EC7100: Final Exam Do any two questions out of four. All questions

advertisement

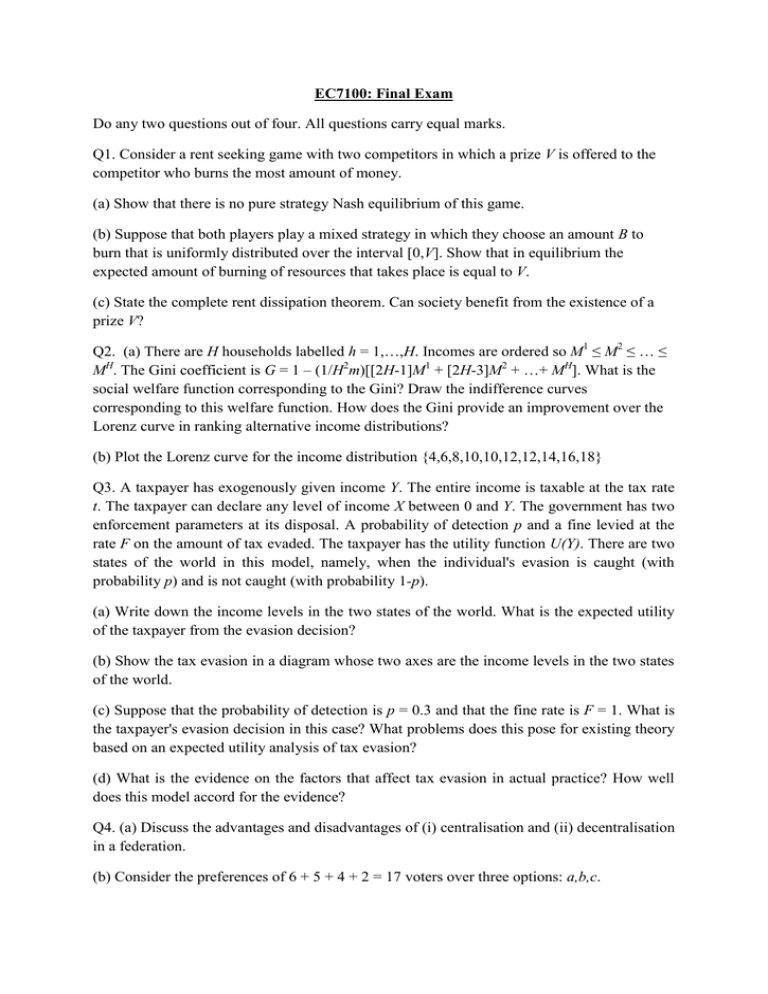

EC7100: Final Exam

Do any two questions out of four. All questions carry equal marks.

Q1. Consider a rent seeking game with two competitors in which a prize V is offered to the

competitor who burns the most amount of money.

(a) Show that there is no pure strategy Nash equilibrium of this game.

(b) Suppose that both players play a mixed strategy in which they choose an amount B to

burn that is uniformly distributed over the interval [0,V]. Show that in equilibrium the

expected amount of burning of resources that takes place is equal to V.

(c) State the complete rent dissipation theorem. Can society benefit from the existence of a

prize V?

Q2. (a) There are H households labelled h = 1,…,H. Incomes are ordered so M1 ≤ M2 ≤ … ≤

MH. The Gini coefficient is G = 1 – (1/H2m)[[2H-1]M1 + [2H-3]M2 + …+ MH]. What is the

social welfare function corresponding to the Gini? Draw the indifference curves

corresponding to this welfare function. How does the Gini provide an improvement over the

Lorenz curve in ranking alternative income distributions?

(b) Plot the Lorenz curve for the income distribution {4,6,8,10,10,12,12,14,16,18}

Q3. A taxpayer has exogenously given income Y. The entire income is taxable at the tax rate

t. The taxpayer can declare any level of income X between 0 and Y. The government has two

enforcement parameters at its disposal. A probability of detection p and a fine levied at the

rate F on the amount of tax evaded. The taxpayer has the utility function U(Y). There are two

states of the world in this model, namely, when the individual's evasion is caught (with

probability p) and is not caught (with probability 1-p).

(a) Write down the income levels in the two states of the world. What is the expected utility

of the taxpayer from the evasion decision?

(b) Show the tax evasion in a diagram whose two axes are the income levels in the two states

of the world.

(c) Suppose that the probability of detection is p = 0.3 and that the fine rate is F = 1. What is

the taxpayer's evasion decision in this case? What problems does this pose for existing theory

based on an expected utility analysis of tax evasion?

(d) What is the evidence on the factors that affect tax evasion in actual practice? How well

does this model accord for the evidence?

Q4. (a) Discuss the advantages and disadvantages of (i) centralisation and (ii) decentralisation

in a federation.

(b) Consider the preferences of 6 + 5 + 4 + 2 = 17 voters over three options: a,b,c.

(6)

(5)

(4)

(2)

a

c

b

b

b

a

c

a

c

b

a

c

Is there a Condorcet winner? Suppose that the winner is now chosen through "runoff voting".

Which option wins in this case?

(c) Discuss if single peakedness is a sufficient or a necessary condition for choosing a

Condorcet winner.

End