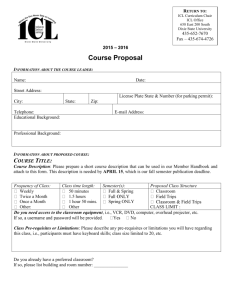

For 2011 - Sign In

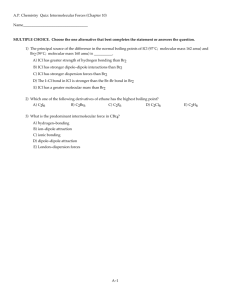

advertisement