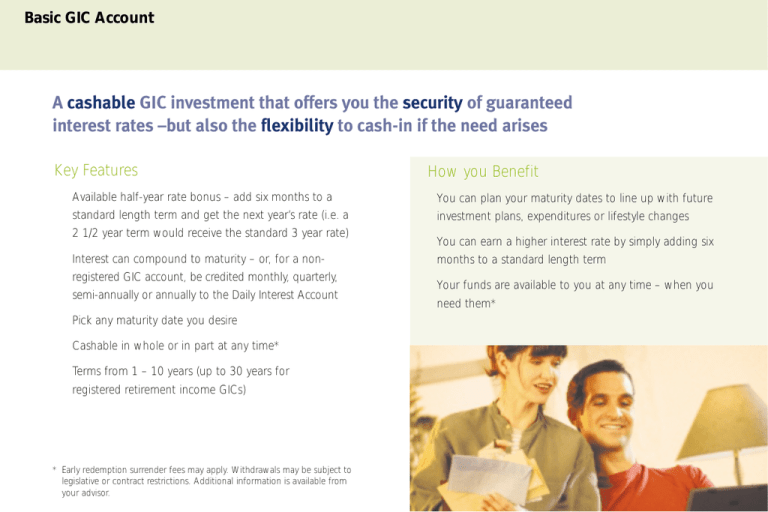

A cashable GIC investment that offers you the security of guaranteed

advertisement

Basic GIC Account A cashable GIC investment that offers you the security of guaranteed interest rates –but also the flexibility to cash-in if the need arises Key Features How you Benefit • • You can plan your maturity dates to line up with future Available half-year rate bonus – add six months to a standard length term and get the next year’s rate (i.e. a 2 1/2 year term would receive the standard 3 year rate) • Interest can compound to maturity – or, for a nonregistered GIC account, be credited monthly, quarterly, semi-annually or annually to the Daily Interest Account • • • Pick any maturity date you desire Cashable in whole or in part at any time* Terms from 1 – 10 years (up to 30 years for registered retirement income GICs) * Early redemption surrender fees may apply. Withdrawals may be subject to legislative or contract restrictions. Additional information is available from your advisor. investment plans, expenditures or lifestyle changes • You can earn a higher interest rate by simply adding six months to a standard length term • Your funds are available to you at any time – when you need them* Laddered GIC Account A GIC investment that will automatically diversify your portfolio, by ensuring that a portion matures each year and is reinvested at attractive long-term rates Key Features How you Benefit • • You have greater protection against fluctuating interest Your investment is evenly divided into multiple term lengths, all receiving the same initial competitive interest rate (i.e. into 1, 2, 3, 4 and 5-year terms) • • Laddered terms of 1 to 5 years, or 1 to 10 years A portion of your investment matures each year and can either be automatically reinvested into 5 or 10-year terms or withdrawn • Interest can compound – or, for a non-registered GIC account, be credited monthly, quarterly, semi-annually or annually to the Daily Interest Account • Cashable in whole or in part at any time* * Early redemption surrender fees may apply. Withdrawals may be subject to legislative or contract restrictions. Additional information is available from your advisor. rates in the future • One attractive initial interest rate for all your investment terms • Your GIC investments can renew automatically into attractive long-term rates, with minimal involvement by you • Your funds are available to you at any time – when you need them* Escalating Rate GIC Account A GIC investment that provides you with increasing interest rates each year Key Features How you Benefit • • • Regardless of whether interest rates rise or fall, the rate Guaranteed increasing rates for each year of the term Very attractive interest rates for the final years of the term • • • Interest will compound to maturity on your Escalating GIC investment is guaranteed to increase during each year of the term • You can lock-in now to guarantee higher interest rates in later years Cashable in whole or in part at any time* • Your funds are available to you at any time – when you Terms of 3 or 5 years * Early redemption surrender fees may apply. Withdrawals may be subject to legislative or contract restrictions. Additional information is available from your advisor. need them* Market Growth GIC Account A GIC investment that enables you to participate in the growth potential of market-based investments, while guaranteeing your principal Key Features How you Benefit • • You can participate in the growth potential of Links your returns to market-based investments selected by Manulife Investments • Investment growth during the term is credited on the maturity date* • Your principal investment is 100% guaranteed at the maturity date • • Non-cashable during the term Offered by Manulife Investments during limited time periods * Interest is based on the performance of a market-based investment, and is credited on the maturity date. At any date prior to the maturity date, the interest is zero and the value of the investment is the principal amount. market-based investments – and your principal is 100% guaranteed • Enables you to diversify your GIC portfolio and to benefit from a unique investment type, while guaranteeing your principal Daily Interest Account A GIC account that provides easy access to your money, without fees Key Features How you Benefit • • • • A convenient place to ‘park’ your money while you take A short-term holding account Money is available anytime without fees Interest is compounded daily and credited monthly time to make longer-term investment decisions • Gives you access to your money anytime without fees, to meet your short-term liquidity needs • Also useful if you want to consolidate your funds for future investment purchases Retirement Income Features You can enjoy additional retirement income benefits with the Manulife Investments GIC Key Features How you Benefit • • Provides you with a wide range of flexible options for Choose from Basic (cashable), Laddered or Daily Interest Account investment types • Select from several payment frequency options – monthly, quarterly, semi-annual or annual • Scheduled payment amount options – choose the government prescribed minimum or maximum, level or indexed payments • Withdrawal order options – choose to have proportional payments drawn from all GIC investments in your contract, or using the interest first from the GIC investments with the lowest rates • Flexible withholding tax options – you choose the tax rate, subject to minimums • • Payments deposited directly to your bank account Free annual cash withdrawal option – in addition to scheduled payments, you can withdraw up to 10% of the total plan value once per year, to a maximum of $10,000, without charge payment frequency, payment amounts, withdrawal orders and withholding tax • Ability to change your payout options as your needs change • Greater access to your money with additional 10% free annual cash withdrawals • Automatic payments are conveniently deposited to your bank account