WPP POS II Booklet - Benefits Enrollment Web Site

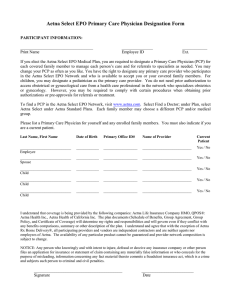

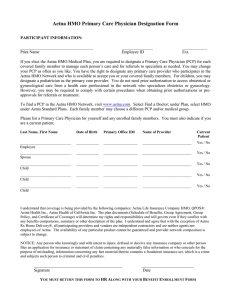

advertisement