of Schneider Electric SA

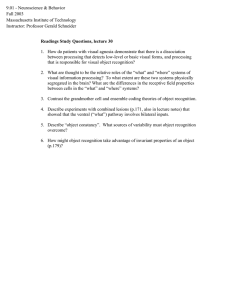

advertisement