

etc. As per the Agreement, Areva France could sub-contract these services either to a third party service provider

(Service Provider) and/or to any other subsidiary of the group.

The question for consideration before the AAR, inter alia, was whether the payments by the applicant to Areva

France were taxable in India under the provisions of the Act and the India-France tax treaty.

Based on the facts of the case, the AAR observed and held as follows:

• Presence of equipment in India, at the disposal of Areva France would create a PE for Areva France in India;

• The employees of the applicant would be equipped to carry out the activities on their own, without reference to

Areva France, once the Agreement comes to an end. Accordingly, services provided by Areva France would

make available technical knowledge/experience to the applicant.

• The consideration for support services rendered by Areva France under the Agreement would qualify as FTS

under the Act as well as the India-France tax treaty.

• As the applicant constitutes a PE in India, the income by way of FTS would be taxed under Section 44DA of the

Act, which, inter alia, deals with taxation of FTS when the foreign company has a PE in India.

Areva T & D India Ltd [2012] 18 taxmann.com 171 (AAR)

For further details please refer to our Flash News dated 29 February 2012 available at this link

Subsidiary in India attending to the business of the Multinational Group constitutes a PE in India

10

The applicant, a tax resident of Singapore, was engaged in the business of door-to-door express shipments by air

and land and performing related transport services. The applicant entered into an agreement with one of its group

company in India for movement of packages to and from India i.e. inbound and outbound. The question for

consideration before the AAR, inter alia, was whether there was a PE of the applicant in India under the IndiaSingapore tax treaty.

The AAR, based on the facts of the case, observed and held as follows:

• The business of the Aramex Group as regards the articles sent to India could not be performed without the

association of the Indian company;

• The Indian company had a fixed place of business and branches in India and business of the Aramex Group was

being carried on by the Indian company i.e. obtaining order, collecting articles and transporting them to a

destination so as to be taken over and delivered by the Group. Thus, the Indian company was a fixed place PE of

the Aramex Group in India under Article 5(1) of the tax treaty;

• The Indian company secured orders in India wholly for the Aramex Group and had the right to conclude contracts

for the Group for its express shipment business. Therefore, the Indian company was also an Agency PE of the

Aramex Group under Article 5(8) of the India-Singapore tax treaty;

• The exception with respect to control over a subsidiary not constituting a PE under Article 5(10) of the tax treaty

was not applicable as the whole business in India of the Group was carried on within the geographical contours of

India. Further, mere description of the Indian company as an independent entity or non-exclusive agent was not

good enough; and

• Therefore, the Indian company constituted a PE of the applicant in India under Article 5 of the tax treaty and the

receipt from outbound and inbound consignments attributable to PE in India was liable to tax in India.

Aramex International Logistics Private Limited [2012] 208 Taxman 355 (AAR)

For further details please refer to our Flash News dated 13 June 2012 available at this link

Residuary Article under the tax treaties

Taxability of income under residuary Articles in tax treaties

The taxpayer, an Indian company engaged in the business of trading and export of sea foods, made payments to a

Singapore based company towards consultancy charges without deduction of tax at source on the basis that the

services were rendered outside India and therefore not taxable as Fees for Technical Services (FTS) under Section

9(1)(vii) of the Income-tax Act, 1961 (the Act).

The AO held that, as the services were used in India, the amounts paid to the non-resident were taxable in India as

FTS. On appeal, the Commissioner of Income-tax (Appeals) [CIT(A)] held that, as the consultancy charges were

not covered by the scope of FTS under Article 12 of the India-Singapore tax treaty and also as the non-resident did

not have a PE in India, there was no obligation on the taxpayer to withhold tax on the payments made to the nonresident.

Before the Kolkata Tribunal, the tax department contended that, even though the consultancy charges were not

taxable in India as business profits under Article 7 or as FTS under Article 12 of the India-Singapore tax treaty,

these amounts were taxable in India as residuary income under Article 23 of the India-Singapore tax treaty.

The Kolkata Tribunal, on the issue of taxability of consultancy charges as residuary income under Article 23 of the

India-Singapore tax treaty, held as follows:

• A tax treaty assigns taxing rights of various types of income to the source state upon fulfillment of conditions laid

11

down in respective clauses of the tax treaty. Only when these conditions are satisfied, does the source state get

the right to tax such income.

• When a tax treaty does not provide for the taxability of a particular kind of income under the tax treaty provision

dealing with that particular kind of income, the taxability cannot be invoked under the residuary provisions of

Article 23 of the tax treaty.

• Article 23 of the tax treaty begins with the words ‘items of income not expressly covered’ by the provisions of the

other Articles, and therefore, does not apply to items of income which can be classified under other Articles of the

tax treaty whether or not taxable under those Articles.

• Accordingly, the income from consultancy services which cannot be taxed under Article 12 or Article 7 of the tax

treaty because the conditions for taxability specified therein are not satisfied, cannot be taxed under Article 23 of

the tax treaty either.

• Therefore, in the instant case, the taxpayer is not liable to withhold tax on the payments made to the nonresident.

DCIT v. Andaman Sea Food Pvt Ltd [2012] 52 SOT 562 (Kol)

For further details please refer to our Flash News dated 13 July 2012 available at this link

Depreciation on Goodwill

Goodwill in the form of difference between the amount paid and the cost of the net asset acquired from the

amalgamating company is an asset eligible for depreciation under the Act

Pursuant to a Scheme of Amalgamation of an Amalgamating Company with the taxpayer, duly sanctioned by the

High Court, the assets and liabilities of the Amalgamating Company were transferred to and vested in the taxpayer.

The excess consideration paid by the taxpayer over the value of the net assets acquired from the Amalgamating

Company was considered as goodwill arising on amalgamation on account of the reputation which the

Amalgamating Company was enjoying in order to retain its existing clientele. The taxpayer claimed depreciation on

goodwill under Section 32 of the Act, treating it as an intangible asset. The AO disallowing the claim for

depreciation contended that as no amount was actually paid on account of goodwill it is not an asset falling under

Explanation 3(b) to Section 32(1) of the Act.

The Supreme Court did not dispute the factual finding of the Tribunal and the Commissioner of Income-tax

(Appeals) [CIT(A)] that, as a part of the Scheme, assets and liabilities of the Transferor were transferred for a

consideration and the difference between the cost of the net assets and the amount paid constituted goodwill.

Explanation 3(b) to Section 32(1) of the Act states that the expression ‘asset’ shall mean an intangible asset, being

know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of a

similar nature. The Supreme Court held that the principle of ejusdem generis would strictly apply to the words ‘any

other business or commercial rights of a similar nature’ of Explanation 3(b) to Section 32(1) of the Act. Accordingly,

‘goodwill’ would be an asset under Explanation 3(b) to Section 32(1) of the Act and depreciation on ‘goodwill’ would

be allowable under Section 32 of the Act.

CIT v. Smifs Securities Ltd. [2012] 24 taxmann.com 222 (SC)

For further details please refer to our Flash News dated 29 August 2012 available at this link

Consideration paid for acquiring the clientele is an ‘intangible asset’ and is eligible for depreciation

The taxpayer, a share broker vide Deed of Assignment of Business, Sale of Goodwill and Master Services

Agreement, purchased entire clientele business of Ashmavir Financial Consultants Pvt. Ltd. (AFC).The taxpayer

has booked the aforesaid expenditure as purchase of goodwill and has claimed 25 percent of depreciation. The AO

rejected the taxpayer’s claim. The CIT(A) upheld the order of the AO.

12

The Tribunal held that the specific words of Section 32 of the Act reveal the similarity in the sense that all the

intangible assets specified are tools of the trade which facilitates the taxpayer to carry on the business. Therefore,

the expression ‘any other business or commercial rights of similar nature’ would include such rights which can be

used as a tool to carry on the business. Further commercial rights gain significance in the commercial world as they

represent a particular benefit or advantage or reputation built over a certain span of time and the customer

associate with such assets. The purchase of the clientele business by the taxpayer from AFC is a right which can

be used as a tool to carry on the business. Relying on the Supreme Court’s decision in the case of Smifs Securities

Ltd and Mumbai Tribunal’s decision in the case of Jyoti India Metal Industries Pvt. Ltd it was held that the taxpayer

is entitled for the depreciation.

India Capital Markets P Ltd v. DCIT (ITA.No.2948/Mum/2010)

For further details please refer to our Flash News dated 17 December 2012 available at this link

Non-compete fees

A ‘non-compete right’ is not an ‘intangible asset’ and therefore not eligible for depreciation

The taxpayer, a joint venture of Sharp Corp, Japan, and L&T Ltd, paid L&T, a consideration for not competing with

it for seven years. The taxpayer claimed that the non-compete fee was revenue in nature. It also claimed,

alternatively, that the rights under the non-compete agreement were an ‘intangible asset’ under Section 32(1)(ii) of

the Act, eligible for depreciation. The AO rejected the taxpayer’s claim.

The High Court held that the advantage derived by the taxpayer from the non-compete agreement entered into with

L&T is for a substantial period of seven years and ensures a certain position in the market by keeping out L&T. The

advantage cannot be regarded as being merely for facilitation of business and ensuring greater efficiency and

profitability. The advantage falls in the capital field. With regard to depreciation on an ‘intangible asset’, the High

Court held that the non-compete rights cannot be treated as an ‘intangible asset’ under Section 32(1)(ii) of the Act

because the nature of the rights mentioned in the definition of an ‘intangible asset’ spell out an element of

exclusivity which inures to the taxpayer as a sequel to the ownership. The ‘intangible asset’ should be such that,

but for the ownership of the ‘intangible asset’, the taxpayer would be unable to either access the advantage or

assert the right ‘in rem’ i.e. as against the world. In the case of a non-competition agreement, it is a right ‘in

personam’ where the advantage is restricted and does not confer an exclusive right to carry-on the primary

business activity. The rights under a non-competition agreement cannot be transferred; the same is purely

personal. As a result of the above the said right cannot be termed as an ‘intangible asset’.

Sharp Business System v. CIT [ITA 492/2012 & CM APPL. 14836/2012, dated 5 November 2012]

For further details please refer to our Flash News dated 22 November 2012 available at this link

Composite Contract

Loss making onshore activity does not indicate that the composite contact was artificially split to avoid

payment of taxes

The taxpayer, a tax resident of China, entered into contracts with two Indian customers for offshore supply of

equipment and onshore supplies and services, including installation and commissioning of thermal power units. A

separate consideration was specified for each activity in the agreements.

13

The taxpayer, relying on Ishikawajma-Harima Heavy Industries Ltd v. DIT [2007] 288 ITR 408 (SC), claimed that

the profit from offshore supply was not taxable in India. As regards the onshore activities, the taxpayer claimed a

loss vis-à-vis its project office, which constituted its Permanent Establishment (PE) in India.

The AO contended that the original contract was for erection of power plants and was split into two parts in such a

way that the activities in India would always result in loss. Further, on the basis that the PE in India was not

compensated at arm’s length for its services, the AO made a transfer pricing adjustment for services rendered by

the PE in connection with offshore supplies.

Based on the facts of the case, Kolkata Tribunal observed and held as follows:

• The transactions have to be looked at as a whole, and not on a standalone basis, when the overall transaction is

split in an unfair and unreasonable manner with a view to evade taxes;

• In each set of the contracts, there was a ‘cross fall breach clause’ which provided that a breach in one contract

would automatically be classified as breach of the other contract. This clause gave an indication that the

‘offshore supplies’ contract and ‘onshore supplies’ contract had to be viewed as an integrated contract;

However, this fact by itself did not indicate that the onshore services and supplies contract was understated so

as to avoid tax in India. That would be the situation in which while offshore supplies showed unreasonable

profits, the onshore supplies and services resulted in unreasonable losses;

• In the instant case, if both these contracts were put together, there was no profit earned by the taxpayer.

Therefore, there could not be an occasion, even otherwise, to tax income from these contracts in India.

• Since the working of overall losses given by the taxpayer was not examined by the AO, the matter was

remanded to him to examine the taxpayer’s claim regarding overall loss on the project.

Dongfang Electric Corporation v. DDIT [2012] 52 SOT 496 (Kol)

For further details please refer to our Flash News dated 3 July 2012 available at this link

Income from composite contract entered by a consortium including Offshore supplies fully taxable in India

considering the Consortium as an AOP

The applicant, a tax resident of France, along with other members formed a consortium and obtained a contract

from Bangalore Metro Rail Corporation Limited (BMRC) for design, manufacture, supply, installation, testing and

commissioning of signaling/train-control and communication systems. The question for consideration before the

Authority for Advance Ruling (AAR), inter alia, was whether the amounts received by the applicant for offshore

supply i.e. supply of overseas plant and materials and offshore designing and training of personnel for operation

and maintenance would be taxable in India under the provisions of the Act and India-France tax treaty.

Based on the facts of the case, the AAR observed and held as follows:

• The tender floated by BMRC was a composite tender for installation and commissioning of a signaling and

communication system;

• A contract for the installation and commissioning of a project cannot be split up into separate parts as consisting

of independent supply of goods and for installation at the work site;

• The basic principle in interpretation of a contract is to read it as a whole and to construe all its terms in the

context of the object sought to be achieved and the purpose sought to be attained by implementation of the

contract [relying on the rulings in the case of Linde A.G. (AAR No. 962 of 2010) (AAR) and in Roxar Maximum

Reservoir Performance WLL (AAR No. 977 of 2010)(AAR)];

• The AAR relied on the decision of the Supreme Court in the case of Vodafone International Holdings BV [2012]

341 ITR 1 (SC) wherein the Apex Court observed that it is the task of the Revenue/Court to ascertain the legal

nature of the transaction and while doing so it has to ‘look at’ the transaction as a whole and not to adopt a

dissecting approach;

• Accordingly, the contract could not be split-up to treat a part of it as confined to offshore supply of equipment not

capable of being taxed in India; and

• Therefore, the income from the contract had to be taxed as a whole, under the Act and the tax treaty. The AAR

also held that the applicant along with the other members of the consortium were liable to be taxed as an

‘Association of Person’ (AOP) in respect of the income arising from the contract.

14

Alstom Transport SA [2012] 208 Taxman 223 (AAR)

For further details please refer to our Flash News dated 13 June 2012 available at this link

Carbon Credits

Sale consideration on transfer of carbon credits is a capital receipt. There is no element of profit and

therefore it cannot be taxed under the Act

The taxpayer was engaged in the business of power generation through a biomass power generation unit. During

AY 2007-08, it had received Carbon Emission Reduction Certificates (CERs), popularly known as ‘Carbon Credits’,

for the project activity of switching off of fossil fuel from naphtha and diesel to biomass. The taxpayer sold these

CERs to a foreign company and accounted the sale consideration as capital in nature and therefore had not offered

the same for taxation. The AO held the sale proceeds to be a revenue receipt since the CERs were a tradable

commodity and even quoted on the stock exchange. Accordingly, the AO added the net receipt from the sale to the

returned income. The CIT(A) confirmed the order of the AO.

The Hyderabad Tribunal held that Carbon credit is in the nature of ‘an entitlement’ received to improve the world’s

atmosphere and environment by reducing carbon, heat and gas emissions. It is not generated or created due to

carrying on business but it is accrued due to ‘world concern’. Due to that a taxpayer gets a privilege in the nature of

the transfer of carbon credits. A person who has surplus carbon credits can sell them to others to have the

emission commitment capped under the Kyoto Protocol.

Transferable carbon credit is not a result or incidence of one’s business and it is a credit for reducing emissions.

The persons having carbon credits get benefit by selling the same to a person who needs carbon credits to

overcome one’s negative point carbon credit. The amount received is not received for producing and/or selling any

product or by-product, or for rendering any service for carrying on the business. Carbon credit is entitlement or

accretion of capital and hence income earned on the sale of these credits is a capital receipt. Reliance was placed

on the judgement in the case of Maheshwari Devi Jute Mills Ltd. [1965] 57 ITR 36 (SC) wherein the Supreme Court

held that the transfer of surplus loom hours to other mills out of those allotted to a taxpayer under an agreement for

control of production was capital receipt and not income. Similarly, in the present case, the taxpayer transferred the

carbon credits like loom hours to some other concerns for a certain consideration. Therefore, the receipt of such

consideration cannot be considered as business income, and was a capital receipt. Carbon credit does not

increase profit in any manner and does not need any expense. There is no cost of acquisition or cost of production

to get this entitlement. Carbon credit is not in the nature of profit or in the nature of income and it cannot be

subjected to tax in any manner under any head of income. It was not liable for tax for the year under consideration

in terms of Sections 2(24), 28, 45 and 56 of the Act.

My Home Power Ltd. v. DCIT [2012] 27 taxmann.com 27 (Hyd)

For further details please refer to our Flash News dated 8 November 2012 available at this link

Sham Transactions & tax avoidance

Sale of pledged shares at loss to a group company which set-off capital gain arising from the transfer of

other shares is not a ‘colourable transaction’

The taxpayer in Assessment Year (AY) 1993-94 sold certain shares of Rustom Spinners Ltd and derived long-term

and short-term capital gain. The taxpayer had also sold certain equity shares of Rustom Mills and Industries Ltd

and claimed long-term capital loss. The AO was of the view that the transfer of shares would be complete only

when the share certificates along with duly executed transfer forms are delivered to the purchaser. However, in the

15

present case, there was no valid transfer since the share certificates were in the possession of IDBI bank who had

lien over such shares. Further, the AO noted that the purchaser company and the taxpayer were part of the same

group of companies. Consequently, the full transaction was intended to create loss to the taxpayer so that its

capital gains resulting from the sale of shares of Rustom Spinners Ltd could be set-off.

The Gujarat High Court observed that since the taxpayer had entered into the agreement, given Power of Attorney

and received the full sale consideration from the purchaser company, the transfer of shares was complete by virtue

of Section 2(47) of the Act. There is no provision in the Act which would prevent the taxpayer from selling loss

making shares. Further, there is no restriction that such a sale cannot be effected with a group company. Simply

because such shares were sold during the previous year when the taxpayer had also sold some shares at profit by

itself would not mean that this is a case of ‘colourable device’ or that there is a case of tax avoidance. In the

present case, the shares were pledged to IDBI Bank and therefore, it would not be possible for the taxpayer to

deliver the original share certificates to its purchaser along with the on the legal relation between the taxpayer and

IDBI and the purchaser’s right to have shares transferred in its name. However, this would not establish that the

sale of shares was only a paper transaction and a device contrived by the taxpayer. Accordingly the High Court

held that the transaction could not be treated as a duly signed transfer forms. This may have repercussions

‘colourable device’ created for tax avoidance.

CIT v. Biraj Investment Pvt. Ltd. [2012] 24 taxmann.com 273 (Guj)

For further details please refer to our Flash News dated 17 September 2012 available at this link

When a transaction is sham, it cannot be considered as a part of tax planning or legitimate avoidance of

tax liability

The taxpayer provided a guarantee to the extent of INR 1 billion in favour of Vysya Bank Ltd. for extending financial

facilities to Geekay Exim India Ltd. Geekay Exim India Ltd is a company belonging to G. K. Rathi Group. Since

Geekay Exim India failed to repay its loan, the bank invoked the guarantee under which the taxpayer agreed to

transfer its own land to the Bank. In its return of income for the year under consideration the taxpayer had set off

capital gains arising on transfer of land to the bank against the short term as well as long term capital loss arising

from sales of shares.

The facts with respect to capital loss on sale of shares are as follows:

• The taxpayer has invested INR 480 million (INR 150 per share including premium of INR 140 per share) in its

four subsidiary companies during the period 28 March 2000 to 30 March 2000. This amount was received by the

taxpayer from a company belonging to G. K. Rathi Group. The same amount was again reinvested by the above

mentioned four subsidiary companies into another group company of G. K Rathi Group.

• The abovementioned shares in four companies (along with other shares already held by taxpayer in these four

companies) were sold to Radha Financial Services Pvt. Ltd. and Diplomat Trading Pvt. Ltd. at INR 5 in Financial

Year (FY) 2000-2001, which resulted in substantial long term and short term capital losses to the taxpayer.

• Further the taxpayer had converted its loan given to Killick Halco Ltd., a loss making company, into equity at a

premium of INR 700 per share on 31 March 2000. During the year under consideration, the shares held in Killick

Halco Ltd were sold to Snowcem India Limited (a group company) at INR 83 per shares which again resulted in

substantial losses to the taxpayer.

• Further shares acquired in Pelican Paint Ltd. at INR 518 and INR 365 per share in FY 1998-1999 and 19992000 respectively were sold to Snowcem India Limited (a group company) at INR 10 during the year under

consideration which again resulted in substantial losses.

• The Bombay High Court held that the share transactions were merely a sham to claim the set-off of artificial

capital loss against the capital gains arising out of transfer of land. The High Court observed that there was a

concurrent finding of the authorities below that the transaction was a colourable device and relying on the

Supreme Court ruling in Vodafone International Holdings [TS-23-SC-2012], it held that a colourable device

cannot be a part of tax planning. Therefore, where a transaction is sham and not genuine as in the present case

then it cannot be considered to be a part of tax planning or legitimate avoidance of tax liability. On the alternate

plea raised by the taxpayer that the value of the land should be allowed as business loss since the guarantee

was given in the normal course of business, the High Court remitted the matter back to the Tribunal.

Killick Nixon Limited v. DCIT [2012] 208 Taxman 45 (Bom)

16

For further details please refer to our Flash News dated 22 March 2012 available at this link

Sale & lease back of machinery not a ‘sham’ or ‘colourable’ device to avail benefit of depreciation

The taxpayer had purchased igni-fluid boilers from its sister concern for a total consideration of INR 25 million in FY

1994-95. The taxpayer paid INR 5 million to its sister concern and for the balance it entered into a finance

agreement with Wipro Finance Limited by way of a hire purchase agreement. On the same day the taxpayer

entered into a lease agreement with its sister concern for the same boilers. The AO claimed that the sale and lease

back arrangement was a sham and colourable device adopted by the taxpayer to avail benefit of depreciation and

the alleged purchase by the taxpayer was merely a financial accommodation for its sister concern.

The Madras High Court observed that the AO was not correct in rejecting the taxpayer’s claim on the ground that it

had not taken actual possession of boilers. Since the law recognized constructive delivery as an acceptable mode

of delivery and possession and the fact that the taxpayer had not taken physical possession, per se, did not

pronounce anything against the sale that took place between the taxpayer and its sister concern. The High Court

further observed that the genuineness of the said transaction could not be questioned as there was no material on

record to show that the sale between the taxpayer and its sister concern was a sham transaction. Further the fact

that the sister concern of the taxpayer had undertaken responsibility to meet the liability of the taxpayer to pay the

hire purchase amount was not relevant to decide whether the sale transaction was colourable. It was also observed

that in subsequent years the revenue itself had accepted the transaction to be a genuine. Further, relying on the

Supreme Court ruling in the case of Vodafone International Holdings B.V. the High Court held that while

ascertaining the legal nature of the transaction one has to look at the entire transaction as a whole and not to adopt

a dissecting approach and hence it was held that the transaction was not a sham or a colourable device just to

enable the taxpayer to claim the benefit of depreciation.

CIT v. High Energy Batteries (India) Ltd. [2012] 208 Taxman 213 (Mad)

For further details please refer to our Flash News dated 29 May 2012 available at this link

Transfer of shares through a legitimate scheme of arrangement is not a ‘Tax avoidance device’

The Bombay High Court while approving the scheme of arrangement in the case of Unichem Laboratories Limited

(along with other petitioners) has held that a tax efficient transfer of shares under a scheme of arrangement under

Sections 391 to 394 of the Companies Act, 1956, could not be held to be a tax avoidance device just because such

transfer would have been liable to capital gains tax if transferred otherwise. It also reaffirmed that the Income-Tax

Authority is not required to be heard while sanctioning the Scheme.

AVM Capital Services Pvt. Ltd. (Company Petition No. 670 of 2011, dated 12 July 2012) (Bom) (HC)

For further details please refer to our Flash News dated 20 July 2012 available at this link

Income from sale of CCD taxable as interest income

The applicant, a tax resident company of Mauritius, and V Ltd (V), an Indian company, made an investment in

another Indian company, S Ltd (S) by way of equity shares and CCDs. Prior to the mandatory conversion date, the

applicant was given the put option to sell shares and CCDs on specified dates to V. A call option was also given to

V to purchase the said shares and CCDs from the applicant. V exercised this option and proposed to purchase the

stake in S from the applicant. The issue before the AAR, inter alia, was whether the gains arising to the Applicant

on the sale of shares and CCDs of S Ltd are exempt from capital gains in India under Article 13(4) of the IndiaMauritius tax treaty?

Based on the facts of the case, the AAR, inter alia, observed and held as follows:

• Relying on the Supreme Court’s decisions in the case of CWT v. Spencer and Co. Ltd. [1973] 88 ITR 429 (SC)

and Eastern Investments Ltd. v. CIT [1951] 20 ITR 1 (SC), the AAR observed that the CCDs created or

recognised the existence of a debt, which remained till it was repaid or discharged.

• The income derived from the sale of CCDs would be taxable as interest income since the CCDs were a debt

instrument.

• In the instant case, CCDs did not carry any interest, but instead, gave the option for the conversion into shares

at a different price. The conversion rates for CCDs into equity shares varied depending upon the period of

17

holding of these CCDs. The AAR observed that this was ‘Interest’ falling within the meaning of Section 2(28A) of

the Act as well as under Article 11 of the tax treaty.

• The amount paid by V was clearly towards the debt that was taken by S from the Applicant. Hence, the

appreciation in the value of CCDs was clearly a payment of ‘Interest’ and was taxable under the provisions of

Article 11 of the tax treaty.

• On a perusal of agreement, it was held that the Indian holding and subsidiary companies are one and the same.

• Accordingly, the entire gains arising to the applicant on the sale of CCDs were not exempt from capital gains tax

in India under the tax treaty. Further, the AAR held that that sale of Indian company’s shares by a Mauritius

company is not exempt under the tax treaty.

Z, In re [2012] 345 ITR 11 (AAR)

For further details please refer to our Flash News dated 5 April 2012 available at this link

Mergers and acquisitions

Gujarat High Court allows appeal of Vodafone Essar Gujarat Limited and approves Scheme of Arrangement

for transfer of Passive Infrastructure Assets

The Company Judge of the Gujarat High Court rejected the Scheme of Arrangement (Scheme) on the ground that

the sole object of the Scheme was to avoid tax.

On an appeal, the division bench of the Gujarat High Court, while approving the Scheme, held that:

• The Scheme is supported by adequate commercial rationale including recommendations of the working group

on the telecom sector.

• Transfer of an undertaking by way of gift for commercial reasons is tantamount to reconstruction of business

and, hence, is an ‘arrangement’ covered under Section 391 of the Companies Act.

• A scheme which is supported by adequate commercial rationale may result in the benefit of saving income tax or

other taxes, which itself cannot be a ground for coming to the conclusion that the sole object of framing the

Scheme is to defraud the tax authorities.

• While examining the Scheme each and every objection of a third party cannot be considered by carrying out

microscopic examination.

• The Court accepted the locus of the tax department to raise objections to the Scheme in its capacity as a

creditor of the Company.

Vodafone Essar Gujarat Limited v. DIT [2012] 24 taxmann.com 323 (Guj)

For further details please refer to our Flash News dated 12 September 2012 available at this link

Transfer of shares at cost by Indian company to an overseas parent company as part of a group

restructuring exercise cannot be treated as a sham transaction or colourable device

The Mumbai Tribunal, in the case of Euro RSCG Advertising Pvt. Ltd. held that the transfer of shares at cost by an

Indian company to an overseas parent company as a part of a group restructuring exercise cannot be treated as a

sham transaction or colourable device. Further, it was held that the cost of acquisition has to be taken as per the

book value and not the fair market value as adopted by the AO, more so because the same has been accepted by

the tax department in scrutiny proceedings in the earlier years. The share purchase agreement cannot be brushed

aside, unless there is something on record to prove that it was a non-genuine arrangement.

Euro RSCG Advertising Pvt. Ltd. v. ACIT [2012] 53 SOT 90 (Mum)

Note: This case is argued by KPMG in India Tax Dispute Resolution Team

For further details please refer to our Flash News dated 20 July 2012 available at this link

Gift of shares in an Indian company by a foreign company could be regarded as a genuine transaction

18

British India Steam Navigation Co. (UK Co) gifted the shares of Hill Park Ltd (HPL), a company incorporated in

India, to the taxpayer during the year 2007. Both the taxpayer and UK Co. were a 100 percent-owned subsidiary of

the same parent company based in the UK.

The main issue for consideration before the Mumbai Tribunal was whether such transaction can be termed as a

‘gift’ within the meaning of Section 47(iii) of the Act.

In connection with the above, based on the facts and arguments of the case, the Tribunal, inter-alia, observed and

held as follows:

• As the term ‘gift’ is not defined under the Act, reference could be made to the definition of ‘gift’ under the Transfer

of Property Act, 1882 (TPA);

• Under the provisions of the TPA, there is no requirement that a ‘gift’ can be made only between natural persons

out of natural love and affection. Therefore, a company can also gift shares, provided its Articles of Association

permit the making of such a gift; and

• In the instant case, the UK Co was authorised to make such gift as per the laws of the UK and the gift would be a

capital receipt in the hands of the taxpayer.

DP World Pvt Ltd v. DCIT [2012] ITA No. 3627/Mum/2012 (Mum)

For further details please refer to our Flash News dated 19 October 2012 available at this link

Slump sale

Delhi High Court holds that transfer of an undertaking under a Scheme is 'Slump sale' taxable under

Section 50B of the Income-tax Act

The taxpayer had entered into a Scheme of Arrangement under Section 391 to 394 of the Companies Act, 1956

(the Scheme) pursuant to which it transferred its project finance business and assets-based financing business to

its subsidiary for a lump sum consideration. The Scheme had been approved by the Calcutta High Court. The

taxpayer has filed a writ petition challenging the order of the Settlement stating the transfer of the project finance

business as taxable under Section 50B of the Act as ‘slump sale’.

The Delhi High Court, dismissing the writ, rejected the contention that a transfer under the scheme sanctioned by

the Court is not a sale under Section 50B of the Act. The High Court also rejected the contention that Section

2(42C) of the Act deals with a limited category of transactions being ‘sale’ and the broader and wider definition of

the term 'transfer' under Section 2(47) of the Act is not applicable to ‘slump sales’.

SREI Infrastructure Finance Ltd v. Income Tax Settlement Commission and Ors [2012] 207 Taxman 74 (Del)

For further details please refer to our Flash News dated 20 April 2012 available at this link

Transfer of tangible and intangible assets pertaining to sealants and adhesive business is a slump sale

taxable under Section 50B of the Act

The taxpayer sold/transferred/assigned trademarks, copyrights, know-how, assets and goodwill pertaining to the

Sealants and Adhesives Business through separate agreements for an aggregate consideration of INR 320 million.

The taxpayer offered to tax sale consideration amounting to INR 18.9 million received on account of goodwill and

non-compete fee. Consideration received on the sale of Trademarks, know-how, copyright, amounting to INR 280

million was not offered for taxation taking the view that same being capital receipt, was not taxable.

Based on the facts of the case, the Mumbai Tribunal held that in spite of separate agreement for each asset

specifying separate consideration, the transaction involved the sale of the entire business and therefore was a

slump sale. Further the Tribunal held that the provisions of Section 50B read with Section 2(42C) of the Act and

Explanation 1 to Section 2(19AA) of the Act were applicable to the transaction.

19

Mahindra Engineering and Chemical Products Ltd. v. ITO [2012] 51 SOT 496 (Mum)

For further details please refer to our Flash News dated 4 May 2012 available at this link

The Mumbai Tribunal rules that negative net worth cannot be ignored for the purposes of computing capital

gains on slump sale of business under section 50B of the Income-tax Act

The Special Bench of the Mumbai Tribunal held that the negative figure of net worth of the undertaking should not

be ignored for working out capital gains in the case of a slump sale under Section 50B of the Act. The Special

Bench held that to contend that the cost or net worth can never be negative is too wide a proposition to be

accepted in the case of a capital asset in the nature of an undertaking. It was held that the legislature has very

rightly used the words ‘deducting from’ only to make its intention clear that for determining the income chargeable

under the head ‘capital gains’, if the amount of net worth is positive, that should be reduced from and if it is negative

then it should be added to the full value of consideration.

DCIT v. Summit Securities Limited [2012] 135 ITD 99 (Mum)

For further details please refer to our Flash News dated 9 March 2012 available at this link

Applicability of 14A disallowance

Section 14A does not apply to shares held as stock-in trade

During the year under consideration, the taxpayer had received dividend income which was exempt from tax.

However, the taxpayer did not make any disallowance of expenditure relating to the said exempt income. In the

books of account, the taxpayer had shown the shares as stock-in trade and was of the view that such stock-in-trade

could not be taken into account while computing the disallowance under Rule 8D of the Income-tax Rules, 1962

(the Rules). The Assessing Officer (AO) computed the disallowance under Section 14A of the Act as per Rule 8D of

the Rules and disallowed the expenditure holding that the provisions of Section 14A of the Act were applicable

even in relation to the dividend received from the trading shares. The Commissioner of Income-tax (Appeal)

[CIT(A)] excluded the stock-in trade from the purview of computation of disallowance of expenditure under Rule 8D

of the Rules.

The Mumbai Tribunal relying on the decision of Karnataka High Court in the case of CCI Ltd. v. JCIT (2012) 250

CTR 291 (Kar) has held that since the taxpayer had not retained the shares with the intention of earning dividend

income, the disallowance of interest in relation to the dividend received from trading shares cannot be made. It was

further held that, there being a direct decision of the Karnataka High Court on this issue, the same has to be

followed, in preference to the Special Bench’s decision of the of Mumbai Tribunal in the case of ITO v. Daga Capital

Management P. Ltd. [2009] 117 ITD 169 (Mum) (SB).

DCIT v. India Advantage Securities Ltd (ITA No 6711/ Mum/2011, dated 14 September 2012)

For further details please refer to our Flash News dated 12 October 2012 available at this link

Principal-agent relationship

Supreme Court held that tax should not be withheld on the vendor’s discount since it is not commission or

brokerage

The taxpayer, an association of stamp vendors, bought stamps from the State Government at prescribed discounts

ranging from 0.5 percent to 4 percent. The tax department claimed that the stamp vendors were ‘agents’ of the